Earning A Steady Stream of Income with Dividends

There are 5 main types of dividends. Want to get the most out of your investments? Consider investing in a company that pays dividends.

When trying to decide what companies’ stock to invest in, one important thing to look out for is whether a company pays dividends on its stock.

Dividends, put simply, are a way to make a profit on investments. Dividends are paid out of a company’s earnings directly to shareholders, who can either cash out or reinvest them. Investing in companies that pay dividends allows you to make money alongside the companies whose stock you choose to invest in.

This article will explain exactly how dividends work, the different types of dividends you can be paid, and how to determine whether or not to invest in a company’s dividends.

Dividends explained in 3 bullet points:

- A dividend is a payment from a company to its shareholders. A dividend can be paid as cash or as fractional shares of stock.

- Not all companies pay dividends. Usually large, established corporations pay dividends. Smaller, faster growing companies don't make enough profit to pay dividends. Companies that pay dividends include Target, JP Morgan, CVS, Johnson & Johnson, Cisco Systems, Apple, Disney, AT&T, Exxon, and many others.

- Dividend payouts will affect a companies stock price. For example, if a company pays out $1 per share, the stock price will drop by $1.

How Do Dividends Work?

Dividends are payments that a company makes to its stockholders in order to share profits. A dividend is paid per share of stock; for instance, if you own 50 shares of stock in a company, and that company pays $2 in annual cash dividends, you will receive $100 from that stock.

Paid on a regular basis, dividends are one of the primary ways stockholders make money off of their investments in a given company. However, not all companies pay dividends; you must choose dividend stocks when investing if you want to reap the benefits of regular dividend payments.

Both private and public companies pay dividends, but there is no law that requires companies to pay their shareholders dividends, and not all shareholders are entitled to receive them equally. Different classes of stock can earn different dividends, or even none at all. A company has two types of stock: common stock and preferred stock. If you have invested in preferred stock, you will have a higher claim to dividends than the investors who invested in common stock.

Types of Dividends

Dividends are generally paid out of a company’s common stock. Here are the different types of dividends that a company uses to pay its shareholders:

- Cash dividends: Companies pay cash dividends directly into a shareholder’s brokerage account. These are the most common type of dividends to receive.

- Stock dividends: Companies can pay investors in additional shares of stock rather than cash payments. Investors can sell stock dividends for an immediate payoff, or they can hold them.

- Dividend reimbursement programs: Also known as DRIPs, these programs allow stockholders to reinvest dividends back into the company’s stock. They allow individuals and sometimes even corporations or nonprofits to buy shares of stock directly from the company itself at a massive discount. Sometimes, you can even reinvest without any trading or administrative costs at all.

- Special dividends: Special dividends pay out on all shares of a company’s stock, and do not recur. Companies can issue special dividends to their stockholders in order to distribute accumulated profits that they have no immediate need for. A special dividend might also come from a company that doesn’t usually offer dividends. They are generally considered a one-time bonus payment in addition to regular, recurring dividend payments. Companies tend to announce special dividends when they are making a higher profit and want to reward their shareholders.

- Preferred dividends: This type of dividend is not paid out of a company’s common stock; instead, it is paid out to owners of preferred stock. Preferred stock functions like a bond: the dividends are usually consistent and fixed. While there is less potential for growth, preferred dividends will also receive payments first if a company goes bankrupt.

How Often Are Dividends Paid?

Dividends are typically paid quarterly, although some are paid monthly or semiannually. A company’s board of directors approves each dividend, and then announces when the dividend will be paid, its amount, and the ex-dividend date.

There are three dates to remember when you are investing in dividend stock:

- Declaration date: The date when a company’s board announces that a dividend will be paid. The board of directors will then vote on whether or not to pay the dividend.

- Ex-dividend date: Investors must own the stock by the ex-dividend date in order to receive the dividend; if they do not own the stock by then, they are ineligible. Investors who sell the stock after the ex-dividend date passes are still permitted to receive the dividend because they still owned the stock on the ex-dividend date itself. The ex-dividend date is typically one business day before the company checks its shareholder roster to determine who gets a dividend.

