Restricted Stock Units (RSUs) Made Simple

More and more commonly, RSUs are making up a huge portion of tech compensation. Here's how they work and what to do with yours.

Restricted stock units (RSUs) are a common form of equity-based compensation, especially at tech companies. Many organizations find granting RSUs to be an effective way to motivate and reward employees without shelling out extra cash.

However, as you’ve probably heard, they can also get pretty complicated. Let’s talk about what RSUs are, how they work and how to navigate your decisions surrounding them.

What Is an RSU?

An RSU, or restricted stock unit, is a promise from your company to award you a specified number of shares of stock. These shares are “restricted” because you won’t actually receive them until their terms are fulfilled.

RSUs are typically paid out as part of an employee's compensation. They vest, or are earned, over a certain period of time - usually over 4 years.

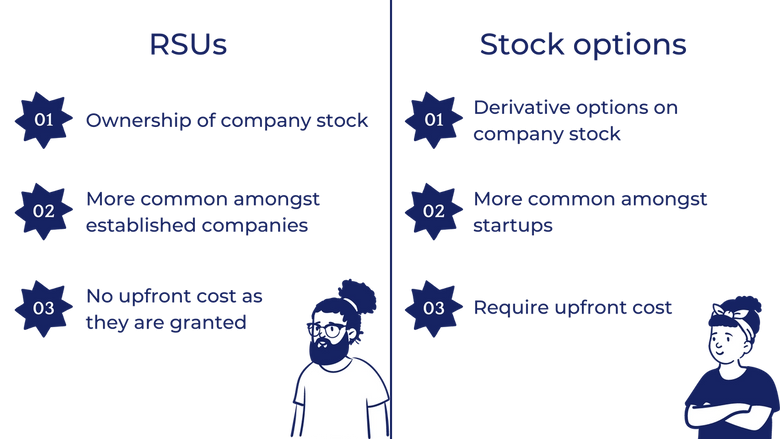

RSUs are often compared to other equity-based compensation vehicles, such as stock options. However, you’ll notice that RSUs tend to have a presence in large, established firms, whereas stock options are often granted at startup and early-stage companies.

How Does Vesting Work?

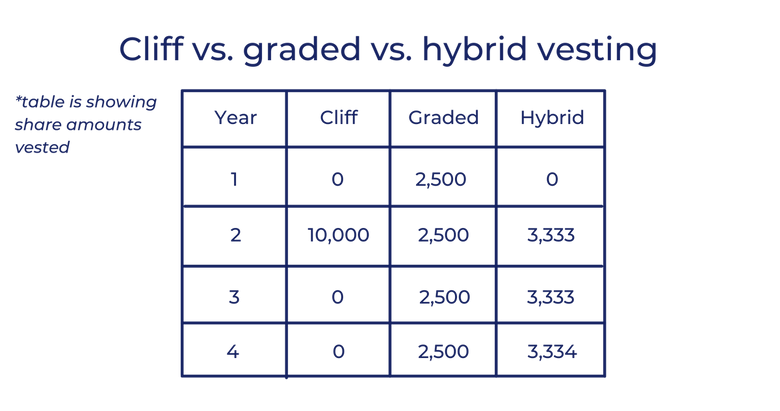

RSU vesting schedules can vary depending on the firm. However, most follow one of the following types of time-based vesting schedules:

- Cliff vesting: after a specified amount of time, all of your shares will vest at once

- Graded vesting: a fraction of your shares will vest over several periods of time

- Hybrid: a combination of cliff and graded vesting (ex: you receive 50% of your shares after one year, followed by 25% for each of the next two years)

At many companies, RSU packages are presented in the terms of dollars. However, this can get confusing if the value of the shares changes over time. For example, imagine you receive $100,000 in RSU grants at $100 per share. When your shares vest, you’ll receive a total of 1,000 units, regardless of the price at vesting.

A closer look at vesting schedules

RSU vesting schedules can get pretty nuanced, so we’ll go through a scenario to make them easier to understand. Let’s say you’ve received an offer that includes $250,000 in RSUs over a four-year graded vesting period with no cliff. On the grant date, each share trades at $25. Based on the terms of your contract, you’ll receive equal portions of the award every quarter.

Based on this arrangement, you’ll receive a total of 10,000 shares once your entire award has vested. Therefore, your company will grant you 625 shares each quarter for four years (2,500 shares per year). However, the actual value you receive may vary from quarter to quarter.

