Bullish vs Bearish: What's the Difference?

Pros and cons of investing in bull vs bear markets.

To fully understand how financial markets operate, it is important to understand the difference between bear and bull markets. Bearish is a term used to describe a downward movement in the stock market. Bullish is a term used for the opposite instance when the market is moving upward. Each designation can represent the change in an asset as well as a change in the entire market.

The origin of the labels comes from the way each animal attacks their prey in nature. It is said that a bull thrusts its opponent upward with its horns while a bear rips its prey to the ground. Thus, when applied to the market, each animal represents the movement they perform in nature.

Fluctuations of stock prices define bull and bear markets. Bullish means positive and bearish means negative in terms of stock performance. Market conditions constantly adapt over a given period. Technical analysis on the historical performance of market indices such as the Dow Jones Industrial Average and the S&P 500 reveals that the overall stock market operates on an uptrend in the long term.

Bearish investors who engage in short selling have a different trading strategy than long-term investors. Downtrends occur in the short term for both market and asset investments. Bearish investors will never bet against the performance of the market in the long run, but bearish market sentiments can cause downward trends in the short term. Bearish investors make informed investment decisions according to this principle.

Market trends and price movements are valuable knowledge for stock traders looking to capitalize on short-term profits within a specific time frame.

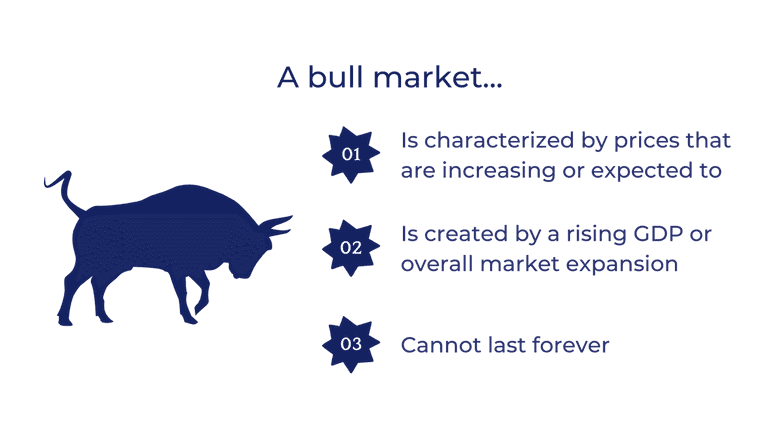

What Is a Bullish Market?

When the market itself is bullish it means that prices are increasing or expected to, and thus both the economy and publicly traded equity options are performing well.

Bullish Investor

A bull or bullish investor believes a particular asset is primed to rise. Bullish can also apply to any individual security. When an investor is bullish, they are more likely to invest unless they are waiting for a bull pattern to take place and offer the security at a discounted price.

Characteristics

A bull market represents positive market momentum. Bullish means that, generally speaking, market assets are moving upward or in a positive direction. Bullish patterns are created by a rising GDP or overall market expansion. Bullish investors tend to have the patience to allow downward resistance to eat into returns in hopes of actualizing substantial returns in the long run.

Duration

No bullish market lasts forever, which is why investors must carefully consider the possibility of the market dipping. Periods of inflated success are classified as bubbles, and as we all know, bubbles tend to pop eventually. The popping of said bubble is often difficult to predict, though skilled investors seek to anticipate these bursts far in advance.

Going Long

Going long on an investment means that the investor is willing to hold the asset in the long term. Long-term investors will place less value on the short-term success of the investment and more on the ability of the asset to maintain steady growth in the long run. Historically speaking, the global stock market operates on an upward trend.

What Is a Bearish Market?

When the market is bearish, it is marked by a decline in prices.

Bearish Investor

A bear or bearish investor is the antithesis of a bullish investor. This type of investor believes that the market or a particular asset is primed to fall in value. The anticipation of this drop in asset value can be important in determining how a stock will recover from periods of economic uncertainty. Bearish investors may also anticipate that periods of decline precede opportunities to buy the asset at a discounted rate.

