Review of Ally Invest vs. Robinhood and Public

Interested in commission-free trading? Find out which investment platform is right for you.

As the investment branch of the digital financial services company Ally Financial, Ally Invest has become a staple among new and experienced investors alike. Since October 2019, it’s attracted even more customers with commission-free trading.

Fortunately for consumers, free trading has increasingly gained traction in the industry as more companies opt for fee-free models. However, that can also make it hard to figure out which platform to choose for your investment needs.

In this article, we'll breakdown:

- What is Ally Invest?

- Ally Invest vs Robinhood

- Ally Invest vs Public

- Pros and cons of Ally Invest

What Is Ally Invest?

Ally Invest is a full-service online investment platform. The service was launched in 2005, but it has inherited the brand reputation of its parent company Ally Financial, which has been around since 1919. For existing customers at Ally Bank, Ally Invest is a clear choice. Not only does it allow you to keep your money in one place, but it also makes it easier to move funds across your accounts.

Investment basics

Investment options

Ally Invest offers a variety of investment options, including stocks, bonds, ETFs, mutual funds, fixed income and options. Additionally, if you make a separate but connected Ally Invest Forex account, you’ll be able to trade foreign currencies.

Fees

Although there are no fees for eligible stock and ETF trades, options trades cost 50¢ per contract. Bond traders will also cost $1 each, with a $10 minimum, and certificates of deposit (CD) are $24.95 per transaction. Ally Invest also charges miscellaneous fees for extra services, all of which are listed on its website.

Account types

When you sign up with Ally Invest, you can choose from a selection of account types. In addition to individual, joint and custodial taxable accounts, you can also opt for a Traditional, Roth, Rollover IRA or Coverdell account.

You can also decide between a self-directed or managed account. Self-directed accounts have a minimum balance of $0 and allow you to make your own investment decisions.

However, managed accounts impose a $100 minimum and allow you to choose from a variety of options:

- Socially responsible: based on companies actively practicing sustainability, energy efficiency or other environmentally friendly initiatives

- Tax optimized: helps maximize investments for those making after-tax contributions to their investments

- Core: diversified across domestic, international and fixed-income assets, based on the investor’s chosen level of risk

- Income: conservative risk profile containing assets with high-dividend yields

Ally Invest managed portfolios will also automatically rebalance as needed without charging any advisory fees, Additionally, if you choose the Cash Enhanced Managed Portfolio, 30% of your funds will remain as cash, earning steady interest.

Trading tools

While Ally Invest is primarily accessible through desktop, you can also download the mobile app to use it on the go. Through the app, you can manage your account in several ways, including viewing your portfolio, tracking your goals and executing trades. If you have an Ally Bank account, you can also perform banking tasks on the same app.

Ally Invest also offers many tools for researching investments and managing your portfolio. If you want to look at a stock’s performance before investing, you can access real-time streaming charts, market and company snapshots and market data.

You can also determine whether or not to buy a stock using the profit/loss and probability calculators, which will predict their potential performance based on previous data. Additionally, to get a more holistic view of your financial situation, you can also use the Maxit Tax Manager to see how your trades impact your taxes.

In addition to its advanced educational resources, Ally Invest is also praised for its customer service. On top of email and in-app live chat options, the company also offers a 24/7 phone line. For many clients, having a direct line to call may be critical, especially when you have a lot of money invested.

Investor level

Ally Invest is suited to all levels of investors. Its robo-advising services and managed accounts make it an option for those who don’t want to spend much time managing their portfolio. However, its mobile app and analysis tools equip active traders with the resources they need to make wise investment decisions.

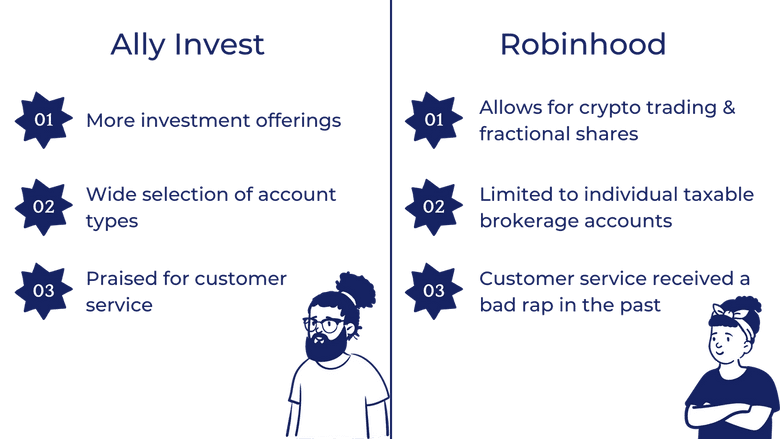

Ally Invest vs. Robinhood

Founded in 2013, Robinhood is often credited with pioneering commission-free trades. Contrary to Ally Invest, Robinhood actually started as a mobile app before expanding to a web platform. However, that’s not the only difference between the two services. Let’s take a look at how the investment offerings compare between Ally Invest and Robinhood.

