Sell better with a trading plan

optimize your RSUs

See why a trading plan is better than selling on your own

Sell RSUs weekly

Efficient, gradual trades

Every time you vest, trades are smoothed out over 12 weeks to get the best average price.

Keep more of what you earn

Automatically time your trades to pay less in taxes. More about tax savings

What about trading windows?

By pre-scheduling your trades you’re allowed to trade at any time. Learn more about 10b5-1 plans.

The most savvy use trading plans

Meta

Executives have been using trading plans for decades

Candor makes it accessible to regular employees — no expensive lawyers or advisors needed

Beats traditional paper-based plans

| 5-minute setup time |

| Works continuously |

| Works on future vests |

| Re-invest your RSUs into a portfolio |

| 3 built-in tax settings to choose from |

| Traditional, paper-based 10b5-1 plans | Candor 10b5-1 plan |

|---|---|

Weeks of emails and calls to setup | |

Redo process every year | |

Not available | |

Not available | |

Not available |

Get clarity today

More than trading plans

Get the most from your RSUs

Frequent questions

How does Candor work?

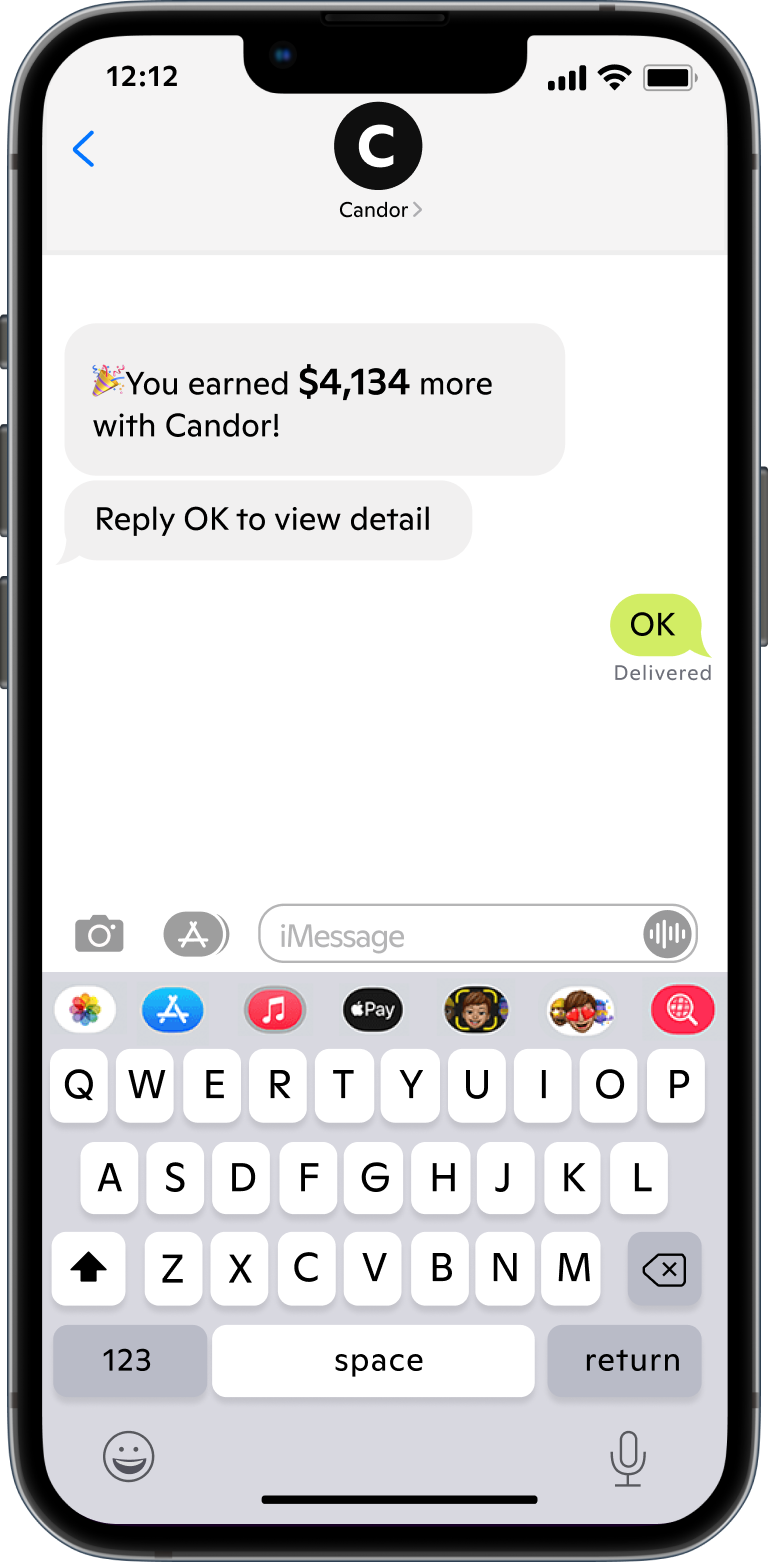

Candor helps you use a trading algorithm to manage your RSUs. With Candor, you can automatically time trades to save on taxes, reduce losses and earn more per share.

The first step is to see what we recommend for your specific situation. Get your recommendations here.

After that, you'll have a chance to access the dashboard and fine tune your settings. If you have any questions, email hello@candor.co or use the chat feature on your dashboard.