Characteristics

A bearish market characterizes periods of economic recession. Several factors have proven to cause these tumultuous periods of inflation and economic correction of an expansionary period. Bearish periods may be permanent for a particular asset. Extended periods of bearish performance for a company may lead to bankruptcy.

Duration

Bearish periods can last as little as two weeks and up to several years. However, the period itself isn’t labeled as bearish unless it lasts at least two weeks. Bearish periods of over two periods (3-month periods) represent a recession. Recessions lasting for several years are classified as depressions.

Short(ing)

Investors who choose short stocks are generally not interested in the long-term viability of the asset itself. Short investors are anticipating short-term returns due to upcoming volatility. If a short investor expects company earnings reports to boost the value of the stock, they’ll buy in before the announcement and sell shortly after at a profit.

Similarities and Differences

Similarities

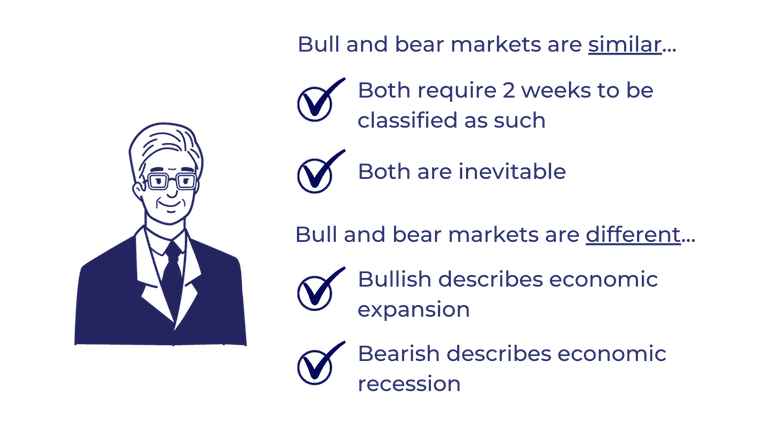

- Both periods require at least two weeks to be officially classified as bearish or bullish.

- The terms are used to describe movements in the market.

- Skilled investors use each term to describe the recent and upcoming performance of an asset.

- Each term is applicable to the entirety of the market as well as individual stocks.

- Both forms of economic performance are inevitable. The two coexist and neither will ever dissipate from existence so long as the other exists.

Differences

- Bearish is used to describe periods of economic recession. Bullish is used in the opposite instance, to describe a period of economic expansion.

- Although periods of expansion and recession always exist, the market has expanded long-term. The historically bullish performance of the market allows long-term investors to rest assured that they will likely eventually realize a return on their investment.

- On average, investors tend to be less active in bear markets. Although it makes the most sense to buy when asset prices are low, there is a lack of confidence that investors associate with a bear market.

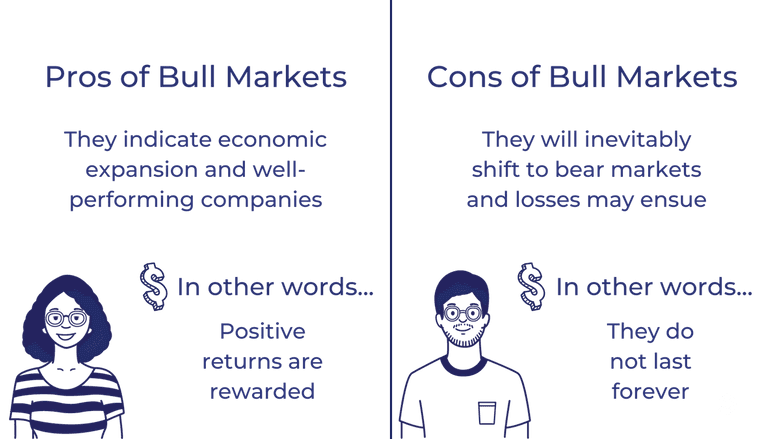

Pros and Cons of a Bull Market

Pros

Bull markets demonstrate economic expansion, which means that companies are performing well and actualizing returns. During a bull market, the economy distributes its positive returns toward investors. When businesses are performing well, they are ultimately destined to fall soon. However, if an investor is well equipped with this knowledge, they can anticipate the dips and sell before the price of the stock falls dramatically. Short-term investors typically see bullish market performance as a perfect time to sell, since they are seeking to optimize their returns in the short run.

