10b5-1 plans, simplified

Automate SEC reporting and simplify 10b5-1 administration. Works with your existing stock admin platform.

Automate SEC reporting and simplify 10b5-1 administration.

Works with your existing stock admin platform.

As seen on

Painless administration

Fully automated 10b5-1 plan enrollment

1

Add your 10b5-1 policies

Employees can only start plans within the rules set by you.

2

Employees self‑onboard

Fast and simple enrollment, with high-touch onboarding for Section 16 D&Os.

3

Effortless administration

From plan approvals to SEC fillings, it's all automated and auditable.

Zero switching costs

Works with your existing stock admin

T+1 ready share settlement

Less work with every trade. Settle trades quickly and painlessly.

Full SEC reporting suite

Save time with automated SEC reporting and avoid costly errors.

Insider trading supervision

Enhance affirmative defense and keep policies current with evolving case law.

T+1 ready share settlement

Less work with every trade. Settle trades quickly and painlessly.

Full SEC reporting suite

Save time with automated SEC reporting and avoid costly errors.

Insider trading supervision

Enhance affirmative defense and keep policies current with evolving case law.

Try it out

Sail through trading windows with ease

Cooling off periods

Amendment and termination

Regulatory fillings

Special blackout lists

Trading windows

Always up to date on SEC compliance

From cooling off periods to good faith case law, Candor's compliance suite always keep up with the latest SEC rules and case law.

SEC COMPLIANCE SUITE

SEC compliant cooling-off periods

Section 16 reporting

Amendment & termination restrictions

Dynamic trading windows

Rule 144 enforcement

Special blackout lists

Hedging & shadow trading

MNPI recordkeeping

Single-trade plan enforcement

Plan approval audit logs

Good faith monitoring

Overlapping plan enforcement

Advisory services provided by Candor Financial LLC, an SEC registered investment adviser. Registration does not imply a certain level of skill or training nor does it imply endorsement by the SEC. Securities held at Apex Clearing are insured by the Securities Investor Protection Corporation. SIPC does not protect against the decline in value of your securities. Learn what SIPC covers

Empower employees

Give every employee affirmative defense

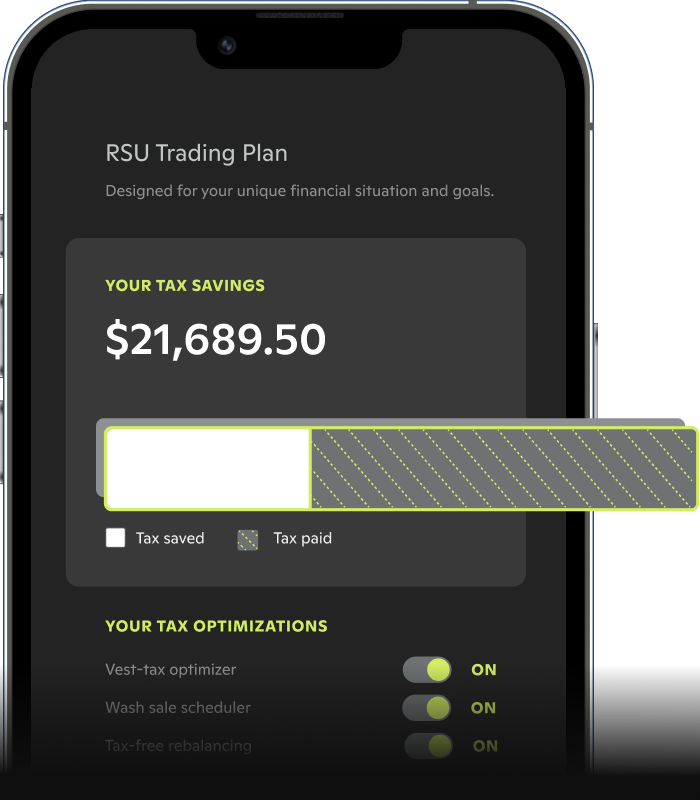

Simplify RSUs for all

Candor’s intuitive interface + plans are designed to help employees consider risk, diversification, and taxes proactively.

Empower employees with education

Every trading plan starts with required compliance education in a simple-to-understand format.

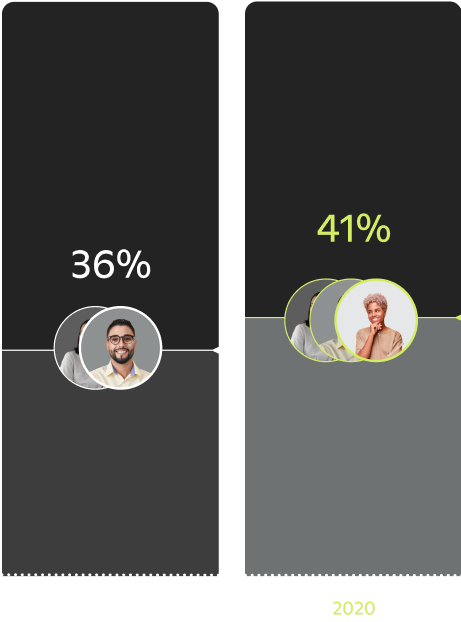

Retain employees longer

41% of employees say that stock plan benefits influence their decision to stay in their job.

Source: E*TRADE participant whitepaper 2021

Candor stands for wealth equity

Most of us in tech are first gen — first to go to college, first to be an engineer, first to be paid in RSUs.

At Candor, we’re building products to help you invest not just in yourself but also in your communities — all towards building lasting legacies of wealth and opportunity.

Get a demo

See how Candor can work for your organization.

+ Add an optional message

Whitepaper

How the SEC is catching insider trading

Read the latest whitepaper on how ARTEMIS is changing the SEC's enforcement priorities.