Robinhood Gold: A How-To Guide

Learn about how Robinhood Gold works, how you can utilize it, and the pros and cons of the premium account.

Robinhood is one of the most valuable private companies in Silicon Valley. The stock-trading mobile app is on a fast track for success with plans to go public in 2021.

Robinhood was one of the first trading platforms to provide free stock trading, causing online brokerage firms to cut commissions and helping create the now-industry standard of commission-free trades.

Robinhood’s offerings include equity, cryptocurrency, options trades, and cash management products. They also have a premium account for users called Robinhood Gold. This article will explain how Robinhood Gold works, what it includes, and who benefits from this premium account.

What Is Robinhood Gold?

Robinhood Gold is a suite of tools, data, and strategies that allows users to enhance their brokerage accounts with Robinhood. There are four premium features.

1. Bigger Instant Deposits

Using Robinhood Gold, you get instant access to your money with larger instant deposits rather than waiting five business days for the funds to clear. This can increase your buying power, allowing you to invest when opportunities come up instead of waiting.

Robinhood Gold calculates your instant deposit limit based on your account balance:

- If your portfolio balance is over $50,000, then you have a $50,000 instant deposit limit.

- If your portfolio balance is $25,000, then you have a $25,000 limit.

- If your portfolio balance is $10,000 balance gives you a $10,000 limit.

- If your portfolio balance is under $10,000, you get a $5,000 limit.

Without Robinhood Gold services, all Robinhood users get $1,000 in instant deposits, regardless of their account value.

2. Professional Research From Morningstar

Robinhood Gold’s partnership with the independent investment research company Morningstar provides its gold users with unlimited access to Morningstar’s premium, in-depth stock research reports.

These research reports are available on 1,700 stocks with frequent updates based on current company events. The reports cover information including the company’s business strategy, economic moat, fair market value, risk, and leadership.

Research reports allow Robinhood Gold investors to make more informed investment decisions. They can be accessed on the Robinhood mobile app as well as the website.

3. Level II Market Data From Nasdaq

In partnership with Nasdaq, Robinhood Gold offers its users a wealth of information on the stock market beyond just the best ask and the best bid. It shows you aggregated quantities at the individual asks and bids, which can help investors figure out the availability or desire for a stock at a given price.

4. Access to Investing on Margin

Having a margin account allows users to borrow money from Robinhood in order to buy more stocks, giving its users greater potential gains or losses. When you enable borrowing, you have greater buying power represented by your cash combined with what you have borrowed from Robinhood.

The Financial Industry Regulatory Authority (FINRA) dictates that you must have a minimum of $2,000 portfolio value, minus any cryptocurrency positions, in your Robinhood account to qualify for margin trading.

If you are interested in margin trading but don’t want to take on too much additional risk, Robinhood Gold also allows you to set your own limit as to how much money you can borrow. You can set this limit at any amount.

You can track how much margin you use in the Robinhood app’s Margin Investing settings. This will tell you your:

- Total Margin, the maximum margin you are allowed based on your portfolio value;

- Margin Used, the portion of the margin you are currently using; and

- Borrowing Limit, your own self-imposed limit on how much money you can borrow from Robinhood.

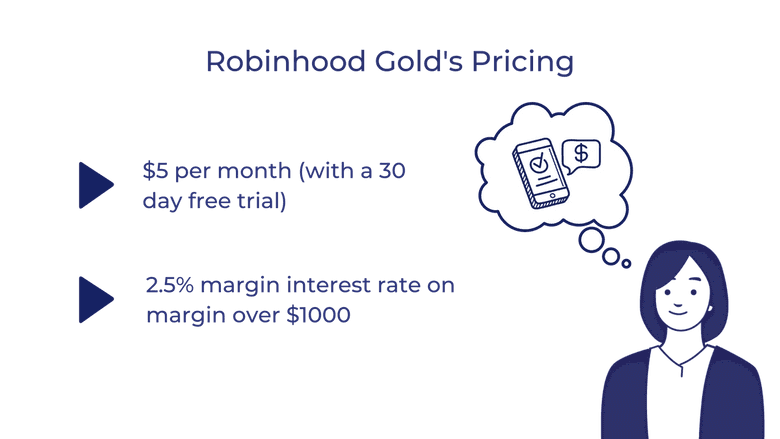

What Is the Pricing of Robinhood Gold?