Long-term investors can rest assured that the global stock market will usually be bullish. In understanding this sentiment and applying it correctly, investors can begin to understand the value of time.

Stock indices that track the entirety of the market can be reliable investments in the long term. Taking this into account, it becomes apparent that investors can begin to rely on these indices to return steadily, making index investments an option for college or retirement savings accounts.

Cons

What goes up must come down. Bull markets are welcomed until they inevitably shift into bear markets and correct some of the positive returns they previously yielded. If bullish investors become too excited about positive trends, they may falsely anticipate more returns. If the market suddenly turns, bullish trends may be corrected and losses will ensue for investors who anticipated the trend to continue positively.

Bullish investors may be overzealous in a company’s predicted value. If an investor overestimates how well a company will perform, they may find themselves in unanticipated turmoil.

If a company has the potential to be profitable, an overly bullish investor may be willing to risk more capital in hopes of actualizing massive returns. However, placing too much faith in a stock that ends up underperforming can cost bullish investors a fortune.

Pros and Cons of a Bear Market

Pros

A bear market can be the best time to purchase an asset. Investors make sure to buy as low as possible and sell as high as possible. In adopting this notion, it becomes obvious that purchasing just before a bear market transitions into a bull market is usually the ideal strategy for short-term investors.

There is a clear distinction between a permanent bear market and a permanent bear market for individual stocks. In other words, bearish performance is not always followed by bullish performance, as the company's bearish trend may be a sign of bankruptcy or underperformance.

If an investor is able to recognize a short-term bear market, they can determine the best time to buy a stock. Since the primary goal of investing is to actualize returns through buying low and selling high, an investor who is able to predict bear markets has a massive advantage.

Cons

Bear markets demonstrate economic recession. This underperformance means companies are not actualizing returns to investors. If recessions last for multiple quarters, they may turn into depressions. Economic depression is a symbol of underperformance by a given economy. The Great Recession and the Great Depression are both well-known examples of the American economy slipping into turmoil. During these times, companies underperform and citizens feel the effects through unfavorable repercussions such as inflation, lack of availability, and closures of small businesses.

Therefore, bear markets are essential to the economy and can be quite useful for investors, but an extended period of time in a bear market can be hurtful to the economy.

Bearish performance for a given asset can derail a company in its entirety. Bearish performance in a company may represent a temporary setback or a permanent trend towards inevitable failure. If a company's stock performance is trending downward, it is important to accurately determine why it is doing so.

Takeaways

Arthur Burns and Wesley Mitchell were the creators of what we know today as the business cycle. Their proposition states that business-related ventures fluctuate upwards and downwards in a never-ending cycle, where peaks are periods of economic expansion or positive movement, and the opposite are periods of economic depression. Both periods occur frequently and constantly counteract each other. A bearish market will always be followed by a bullish market, and vice versa. No matter what an investor discovers about a particular asset, it is crucial to remember that what goes up must come down.

The information provided herein is for general informational purposes only and is not intended to provide tax, legal, or investment advice and should not be construed as an offer to sell, a solicitation of an offer to buy, or a recommendation of any security by Candor, its employees and affiliates, or any third-party. Any expressions of opinion or assumptions are for illustrative purposes only and are subject to change without notice. Past performance is not a guarantee of future results and the opinions presented herein should not be viewed as an indicator of future performance. Investing in securities involves risk. Loss of principal is possible.

Third-party data has been obtained from sources we believe to be reliable; however, its accuracy, completeness, or reliability cannot be guaranteed. Candor does not receive compensation to promote or discuss any particular Company; however, Candor, its employees and affiliates, and/or its clients may hold positions in securities of the Companies discussed.