Fractional Shares: Investing Made Accessible

The advantages and disadvantages of fractional shares, put simply.

Fractional shares are partial shares of a company’s stock. Rather than purchasing an entire share of stock, fractional shares allow you to buy a portion based on a dollar amount; this enables you to buy shares in a company you otherwise could not afford. For example, if a stock is listed at $3,000 but you only have $300 to invest, you could buy 1/10 of the asset and earn returns accordingly. If you were restricted to purchasing only full shares, you would not be able to invest in this company.

The flexibility of fractional shares is enticing because you can diversify your portfolio to the nearest cent. This also benefits the issuer of the stock since more people can invest in the company. These investments will inevitably increase cash flow and provide the issuer with more capital to perform any pricey transactions they otherwise would not have been able to perform.

How Do They Work?

Fractional shares are traded in the same way as whole shares, and the transactions take place on the same mobile apps and online brokerages as typical equity stock trading. Some brokerages only allow fractional share ownership in large companies, such as Amazon and Apple. The specific rules about fractional share trading differ from brokerage to brokerage.

It's worth noting that fractional shares combine to fulfill complete shares. In simpler terms, ten purchases of one-tenth of a stock will comprise an entire share purchase. This artificially creates the ability for payment plans for stocks. Rather than wait to purchase an entire share, investors, can buy a fraction of a share weekly, in order to capture more benefit.

Fractional shares are considered readily available for traditional equity stock and less available for fund purchases. This is due to the strenuous workload a fund manager must undertake to accept trades on fractional shares of stock.

Do They Pay Dividends?

Fractional shares pay dividends, though the amount you earn in dividends will be proportional to the amount of a share you own. If a share receives $100 in dividends and you own half of a share, you will receive $50.

Just as dividends are only offered for some equity investments, dividends are also only available for select fractional share investments. If a company offers dividends for whole shares of its stock, it is likely they will offer the same benefit for fractional shares. Instances in which companies do not offer dividend payments apply to fractional shareholders as well. In other words, owning fractional shares of stock does not always mean you will receive dividend payments.

Why Do They Exist?

Having the option to purchase a fractional share attracts many investors and typically correlates with more investment in the company. By lessening the barriers to investors, fractional shares provide a more affordable option for investing in many fan-favorite companies around the world.

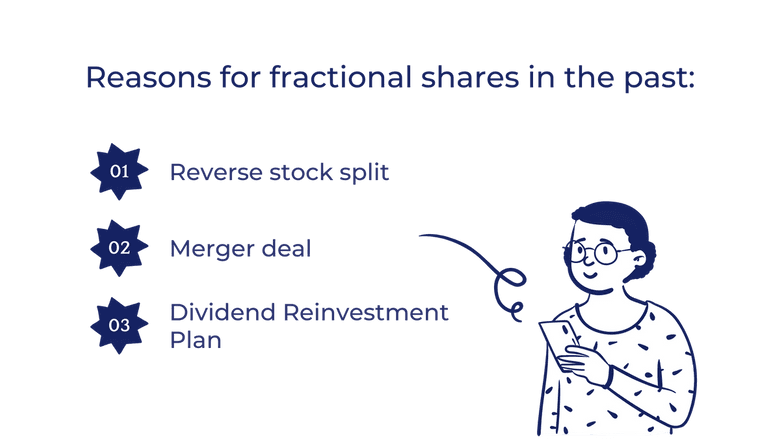

Until recently, fractional shares have only been distributed for a few reasons.

- Reverse stock split: When an investor owns an odd amount of shares in a company and a reverse stock split takes place, fractional shares are distributed. For example, if you own three shares and there is a reverse split, you would now own one and a half shares.

- Merger: Merger deals may incite fractional share ownership. When two companies merge, they agree to combine stocks at an agreed-upon ratio, which may result in ownership of fractional shares.

- DRIP: DRIPs, or Dividend Reinvestment Plans, may also create fractional share ownership, as the dividend amount used to purchase stock may not be enough to purchase an entire share. For example, if a company has a plan to reinvest a dividend payment of $25 to a stock that costs $30, the plan will result in ownership of 5/6 of that stock. These naturally occurring instances of fractional share ownership clarify the logistics of owning equity.

Buying And Selling Fractional Shares

Buying and selling fractional shares works in the same way as buying and selling whole shares. Typically, the company decides whether fractional shares will be offered. However, on several occasions, brokerages have been forced to block trades on fractional shares. In essence, the ability to trade fractional shares is typically determined by the individual companies, though it can be influenced by the brokerage as well.

Fractional shares fluctuate with the stock itself. For example, when a company’s stock rises by 10% over a given period, each share rises in value by $2. If someone owns half a share, they will experience 10% growth as well, though they will only return $1 since they only own half a share.

Where Can You Buy Them?

Most online brokerage firms allow for partial share purchases on traditional equity stock. Brokerages such as Fidelity, Charles Schwab, SoFi, and Robinhood allow fractional share investments on certain equity investments; many online brokers also do so commission-free.

Fractional shares are a relatively new concept in the investing world. Therefore, some brokers do not yet allow you to purchase them, and some publicly traded companies haven’t made fractional share investing possible yet.

Online brokerages have different policies when distributing fractional shares. Robinhood, for example, allows fractional share trading for stocks that are worth more than $1 per share and have a market capitalization of more than $25 million.

ETFs and some mutual funds do not allow you to purchase fractional shares. Whether or not a fund allows for fractional investments is up to the fund manager. If you purchase fractional shares in a fund, you will receive your respective fraction of returns. If fractional shares are not available for a fund, it may be due to the extra effort that the manager does not intend to undertake.

