Common Stock and the Potential for Capital Appreciation

Common stock offers dividends, voting rights, and other benefits. Learn how to become a top-tier investor with common stock.

Historically, investing in the stock market has been a versatile and often effective way to generate profit. In simple terms, stocks are investments that represent partial ownership of a corporation.

Keep reading to learn about one of the most frequently invested in stocks, common stocks, and how it compares to preferred stock.

Common Stock vs Preferred Stock

Rank

Preferred stockholders rank above common stockholders in receiving company assets in the event of bankruptcy, also known as liquidation. A more professional way to describe this ranking is to say that preferred stock is senior to common stock. For this reason, share prices of preferred stocks are generally less prone to volatility than share prices of common stock.

Dividends

Preferred stock is harder to obtain and is usually owned by a firm’s initial employees. In addition, owners of preferred stock receive fixed dividends. Fixed dividends are guaranteed and predetermined.

Common stock dividends are not guaranteed and are issued only if the firm decides to pay dividends. For instance, some companies will keep their profits as retained earnings, and others will decide to pay dividends. Often, growing companies will retain earnings while more mature companies tend to have dividend payouts.

Voting Rights

Common Stock

Many prospective investors seek to invest in common stock because it gives shareholders voting rights as well as the entitlement to a company’s profits, known as dividend payments. However, in the United States, a company can have both a voting and non-voting type of common stock.

Generally, voting rights are exercised by shareholders at:

- Annual general meetings (AGMs)

- Via proxy forms. Proxy forms allow for shareholders who are not physically able to attend the AGM to vote on all the issues on which shareholders have the right to vote on.

Public companies need approval from their shareholders before issuing shares -- this is an example of common stockholders exercising their voting rights.

Preferred Stock

Preferred shareholders do not have the right to vote on corporate decisions. These decisions include choosing the board of directors, providing input on corporate policies, and providing opinions on corporate decisions like mergers, acquisitions, or stock splits. A stock split is when a company divides the existing shares of its stock into new shares to increase the stock's ability to be transferred easily into cash (i.e. increase the stock's liquidity)

Common Stock on the Stock Exchange

Public companies trade their common shares on a public exchange. The two main public exchanges that are based in the US are the New York stock exchange and the NASDAQ. There are also multiple public stock exchanges abroad, such as the Tokyo Stock Exchange, the London Stock Exchange, and the Hong Kong Stock Exchange.

Companies issue stock in order to raise capital and in hopes of growing. Traditional options for purchasing common stock are via a broker, or directly from the company. However, investing in common stock has become more accessible with the ascendance of online brokerages such as Robinhood and Webull.

Going Public

Companies can sell their stock on public exchanges by going public through an initial public offering (IPO). Once a company goes public, its stock can be bought on the open market by anyone with a brokerage account.

Companies looking to go public must have a steady revenue as well as a low debt-to-equity ratio. The debt-to-equity ratio of a company can be found by taking a firm's total liabilities and dividing that by their total shareholders’ equity. The information needed to make that calculation can be found on the company’s balance sheet.

Prior to an IPO, the company must decide how many shares they want to issue and what they should be priced at, and they are usually helped by an investment bank. In this process, a company determines their stocks’ par value which is the face value of the stock as stated on the company’s balance sheet. Shares of common stock may or may not have a par value, depending on the state laws in which the company is chartered. If the stock has a par value, the shares may be issued at a price above its’ face value.

Within Mutual Funds and ETFs

Mutual funds and exchange-traded funds (ETFs) are investments that consist of a collection of securities which can include common stocks. They are a way for investors to diversify their portfolios, and they have some key similarities and differences.

- Mutual funds are usually actively managed by a fund manager who makes decisions to buy and sell stocks or other securities within that fund in order to beat the market and help their investors profit.

- ETFs are bought and sold on an exchange, and their prices fluctuate throughout the day, just like a stock.

Both of these funds utilize common stocks as part of the pooled securities, and both offer ways to either earn capital gains or capital appreciation.