What Should You Do With Your RSUs After they Vest?

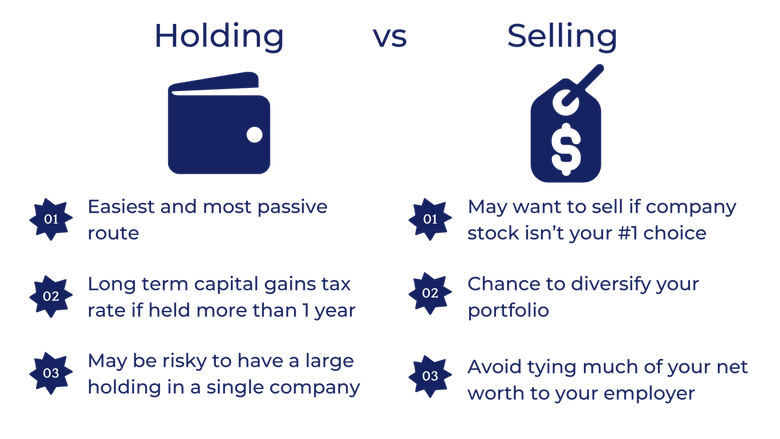

Once your RSUs vest, you have two options: hold or sell. However, there are pros and cons to each, so it’s important to thoroughly consider your choices.

When to hold your RSUs

The easiest and most passive route to take after your RSUs vest is holding them in your portfolio. Many recipients also claim that this decision may carry tax benefits, as investments held for over one year will be taxed at the more favorable long-term capital gains rate.

However, RSU recipients can theoretically avoid capital gains taxes altogether by selling their stocks before making any profits. Therefore, you may only want to hold your RSUs if you would have purchased the stock anyway based on predictions of its future performance.

When to sell your RSUs

Financial advisors typically suggest selling your RSUs almost immediately upon vesting.

Your company stock isn't your #1 choice for what to spend your money on? You may want to sell.

A common saying is that holding stock is like receiving a cash bonus and using it to purchase shares in your company. In other words, if company stock isn’t your #1 choice for what to spend your money on, you may want to sell your RSUs.

Want to diversify your portfolio? You may want to sell.

Even if you’re eager to invest in your company, you still may want to sell your shares in the interest of diversifying your portfolio. Depending on your compensation package, your vested shares might make up a significant portion of your investments.

While you may be excited to give your portfolio a boost, this can be a risky position. Financial planning resources often advise limiting your holdings in any one company to 5-10% of your total investments.

Don't want to tie your net worth to your employer? You may want to sell.

On top of that, by holding a lot of company shares, you may be tying a large chunk of your net worth to your current employer. Therefore, if your company’s performance happens to decline suddenly, you may lose both your job and the value of the stock in your portfolio.

Because of these risks, many RSU recipients opt to sell their vested stocks in order to buy more diversified investments like ETFs or index funds.

If You've Decided to Sell, There Are Some Things You Should Know

Selling differs between private vs. public companies

Your options after receiving RSUs may be limited by your organization’s status as a private or public company:

- Oftentimes, when you receive stock in a public company, you’ll be able to turn around and sell it off right away.

- At a private company, on the other hand, it may be more difficult to get rid of your stocks.

Even if you manage to list your shares on a private pre-IPO platform like EquityZen or Nasdaq Private Market, you may not be able to sell them for what they’re worth. Since you’ll pay taxes based on the full value of the award, this can leave you in a sticky situation.

However, many private firms bypass these potential problems using what’s called a double-trigger vesting system. In this arrangement, companies won’t distribute your stock until two requirements are met. For example, one contract may stipulate that employees will receive their stocks once a certain amount of time has elapsed and the company has gone public.

Watch out for trading restrictions on selling

Even at publicly traded companies, employees may face restrictions in selling their vested RSUs. In order to avoid insider trading or accusations of it, many companies will impose blackout periods in which employees aren’t allowed to buy or sell company stock.

Directors and executives may follow even stricter regulations regarding trading windows since they often hold more classified information about the company’s standing. Fortunately, they can bypass these limitations by setting up a 10b5-1 plan. This will allow them to schedule their stock sales ahead of time to ensure that their decisions aren’t influenced by new information.

