Backdoor Roth IRAs: The Loophole You Should Know

Backdoor Roth IRAs can be a powerful strategy to save for retirement if used correctly. Find out if it's right for you and how to set one up.

A backdoor Roth IRA is a strategy that allows high-income people to save for retirement. There are a few ways to create a backdoor Roth IRA and this article will explain in detail what a backdoor Roth IRA is, how someone can open one, and who a backdoor Roth IRA is right for.

What Is a Backdoor Roth IRA?

Roth IRAs, or Roth individual retirement accounts, impose income limits so that people with incomes above a certain threshold cannot contribute to them. A backdoor Roth IRA is a strategy to get around this rule, hence the name.

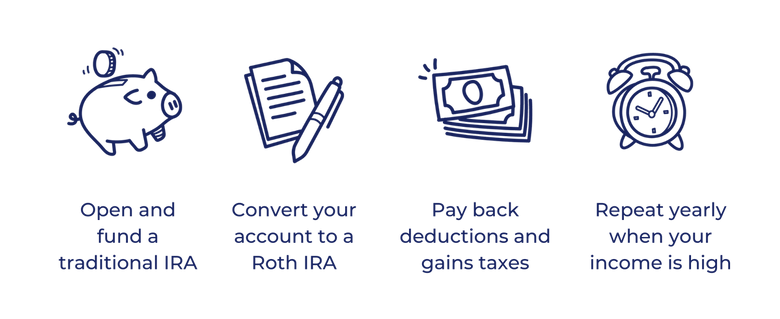

Essentially, the process comes down to opening a traditional IRA, converting it into a Roth IRA, paying taxes on the deposit, and reaping the rewards of having a tax-efficient model.

You may be wondering why you would want to do this - traditional IRAs don't impose income limits, so why go through the effort? It's crucial to understand traditional and Roth IRAs in order to understand the backdoor Roth strategy.

Here's what you should know about Roth and traditional IRAs on a basic level

Roth IRAs

So, why go through the trouble to open a Roth IRA? The answer really depends on your financial situation, but Roth IRAs have some attractive characteristics:

- Contributions to these accounts are taxed going in, so the money in your account grows tax-free and there are no taxes imposed when you withdraw it in the future. Thus, these accounts are popular amongst investors who believe their taxes will be higher in the future.

- Roth IRAs allow you to withdraw contributions early and penalty-free (withdrawing earnings early, however, will lead to penalties).

- Roth IRAs don't force you to take required minimum distributions, or RMDs, so you never have to withdraw your money and can allow it to grow like any other investment account.

One of the drawbacks of a Roth IRA is that the IRS imposes income limitations based on your filing status on your tax return. In 2021, the government implemented limits on taxpayers of $208,000 (married filing jointly) or $140,000 (single). So if your income is above these levels, you cannot contribute to a Roth IRA - this is the problem that the backdoor Roth IRA solves.

👉 Read next: An Overview of Roth IRAs

Traditional IRAs

So, what about a traditional IRA? This account is tax-deferred and therefore, you'll pay taxes on it when you start making withdrawals during retirement. There can be a sizable advantage in having a Roth IRA as your withdrawals are tax-free income to live off of in retirement. The advantage to a traditional IRA is that there are no income limitations, so folks with higher incomes can use them to save for retirement.

You may be wishing you could combine the best aspects of traditional and Roth IRAs - that's exactly what a backdoor Roth IRA does.

When Does a Backdoor Roth IRA Make Sense?

While backdoor Roth IRAs can be a great strategy to get around the Roth IRA income limit, they may not make sense for everyone.

To recap, to open one you need to first open a traditional IRA, and then you'll convert it to a Roth IRA. The faster you make the conversion the better because you'll have to pay taxes on any earnings in your traditional IRA. Even more importantly, you want to make sure you haven't deducted your contributions to your traditional IRA.

Remember, traditional IRAs incur taxes when funds are removed, so converting from a traditional IRA to a Roth IRA requires those funds to be taxed.

👍 When it makes sense

Roth IRAs are a popular choice if amongst investors that believe they will be in a higher tax bracket in the future since the investment is taxed going in rather than when the funds are withdrawn. For example, if someone anticipates moving into a higher tax bracket that increases their taxes by 5%, they will save money with a Roth IRA because they will be taxed at the lower rate.

