The High Volatility of After-Hours Trading

After-hours traders may benefit from being able to trade for a longer portion of the day; however, there are certain risks to be aware of before utilizing this strategy.

Trading activity typically takes place during a given segment of the day, called the trading session. For example, the trading sessions for the NASDAQ and the New York Stock Exchange (NYSE) occur from 9:30 AM to 4:00 PM Eastern Time every Monday through Friday.

While the majority of trading takes place during these hours, it is possible to trade before and after the markets open.

What Is After-Hours Trading, And How Does it Work?

Trading after the market has officially closed for the day is called after-hours trading. If an exchange closes at 4:00 PM EST, day trading must cease at that point; however, investors may be able to engage in after-hours trading from 4:00 PM to 8:00 PM EST.

After-hours trading is characterized by lower trading volume and higher bid-ask spreads, leading to potentially higher risk (more on this later).

During after-hours trading, investors use electronic communication networks (ECNs) — digital markets that match orders based on buy and sell prices — which match buyers and sellers based on limit prices.

Be aware that you can only use limit orders during the after-hours trading window. So, what does that mean? Essentially, if the stock is available at the limit price, then the order will be executed at that price or better.

After-Hours Trading vs. The Normal Trading Session

Before engaging in after-hours trading, there are some important things to be aware of. While after-hours trading has some notable benefits, there are also additional risks to trading outside of the normal trading session.

1. Bid-ask spread differs

The trading volume during the trading day tends to be much higher than the trading volume after hours. When trading activity is high, bid-ask spreads tend to be narrower. This essentially means that you're more likely to have your trade executed at a desirable price.

Because trading volume is lower during after-hours trading, bid-ask spreads tend to be wider, which can leave you more vulnerable to bad prices. If you were able to place market orders during this time, they may be executed at undesirable prices. Since you are confined to limit orders, this is less of a concern, but you are left with the risk that your order won't be filled.

2. You can react to major news during after-hours trading

Major news may take place within a company in real-time after the market closes. Suppose a company declares a significant loss: after-hours traders may sell their stock in the company, thus lowering the closing price from the previous market session.

When the market opens the next day, investors trading during regular market hours will have no choice but to accept that the stock's value dipped and they may incur a significant loss if they decide to sell.

3. How you place your order differs

During the normal trading session, trades occur through market orders on an exchange. So, you place an order and your trade is almost guaranteed to be placed, but it will be done at the current best price.

As discussed above, trading after hours confines you to limit orders only — while this offers you some protection in that your trade will only be executed at the limit price or higher, limit orders are not guaranteed to be executed.

Who Can Trade After Hours?

Trading after hours was only available to institutional investors up until 1999. This meant that individual investors could only engage in stock trading during the traditional hours trading session.

However, after-market trading is now more widely available due to ECNs (described above). People typically trade after hours through their brokerages. So, if your brokerage allows after-hours trading, then you can do so as well.

Why Do People Trade After Hours?

Breaking news can drastically affect a stock's public sentiment. Since the average investor usually only trades for roughly seven hours out of the day, that means they are only trading in reaction to the news for a third of the day. During the seventeen or so hours that the normal trading session is closed, most investors are not making any trades.

Essentially, this means that most investors have no control over their portfolios for the vast majority of the day. An investor not trading after hours may see the price drop exponentially the following day when the market opens again.

Advantages and Disadvantages of This Strategy

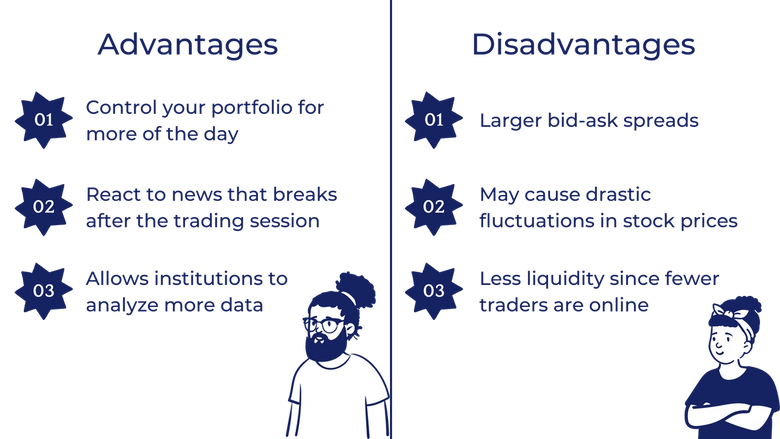

Although traders will typically have to alter their trading strategy during after-hours sessions because there is less liquidity in the market, there may be certain advantages to having control over a portfolio during post-market trading hours. Let's discuss the advantages and disadvantages.

Advantages

- After-hours trading allows you to have control over your portfolio for a more significant portion of the day.

- After-hours trading allows you to react to news that breaks or events that occur after the traditional trading session.

- Extending the trading session allows institutions to analyze more data than the traditional investor. For example, a firm interested in making a significant transaction on a given stock can wait to see how most traders react throughout the day. If news of a change in leadership occurs late in the trading session, after-hours traders have the luxury of analyzing the stock's performance before market close to see if their stock is losing public approval.

Disadvantages

- After-hours trading tends to be characterized by larger bid-ask spreads, meaning that you may not be able to execute your order at your desired price.

- After-hours traders may cause drastic fluctuations in stock prices while other investors can not make trades (say if their brokerage doesn't allow them to). Massive losses may occur for these investors.

- There may be less liquidity during after-hours trading since fewer traders are online once the traditional trading session ends.

Key Takeaways

- Stock markets across the globe have set times in which most trading activity takes place; this is called the trading session.

- The New York Stock Exchange and NASDAQ operate from 9:30 AM to 4:00 PM EST.

- After-hours trading on these stock exchanges occurs from 4:00 PM to 8:00 PM EST.

- There are several advantages and disadvantages to extended hours trading, and only institutional investors were allowed to partake until roughly 1999.

The information provided herein is for general informational purposes only and is not intended to provide tax, legal, or investment advice and should not be construed as an offer to sell, a solicitation of an offer to buy, or a recommendation of any security by Candor, its employees and affiliates, or any third-party. Any expressions of opinion or assumptions are for illustrative purposes only and are subject to change without notice. Past performance is not a guarantee of future results and the opinions presented herein should not be viewed as an indicator of future performance. Investing in securities involves risk. Loss of principal is possible.

Third-party data has been obtained from sources we believe to be reliable; however, its accuracy, completeness, or reliability cannot be guaranteed. Candor does not receive compensation to promote or discuss any particular Company; however, Candor, its employees and affiliates, and/or its clients may hold positions in securities of the Companies discussed.