Fully automated 10b5-1 trading

Capture whole issuers with 10b5-1 automation that scales from the CEO to the rank-and-file.

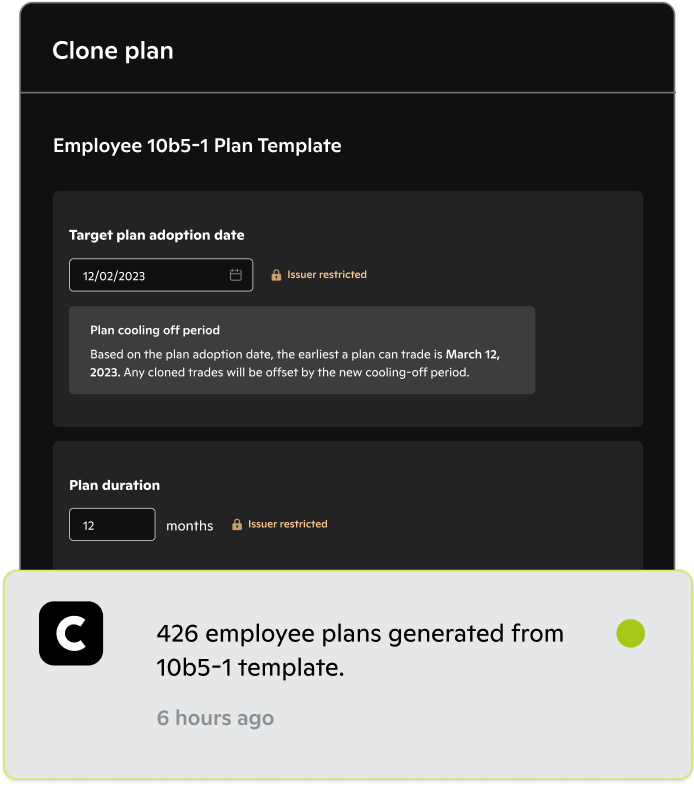

Automate 10b5-1 plans

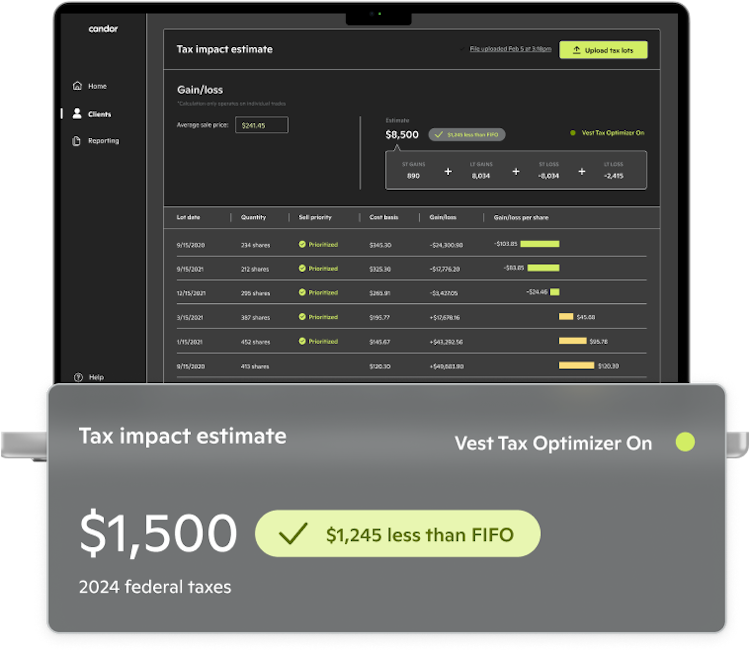

Accurately project taxes

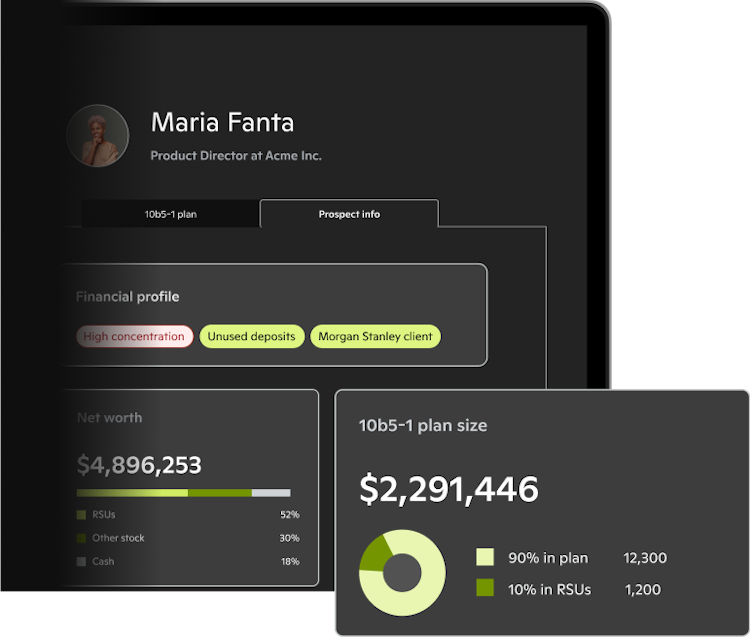

Access lead analytics

10b5-1 made effortless

Offer 10b5-1 to thousands of clients at once

Reduce trading desk risk and eliminate human error

With scalable and automated taxes, financial planning, and form filing, easily go from serving tens to thousands of clients.

