Impact Investing: Make a Difference With Your Money

With impact investing you can make your money work not just for you, but also for social and environmental change too. Why not aim for both?

Impact investing is an investment strategy that aims to generate a specific and measurable positive social impact or environmental impact alongside a financial return for the investor.

The impact investing industry has been growing exponentially in recent years. It’s estimated that the size of the market as of 2020 was USD $715 billion in assets under management (AUM), up from USD $502 billion in 2019, according to the Global Impact Investing Network (GIIN).

While the idea that business and capital markets can be a force for positive social change isn’t new, impact investing does differ from other values-based investment strategies. An impact investor proactively targets positive impact, as opposed to simply avoiding investments that may have a negative impact or taking social and environmental factors into consideration for the sake of a better financial return. Impact investing is also different from philanthropy, as there is still a goal to generate financial returns.

Impact investments can take many forms: they exist in both the public and private sectors, across different industry sectors, different geographic regions, and across all asset classes (like stocks, bonds, real estate, and more). Impact investors can target a range of financial returns depending on their goals.

An Overview of Values-Based Investing: ESG vs. SRI vs. Impact Investing

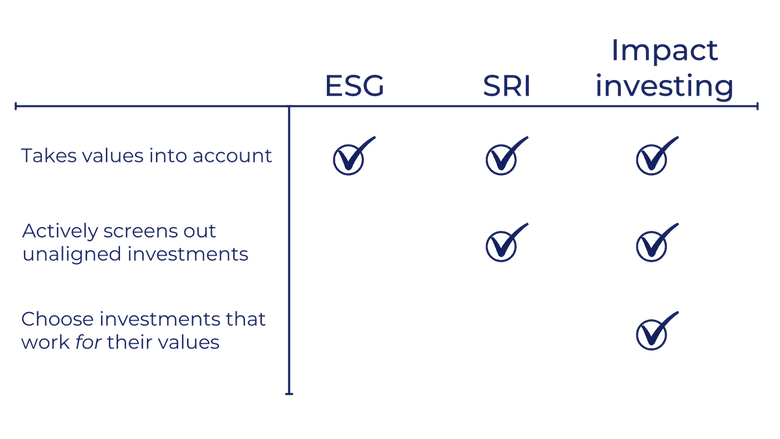

This may not be the first you’ve heard of values-based investing or responsible investments — environmental, social, and governance (ESG) investing and socially responsible investing (SRI) fall under this umbrella alongside impact investing. Although all three terms are sometimes used interchangeably, there are distinctions between the terminology that are helpful to understand.

ESG investing takes into account any environmental, social, and governance factors that a company has control over. Integrating these factors as criteria can enhance financial analysis and help identify potential risks and opportunities. Despite the inclusion of values-related factors, though, the main focus of ESG investing is still on financial performance.

A step beyond ESG investing, SRI is a type of investing that involves actively screening investments to exclude businesses or companies that don’t align with the investor’s values. Some common examples of this are avoiding investing in companies involved in fossil fuel production or the manufacturing of firearms.

Compared to ESG investing and SRI, impact investing is more proactive and outcome-focused. It is characterized by a direct connection between an investor’s value-based priorities and the use of that investor’s capital. While SRI or ESG investors might avoid investing in companies that go against their values, impact investors look for investment opportunities that work for their values.

While generating financial returns is still an important goal of impact investing, the social or environmental benefit of the investment is the top priority. In this vein, impact investors might direct funds towards organizations, businesses, or projects overlooked by traditional investors or in service to causes not typically addressed by public financial markets.

What Impact Do Impact Investments Have?