Why Do People Buy Them?

There are many reasons to purchase a fractional share. The primary reason is if you do not have the capital to buy an entire share. If the amount of money you have does not exceed the price of a whole share, you may choose to purchase fractional shares instead, thus making investing more affordable.

Additionally, you may seek to limit your risk and diversify your portfolio by only purchasing fractional shares as opposed to whole shares. With fractional shares, you are not constrained by the share price of a stock, as you can diversify your portfolio to the nearest cent. Without this limitation, you can build a portfolio with many different investments. A diversified portfolio composed of individual stocks can only benefit from utilizing fractional share investing.

Advantages and Disadvantages of Fractional Shares

Advantages

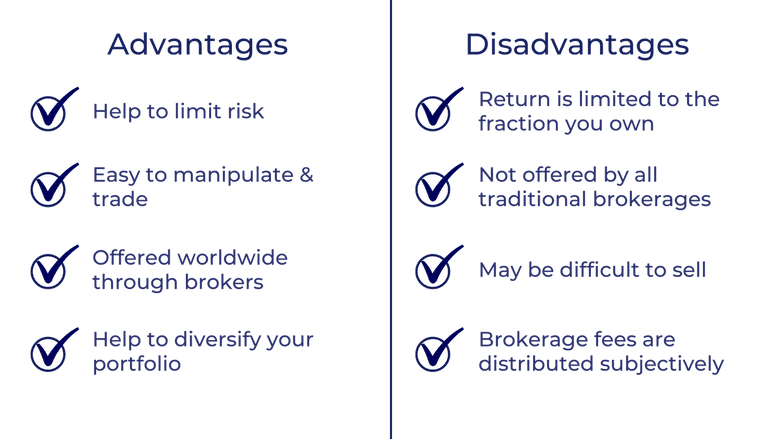

- You can limit risk by only purchasing a fraction of the stock’s volatility. If a stock drops exponentially, you will lose a fraction of the amount that an investor with a whole share would. Account fees and stock prices are cohesively associated with a single share of said stock.

- Fractional shares are as easy to manipulate as whole shares of the same stock. For example, if a stock split takes place, fractional shares will adjust accordingly. They behave similarly to whole shares in equity stock, which means you can trade them with ease using an online brokerage account. The user-friendliness of investing in fractional shares is often appealing to many investors.

- Many U.S. stocks are listed on the NASDAQ to easily display economic performance using real-time metrics. Fractional shares work similarly and therefore provide no additional strain to anyone managing equity stock investments. Fractional shares of equity stock trade easily and fluctuate in accordance with the company’s overall performance.

- Interactive brokers offer the service worldwide, making this form of investment easy to perform. Though the concept of trading fractional shares is relatively new, most online brokerage accounts have sought after the opportunity and made it available to their investors. Though it is not yet available for all forms of investment, it may be as technological advancements allow issuers to trade fractional shares with more ease.

- Fractional shares allow you to diversify your portfolio down to the nearest cent. If you attempted to diversify your portfolio equally into four categories, you would have trouble doing so without fractional shares. Owning a portion of stock allows you to attain perfect diversification of 25% across each category, regardless of share price.

Disadvantages

- Return is limited to the fraction in which you own. If a share rises exponentially, the fractional shares will only reap a fraction of the rewards. If a whole share in a company’s stock returns $1000 per share, and you own 1/100 of a share, you will only earn $10.

- Although many brokerages allow fractional share investment, not all traditional brokerages do. You may have to switch brokerages to engage in fractional share trading. Though this may not be the case in the near future, many investors may feel that switching brokerages is not worth the ability to trade fractional shares.

- It may be difficult to sell fractional shares. If there is not enough trading volume for a particular stock, you may encounter difficulty trading until volume picks back up again. Trading whole shares of stock allows you to bypass these nuisances.

- Brokerage fees are distributed subjectively by the brokerage itself. In other words, some brokerages may charge $1 to sell a whole share AND a fractional share. The lesser the fraction of a share you own, the larger the proportion of the fee to your total return on investment. Let’s say a company charges their investors a $1 fee to sell a single share in their company. Said company’s stock returns $10 per share in a given period. An owner of 1/10 of a share will owe all their returns upon selling the stock, whereas a whole shareowner would owe 1/10th of their total return on investment.

Takeaways

Fractional shares are a relatively new concept in the investment world. Their introduction has allowed millions of investors to control the diversification of their portfolio, as well as the ability to purchase ownership in a company at a more affordable price. The advantageous qualities are not without an antithesis, as fractional shares can also be difficult to navigate for a lender and cause headaches for fund managers. Regardless, it appears as if their presence in the investing world is here to stay.

The information provided herein is for general informational purposes only and is not intended to provide tax, legal, or investment advice and should not be construed as an offer to sell, a solicitation of an offer to buy, or a recommendation of any security by Candor, its employees and affiliates, or any third-party. Any expressions of opinion or assumptions are for illustrative purposes only and are subject to change without notice. Past performance is not a guarantee of future results and the opinions presented herein should not be viewed as an indicator of future performance. Investing in securities involves risk. Loss of principal is possible.

Third-party data has been obtained from sources we believe to be reliable; however, its accuracy, completeness, or reliability cannot be guaranteed. Candor does not receive compensation to promote or discuss any particular Company; however, Candor, its employees and affiliates, and/or its clients may hold positions in securities of the Companies discussed.