Accurately project future taxes

Get automatic estimates for future tax burden, no manual calculation required.

Use lead analytics to identify high-value clients

Offer high-touch servicing to leads with the financial profiles you are looking for.

Issuer compliance platform

Powerful SEC compliance tools issuers love

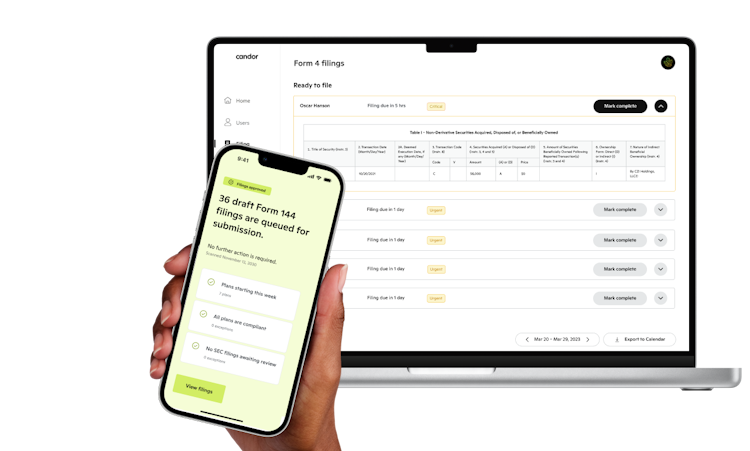

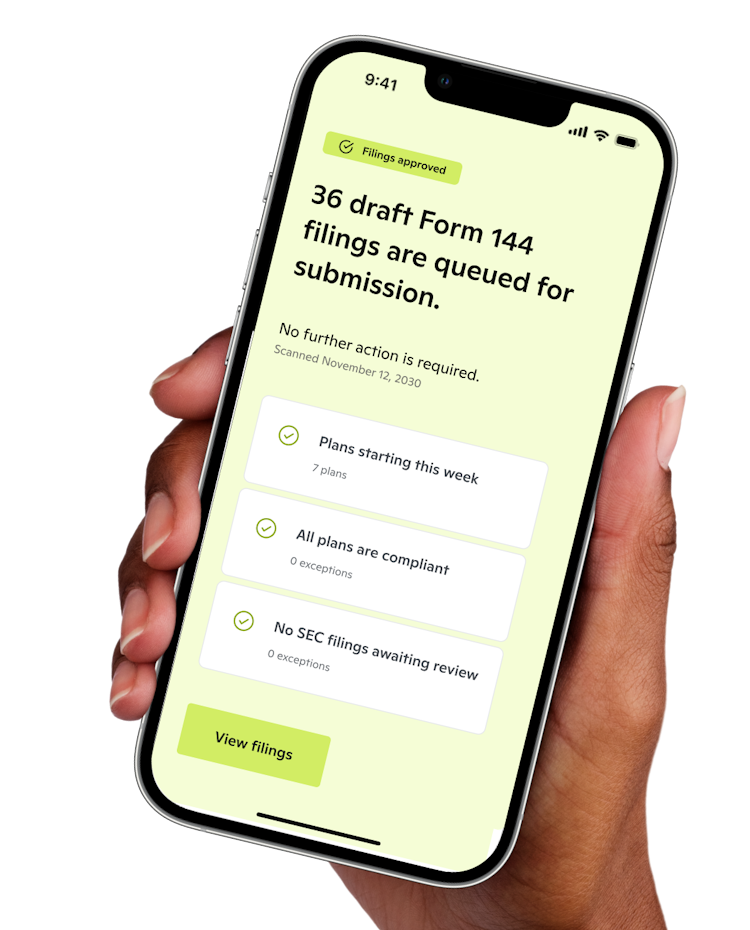

Automated Form 4 and Form 144 reporting

SEC filing calendar and reminders

Automated issuer policy enforcement

Always compliant with SEC & issuer policies

From cooling-off periods to trading windows, Candor's Compliance Engine ensures plans are always created compliant from the start.

Cooling-off period enforcement

Termination restrictions

Section 16 exclusions

Plan duration restrictions

Screen for overlapping plans

Trading window enforcement

Single-trade plan enforcement

Special blackout lists

MNPI certification

Advisory services provided by Candor Financial LLC, an SEC registered investment adviser. Registration does not imply a certain level of skill or training nor does it imply endorsement by the SEC. Securities held at Apex Clearing are insured by the Securities Investor Protection Corporation. SIPC does not protect against the decline in value of your securities. Learn what SIPC covers

Fully automated settlement process

From restricted securities to DRS, DWACs and Rule 144 enforcement, Candor automates the settlement process so you can scale your business.

Grow AUM with broadbase access

Candor is the only platform built for all employees, not just executives.

Open to all levels

10-min self-onboarding

Simple admin tools

Get a demo

See how Candor can scale your 10b5-1 services.