Preferred Stock vs. Common Stock: Which Is Better?

Preferred stock can be a safer investment than common stock. A mixture of common stock and bonds, learn how preferred stock can boost your portfolio.

When investors have conversations about the stock market, they typically refer to a common or traditional stock, which every publicly traded company has. Preferred stock is what some companies offer in addition to common stock.

In this article, we'll go over everything you need to know about the two, to help you get the most out of your investments.

What are the Similarities?

Common stocks and preferred stocks are both investments in the underlying businesses. This means that both allow you to claim a portion of a company's profits and assets. In other words, owners of both common and preferred stock earn profits generated by the issuer of said stock. Common stocks earn profit from capital gain while preferred stocks receive guaranteed dividend payments.

These are both considered equity stocks, as the value of each fluctuates with the performance of the company itself. If a stock exceeds its estimated par value, common shareholders will reap the rewards of their risk. If the stock fails to reach par value, preferred stockholders will be glad they chose not to purchase common shares. An investor who is willing to place a ceiling on their potential returns to limit risk will invest in preferred over common stock.

What are the Basic Differences?

Common Stock

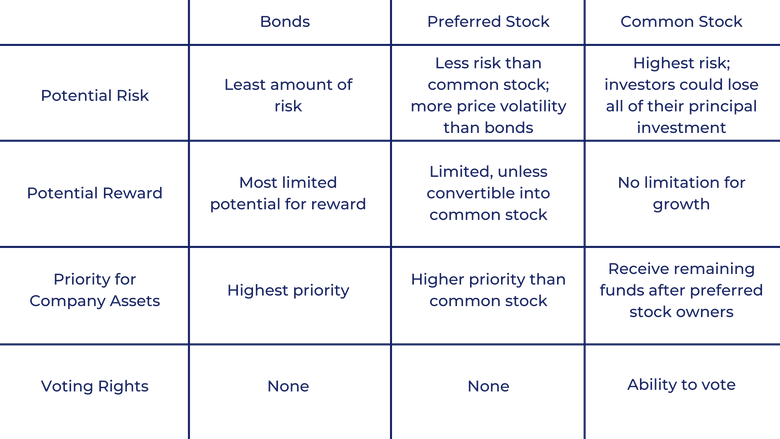

The common stock represents shares of ownership in a company. Most investors purchase common stocks, as they are more readily available and have more upside potential. As the value of a stock rises, owners of common stock make capital gains on their investment. The opposite is also true: owners suffer losses as the stock’s value falls below a given benchmark. The loss of a common stockholder is limited to the amount of their initial investment. However, since there is no limit on how high a stock can rise, there is no limitation on rewards.

This form of investment is most suitable for individuals willing to risk their principal investment, as there are no guarantees of return. Common stock owners also get to vote on corporate policy and other decisions of the company’s future. During liquidation periods, common stockholders are the last to be addressed and have low prioritization in the company’s assets.

Preferred Stock

Preferred stock owners only receive dividend payments and do not make returns on capital investment as the price of the stock rises. To calculate the dividend yield of a preferred stock owner, you must divide the dollar value of the dividend by the value of the stock itself. Unlike common stock dividends, these dividends are guaranteed.

Preferred stock owners have no right to vote on decisions in the company. These investors do not get to voice an opinion on M&A proposals, executive personnel decisions, or corporate policy. During liquidation, preferred stockholders have a higher priority over company assets. There are several classes of preferred stock, which allows preferred stockholders to increase upside potential and earn higher yields.

A Third Option: Bonds

Interest rates on bonds are paid out before dividends are distributed to common or preferred stock owners. Consequently, bonds are one of the safest ways to invest in a company, as the returns are more guaranteed than even preferred stocks. However, the lesser risk is accompanied by lesser rewards, as the interest payments typically return fewer capital gains than either previously mentioned stock option. For this reason, bonds are low-risk, low-reward investments.

In terms of potential returns, common stocks trump preferred stocks, which both offer higher rewards than bonds. Similar to preferred stocks, bondholders don't vote on corporate policy. The interest rates distributed to bonds are guaranteed to be lower than dividend yields earned by preferred investors.

Now that we've covered the basics, we'll do a deeper dive into some of these differences.

How Can These Differences Be Broken Down?

Earnings

Common stocks earn profit from capital gains and dividends, whereas preferred stocks make their gains from dividend payments.

Common stocks fluctuate much more than preferred stocks, which means they have more return potential. However, as you may have guessed, preferred stocks generate much lower risk potential than common stocks. Just as common stocks can fluctuate upwards and yield massive returns, so can they plummet and squander any initial investments.

Companies must pay preferred stockholders before they can distribute the remaining funds to common stock owners. The label “preferred stock” comes from their preferred status over common stockholders. Preferred shareholders have a much higher certainty of return on investment than owners of common stock. Since they have less risk, their rewards will also be limited.

