Top 10 Hedge Fund Managers by Net Worth

Why reinvent the wheel when you can learn the strategies of the top hedge fund managers? A look into the wealthiest hedge fund managers and the strategies that made them rich.

Despite the economic turmoil and record unemployment brought on by the Covid-19 pandemic, many sectors saw increased success in 2020. Hedge funds were among the lucky industries, returning a 10-year high of 11.6% overall.

Hedge funds are alternative investments, similar to private equity or venture capital, based on pooled funds that are invested strategically to earn returns. Esteemed billionaire and Berkshire Hathaway CEO Warren Buffett has famously proclaimed his skepticism of the industry.

He pointed out that the S&P 500 has yielded returns of 125.8% over ten years, compared to an average of 36% in returns from a group of five hedge funds. Especially since hedge funds charge 2% management fees and 20% performance fees on average, he decided that investors were better off buying index funds.

Despite the doubt surrounding hedge funds within the finance world, many hedge fund managers have made fortunes for themselves and their investors through savvy investments. Let’s take a look at the top hedge fund managers according to the Forbes Real-Time Billionaires List.

1. Jim Simons

Photo Credit: Vanity Fair

Jim Simons is well-known for employing a data-driven approach to investing before it was widespread in the industry, earning him the nickname of the “Quant King.”

Before he was known as a hedge fund manager, Simons made notable strides as a mathematician. He worked on mathematical theories like the Chern-Simons form and aided in code-breaking efforts during the Vietnam War.

Breaking into finance

In 1978, Simons founded Renaissance Technologies’ predecessor, Monemetrics, where he used statistical models to analyze data and predict future returns. From 1988 to 2018, the firm’s Medallion fund yielded high returns of 66.1% before fees and high net profits of 39.1%.

Key strategy

In addition to his advantage as a quantitative investor, Simons also attributes his success to his ability to identify talent. He’s said, “Hire the very best people you possibly [sic] can and I have good taste in people. And then, let them carry the ball.”

2. Ray Dalio

Photo Credit: Fox Business

You may have heard of Ray Dalio as the person to thank for the beloved McDonald’s McNugget. While he didn’t invent the menu item, he did work with McDonald’s chicken producer to create synthetic corn and soy futures to lock in their prices long-term, enabling the fast-food chain to start selling McNuggets. Outside of this legacy, Dalio is also known as a successful hedge fund manager and critic of modern capitalism.

Breaking into finance

Dalio first learned about investing while working as a caddy at age 12 and overhearing golfers’ conversations about the market. After college, he got a job on the floor of the New York Stock Exchange. He worked a few different jobs in commodities trading before joining Shearson, where he hedged futures until he was fired after an altercation with his boss.

In 1975, he founded Bridgewater Associates. Despite overall growth, he was faced with a humbling setback after mistakenly predicting a financial crisis in 1982. On the other hand, Dalio saw strong success in 2008 when he foresaw the end of the housing bubble, yielding gains of over 9% while many other investors saw losses.

Key strategy

Dalio made a lot of successful investments using cause-and-effect models to determine which trades to take. Before entering a commodities position, he’d learn as much as possible about the business and industry so he could break down the moving pieces and predict what would happen in the future.

3. Ken Griffin

Photo Credit: Pensions & Investments

In addition to making a name for himself as a hedge fund manager, Ken Griffin is also known as a strong political force in Chicago. For instance, his donations were credited with stopping the Illinois Fair Tax in 2020. He’s also invested over $800 million in real estate.

Breaking into finance

Griffin started trading from his Harvard dorm in 1987, where he put a satellite dish on the roof to get real-time stock alerts. As a student, he mostly made money from taking advantage of systemic inefficiencies in the convertible bond market.

Once he graduated, he moved to Chicago to work with Glenwood Capital’s Frank Meyer, making 70% returns in the first year. The next year, he and Meyer raised $4.6 million to launch Citadel Investment Group.

Key strategy

Citadel is known for buying up distressed or unpopular assets in order to take advantage of the discount. For example, after Enron collapsed in 2002, Citadel started an energy trading business. Later on, after the hedge fund, Amaranth saw failed bets on natural gas, Citadel and J.P. Morgan bought the company’s energy portfolio.

4. Steve Cohen

Photo Credit: Vanity Fair

If you don’t know Steve Cohen for his reputation in finance, you may know him for his other investments. While the Long Island native typically keeps a low profile, he’s known as the owner of the New York Mets baseball team. He’s also seen his fair share of press after his firm faced investigations by regulatory agencies like the Securities and Exchange Commission.

Breaking into finance

During his freshman year of college at the University of Pennsylvania, Cohen started investing his money at the Merrill Lynch office downtown. Eventually, he stopped using traders’ tips in favor of his own investment strategies.

Once he graduated from college, Cohen got a job in options arbitrage at a brokerage called Gruntal & Co., where he created and executed risk-free trades. In 1992, he left to start his own hedge fund called SAC Capital Advisors. Although investors were initially shocked at his aggressive fee structure, his impressive returns brought in more clients.