Capital Appreciation & Capital Gains

Common stock provides the opportunity for capital appreciation. Capital appreciation is an increase in the price or intrinsic value of assets. Common stockholders tend to fare better than preferred stockholders and bondholders despite the fact that common stock can be unpredictable, or volatile, in the short term.

Stated simply, when the company that common shareholders invested in does well, so does the investor. This can be seen by potential dividend payments or a rise in stock prices. However, in the event of liquidation, the common shareholder loses their investment.

Holders of common stock have the right to sell the stock and realize capital gains, which can be an attractive opportunity for investors because they are not tied down to their initial investments. Capital gains are the profits realized from the sale of an asset. If you hold the common stock for one year or less, your profit from its sale is treated as a short-term capital gain. If you hold the stock for more than a year, the income is treated as a long-term capital gain.

Taxes on Capital Gains

Capital gains from common stock are taxable when it is sold, or when dividends are paid out. The tax rate for capital gains depends on whether the stock was held as a short-term capital gain or a long-term capital gain.

A dividend has two applicable tax rates: one if it is a qualified dividend and another if it is a non-qualified dividend. The most notable difference between the two is that non-qualified dividends are taxed at ordinary income rates, while qualified dividends receive more favorable tax treatment by being taxed at capital gains rates.

Pros and Cons of Common Stock

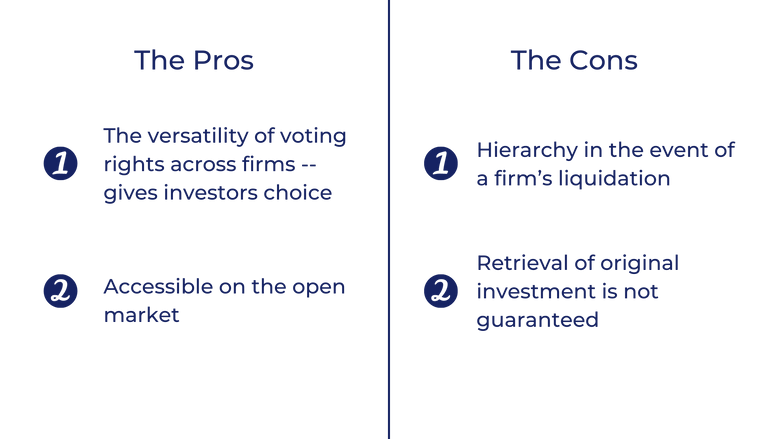

The Pros

The pros of investing in common stock are its versatility and accessibility. The voting rights associated with common stock vary by firm, which allows investors to find what is right for them. Common stock is also accessible on the open market, and compared to preferred stock, is available to any investor with a brokerage account.

The Cons

The con of common stock is the hierarchy in the event of a firm’s liquidation. As previously mentioned, common stock shareholders are at the bottom of the totem pole in regards to retrieving their investments, and the retrieval of their original investment is never guaranteed.

Takeaways

At first glance, common stock is seemingly simple. However, when you take a deeper look at the rights it gives to shareholders, it is a multifaceted and versatile asset. It varies by firm in terms of whether it provides voting rights, and whether it pays dividends. For these reasons and more, it is crucial for investors to complete research prior to investing in different common stocks.

The information provided herein is for general informational purposes only and is not intended to provide tax, legal, or investment advice and should not be construed as an offer to sell, a solicitation of an offer to buy, or a recommendation of any security by Candor, its employees and affiliates, or any third-party. Any expressions of opinion or assumptions are for illustrative purposes only and are subject to change without notice. Past performance is not a guarantee of future results and the opinions presented herein should not be viewed as an indicator of future performance. Investing in securities involves risk. Loss of principal is possible.

Third-party data has been obtained from sources we believe to be reliable; however, its accuracy, completeness, or reliability cannot be guaranteed. Candor does not receive compensation to promote or discuss any particular Company; however, Candor, its employees and affiliates, and/or its clients may hold positions in securities of the Companies discussed.