How to Avoid Phishing Online

If you want to lessen your chances of being scammed, or have been scammed already and don’t know what to do, consider this your ultimate guide.

In today’s society, the advancement of technology has made it relatively easy to be scammed, whether it be social media, internet browsers, or incredulous accessibility to calls and text messages. Nowadays, phishing — a term used to define the act of being scammed online — is among the most prevalent forms of thievery in American society, which means the typical consumer ought to be very cautious when navigating the web.

Throughout this article, we will analyze the process that takes place when an individual is scammed, and more importantly, what to do if it happens to you.

Most Common Ways People Get Scammed

Scammers come in all shapes and sizes. Typically, they are after personal information that can be of value to them. Credit card information or social security details would be ideal for a scammer. However, most people are pretty awry when giving up their financial info online, so scammers have to be quite tricky to pull off such a stunt.

A very prevalent form of phishing comes in the form of email, phone calls, or text messages. Essentially, a scammer will begin their process by luring their victims into an interaction, potentially in the form of clicking a link of some sort. After they get an individual to go to their website, they will attempt to collect as much information as possible.

Most forms of phishing require more direct forms of thievery than just clicking a link, such as asking for passwords or credit card information.

Here are some examples of common phishing methods:

- A scammer may send email lists to random individuals they feel are susceptible to being scammed and convince the victim to use their service.

- Sometimes, a scammer will try to sell a product, such as cheap sports paraphernalia or school textbooks that consumers are looking for deals on.

- A scammer may convince an individual that their insurance warranty has expired. They trick the victim into creating a password to access a portal that will allow them to renew their “warranty.” Once a password has been created, the scammer will plug the same password into other online platforms to see if it works elsewhere.

Recognizing Threats

A great scammer will attempt to make their scam look as authentic as possible, so it may be challenging to recognize when someone is trying to fool you.

A great combatant of scams will question all offers online that sound peculiar. If a consumer visits a website often, say Amazon, they do not have to worry about being scammed by the site because they have built rapport with it. However, suppose another site, such as Amazon Plus, attempts to spin off a more readily accepted brand into something new. In that case, a consumer may be wise to verify that the product actually exists.

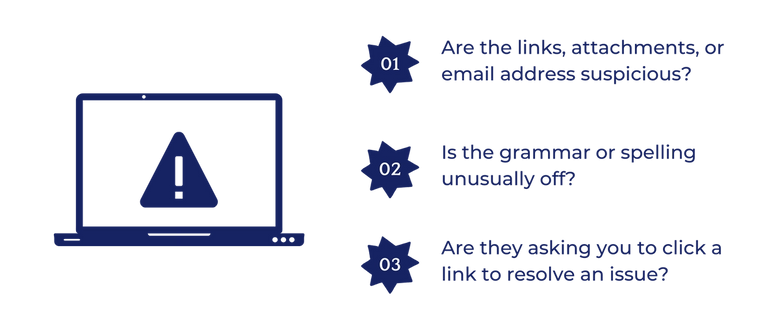

Here are some things to look out for if you get a phishing email:

- Hover over links within the email to see if they redirect you to somewhere other than where the email claims (but don't click on them)

- Look at the email address and see if it's associated with the company contacting you

- If there are any attachments, do they look suspicious?

- Check for a lot of grammar and spelling mistakes

- Do they tell you that they've noticed suspicious activity in your account and ask you to click a link to resolve it?

- Do they make you an offer that seems too good to be true?

Scammers have gotten very good at making phishing emails appear to be coming from a given company. If you're suspicious of an email you've received but don't want to disregard it in case it's legit, you should contact the company directly and ask. However, do not use the phone number provided in the email — go directly to the company website from your browser and find the phone number there.

Above all else, it is never a bad idea to educate yourself on different strategies scammers attempt to implement when it comes to phishing. Aside from the tactics mentioned above, here are some other valuable resources that may help you determine if you are being scammed.

Technical Prevention

A serviceable tool for combating phishing comes in the form of antivirus computer software.

Toolbox.com recently compiled a list of antivirus software that can help prevent your data from being stolen online. Each of these ten software platforms should do the trick — just click here and see which one is best for you.

Unfortunately, antivirus software isn’t always enough to protect yourself from scammers online. This is because clever scammers will meticulously find ways to combat complex software algorithms by convincing you to put your information into a false website.

Essentially, credible antivirus software will most likely deter viruses and encryption hacking, but it can’t always save you from yourself. Therefore, even if you go ahead and find excellent antivirus software, it may still be necessary to evaluate your personal e-commerce habits to make sure you don’t get yourself in trouble.