What is Robinhood?

Robinhood is a fintech company based in Silicon Valley’s Menlo Park, California. It proudly boasts its mission “to democratize finance for all” by making trading accessible for the average consumer.

However, the platform has faced its fair share of complaints and controversies over the years. Customers have been frustrated at outages during high-volume trading days, including the start of COVID-19 lockdowns and the day of Apple and Tesla stock splits. On top of that, in June 2021, the company agreed to a payment of $70 million to settle regulatory investigations. The complaints included repeated outages, approving inexperienced traders for risky strategies, and failing to disclose its practice of payment for order flow (PFOF).

Still, customers continue to flock to Robinhood because of its simple trading platform and engaging user experience.

Investment options at Ally Invest vs. Robinhood

Minimal fees and crypto trading

While Robinhood’s investment offerings are more limited than Ally Invest, users can still enjoy fee-free trades on stocks, ETFs, options and American Depository Receipts (ADRs) for over 650 globally-listed companies. On top of that, Robinhood Crypto also allows cryptocurrency trading.

Buy and sell fractional shares

Unlike Ally Invest, Robinhood allows customers to buy and sell fractional shares. This makes diversification easier and investing more accessible for many investors. Instead of avoiding pricey stocks due to budgetary constraints, customers can choose to purchase $50 worth, for example. However, whereas Ally Invest offers a wide selection of account types, Robinhood users are limited to individual taxable brokerage accounts.

👉 Read Next: A Deep Dive Into Fractional Shares

Robinhood Gold

Although Robinhood accounts are free by default, customers can opt for a premium option for additional features. For $5 per month, Robinhood Gold members are allowed bigger instant deposits and access to investing on margin. Additionally, they can access investing resources including research from Morningstar and Level II Market Data from Nasdaq.

👉 Want to learn more about Robinhood Gold? Read Robinhood Gold: A How-To Guide

Bad reputation for its customer service

However, in terms of customer service, Robinhood hasn’t always gotten the best press. In June 2020, a college student took his own life after seeing a balance of -$730,165 in his Robinhood account and failing to get a response from the company when he emailed about it. Since then, the company has made efforts to expand customer support, like launching a direct phone line.

Concluding thoughts

Overall, Robinhood is a simple, streamlined platform for those who want to practice their stock-picking skills. It’s mainly aimed at active traders who want to keep an eye on their stocks throughout the day. However, it does present significant limitations, including a narrow selection of investment choices and account types.

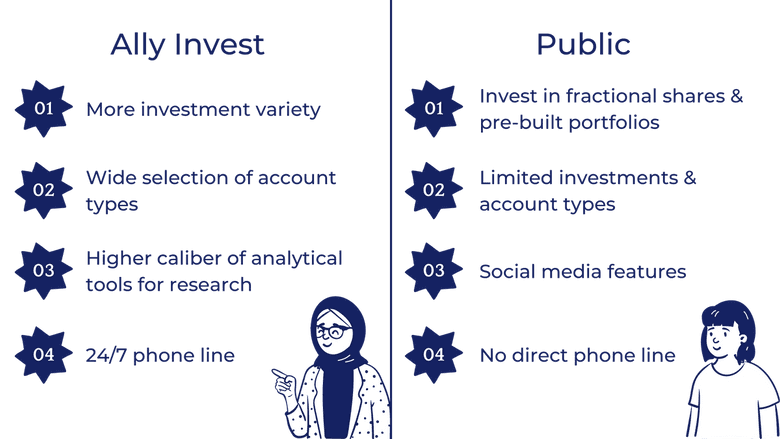

Ally Invest vs. Public

Another company vying for a piece of the commission-free investment market is Public. Although it’s only been around for a few years, it’s already disrupted the industry with its attempt to merge investing and social media. Let’s talk about what else Public brings to the table, and why you might want to give it a try.

