How VCs Make Money: Carried Interest

Carried interest allows the general partner of an investment fund to large shares of the profits. Read on to learn why it's contoversial.

What Is Carried Interest?

Carried interest is the share of a fund's profits that fund managers get paid for setting up and maintaining hedge funds and private equity funds. The actual percentage these individuals receive is often calculated as a management fee of about 2% of the total capital invested and anywhere from 15-30% of the fund's eventual profits.

The managers who earn a percentage of the profits are called general partners, and they often use carried interest loopholes to lower their tax rates.

How Does it Work?

Here is how it typically works:

- Private equity firms partner with investors with large sums of capital to buy and strengthen business in the economy.

- The investors contribute most of the money to the fund, and the equity partners contribute smaller shares of monetary capital along with their entrepreneurial knowledge and expertise.

- When the firm sells a company, the general partners receive a portion of the profits made on that investment: the profits they receive are called carried interest.

The United States Tax Code allows these profits to be taxed as capital gains to reward investors for sharing their capital and expertise with small businesses in the economy. The taxation on capital gains is inherently lower than ordinary income, so why are these profits considered capital gains?

Let us examine why with an example...

Jeff, a relatively wealthy lawyer, and Martha, a savvy businesswoman, decide to open a clothing store together. Jeff decides that his primary contribution will come from the start-up capital required to open the store, while Martha runs operations in the store itself with her business expertise. Since Jeff paid for the store out of pocket, he will receive an 85% stake, while Martha gets 15%.

After a few years, the two decide to sell their ownership in the store at a profit. The gains they actualized by selling the store at a profit are taxed as capital gains since they are a return on investment. In being taxed as capital gains, Jeff and Martha avoid high tax rates associated with ordinary income and instead pay lower capital gains tax rates. However, some may argue that only Jeff should receive this loophole since he is the only one that actually contributed monetary investment.

Let's investigate this conversation further by examining the loophole and considering the differing perspectives on their appropriate taxation.

Carried Interest Loophole

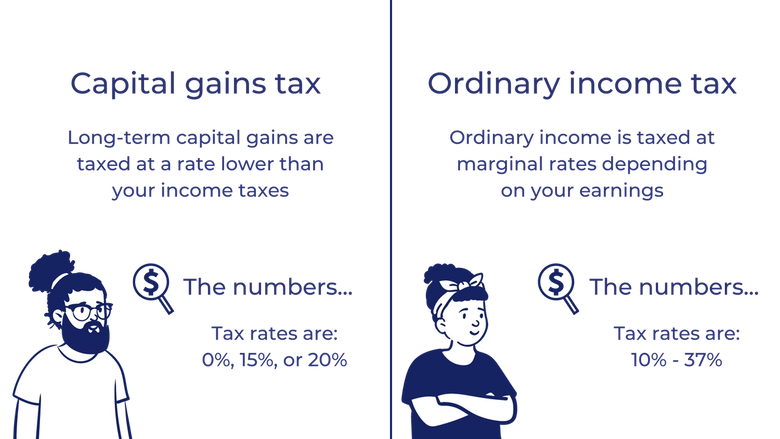

To understand how individuals have manipulated carried interest loopholes to avoid paying higher tax rates, it is crucial to understand the distinction of taxation between long-term capital gains and ordinary income.

Taxation: capital gains vs. ordinary income

Essentially, there is a ceiling by which an investor can be taxed for long-term capital gains. Long-term capital gains are taxed at a rate of either 0%, 15%, or 20% depending on your income tax bracket:

- If your tax brack is 10-15%, your capital gains will be taxed at the 0% rate;

- If your tax brack is 25-35%, your capital gains will be taxed at the 15% rate;

- And if your tax brack is above 35%, your capital gains will be taxed at the 20% rate

Ordinary income is taxed anywhere from 10-37%, so if you're in a high tax bracket, your capital gains tax rate is going to be much lower.

As a more concrete example, $1,500,000 taxed as long-term capital gains will only incur a 20% tax rate, whereas the same value could be taxed at speeds up to 37% if it were to be ordinary income.

Controversy Behind the Loophole

What are those against it saying?

The controversy behind the loophole is that carried interest profits are written off as capital gains and therefore incur lower taxes. Some people feel this loophole benefits wealthy investors who keep higher percentages of their income. They may argue that since these managers hardly invest any of their own capital, the profits are not technically capital gains.

What about those in favor?

Proponents of the tax loophole may argue that it promotes investment in the economy, and by eliminating it, less investment may occur. They also may claim that their tax benefits are earned as they provide support for entrepreneurial ventures, and that fewer massive funds means startups are less likely to find a willing donor.

Overall thoughts on the controversy

Venture capital and hedge fund managers create investment income for companies that may not otherwise survive. However, it may be difficult to claim that their profits should be subject to lowered capital gains rates while small business taxpayers continue to pay heightened ordinary income tax rates. Either way, the issue can be pretty polarizing, and many interesting points come from each side of the spectrum.

Key Takeaways

- Carried interest comes from transactions made by fund managers who invest in small businesses.

- The carried interest loophole allows these managers to pay lower tax rates on their profits from the investment. However, the carried interest loophole can only be implemented if returns exceed a hurdle rate: a specified return level that must be met. The tax treatment of these individuals may be subject to polarizing debate.

- A general partner has management duties and fiduciary responsibility, while a limited partner is one with no management or fiduciary duties.

- Funds will typically make transactions on a business as quick as three years after the initial investment, though it is also common for up to seven years to go by before transactions within the fund are performed. This is called the holding period and describes how long the partners allow allocation from the investment fund to be distributed to a specific company.

The information provided herein is for general informational purposes only and is not intended to provide tax, legal, or investment advice and should not be construed as an offer to sell, a solicitation of an offer to buy, or a recommendation of any security by Candor, its employees and affiliates, or any third-party. Any expressions of opinion or assumptions are for illustrative purposes only and are subject to change without notice. Past performance is not a guarantee of future results and the opinions presented herein should not be viewed as an indicator of future performance. Investing in securities involves risk. Loss of principal is possible.

Third-party data has been obtained from sources we believe to be reliable; however, its accuracy, completeness, or reliability cannot be guaranteed. Candor does not receive compensation to promote or discuss any particular Company; however, Candor, its employees and affiliates, and/or its clients may hold positions in securities of the Companies discussed.