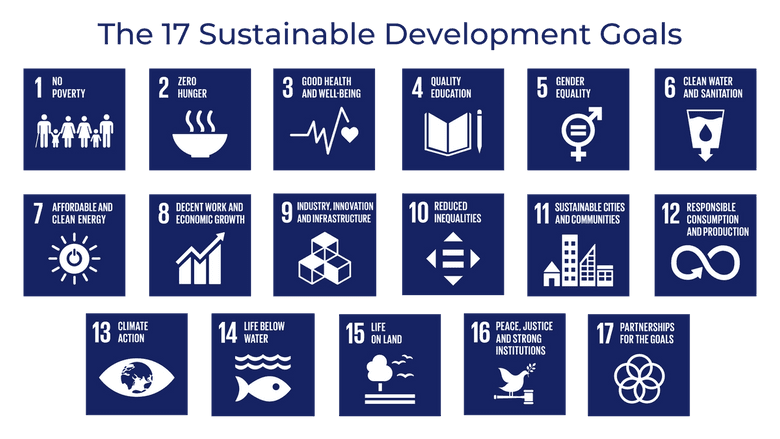

An impact investor can address a wide range of issues with their investments in line with their own specific values and priorities. There is a particular focus among many impact investors on the Sustainable Development Goals (SDGs) adopted by the United Nations in 2015. A collection of 17 interconnected global goals designed as a “blueprint to achieve a better and more sustainable future for all,” the SDGs address a long list of global issues, including poverty, hunger, access to healthcare, education, clean water, sanitation, gender equality, renewable energy, sustainability, climate change, and animal rights.

The GIIN launched a campaign in 2016 calling for investors to direct more investment capital towards the SDGs. Since then, more and more impact investors have aligned their portfolios with these global goals and utilized them as a framework for impact measurement.

Financial Performance

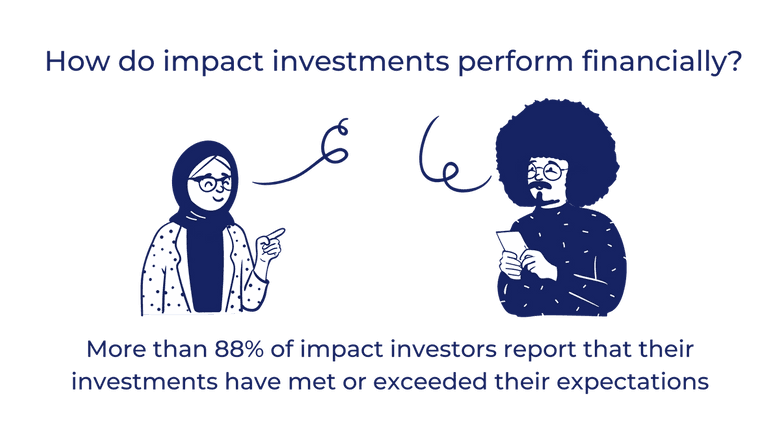

If the first priority of impact investing is generating a positive social or environmental impact, how well do impact investments perform financially?

The answer to this question mostly depends on the investor and their goals. Some investors might intentionally aim for below-market-rate returns on their investment, but others might pursue market-rate or even market-beating returns. According to the GIIN’s 2020 Annual Impact Investor Survey, more than 88% of impact investors report that their investments have met or even exceeded their expectations in terms of both positive social and environmental impact and financial performance.

Impact Investments and Investor Examples

Like any other investment, impact investments can come in a range of investment vehicles — bonds, debt, and equity investments, to name a few — and across types of financial services. Impact investments appeal to a variety of individual and institutional investors, including fund managers, private equity and venture capital firms, private foundations, financial institutions, pension funds, family offices, religious institutions, and other asset management firms.

Common impact investments include investments in companies or projects that operate in underserved or low-income communities with a goal of improving quality of life: whether through education, access to healthy food and clean water, or through healthcare. Other common impact investments are in companies that are working to find green energy solutions or address climate change.

There are a number of notable impact investing firms:

- Vital Capital Fund, a private equity impact investment fund with $350 million in AUM that invests primarily in businesses and projects in developing areas. It invests primarily in sub-Saharan Africa, designed to enhance quality of life.

