Are P/E Ratios Accurate?

Learn how to calculate a P/E ratio and determine what it means to get a high vs low number in just a few minutes.

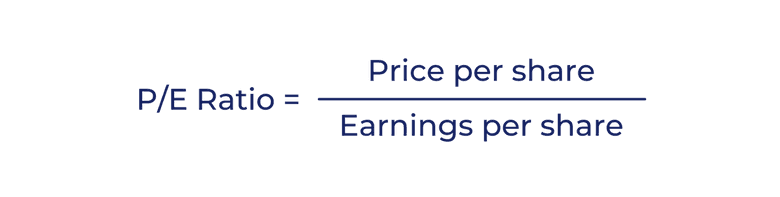

The Price Earnings ratio (P/E ratio) is a popular indicator that gives investors a better sense of a company's value. The proportion relates the share price of a company’s stock price to its earnings per share (EPS). It is most common to compare P/E ratios across different companies, but you can also compare P/E ratios of market indexes including the NASDAQ and the S&P 500.

A Clarifying Example

For example, Company A and Company B both sell umbrellas. Company A’s share price is $50 and Company B’s trades at $10. You may see these prices and assume Company B has more value, but you should calculate the P/E ratio of each to verify your claim.

Here is the information you would gather for this hypothetical example:

- To begin this process, you should compare the price of each stock to its respective earnings to determine an appropriate valuation of each company. You find that Company A earns $1,000,000 per year, while Company B only generates roughly $100,000.

- Now, you must determine how many publicly traded shares are available to the general public. With some quick research, you discover that Company A sells 50,000 shares while Company B only offers 10,000.

You now have all of the information you need to calculate the P/E ratios. Here's how to do it:

- You find the EPS by dividing the total earnings by the number of shares each company offers. You determine that Company A’s EPS is $20 ($1,000,000/50,000) and Company B’s is $10 ($100,000/10,000).

- Recall that the P/E ratio is found by dividing the share price by the company’s EPS. Therefore, you conclude that Company A’s P/E ratio is 2.5 (50/20) and Company B’s P/E ratio is 1 (10/10).

You now seek to apply your savvy new knowledge to make the most informed investment decision between the two companies. After reminding yourself what the P/E ratio represents, you understand that the lower the P/E ratio, the less you pay for the same earnings. Basically, the lower P/E ratio indicates that the company may be undervalued. Therefore, you choose to invest in Company B.

Types of P/E Ratios, Explained

There are several ways to determine the earnings of a company. You can use absolute valuation to calculate a company's value based on records of performance. For example, analysts can use previous benchmarks of earnings reports and determine how they affected the stock price. Using this information, they can determine an absolute valuation for the stock's near future. This estimate can help analysts predict how the P/E will fluctuate and make investment decisions accordingly.

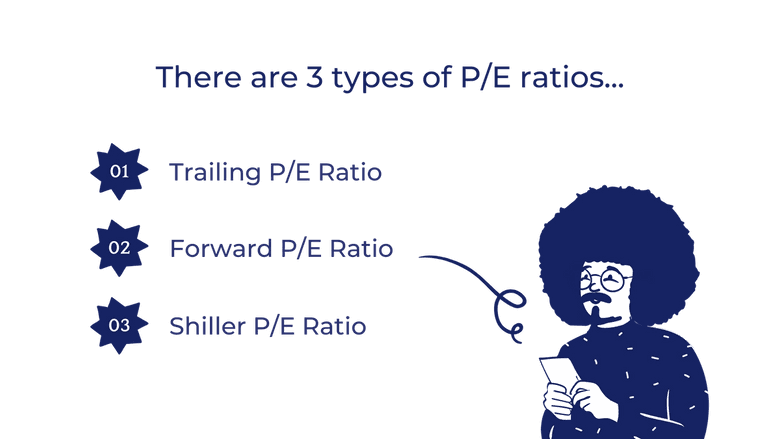

The price-to-earnings ratio is typically calculated using the current value of a stock. However, it is also possible to use the average price of said stock over a set period. Overall, there are three methods for calculating a P/E ratio. Each approach provides a different interpretation of the stock’s value.

Trailing P/E Ratio

Trailing earnings are generated by previous periods of earnings. The Trailing P/E ratio is calculated by dividing the current share price by the previous trailing twelve-month, or TTM, earnings per share. This approach can be beneficial if you prefer to use actual reported data over predictive calculations.

Simply analyzing the market price of a stock, or the current stock price, may not provide an accurate benchmark for the company's performance in the future. Previous trends of increases in share price can not account for future external factors such as a pandemic. In essence, upward and downward trends do not last forever and past performance does not predict future performance.

Forward P/E Ratio

Forward earnings use future estimates of company earnings. Investors using forward earnings attempt to read the market and derive an accurate prediction about the company's future performance. Thus, the forward P/E ratio compares current earnings to predicted future earnings. Though this method uses estimated data, it can be useful if you predict upticks in future earnings.

Alongside the growth rate of a stock, future earnings estimates can be helpful predictive indicators. Predicting earnings growth is inherently more challenging than analyzing the earnings yield of past periods. However, the growth prospects of a stock ultimately provide future cash flow estimates. In other words, predicting how a stock will perform can be difficult, yet valuable in analyzing the company's future.

Since current earnings are typically not publicly available until earnings reports are released, forward earnings estimates can play an integral role in predicting upticks of company performance in the short term and the long term.