Unfortunately, after pleading guilty to charges of insider trading in 2013, SAC was forced to close down. Cohen founded Point72 Asset Management, which started managing outside capital in 2018.

Key strategy

At the start, Cohen made his profits through tape reading, a method based mainly on pattern recognition. However, in recent years, he’s said that it’s gotten harder to make money with intuitive approaches.

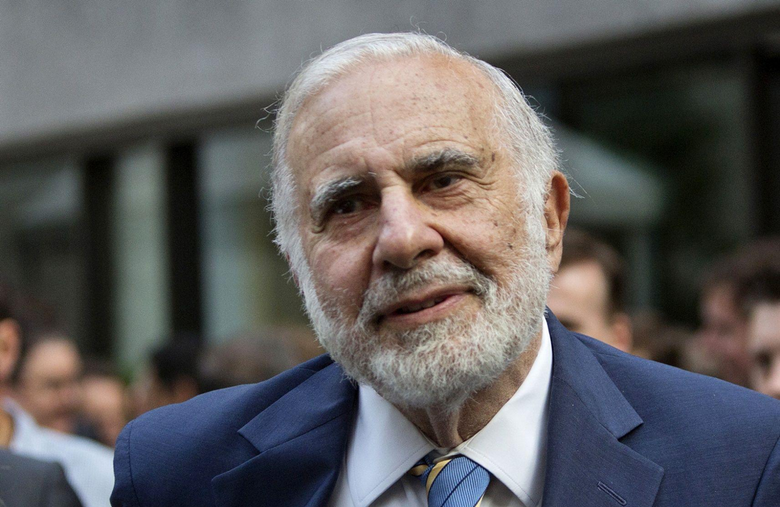

5. Carl Icahn

Photo Credit: Yahoo Finance

Carl Icahn is widely known for his rags to riches story. After growing up in a rough neighborhood in Far Rockaway, Queens, he was accepted into every Ivy League school. He ended up studying Philosophy at Princeton and enrolled in medical school at NYU. However, he dropped out of the program after two years to join the army reserves.

Breaking into finance

In 1961, Icahn became a stockbroker at Dreyfus. After deciding he wanted to further pursue a career in finance, his uncle lent him $400,000 to buy a seat on the New York Stock Exchange. At that point, he founded Icahn & Co., focusing on options strategies and arbitrage. In 2004, he raised $3 billion to found his current firm, Icahn Partners.

Key strategy

At his start, Icahn was well-known for methods that seemed predatory to many. For example, he would often buy a controlling share in struggling companies. Then he’d use whatever means possible to turn a profit, sometimes by stripping and selling assets.

Later on, Icahn became more favorably known as a shareholder activist. At some point, he gained such a widespread reputation that any companies he bought into would gain a sudden increase in stock price known as an “Icahn lift.”

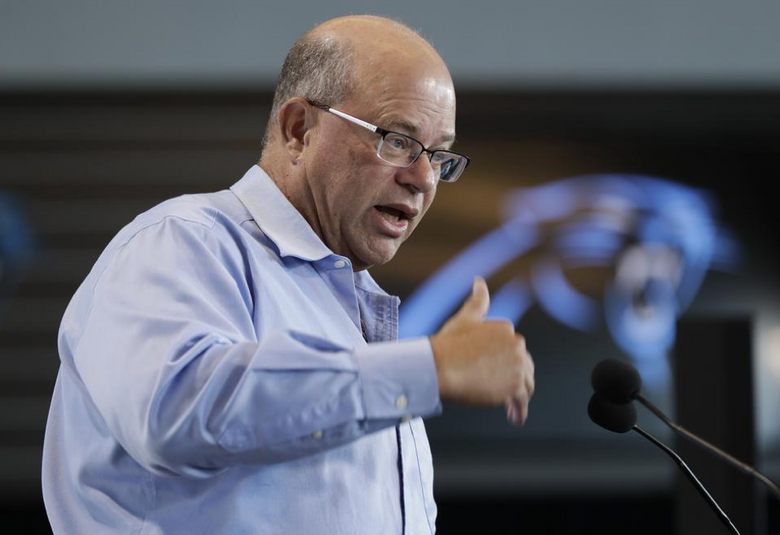

6. David Tepper

Photo Credit: Forbes

On top of his investment management career, David Tepper has also made waves in the sports industry. After purchasing the Carolina Panthers for $2.2 billion in 2018, he started plans to launch a new Major League Soccer team by 2022. However, his success at Appaloosa Management is to thank for his recent ventures. At its peak, the firm had $20 billion in assets under management (AUM).

Breaking into finance

After studying economics at the University of Pittsburgh, Tepper earned his MBA from Carnegie Mellon University. After graduation, he went on to various finance and trading jobs before working as a credit analyst at Goldman Sachs, where he worked up to head trader at the high yield desk.

