Tail Risk: Be Aware of Extreme Case Scenarios

Tail risk can pose a real threat to your portfolio. Here’s how you can protect against it.

We all know that investing can be risky. Unlike in an FDIC-insured bank account, you’re not guaranteed to retain any money you add to your stock portfolio. Still, many investors confidently commit their entire savings to market indexes like the S&P 500, banking on expected returns of 8-11% per year.

However, while these benchmarks may see high average returns over time, they often fluctuate in the short term. If a tail risk event occurs, your investment can even lead to extreme losses. Let’s talk about tail risk, how it impacts your portfolio and how to lower your exposure to it.

What Is Tail Risk?

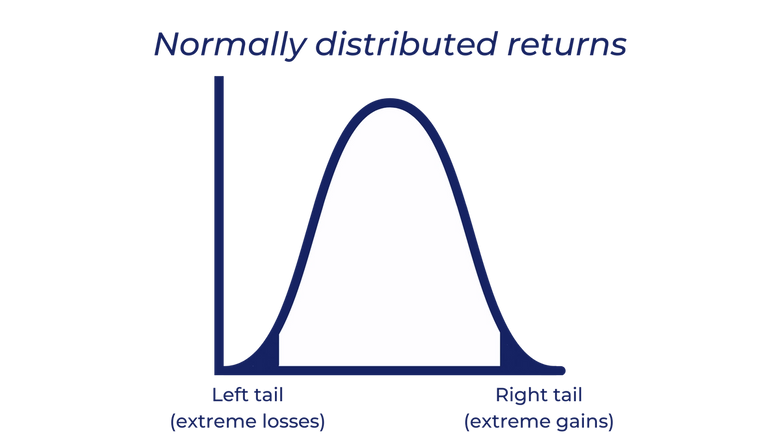

Tail risk describes an extreme case scenario with an unlikely chance of occurring. The phrase gained popularity with the release of Nassim Taleb’s The Black Swan: The Impact of the Highly Improbable and is based on the term for the ends of a normal distribution. Although 99.7% of the data on a bell curve lies within three standard deviations of the mean, 0.3% lies at the far left and right tails combined.

When it comes to investing, the two tails translate to opposite performance outcomes:

- The right tail shows abnormally high returns;

- Whereas the left tail represents extreme losses.

The difficulty of using tail risk...

The problem with tail risk is that stocks very rarely follow a normal distribution of returns. Investors and economists will often simplify their models to make it easier to calculate relevant metrics. For example, many investors like to use volatility, alpha and beta to decide whether or not to buy a stock. Therefore, it’s sometimes better to make some assumptions than to deal with a continuously shifting model.

Unfortunately, making these simplifications can also come with some disadvantages. In reality, many stocks have fat tails, meaning that the extreme outcomes are more likely than one would expect. In fact, some analysts have concluded that “significant market shocks” occur every 3-5 years on average, according to a report by PIMCO.

Tail risk in practice

It’s easy to think about tail risk in the context of everyday life. Think about how many people in safe neighborhoods install home security systems. The odds that anyone will walk up to your house and try to open the door on any given night is probably extremely low. However, many people would rather spend the time and money to prevent break-ins than risk the chance of it happening.

Similarly, investors know that they’re unlikely to face extreme losses on any average day. Most of the time, they can reap good returns just by investing in index funds or ETFs that track the market. However, if a pandemic hits or a nuclear attack occurs against all odds, the market will likely undergo a sharp decline. Knowing this, many investors take measures to protect their portfolios against tail risk, just to be safe.

How Can Tail Risk Impact Investments?

The threat of devastating losses from a market shock, however unlikely, is enough to worry any investor. However, it may create more anxiety among some groups than others.

For example, investors with longer investment horizons, or those who expect to hold a portfolio over a longer period of time, are often less risk-averse. Therefore, they may not be as concerned about mitigating tail risk since they’ll likely be able to wait for market conditions to improve.

On the other hand, other investors don’t have the same luxury. For example, retirees and those close to retirement often have lower risk tolerance since they need funds in the short term. In fact, for some investors in this group, a market decline could even mean a decreased standard of living. Therefore, it can be important for investors who need liquidity to minimize tail risk.

Examples of Tail Risk and Its Impact on Investments

Because tail risk events are so dramatic and unlikely, they’re often very memorable. Many point to the 2011 earthquake and tsunami in Japan or the 9/11 attacks on the Twin Towers as unexpected, disastrous events. Not only do these kinds of tragedies have a devastating impact on communities and human lives, but they also tend to incur a huge economic cost as well.