👉 Candor has launched a platform that allows you to sell your RSUs year-round. Visit our homepage to learn more.

How Are RSUs Taxed?

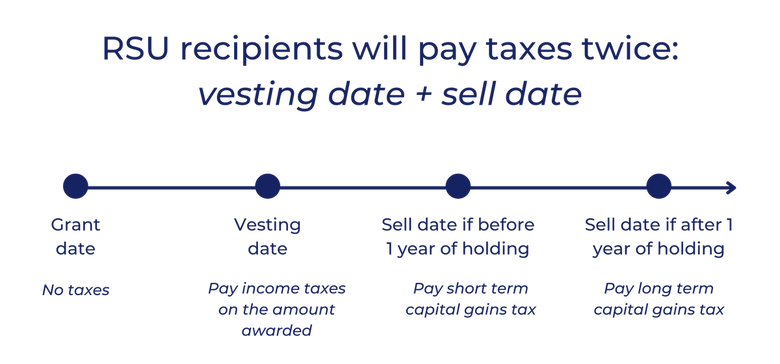

Compared to other forms of equity compensation, the tax treatment of RSUs is relatively straightforward. RSU recipients will pay taxes at two different times: the date the shares vest and the date they’re sold.

1. Taxes on the date the shares vest

When an employee’s RSUs vest and they finally receive their stocks, their award will be treated by the IRS as ordinary income. For this reason, they’ll be subject to federal, payroll, state and local taxes.

Some companies will automatically withhold a portion of the stocks to cover income tax liabilities while others will leave their employees to decide how to handle taxes on their own.

2. Taxes on the date they're sold

Later on, when the employee decides to sell their shares, they’ll be subject to taxation again. The difference in stock price from the time of vesting to the time of sale will be treated as capital gains or losses.

Your capital gains rate depends on how long you hold your RSUs:

- Shares sold within one year of holding will be subject to the short-term capital gains tax rate;

- Whereas stock held for over a year will be subject to the long-term capital gains tax rate.

For example, let’s say you receive $5,000 in company stock once your RSUs vest. Two years later, you sell those shares for $25,000. That year, you’ll be responsible for paying long-term capital gains on the $20,000 you earned from the investment.

What Happens if You Leave Your Company?

Employers often use RSUs to incentivize employees to continue working at the firm. Therefore, your company will often require you to forfeit your unvested RSUs upon leaving. However, some may make exceptions for special circumstances, such as death, disability or retirement.

According to a 2019 survey from the National Association of Stock Plan Professionals, 59% of companies accelerate RSU vesting in the event of death. In contrast, 97% of companies will require the forfeiture of unvested awards upon normal resignation.

RSUs vs. Stock Options

While some companies give their employees equity in the form of RSUs, others will opt for other types of stock-based compensation, such as employee stock options (ESOs).

When ESOs vest you get derivative options on the stock instead of getting direct ownership of company stock, like with RSUs. In other words, employees will receive the right to buy a given amount of stock at a predetermined share price at some point in the future with ESOs. This requires some upfront payment before receiving your award, which may sound less ideal.

The option’s exercise price, or the price at which employees can buy shares, will be the stock’s fair market value at the time of granting. Therefore, if the stock price decreases between the grant and vesting dates, the options will be worth less. This is one reason why stock options are much more common in smaller, newer companies. Whereas startups may have the potential for rapid growth, established companies are more likely to see modest returns over time.

Takeaways

Restricted stock units can be a valuable perk for employees, but their terms and tax implications can get confusing. Be sure to read through your contract carefully upon receiving RSUs, and prepare to make some important decisions when they vest.

The information provided herein is for general informational purposes only and is not intended to provide tax, legal, or investment advice and should not be construed as an offer to sell, a solicitation of an offer to buy, or a recommendation of any security by Candor, its employees and affiliates, or any third-party. Any expressions of opinion or assumptions are for illustrative purposes only and are subject to change without notice. Past performance is not a guarantee of future results and the opinions presented herein should not be viewed as an indicator of future performance. Investing in securities involves risk. Loss of principal is possible.

Third-party data has been obtained from sources we believe to be reliable; however, its accuracy, completeness, or reliability cannot be guaranteed. Candor does not receive compensation to promote or discuss any particular Company; however, Candor, its employees and affiliates, and/or its clients may hold positions in securities of the Companies discussed.