- Payment date: The date that shareholders who held the stock on the ex-dividend date will receive their payout.

How Are Dividends Taxed?

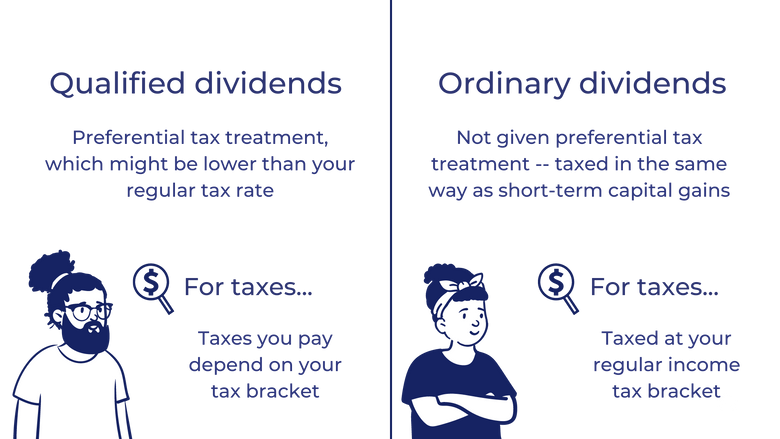

Dividends are taxed based on whether they are considered a qualified dividend or an ordinary dividend.

Qualified dividends are dividends from the U.S. or foreign companies trading on a major U.S. stock exchange, from companies in U.S. possession, or from companies located in a country with a U.S. tax treaty. Qualified dividends are given a preferential tax treatment, which might be lower than your regular tax rate.

The taxes you pay for qualified dividends depend on your tax bracket:

- If you’re in the 10-15% bracket, you do not pay taxes on qualified dividends.

- If you are taxed between 15% and 37%, you pay 15% on any qualified dividends.

- If you are taxed at the 37% rate, you pay 20% on qualified dividends.

The second type of dividend, ordinary or unqualified dividends, can be from foreign companies, REITs, employee stock benefits, tax-exempt companies, and interest from savings or checking accounts. Ordinary dividends are taxed at your regular income tax bracket, the same way short-term capital gains are taxed.

Terminology to Know

What is Dividend Yield?

A company’s dividend yield is a tool for understanding the relative value of a company’s dividend payment. The percentage of a dividend yield shows you what return on investment you’re making when you earn a dividend from a given company.

Dividend yield provides an easy measurement system that compares stocks, which can be useful since dividends are paid as a set amount per share and it can be difficult to compare across companies without it.

To calculate dividend yield, divide the stock’s annual dividend by its current share price. This will give you a percentage that you can use to compare to other companies’ dividend yields, and help you decide which companies provide the best return on investment.

If you don’t want to do these calculations yourself, many financial websites or online brokerage companies will publish companies’ dividend yields based on the stock price on a certain date. You can use these online tools in order to compare and contrast various companies.

Dividend yield and stock price have an inverse relationship, so when the dividend yield is up, the stock price goes down, and vice versa.

There are two ways for a stock’s dividend yield to go up: either the company raises its dividend, or the stock price could go down while the dividend remains unchanged.

For most stocks, investors will want to be suspicious of anything above a 4% dividend yield, as this could indicate that the dividend payout is not sustainable in the long run. Exceptions to this rule include stock sectors created to pay dividends, like real estate investment trusts (REITs). REITs can have safe dividend yields from 5-6% and still have growth potential.

What is a Dividend Payout Ratio?

Another way to make sure a dividend stock with a company is a good investment is to look into their dividend payout ratio, or the portion of its net income that goes toward dividend payments.

If the company pays out a high percentage of its income, that could be a sign that the dividend cannot sustainably remain at its current rate. In general, investors should be on the lookout for companies that have payout ratios at 80% or below. This information can also be found online, on financial advisory or brokerage websites.

Dividends vs. Capital Gains

While dividends and capital gains are both part of investment returns, there are a few key differences between the two terms.

While dividends are cash or additional stock payments from a company’s profit, capital gains represent an increase in share value. Capital gains are not earned until a stock is sold, while dividends represent immediate shareholder earnings.