The Great East Japan Earthquake (GEJE) on March 11, 2011 was said to have totaled $360 billion in economic losses, including 138,000 buildings destroyed. Additionally, the Nikkei 225 Index, which reflects the performance of the Tokyo Stock Exchange, declined 17.5% over the course of five days.

Winners and losers in tail risk events

It’s important to keep in mind that tail risk events rarely have the same effect on every company and industry. More often, some firms will be devastated while others stay stable or even get a boost.

For example, the aftermath of the 9/11 crisis saw steep declines in air travel, entertainment and tourism. American Airlines, whose plane was hijacked in the attack, experienced a stock price decline from $29.70 before financial markets closed on September 11 to $18.00 on September 17. Other airlines saw similar losses.

However, other companies actually thrived as demand for their products and services increased. For example, the government began putting more money toward defense contracts in order to protect against future attacks. As a result, many weaponry and arms manufacturers saw a rise in their stock prices as other companies declined.

Similarly, a lot of investors aimed to profit off of winning companies in the midst of the Covid-19 pandemic. Despite the fact that the market underwent three of its worst days in March 2020, some companies were just starting to thrive at that time.

For example, the video conferencing platform Zoom jumped 272.5% from mid-April to mid-October 2020. Other companies that were well-positioned to adjust to consumers’ changing needs also saw success. However, many industries, such as live sports and in-person dining, had their operations directly disrupted by the pandemic.

4 Methods to Mitigate Tail Risk

Tail events, by definition, will only occur a tiny percentage of the time. However, because their effects can be devastating, it’s important to make the proper preparations.

1. Purchase low-volatility equities

One of the easiest ways to limit your exposure to tail risk is by lowering your overall portfolio risk. Low-volatility stocks have lower variance and narrower distribution curves, meaning that even if a tail risk event does occur, the performance still shouldn’t stray as far from the average.

This strategy can be an effective way to achieve market returns without taking on as much downside risk. Unfortunately, this often means you’ll also miss out on some of the upside in the case of extreme rallies.

2. Invest in a variety of asset classes

Many investors increase their diversification by holding a multi-asset class fund. These portfolios may contain any combination of asset classes, including cash, equity, bonds or alternative investments like real estate or gold. By choosing investments with low or inverse correlation, you can lower your exposure to declines in any one area.

3. Employ a target-volatility strategy

Volatility targeting is an active management strategy that involves periodically balancing your portfolio to achieve constant volatility. Researchers have found that this investment strategy can lead to a higher Sharpe ratio, or return per unit of risk.

However, it does come with a few disadvantages. For starters, it can be relatively time-consuming and difficult to execute for the average investor. On top of that, it can also incur additional transaction costs in the rebalancing process through bid-ask spread and commission fees.

4. Use derivative-based hedging strategies

If you don’t want to change your asset allocation, you can buy derivatives that’ll pay out in a market decline. For example, some investors will buy put options of equities in their portfolio. That way, if the stock’s price declines, they’ll still be able to sell it at a higher price.

Some investors may use more complicated derivative-based methods, such as zero-cost collars. In this strategy, an investor will buy a put option and sell a call option for a stock they’re holding. Ideally, the prices of each option will cancel out, and they’ll be able to limit the gains and losses of their investment at no extra cost.

However, derivative-based strategies can get pretty complex and pricey, depending on how they’re executed. For that reason, they’re more likely to be used by hedge fund managers and Wall Street traders than your average retail investor.

Takeaways

Tail risk is an inevitable aspect of any investment. Of course, you don’t want to live your whole life in fear of a financial crisis. However, you’ll still want to work some risk management strategies into your portfolio to prepare.

Think about which methods make the most sense based on your investment horizon and risk tolerance. If you’re not sure what to do, consider consulting with a financial advisor to figure out the best course of action.

The information provided herein is for general informational purposes only and is not intended to provide tax, legal, or investment advice and should not be construed as an offer to sell, a solicitation of an offer to buy, or a recommendation of any security by Candor, its employees and affiliates, or any third-party. Any expressions of opinion or assumptions are for illustrative purposes only and are subject to change without notice. Past performance is not a guarantee of future results and the opinions presented herein should not be viewed as an indicator of future performance. Investing in securities involves risk. Loss of principal is possible.

Third-party data has been obtained from sources we believe to be reliable; however, its accuracy, completeness, or reliability cannot be guaranteed. Candor does not receive compensation to promote or discuss any particular Company; however, Candor, its employees and affiliates, and/or its clients may hold positions in securities of the Companies discussed.