👎 When it doesn't make sense

If you expect to be in a lower tax bracket when you start withdrawing your funds, it may not make much sense to convert to a Roth IRA since the tax rates paid at the time of deposit are higher than the rates at withdrawal. In this instance, it probably makes the most sense to invest in a traditional IRA.

If Jake invests $1,000 into a Roth IRA but is currently taxed at 15%, he will pay $150 in taxes. Say Jake's tax rate is 5% when he starts making withdrawals. Had Jake chosen to invest in a traditional IRA, he would have paid $50 upon withdrawal, which means he lost $100 by performing a backdoor Roth IRA conversion.

Watch out for the pro-rata rule

Put simply, the pro-rata rule is used to calculate how much of a traditional IRA is taxable when converting it to a Roth IRA. "Pro rata" means proportional, so when applied to a backdoor Roth IRA, the pro-rata rule means that the taxes imposed while converting your traditional IRA to a Roth IRA will be proportional to how much of the money is after-tax and pre-tax. The funds that haven't been taxed yet will be taxed at the pro-rata rate.

Say for example, 40% of the funds in your traditional IRA have been taxed while 60% have not. You don't have a say in which portion of the funds is transferred. Regardless of how much of your funds you plan to convert to a Roth IRA, 60% will be subject to new taxes.

So, you may find yourself frustrated with this rule if you've only paid taxes on a portion of your IRA funds.

Have You Determined if it's Right for You? Here's How to Set One Up

1. Contribute money to a traditional IRA

If you have a traditional IRA, then you're already on your way. If not, you can choose from many IRA providers and fund your account.

Making non-deductible traditional IRA contributions will save you the headache of paying back your deductions later on when converting to a Roth IRA.

2. Convert contributions to a Roth IRA

Doing this quickly will leave you with fewer taxes. If you already have a traditional IRA that has been growing for some time, you may find that your previously tax-deductible retirement income will incur taxes during the conversion process.

There are 3 ways you can do this rollover:

- Direct rollover: Talk with your IRA administrator about transferring your funds from your traditional IRA to your Roth IRA.

- Trustee-to-trustee transfer: Talk with your financial institution about transferring your funds from your traditional IRA to your Roth IRA at a different financial institution.

- 60-day rollover: If the funds from your traditional IRS are distributed directly to you, you have 60 days to put them into your Roth IRA.

3. Be ready to pay the appropriate taxes for the process

If you claimed tax deductions on your traditional IRA and then convert to a Roth IRA, you will have to pay them back on your tax return in the next tax year.

If gains were made in your traditional IRA, they will be taxed when converting to a Roth IRA.

The rollover of tax contributions from one account to the other may take extensive personal finance knowledge to understand. Therefore, it may be helpful to speak with a financial advisor about your retirement savings account.

4. Repeat the conversion process

You can continue using the backdoor Roth IRA in years when your income is too high to directly contribute to a Roth IRA.

Key Takeaways

- One of the most prevalent differences between a traditional IRA and a Roth IRA to remember is the way their owners are taxed.

- It is important to remember that there are limitations on Roth IRAs: contribution limits and income limits, forcing one to use traditional IRAs. Backdoor Roth IRAs come in handy as people can switch their traditional account into a Roth. During the backdoor Roth IRA process, withdrawals from a traditional IRA will be reimplemented as income tax by the IRS.

- Annual contributions to a Roth IRA may not be removed until the funds sit in the account for at least five years. Contribution limits may exist for Roth accounts. Roth IRA contributions differ from traditional ira contributions, and minimum distribution limits may exist for each type of account.

- There are taxation benefits for each type of account; it may be wise to learn which version fits your situation best before deciding to switch over. Financial advisors from the brokerage of choice can help you understand which retirement plan is best for you, so don’t be afraid to reach out.

The information provided herein is for general informational purposes only and is not intended to provide tax, legal, or investment advice and should not be construed as an offer to sell, a solicitation of an offer to buy, or a recommendation of any security by Candor, its employees and affiliates, or any third-party. Any expressions of opinion or assumptions are for illustrative purposes only and are subject to change without notice. Past performance is not a guarantee of future results and the opinions presented herein should not be viewed as an indicator of future performance. Investing in securities involves risk. Loss of principal is possible.

Third-party data has been obtained from sources we believe to be reliable; however, its accuracy, completeness, or reliability cannot be guaranteed. Candor does not receive compensation to promote or discuss any particular Company; however, Candor, its employees and affiliates, and/or its clients may hold positions in securities of the Companies discussed.