Rule of 72: How Soon Will Your Account Value Double?

The rule of 72: the easiest way to learn how long it will take for your money to double. But how accurate is it?

Compound interest formulas and annual rates of return can be difficult to understand. The amount of time necessary to analyze these metrics often provides a negative return on investment. Different investment options will have their own ways of presenting potential returns, and deciphering what they mean for the growth of your money can become somewhat trivial. The rule of 72 can make your calculations a lot easier.

What Is the Rule of 72?

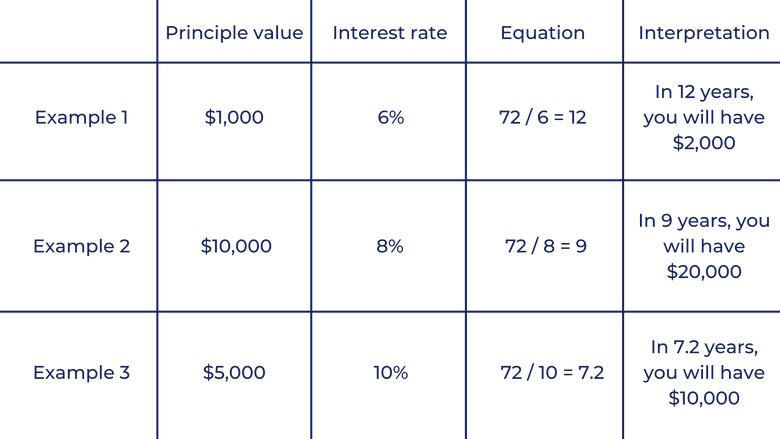

The rule of 72 is a useful tool that allows you to quickly calculate how long it will take for your money to double in any account accruing interest. To find the amount of time doubling will take, you must take the number 72, and divide it by the account's compounded interest rate. The annual rate of return can be calculated in a simple manner using this equation, bypassing the natural log functions that would be otherwise necessary.

Whether you are choosing between credit card lenders, analyzing the stock market, or comparing mutual funds, the rule of 72 can help you decide where to put your money and optimize returns.

The rule itself comes from Luca Pacioli's Summa de Arithmetica. The Italian mathematician invented the rule to ease savings decisions for businesses around the world. The original formula has been adopted for hundreds of years and is still used by businesses across the globe today.

How Does It Work?

The purpose of the rule of 72 is to provide a simplistic representation of an account's ability to accrue interest and the number of years necessary to double the amount of capital in the account.

If you are looking for a rough estimate of the time necessary to double your initial investment, you can use the rule of 72. The rule of thumb for this equation is to divide 72 by the compounded interest rate of the given savings account. Annual interest rates are necessary to determine the growth rate of a particular account. The equation works best with interest accounts that entail given rates within specified parameters.

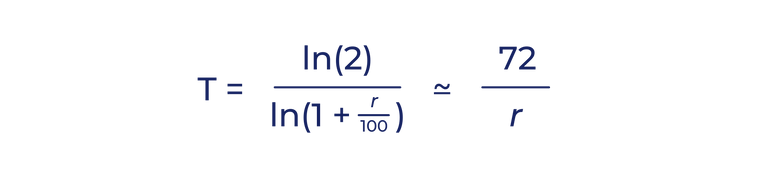

Logarithms are mathematical functions that allow you to derive the rule of 72 formula. The rule of 72 is a simple formula, but for fans of logarithmic functions, the detailed version of the equation is presented below:

How Does It Compare to Other Rules?

As mentioned above, the rule of 72 works best within certain parameters. For example, the rule of 72 is most accurately applied to interest rates between 6-10%. To yield the most accurate results, one numeric value can be added or subtracted from 72 for every 3 percentage points divergent from an 8% interest rate.

For example, a 5% interest rate is 3 percent divergent from 8%, which means the value 71 should replace 72 to yield the most accurate results.

When evaluating an account with continuous compounding conditions, the value 69.3 is supposed to be the most accurate value for these calculations. The rule of 69.3 will yield the most accurate results for an account with continuous or daily compounding.

How Accurate Is It?

The rule of 72 is a simplistic alternative to the formula used to receive a precise value (equation presented above). In using the simplistic formula of dividing 72 by a given interest rate, you can get a ballpark figure as to how long it will take for your money to double. The simple formula only intends to provide a rough estimate.

However, if you want to derive a value with 100% certainty, it would be wise to use the more accurate and complex formula above.

Higher interest rates behave differently than their lower counterparts as they require different numerator values to yield the most accurate results. The time value of money can be calculated using these equations, but the exact decimal value derived by this equation is not to be trusted with absolute certainty.

Simple vs Compound Interest

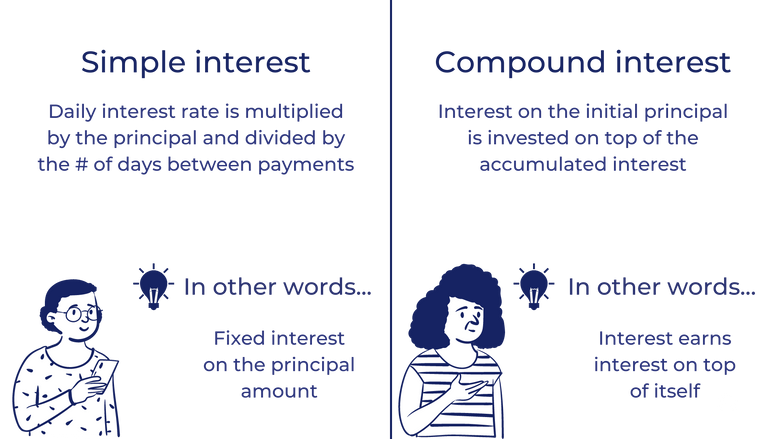

- Simple interest is determined by multiplying the daily interest rate by the principal amount. That figure is then divided by the number of days that elapse between payments. It is used for calculating interest on investments where the accumulated interest is not added back to the principal amount invested.

- Compound interest is the interest on the initial principal invested on top of the accumulated interest of previous periods of a deposit. Compound interest is essentially “interest on top of interest”. It will make the invested money grow at a faster rate than simple interest.

Key Takeaways

- The Rule of 72 is a simplified formula that calculates how long it takes for investments to double. This is calculated by dividing the number 72 by the account’s interest rate.

- The Rule of 72 is only applicable for accounts that utilize compounded interest rates and is most accurate for accounts with interest rates that fall in the range of 6% and 10%.

- The rules of 71, 73, 69, and 69.3 can be more accurate for certain interest rates.

The information provided herein is for general informational purposes only and is not intended to provide tax, legal, or investment advice and should not be construed as an offer to sell, a solicitation of an offer to buy, or a recommendation of any security by Candor, its employees and affiliates, or any third-party. Any expressions of opinion or assumptions are for illustrative purposes only and are subject to change without notice. Past performance is not a guarantee of future results and the opinions presented herein should not be viewed as an indicator of future performance. Investing in securities involves risk. Loss of principal is possible.

Third-party data has been obtained from sources we believe to be reliable; however, its accuracy, completeness, or reliability cannot be guaranteed. Candor does not receive compensation to promote or discuss any particular Company; however, Candor, its employees and affiliates, and/or its clients may hold positions in securities of the Companies discussed.