Shiller P/E Ratio

The Shiller P/E ratio is calculated using given periods. For example, the Shiller P/E may be used to track the performance of an index over ten years. To do so, divide the price of the stock by the earnings of the given period, adjusted for inflation. This method is commonly used to track the performance of the S&P 500 index, which is one of the most accurate stock market indices. This form of P/E is also known as cyclically adjusted P/E.

How Does It Work?

Investors on Wall Street use P/E ratios to their maximum efficacy. The P/E ratio expresses how expensive a stock is relative to its earnings, thus demonstrating how much you are paying for your earnings. Investors use P/E ratios to determine whether a company is over or undervalued.

Undervalued companies are keen for investing, as they are bound to rise in share price to equate to their actual value. Overvalued stock is traded at an inflated value, and can be seen as a poor investment that is bound to decrease in value.

When comparing two companies, the company with a lower P/E ratio will most likely stand out since it is the cheaper option for the same returns. However, higher P/E ratios don't necessarily entail poor investments, as they can represent value that is worth the increased cost for investment.

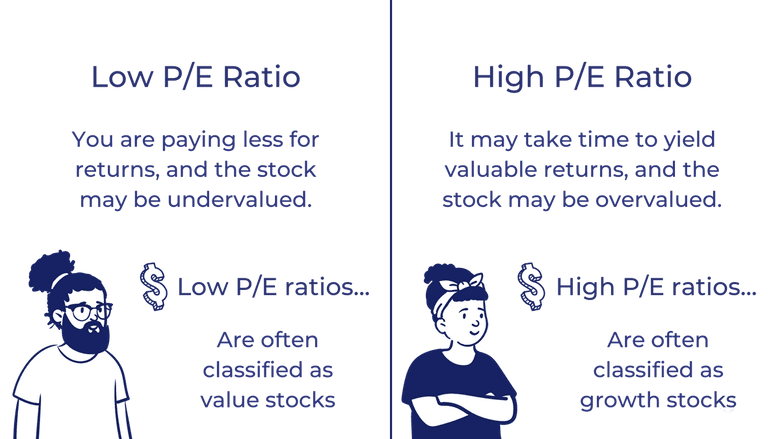

Low P/E Ratio

The lower the P/E ratio, the less you are paying for returns. In the example above, Company A’s investors paid $2.5 for $1 of revenue while Company B paid $1 for $1 of revenue. In essence, P/E intends to display how expensive a stock is relative to its earnings. Therefore, the lower the P/E, the cheaper the stock is.

Equity stocks and mutual funds use P/E ratios to identify themselves as either “growth” or “value” stocks. The stocks with lower P/E ratios are classified as value stocks, as they encompass more value relative to their earnings. Lower P/E ratios may also point towards a possible undervaluation of stock. If a stock is undervalued, it means that investors are buying it for a discount and the price is bound to rise.

High P/E Ratio

High P/E ratios are not inherently negative. The high ratio can mean the investment will take time to yield valuable returns. If an investment has a high P/E ratio it is considered to be a growth stock.

In analyzing P/E ratios, it is crucial to consider why a company’s earnings may be more expensive. If the company is growing or developing an incredible new product that is yet to be released, it will likely have a high P/E since it is not generating revenue on its new product. However, this does not mean that the company represents an expensive/poor investment, as the commodity could entail profitable quarters of returns once it becomes publicly available. It is also possible that a high P/E ratio could represent the overvaluation of a stock as well, which would be bound to fall to reach a fair market value.

Why Are P/E Ratios Used

Why Investors Use It

P/E ratios can be useful for several reasons and occupations. Investors, issuers, and analysts use P/E ratios to determine valuation and analyze trends of previous company performance. These metrics can be useful for making informed investment decisions.

Simply comparing the price of two company stocks does not provide any inherently advantageous information about the worth of said stock. Comparing the share price with earnings creates a figure capable of yielding more intelligent investment decisions.

Why Companies Use It

Companies can use P/E ratios as a way to entice potential investors. If the EPS is monitored carefully by a skilled accountant, a company may gain favor over its competitors by utilizing their impressive P/E figure. If a company can maintain a more favorable P/E ratio over its competitors, it can attract new investors in the industry. This concept is difficult in practice but can be accomplished if monitored carefully.

How Useful Is It?

The P/E ratio is an effective investment metric, but it is not perfect. An enticing P/E ratio will usually be staggeringly low; however, if Company B has limited potential for returns with a lower P/E ratio than Company A, an investor may mistakenly use P/E to determine which company to invest in. Thus, you should understand why a company's earnings are higher or lower before relying entirely on a P/E ratio to help you make an investment decision. In essence, remember that no investment technique is omniscient and capable of predicting performance without error. That being said, the P/E ratio can be a useful tool for investors if applied correctly.

The information provided herein is for general informational purposes only and is not intended to provide tax, legal, or investment advice and should not be construed as an offer to sell, a solicitation of an offer to buy, or a recommendation of any security by Candor, its employees and affiliates, or any third-party. Any expressions of opinion or assumptions are for illustrative purposes only and are subject to change without notice. Past performance is not a guarantee of future results and the opinions presented herein should not be viewed as an indicator of future performance. Investing in securities involves risk. Loss of principal is possible.

Third-party data has been obtained from sources we believe to be reliable; however, its accuracy, completeness, or reliability cannot be guaranteed. Candor does not receive compensation to promote or discuss any particular Company; however, Candor, its employees and affiliates, and/or its clients may hold positions in securities of the Companies discussed.