Robinhood users can sign up for Robinhood Gold at any time, and can try the premium account free for 30 days. After that, the service costs only $5 a month, with your first $1,000 of margin included.

If you use more than $1,000 of margin, you will be charged 2.5% yearly margin interest above the $1,000 benchmark. Robinhood Gold calculates your margin interest daily, and it’s charged to your account at the end of each monthly billing cycle.

Who Wants Robinhood Gold and Why?

Should you pay the monthly fee for access to Robinhood Gold? It will depend on how you plan on utilizing their premium features. If you want to trade on margin, then you will need a Robinhood Gold account.

However, you also want to consider if you will read the research reports that Morningstar provides, or utilize the Level II market data when you make your investments. It will also depend on if you are likely to take advantage of the larger instant deposits, or if you aren’t that committed of an investor.

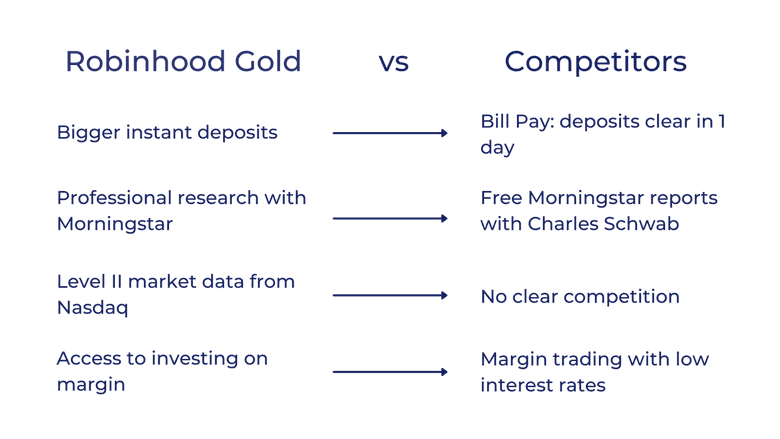

Warrior Trading's Report

The stockbroker guide, Warrior Trading, created a report to explain whether each feature of Robinhood Gold is worthwhile. Warrior Trading found that the Morningstar research reports provided by Robinhood Gold don’t give their readers an inherent edge, and a favorable rating doesn’t mean you should necessarily buy the stock. They also point out that Charles Schwab and other brokers provide Morningstar reports for free.

Warrior Trading found that the Level II Market Data information is more useful, particularly for users to identify short-term supply and demand. They also found that the increased instant deposits make a lot of sense as a feature, as the average Robinhood user doesn’t have a large account balance. However, they also point out that stockbrokers like Charles Schwab offer a Bill Pay option where your funds can clear within one business day.

As for margin trading, Warrior Trading points out Robinhood Gold’s interest rate is lower than discount brokerages like TD Ameritrade and Schwab, but higher than Interactive Brokers.

Considerations

Before you sign up for Robinhood Gold or similar services, figure out what kind of investor you are, and before you throw all of your money behind risky margin trading, figure out if you have the requisite stock market knowledge, experience, and objectives, along with enough money in your portfolio and cash account.

The Robinhood platform generally also works better for mobile app users, individual taxable accounts, margin accounts, and cryptocurrency.

Is Robinhood Gold Worth It?

Because Robinhood Gold is a margin account, that comes with extra levels of risk and financial responsibility. With margin investing, the returns on your stocks directly affect your account value, whether they are positive or negative.

If the stock loses value, the losses are deducted from your account value and not the funds you borrowed. Therefore, margin oftentimes increases your loss just as often as it brings higher rewards, which you need to be prepared for if you choose to invest on margin.