- The Omidyar Network, a “philanthropic investment firm” established in 2004 by eBay founder Pierre Omidyar, is composed of both a foundation and impact investment firm and has reportedly committed over $992 million to both nonprofit and for-profit companies. Omidyar focuses on responsible technology, reimagining capitalism, and on pluralism — for example, some of the initiatives it invests in work to prevent the spread of misinformation and fake news common in today's social media age, fight for racial justice, or work to create counterweights to economic power.

- The Reinvestment Fund, a non-profit community development finance institution with an estimated $1.2 billion in AUM that focuses on rebuilding distressed towns and cities in the United States. It does this through various means, including building equitable food systems, using arts and creative economy to drive community revitalization, and improving access to early childhood education and affordable housing.

- BlueOrchard Finance, a global impact investment manager created as part of a UN initiative in 2001 with around $3.5 billion in AUM. It focuses primarily on connecting entrepreneurs in emerging and frontier markets with investors in an effort to fight global poverty. BlueOrchard reports that it has invested $8 billion across more than 90 countries, focusing especially on projects related to education and climate change.

Although the number of available options is increasing as the demand for responsible investing grows, most impact investment opportunities are still skewed towards wealthier investors.

ESG and SRI investing opportunities are more accessible, as there are a wide array of mutual funds focused on responsible investing — for example, mutual funds with a portfolio of companies in the renewable energy sector or only companies with female leadership.

In contrast, most impact investing funds aren’t publicly traded, and are only open to accredited investors (individuals with a net worth of at least $1 million or annual income of at least $200,000).

👉 Read Next: Accredited Investor vs. Qualified Purchaser: What’s the Difference?

That being said, there are options for average-income individuals interested in impact investing too, such as the Calvert Foundation’s Community Investment Note, RSF Social Finance Social Investment Fund, social enterprise-focused crowdfunding sites like Kiva, and Community Development Financial Institutions (CDFIs).

Benefits and Challenges

While the impact investing market is still growing and developing, there are also certain challenges that exist in the industry.

One major challenge in impact investing is navigating the balance between the intended positive impact and the bottom line (delivering a strong financial return to investors and stakeholders).

Some argue that impact investors profit at the expense of underserved communities, and believe impact investing is problematic because the ‘impact’ is both determined and defined by the investors rather than the investees or intended beneficiaries of the investing. However well-meaning investors may be, there is a ‘top-down’ aspect to the impact investing market. Critics believe that because of this, impact investments might not ultimately benefit communities or create a flow of capital from high to low-income populations.

Another major challenge involved in impact investing is how exactly to measure its impact with consistency and in a concrete way. Though impact investors aim for their impact to be measurable and quantifiable, in reality, this can be difficult to achieve. Using the 17 SDGs as a framework to measure impact might be one tool for addressing this concern.

On the other hand, because impact investing involves earning financial returns in addition to making a positive impact, it could incentivize more people to get involved in efforts usually relegated to philanthropy or charitable contributions. In turn, more capital might be directed towards companies and initiatives that are at least trying to address social and environmental problems.

👉 Read Next: 4 Companies That Use Data Science for Social Impact

The information provided herein is for general informational purposes only and is not intended to provide tax, legal, or investment advice and should not be construed as an offer to sell, a solicitation of an offer to buy, or a recommendation of any security by Candor, its employees and affiliates, or any third-party. Any expressions of opinion or assumptions are for illustrative purposes only and are subject to change without notice. Past performance is not a guarantee of future results and the opinions presented herein should not be viewed as an indicator of future performance. Investing in securities involves risk. Loss of principal is possible.

Third-party data has been obtained from sources we believe to be reliable; however, its accuracy, completeness, or reliability cannot be guaranteed. Candor does not receive compensation to promote or discuss any particular Company; however, Candor, its employees and affiliates, and/or its clients may hold positions in securities of the Companies discussed.