What are Wash Sales?

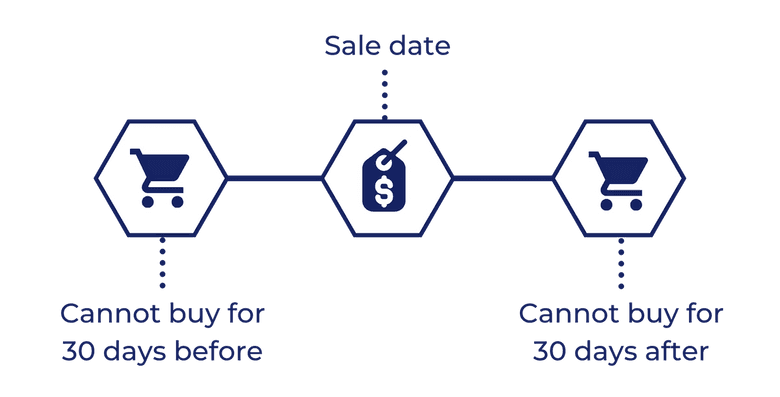

Wash sales happen when you sell a stock at a loss and them buy shares of the same stock within a 30 day window.

This matters a lot if you have RSUs that have depreciated. Many people choose to sell all their RSUs when they start losing value thinking they will be able to write off the loss on their taxes for the year. But that's not always the case -

The wash sale rule says that a security cannot be identified as a loss if you purchase a substantially identical security within 61 days of the initial purchase of the asset. The 61 day period includes 30 days before and 30 days after you sell the security.

For the purpose of tax rules a "purchase of securities" and you vesting your RSUs are identical - essentially the IRS sees each vest as a purchase and you will be penalized if you sell RSUs at a loss close to your vest date (that is considered a purchase).

The Internal Revenue Service (IRS) imposes a 61-day figure to prevent investors from taking advantage of the resulting tax benefits from selling at a loss. Essentially a security must have a seasoning holding period to be considered as a loss.

Why wash sales are done...

Wash sales are done for tax purposes, namely to earn incentives on capital gain losses in a portfolio that no longer need to be accounted for.

Wash sales can occur unintentionally as a result of natural investment behavior. They are often difficult to navigate and require careful inspection of an account's entire transaction history to be avoided.

If you're audited by the IRS, you may be required to provide transaction history of an account because of the possibility that they actualized taxation benefits using wash sales. Audits are becoming a more common occurence for tech employees who earn in excess oof $400,000 annually so wash sales are definitely something to be careful of.

What about intentional tax loss harvesting?

Intentionally harvesting losses through wash sales is illegal and can place uninformed investors into sticky situations with the IRS. Therefore, it is important to be knowledgeable about how the IRS handles wash sales before selling your RSUs.

Capital Gains and Losses on an IRS Tax Form

Realized capital losses are used to reduce your tax bill. So, capital losses are deducted from capital gains in order to create a more fair representation of income.

It is important to note that an individual is subject to penalties for all accounts under their control. For example, an individual may not repurchase sold assets with a Roth IRA (Roth Individual Retirement Account) in hopes of actualizing tax loss so they can write it off from their total capital gains tax.

Moreover, the asset or security in question can not be redistributed to an identical security found in, say, a mutual fund, Exchange-Traded Fund (ETF), or individual brokerage account.

Armed with this information, we may now look at how this principle applies to the ability to report wash sales.

Example 1

John owns exactly 1,000 shares of Apple RSUs. The stock is trading at $125 in this scenario and he decides to sell his shares. John vested each share at an average price of $140, which means John loses $15 per share, or $15,000 in total.

Repurchasing shares

However, John vests the same number of shares at the same price the next day and eventually actualizes a profit as the stock soars to above $150 a share.

Violating the wash sale rule

Now, John still owns the security, therefore he can’t act as if his net capital decreased by $15,000 to claim the tax benefits of the security. John understands the illegality of the situation but attempts to fool the IRS anyway, by reporting his net capital expenditure as -$15,000.

However, the IRS examines the cost basis of his tax return and deems his return as illegitimate since he still owns the security and could sell stock at a profit any time, therefore he is not allowed to act as if the loss was fully actualized.

Example 2

John, now understanding more about wash sales, decides to devise one last devious method to avoid proper taxation. This time, John will sell the security on his personal brokerage account, and repurchase them on an IRA account that is under his wife's name.

Repurchasing shares

He suspects that this method may be too obvious to avoid being caught, so he decides to purchase Apple's preferred stock instead.

Violating the wash sale rule

John believes that, since he is not technically purchasing the same security, that he will be able to write off the $15,000 loss and fool the IRS by continuing to earn returns.

However, since John is still actualizing returns from the security for which he claimed capital losses, he will be penalized by the IRS.

John is to be penalized because he is still earning rewards for positive performance in Apple stock, even if he doesn't technically own the original security any longer. He cannot write off the losses until they are fully actualized, or when he decides to sell the underlying assets he has purchased with the issuer, in this case Apple, altogether.