Dividends are also controlled by a company’s board of directors, scheduled or paid at their discretion. Meanwhile, capital gains are not based on a board decision but instead on the market value of a given company.

Types of Dividend Investors

If you choose to go all-out and throw your weight behind investing in dividends, it’s important to decide on your approach as either a dividend growth investor or dividend yield investor.

- Dividend growth investors: Dividend growth investors buy stocks with a high growth rate in the absolute dividend per share.

- Dividend yield investors: Dividend yield investors buy stocks with the highest dividend yields, deemed to be the safest. This means that the stocks are covered by a minimum ratio of payout to earnings or cash flow. This strategy is especially helpful for investors looking for a large passive income in their retirement, since dividend growth stocks tend to be better long-term investments than high dividend yield stocks.

Why Do People Choose Investments That Pay Dividends?

Investing in companies that pay dividends is one way to create a stable, growing income from investments. Investors usually invest in companies that offer dividends that increase yearly, as this helps outpace inflation. Dividends can also accelerate your portfolio by giving you more income to reinvest.

Even in times of severe economic downturn - such as a global pandemic - good companies have a reputation for maintaining and increasing their dividends, which makes them a more stable investment.

During economic crises, dividends can provide a floor underneath the stock that keeps it from plummeting as much as companies that do not pay dividends to their shareholders. Dividend stocks tend to do better in bear markets.

On average, dividend-paying stocks return 1.91% of the amount you invest, which is a higher return than most high-yield savings accounts, though without the same security.

If you are interested in dividend payments but you do not want to spend the time researching individual companies and their share prices, you can also look into investing in dividend mutual funds and dividend exchange-traded funds (ETFs). Both categories hold many dividend stocks within a single investment and they distribute to investors from those holdings.

You can also choose to invest in real estate investment funds (REITs), which must pay out dividends using 90% of their taxable income each year, and 20% of those dividends must be paid as cash. This makes REITs a great investment option if you are looking for high yields and reliable dividend income.

Why Do Companies Pay or Not Pay Dividends?

Dividends are most likely to be paid by established companies that do not need to invest as much money back into their business. Large and reliable companies have a history of growing dividends without cuts for years, if not decades.

Although dividends on common stock are not guaranteed, investors expect that when a company raises its dividend, it will be maintained. Dividends are indicative of a company’s financial well-being, so investors will typically devalue a stock if they think the dividend will be reduced. This in turn lowers the share price.

Dividends are more common in certain industries, such as utilities and telecommunications. They are less common in high-growth companies, such as in the tech or biotech industry, where their profits need to be reinvested.

Some companies choose not to pay dividends in order to retain earnings and use them to expand, especially in high-growth periods. Starbucks, for example, opened new locations instead of paying dividends, waiting until 2010 to pay dividends to its investors.

This dividend policy is enacted because owners and a company’s board of directors believe that bigger dividend payouts will be possible in the future if they expand now, a method that clearly worked for Starbucks in the long run.

Companies that pay dividends include Target, JP Morgan, CVS, Johnson & Johnson, Cisco Systems, Apple, Disney, AT&T, Exxon, and many others.

If you are looking for the dividend stocks that are doing the best on the stock market right now, check out Investopedia’s list of Top Dividend Stocks for June 2021. You can also take a look at S&P’s 500 Dividend Aristocrats to see 500 companies that have increased their dividends every year for the last 25 consecutive years.

The information provided herein is for general informational purposes only and is not intended to provide tax, legal, or investment advice and should not be construed as an offer to sell, a solicitation of an offer to buy, or a recommendation of any security by Candor, its employees and affiliates, or any third-party. Any expressions of opinion or assumptions are for illustrative purposes only and are subject to change without notice. Past performance is not a guarantee of future results and the opinions presented herein should not be viewed as an indicator of future performance. Investing in securities involves risk. Loss of principal is possible.

Third-party data has been obtained from sources we believe to be reliable; however, its accuracy, completeness, or reliability cannot be guaranteed. Candor does not receive compensation to promote or discuss any particular Company; however, Candor, its employees and affiliates, and/or its clients may hold positions in securities of the Companies discussed.