Shareholders' Role in Companies

Owners of common stock typically have a legal right to vote on the representatives of the company’s board of directors. They can also vote on other major decisions, such as mergers and acquisitions.

The activism of shareholders is rarely enough to block a merger from taking place. However, their votes still help executives in the company to understand the public sentiment of the deal. Preferred stockholders have no voting rights and therefore have no say in M&A deals. Investors may be willing to overlook the risk of owning common stock in exchange for a voice in corporate policy decisions.

Dividends

What are they?

Dividend payments are available to each type of equity stock. Dividend yields fluctuate based on the market price of the given stock. Typically, companies leading their industry and performing well will distribute anywhere from 35% to 55% of their earnings in dividend payments.

Companies are not required to distribute dividends to their shareholders by any means. Large companies like Amazon, Facebook, and Google have never paid dividends to their investors. These dividends are for enticing investors to increase their revenue stream within the stock. Company A, which offers dividends, will provide a more substantial yield than Company B, which doesn’t grant dividend payments if they earn the same amount.

How do they differ between common and preferred stock?

Dividend payments are calculated differently for common and preferred shareholders. The preferred stock’s dividend is guaranteed and typically higher than the variable dividend paid to common stock owners. Companies can distribute variable or fixed dividends. The vast majority of dividend payments are paid out quarterly, or four times a year. However, some companies have no schedule as to when their dividends are paid out, these are called irregular dividends. Some businesses also choose to distribute annual dividends.

What Else Should You Know About Preferred Stock?

What the Three Types Are

1. Convertible Preferred Stock

In some instances, a company will give preferred stockholders the right to convert their preferred stock into common stock. Convertible preferred stocks have more upside potential than typical preferred stocks and less risk than typical common stocks, making them an excellent choice for investors.

Owners of convertible preferred stock have a considerable advantage during a company’s existence. For example, convertible stock owners can earn dividend payments while analyzing how a company performs during the primitive stages of an IPO or after an M&A deal. If the stock outperforms expectations, owners may decide to convert it into common stock or vice versa during periods of underperformance.

Apart from the stock owner choosing to convert it, convertible preferred stock may become common stock for a variety of reasons. For example, the stocks may convert on a predetermined date.

2. Cumulative Preferred Stock

If a company is struggling financially, it may suspend dividend payments to cumulative preferred stock owners. However, they are legally obligated to pay out those dividends eventually. A company may choose to exercise this option in a variety of circumstances. A gas shortage could force United States Oil to suspend their dividend payments until gas regulations allow for typical consumerism to continue in their industry. Issuers of non-cumulative stock cannot do this.

3. Redeemable Preferred Stock

Redeemable preferred stocks give flexibility to companies when interest rates fall. If dividend payments begin to overwhelm a company, it may choose to redeem those stocks. In doing so, the company may now issue new dividend payments at a lower rate. Owners of this form of preferred stock receive higher dividend payments to account for the risk of having their shares redeemed.

Why Companies Issue It

As with common stock, preferred stock raises capital for a company. Along with several tax incentives, a company is likely to distribute preferred stock because it is easier to sell than common stock. Investors buy preferred stock because there are guaranteed returns. However, companies will often issue preferred stock last, as it is more expensive than common stock. The dividend payments issued to preferred stockholders are allocated from after-tax profits, which means the dividends themselves are not tax-deductible.

Should You Buy Preferred or Common Stock?

Preferred shares may be better for individuals seeking to earn dividend income from their portfolios; the guarantee of dividend yields allows investors to rely on companies to pay out a fixed rate, making capital gains much more stable and predictable than typical common stock. However, investors seeking to make extensive capital gains are more likely to choose common stock, as there is much more upside potential. As with all forms of economics, higher risk equates to higher reward.

Investors seeking higher rewards that are able to stomach the increased risk will usually choose common stocks. Investors who are seeking steady returns will usually limit their risk by choosing to invest in preferred stocks. In other words, common stocks are more suitable for long-term growth while preferred shares are more likely to produce high-yield dividends. Stocks with higher volatility are riskier because stock prices fluctuate more often, so preferred stock shares may be preferable to shares of common stock in this instance.

The information provided herein is for general informational purposes only and is not intended to provide tax, legal, or investment advice and should not be construed as an offer to sell, a solicitation of an offer to buy, or a recommendation of any security by Candor, its employees and affiliates, or any third-party. Any expressions of opinion or assumptions are for illustrative purposes only and are subject to change without notice. Past performance is not a guarantee of future results and the opinions presented herein should not be viewed as an indicator of future performance. Investing in securities involves risk. Loss of principal is possible.

Third-party data has been obtained from sources we believe to be reliable; however, its accuracy, completeness, or reliability cannot be guaranteed. Candor does not receive compensation to promote or discuss any particular Company; however, Candor, its employees and affiliates, and/or its clients may hold positions in securities of the Companies discussed.