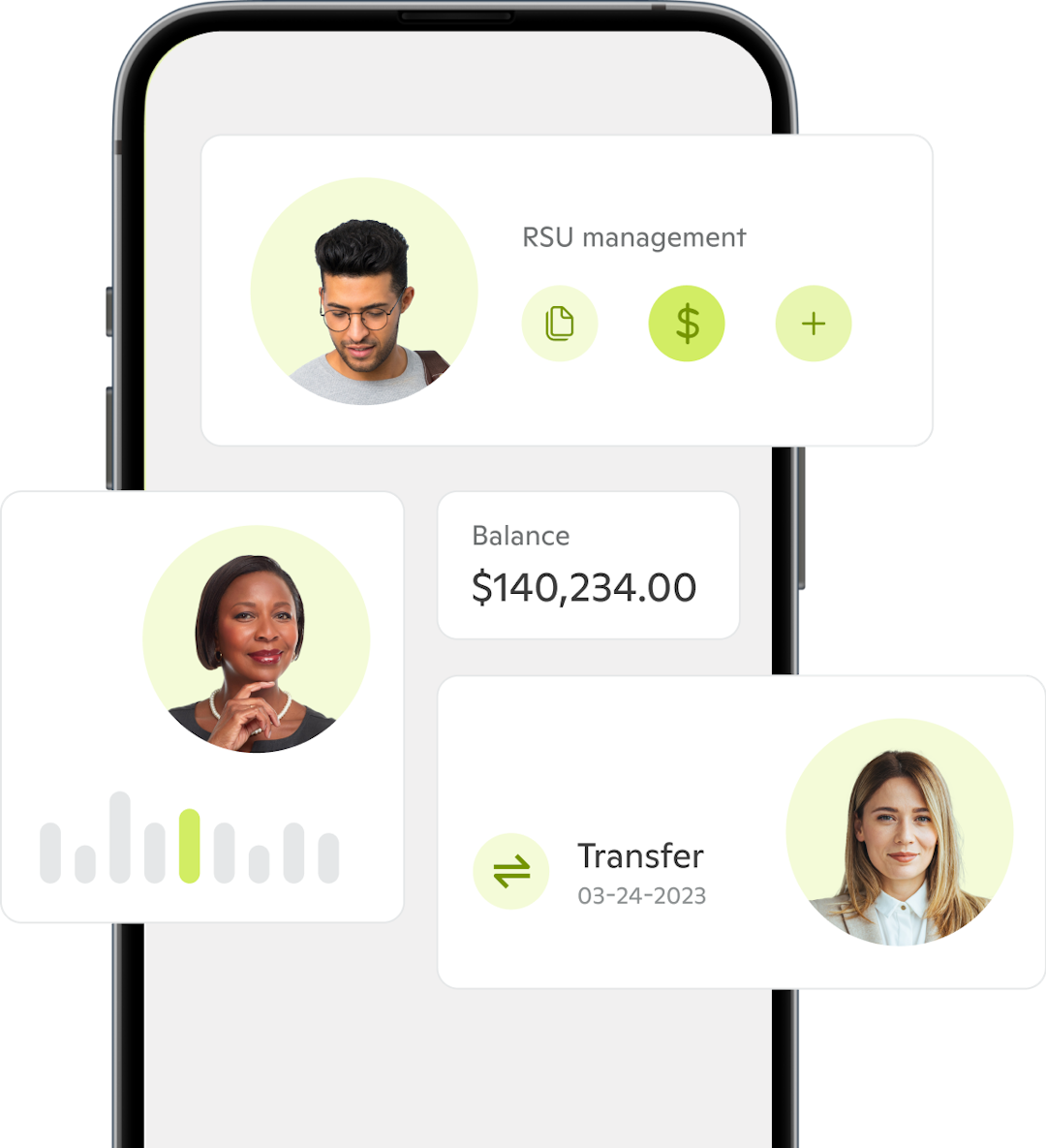

RSUs simplified

Powerful stock tools for employees, issuers and financial institutions.

Protected by the highest security standards

Registered with the SECFinancial-grade encryptionAssets insured by SIPC

Democratizing financial access

Most of us in tech are first gen — first to go to college, first to be an engineer, first to be paid in RSUs.

At Candor, we’re building products to help you invest not just in yourself but also in your communities — all towards building lasting legacies of wealth and opportunity.

At Candor, we’re building products to help you invest not just in yourself but also in your communities — all towards building lasting legacies of wealth and opportunity.