When you trade on margin, you can lose not just your borrowed money, but the value of the securities already in your account. You will also be paying interest on borrowed cash for the duration of the investment.

If you show losses that are greater than the limit set by the broker, Robinhood might make a margin call. This happens when a brokerage platform forces the sale of securities and other assets in your account to make up for your losses. Firms can make a margin call without contacting you, and you are not given a time extension.

However, you can also make a great profit using margin trading, so as long as you understand the risks and have done your research, it can be a benefit to your portfolio.

You should also consider the pros and cons of Robinhood as a platform generally; in a crowded market, there are many other options for trading stocks that might benefit you more.

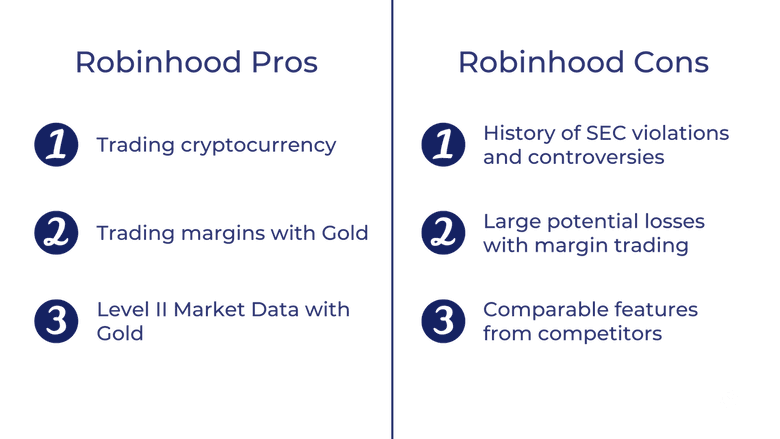

Pros

Robinhood is a free-trading app that allows investors to trade stocks, options, exchange-traded funds (ETFs), fractional shares, and cryptocurrency trading without paying commission or fees. It also has a new recurring investments feature in order to stand out in the market, and it’s one of the few brokers that allows its users to trade cryptocurrencies like Bitcoin or Dogecoin.

Robinhood also has no account minimum, and a streamlined interface that both work to its advantage.

Cons

Various problems with Robinhood include that it does not offer mutual funds or bonds, has no retirement accounts, and there is limited customer support. There is also a lack of range in tradable securities and account options.

Robinhood has also been the topic of more than one scandal this year, with outages, trade restrictions, and volatility in the market working to its disadvantage.

In Conclusion

Before you choose Robinhood as a trading platform, you should be aware that in December of 2020, Robinhood was charged by the Securities and Exchanges Commission (SEC) for misleading customers, with customer orders executed at inferior prices compared to other brokers. They were also the center of the GameStop controversy in January of 2021 when they restricted trading during extreme market volatility on GameStop and other heavily shorted stocks.

Choosing your investment platform is a personal decision, and if margin trading and cryptocurrency trading are more important to you than anything else, Robinhood might be your best option. However, since many other platforms offer commission-free trades now, do your research before committing to Robinhood, or upgrading to Robinhood Gold.

Banner image from Robinhood

The information provided herein is for general informational purposes only and is not intended to provide tax, legal, or investment advice and should not be construed as an offer to sell, a solicitation of an offer to buy, or a recommendation of any security by Candor, its employees and affiliates, or any third-party. Any expressions of opinion or assumptions are for illustrative purposes only and are subject to change without notice. Past performance is not a guarantee of future results and the opinions presented herein should not be viewed as an indicator of future performance. Investing in securities involves risk. Loss of principal is possible.

Third-party data has been obtained from sources we believe to be reliable; however, its accuracy, completeness, or reliability cannot be guaranteed. Candor does not receive compensation to promote or discuss any particular Company; however, Candor, its employees and affiliates, and/or its clients may hold positions in securities of the Companies discussed.