Dealing With Scammers

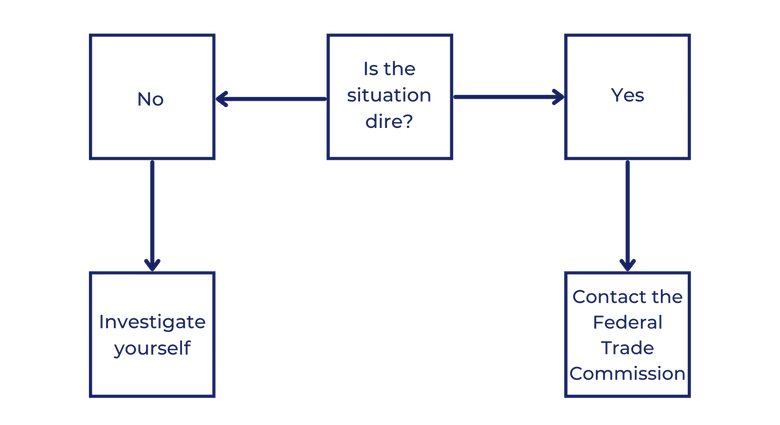

So you think you’re being scammed and want to know what to do, huh? Well, you’ve come to the right place. First of all, if the situation is urgent and would classify as an emergency, it may be wise to contact the Federal Trade Commission directly using this link.

However, if the situation is not dire and you are simply curious as to whether or not the person on the other side of a personal transaction has bad intentions, ask yourself the following questions:

- Is this company contacting me entirely out of the blue, and if so, why would they do this?

- Have I heard of this company before? Do I know anyone else who has heard of them?

- What information have I been able to find about this company, and how do others feel about using this service?

- Why should I trust this organization with my personal information?

- Am I being rushed to perform a transaction? Why might this be?

- Have there been any red flags in their method of communication (grammar mistakes in emails, incoherent phone calls, shotty website design)?

Suppose any of these questions entail peculiar or alarming answers. In that case, it may be best to stay away from the potential scam.

However, if none of the questions raise notable answers, that does not necessarily mean you are in the clear. The questions listed above are relatively easy for a scammer to anticipate. Though they can help eradicate potential scams, they are not 100% effective in identifying phishing platforms online.

What to Do if You Get Scammed

You can call 1-877-382-4357 to speak with a representative from the Federal Trade Commission if you’ve been scammed.

In the meantime, you may want to combat the situation in any way you possibly can. To determine what the appropriate response to being scammed would be, we’ve compiled a list of possible ways to combat your scammer below:

- Hacked Email Account: If a hacker has stolen your email information, monitor the sent emails closely and see if you can freeze the account from sending emails. However, it may be counterintuitive to delete the account since the information in the emails may be useful in a criminal investigation. If a scammer sends harmful information to any personal contacts or colleagues, inform them of the situation immediately and contact the FTC as soon as possible.

- Stolen Credit Card Information: Credit/debit cards can usually be frozen quickly online. “Freezing” a card means halting any transactions from taking place in the account itself. This effectively renders the card useless until the account is unfrozen. If the scammer has already used the card for transactions of any kind, notify your bank and let them know what is going on — if you catch it quickly enough, you will typically get your money back.

- Stolen Identity or Social Security: Stolen personal information of this sort can be pretty serious. If you have identity insurance, contact the agency you purchased it with and work with them to determine the next steps. If you do not have this insurance, contact the FTC using the number above and call the police immediately.

If you or someone you care about has been involved in a scam, don’t worry. You are definitely not the first person to be scammed and certainly won’t be the last either. It may be reassuring to consider that there are steps in place to resolve the issue as quickly as possible. Above all else, consider your moves carefully and do not be afraid to contact authorities if need be.

Key Takeaways

- Typical avenues in which people find themselves being scammed include sketchy emails, websites offering deals that are “too good to be true,” and someone asking you to retrieve/create a password for an online platform you’ve never heard of.

- The best way to prevent yourself from being scammed is to educate yourself on how scammers operate. When giving up your personal information online, ensure that the platform you are interacting with is credible by verifying its reputation online.

- Suppose you have been scammed or fear you are currently being scammed. You may contact local authorities or try to connect with the Federal Trade Commission.

- Identity theft insurance can be precious when someone tries to scam you. If you do not already own such insurance, learn more about your options here.

The information provided herein is for general informational purposes only and is not intended to provide tax, legal, or investment advice and should not be construed as an offer to sell, a solicitation of an offer to buy, or a recommendation of any security by Candor, its employees and affiliates, or any third-party. Any expressions of opinion or assumptions are for illustrative purposes only and are subject to change without notice. Past performance is not a guarantee of future results and the opinions presented herein should not be viewed as an indicator of future performance. Investing in securities involves risk. Loss of principal is possible.

Third-party data has been obtained from sources we believe to be reliable; however, its accuracy, completeness, or reliability cannot be guaranteed. Candor does not receive compensation to promote or discuss any particular Company; however, Candor, its employees and affiliates, and/or its clients may hold positions in securities of the Companies discussed.