In 1993, after being passed over for partner, Tepper left Goldman Sachs to found Appaloosa Management. The firm delivered 57% returns in the first six months and continued to outperform competitors in the following years.

Key strategy

Tepper is known in the hedge fund industry for his confidence and aggressive positions. While this has largely contributed to his success, it’s also been the root of his downfalls. For example, he lost 25% in early 2008 after incorrectly betting that blue-chip stocks would rise. However, he ended up turning a larger profit after investing in financial institutions following the crash.

7. Michael Platt

Photo Credit: Forbes

Although he’s well-known for his financial success, Michael Platt may also be recognized for an Instagram video that circulated in late 2019. In the viral clip, Platt told a taxi driver he was “the highest-earning person in the world in finance.” While the video seemed cringey to some, that didn’t change the fact that Platt had brought in a cool $2 billion that year.

Breaking into finance

Platt’s grandmother introduced him to investing and helped him buy stocks as a kid. After graduating from the London School of Economics in 1991, he started working at JP Morgan.

In 2000, he co-founded BlueCrest Capital Management with William Reeves. He built it into one of the largest hedge funds in the world, with AUM over $35 billion at its peak.

Key strategy

Platt’s overarching strategy involves splitting his investment decisions between systematic predictions and discretionary trade. He’s also known to have high standards for his traders and is averse to staying in losing trades, sometimes letting employees go because of incompatible risk management.

8. Chase Coleman, III

Photo Credit: The Guardian. Chase Coleman, III pictured on the left

Unlike many self-made billionaires on this list, Chase Coleman was born into the New York elite. His grandmother on his father’s side was a descendant of Peter Stuyvesant, and he attended a Massachusetts boarding school called Deerfield Academy.

Breaking into finance

As a kid, Coleman was friends with the son of hedge fund billionaire Julian Robertson. After he graduated from Williams College, he went on to work as a technology analyst at Robertson’s company, Tiger Management. After less than four years, Robertson gave him $25 million to start his own investment fund.

His firm started as Tiger Technology, but as it expanded to sectors like payments and education, he changed the name to Tiger Global. Coleman has seen some losses over the years, but his hedge fund strategies have mostly paid off. Last year, Tiger Global made the most money for its clients out of all investment managers, at $10.4 billion.

Key strategy

Coleman attributes a lot of his success to strategies he learned from Robertson, including concentrating bets, going in on winners and cutting losers. He’s also touted the value of hiring young, coachable talent.

9. Israel Englander

Photo Credit: Tip Ranks

Israel Englander’s story is the picture of the American dream. After his parents survived the Holocaust and his sisters were born in a Soviet labor camp, they immigrated to the U.S. The next year, Englander was born and grew up in the Crown Heights neighborhood of Brooklyn.

Breaking into finance

Englander began trading stocks in high school. While pursuing his degree in finance at NYU, he interned at Oppenheimer & Co. and the New York Stock Exchange. After graduating, he joined Kaufmann, Alsberg & Co., where he traded convertible securities and options.

In the 1970s, he got a seat on the floor of the American Stock Exchange, where he worked as a market maker trading his own account. He started Millennium Management in 1989 with a seed investment of $35 million, including $5 million of his own money.

Key strategy

Englander is known to be pretty averse to risk and partial to diversification. He’s also talked about his efforts to retain talent and improve performance by giving portfolio managers more autonomy while imposing strict risk and loss parameters.

10. George Soros

Photo Credit: USA Today

Although the target of many conspiracy theories in recent years, George Soros is highly regarded for his philanthropic work. He founded the Open Society Foundations, which he’s funded in part with over $32 billion of his personal fortune.

Soros grew up in Nazi-occupied Hungary, where his family survived using falsified documents. In 1947, he left to study at the London School of Economics, where he supported himself by working as a railway porter and a nightclub waiter.

Breaking into finance

After finishing school, Soros started working at the London merchant bank Singer & Friedlander. In 1973, he founded the Soros Fund. One of his largest success stories was his decision to short the British pound in 1992, earning him a profit of $1 billion and the nickname of “the man who broke the Bank of England.”

Key strategy

Soros famously follows the philosophy of reflexivity, which argues that investor perceptions and economic reality affect one another in a feedback loop. The idea is largely based on sociological principles and opposes economic theories like the efficient market hypothesis.

The information provided herein is for general informational purposes only and is not intended to provide tax, legal, or investment advice and should not be construed as an offer to sell, a solicitation of an offer to buy, or a recommendation of any security by Candor, its employees and affiliates, or any third-party. Any expressions of opinion or assumptions are for illustrative purposes only and are subject to change without notice. Past performance is not a guarantee of future results and the opinions presented herein should not be viewed as an indicator of future performance. Investing in securities involves risk. Loss of principal is possible.

Third-party data has been obtained from sources we believe to be reliable; however, its accuracy, completeness, or reliability cannot be guaranteed. Candor does not receive compensation to promote or discuss any particular Company; however, Candor, its employees and affiliates, and/or its clients may hold positions in securities of the Companies discussed.