What is Public?

Public had a soft launch in 2017 under the name of Matador before changing its name in August of that year. However, it first became available to the public in March 2019. Unlike Ally Invest and Robinhood, Public offers its services exclusively on mobile.

Public brands itself as an investing social network, allowing you to leverage other users’ opinions in making investing decisions. As a Public user, you’ll create an investor profile that anyone in the community is able to view. Similarly, you’ll be able to browse other users’ profiles, from celebrity investors to friends on the app.

Additionally, Public hosts virtual Town Halls where you can ask questions and get live answers from founders and CEOs. Although you won’t be able to ask for any investment advice, the feature can be useful in keeping up to date with business news and industry trends.

Investment options at Ally Invest vs. Public

Investment features that make your life easy

Similar to Robinhood, Public allows customers the advantage of investing in fractional shares. It also offers pre-built portfolios, making it a great choice for easy diversification. Although the service automatically deposits dividends into your account, you can change your settings to automatically reinvest them.

Lacking in investment variety

However, Public doesn’t offer nearly as much investment variety as Ally Invest, with only stock and ETF trading. It also only offers individual, taxable brokerage accounts. In other words, even though you can use the Public app to easily create a diversified portfolio, you won’t be able to get any tax benefits on it.

Social media features

Public aims to set itself apart from other investment apps through its social media features, which you can use to crowdsource opinions from other users. In addition to viewing other people’s thoughts on various stocks, you can also create chat groups with friends and community members.

Analytical tools fall short

Unfortunately, it doesn’t offer the same caliber of analytical tools as Ally Invest. Additionally, since Public is mobile-only, it’s already pretty difficult to conduct thorough research before making an investment decision. Therefore, if you prefer using charts and statistical analysis to evaluate potential investments, Public may not be the right platform for you.

Customer service

While it doesn’t offer a direct phone line, users can reach Public customer service through the in-app live chat, email or social media.

Concluding thoughts

Overall, the Public app is most similar to Robinhood, with a social media twist. While it’s a great tool for gaining more hands-on practice with investing, its mobile-only offerings limit users to relying on other users’ thoughts in conducting due diligence.

Pros & Cons of Ally Invest

Pros:

- Managed portfolios: Users can access robo-advising services and automatic rebalancing for passive investing

- Great selection of investment choices: Offers stocks, bonds, ETFs, mutual funds, fixed income, options and forex (with Ally Invest Forex)

- Wide variety of account types: Choose from individual, joint and custodial taxable, Traditional, Roth, Rollover IRA or Coverdell account

- No-commission trades for eligible stocks and ETFs: Buy and sell equity investments with no added fees

- Reliable customer service: Contact an Ally representative 24/7 through live chat, email or phone

- Highly-rated mobile app: Manage your investment and banking accounts on the go using Ally Mobile: Bank & Invest

- Several helpful tools for research and analysis: Track your finances and conduct investment research using real-time updates and analytical tools

Cons:

- Small fee for options trades: 50¢ flat fee per options contract

- No cryptocurrency trading: Unlike with Robinhood, Ally Invest customers can’t take part in the growing crypto market

- No fractional shares: Can’t invest in stock without buying a full share, limiting diversification for lower-value portfolios

Takeaways

Ally Invest is a reliable investing platform for a variety of users. Its research and education tools make it a great choice for experienced traders executing a strategy. At the same time, its managed portfolios and retirement account options can come in handy for more passive investors aiming to build wealth over time.

However, if you’re looking into active trading with a small amount of capital, you might want to turn to Robinhood or Public. Because they offer fractional shares, you’ll be able to dip your hands into several pots without investing all of your money.

The information provided herein is for general informational purposes only and is not intended to provide tax, legal, or investment advice and should not be construed as an offer to sell, a solicitation of an offer to buy, or a recommendation of any security by Candor, its employees and affiliates, or any third-party. Any expressions of opinion or assumptions are for illustrative purposes only and are subject to change without notice. Past performance is not a guarantee of future results and the opinions presented herein should not be viewed as an indicator of future performance. Investing in securities involves risk. Loss of principal is possible.

Third-party data has been obtained from sources we believe to be reliable; however, its accuracy, completeness, or reliability cannot be guaranteed. Candor does not receive compensation to promote or discuss any particular Company; however, Candor, its employees and affiliates, and/or its clients may hold positions in securities of the Companies discussed.