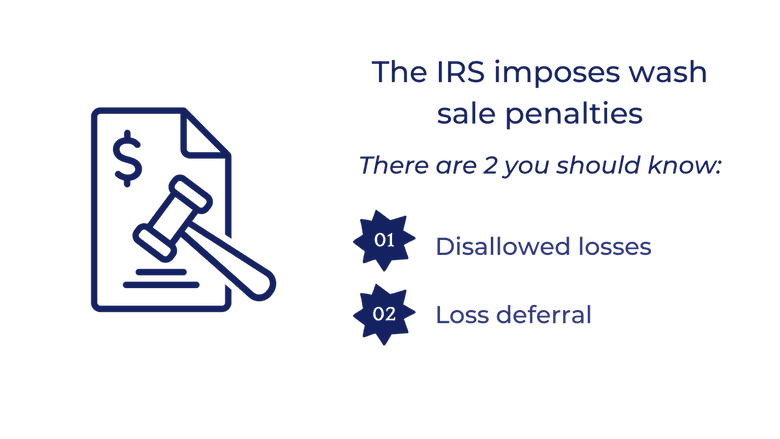

Penalties

There are essentially two main ways the IRS will choose to handle wash sale penalties. Each of them is, as you will soon see, incredibly harmful to an investor and their portfolio.

Countless individuals fail to account for their wash sale transactions. However, the existence of individuals with the intent to manipulate wash sales for their own benefit means the IRS has no choice but to investigate as if the account in question used the illegal procedure intentionally.

Therefore, it is also important to understand how to avoid these harmful penalties, which we will examine further.

1. Disallowed Losses

If you receive a letter from the IRS stating that your losses are disallowed, you can no longer write the losses off from net expenditures (investment income and expenses), and you will have to add the loss to the price of the new stock.

For example, use John’s example with the Apple RSUs. Imagine Apple’s share price falls to $105. If John sold right now, he would lose $35 per share (since he originally purchased at $140), so he goes ahead and writes off a $35,000 capital loss.

However, since he still owns the security, the IRS deems this use of wash sales illegal, since he still owns the security and has not actualized the loss, and disallows this loss from John’s profile.

Essentially, John is now stuck in a position by which, if he sells at $105, he can no longer write off the $35,000 that he lost in Apple stock.

2. Loss Deferral

If the IRS decided to punish John using loss deferrals instead, they would add the eventual loss (let’s say he sold at $105 for a total loss of $35,000) to his capital gains.

If the IRS decides to punish you using loss deferrals instead, it would add the eventual loss to your capital gains.

Let’s say John sold at $105 for a total loss of $35,000, so the IRS would add the loss to his capital gains. Essentially, this means that John is now boosted by a $35,000 boost, meaning that he pays taxes on the $35,000 he lost, as if he’d gained them.

Nobody wants to pay income tax on money they didn’t actually earn, so next we'll discuss how to avoid getting penalized for wash sales.

How to Avoid Being Punished For Wash Sales

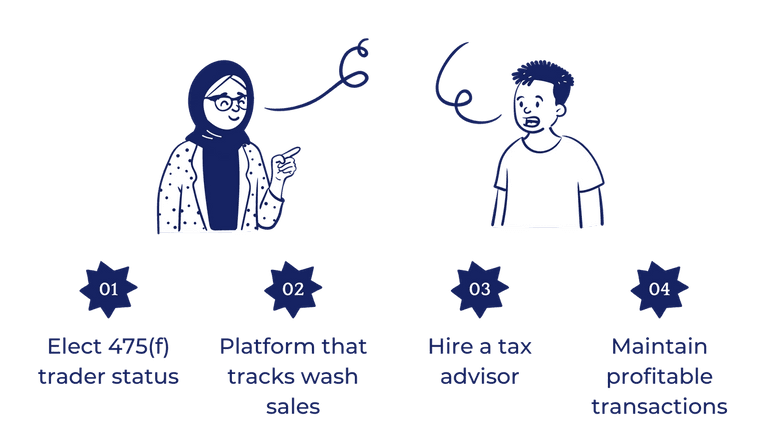

There are several ways you can avoid being punished for wash sales. Here are 4 options to consider:

Elect section 475(f) trader status

The first way to avoid being punished for a wash sale is to elect section 475(f) trader status and use the market-to-market accounting method. Accounts with this added benefit are not subject to wash sale penalties.

Only certain individuals may apply for 475(f) trader status. Dealers of investment strategies are allowed to elect this benefit, but individual traders may not be eligible to receive section 475’s taxation bonus.

Use Candor to track wash sales on RSUs

Moreover, another strategy to avoid being penalized with wash sale transactions is to use a platform that closely monitors your transactions and trades RSUs in a way that avoids wash sales completely.

Hire a tax advisor

Next, you might consider hiring a tax advisor, who gives tax advice and informs investors on specific tax laws that may apply.

Taxpayers can benefit greatly from hiring an individual that is skilled in maneuvering taxable accounts and formulating tax deductions that can prevent events, such as wash sale penalties, from crippling an investment portfolio.

Maintain profitable transactions

Lastly, a simplistic, yet helpful, tip for avoiding wash sales is to maintain profitable transactions. This advice seems obvious and irrelevant at first, though it should be said that short-term investors maintaining positive profit margins don’t need to worry about washing sales at all. In striving to maintain a portfolio full of profitable trading expenditures, one alienates the need to monitor wash sales altogether.

The information provided herein is for general informational purposes only and is not intended to provide tax, legal, or investment advice and should not be construed as an offer to sell, a solicitation of an offer to buy, or a recommendation of any security by Candor, its employees and affiliates, or any third-party. Any expressions of opinion or assumptions are for illustrative purposes only and are subject to change without notice. Past performance is not a guarantee of future results and the opinions presented herein should not be viewed as an indicator of future performance. Investing in securities involves risk. Loss of principal is possible.

Third-party data has been obtained from sources we believe to be reliable; however, its accuracy, completeness, or reliability cannot be guaranteed. Candor does not receive compensation to promote or discuss any particular Company; however, Candor, its employees and affiliates, and/or its clients may hold positions in securities of the Companies discussed.