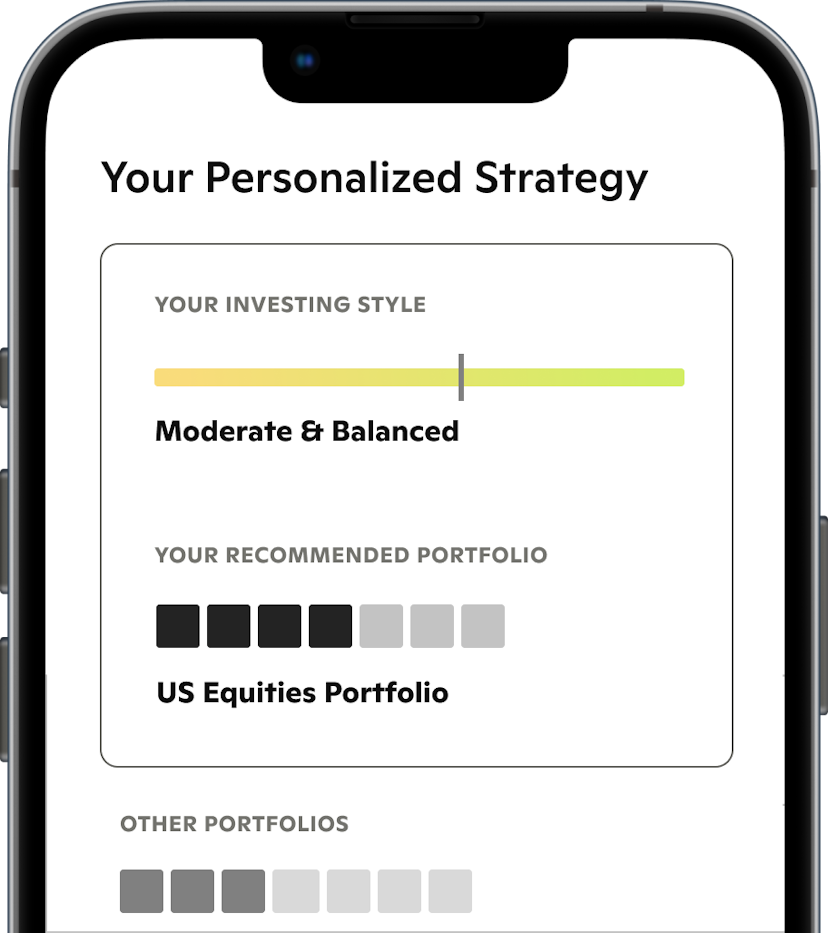

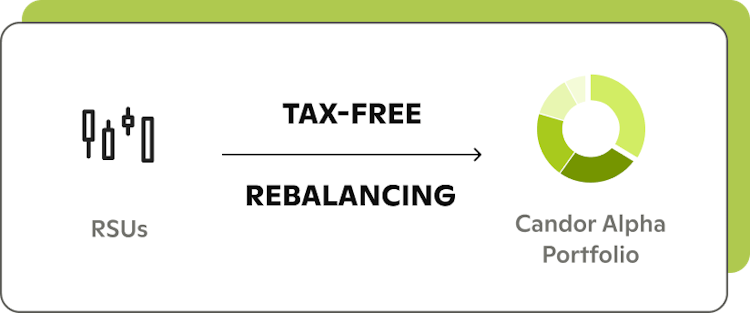

Re-invest your RSUs into a portfolio

Go from one stock to a BlackRock strategy — no account minimums.

Access top institutional portfolios from BlackRock

Candor helps you get direct access to institutional-grade portfolios that are not normally available to the general public.

BLACKROCK’S TRACK RECORD

$10T+AUM

16,500Employees

30+Countries

All trademarks are property of their respective owners. An asset manager has provided this model portfolio to Candor to make available to its clients. The fees that this asset manager receive from investments in the funds constitute the asset manager’s compensation. This may result in model portfolios that achieve a level of performance less favorable, or reflect higher fees, than otherwise would be the case if they were not allocated to to this funds. Candor is ultimately reponsible for approving portfolios and when possible, ETFs may be substituted for lower-fee equivalents at Candor's discretion.

like a hedge fund in your pocket

What are institutional portfolios?

Not available on retail platforms

Roboadvisors don't carry these strategies. Brokerages only offer them to the ultra-wealthy.

Save on taxes

Advisor-managed portfolios often generate extra taxes with rebalancing. Our portfolios don't generate extra taxes.

Sophisticated models

Direct access to the world's top investment firm to use their models directly.

Globally diversified to weather

market events

Alternatives

U.S. Fixed Income

U.S. Equities

International Equities

Sector Equities

Alternatives

U.S. Fixed Income

U.S. Equities

International Equities

Sector Equities

Alternatives

U.S. Fixed Income

U.S. Equities

International Equities

Sector Equities

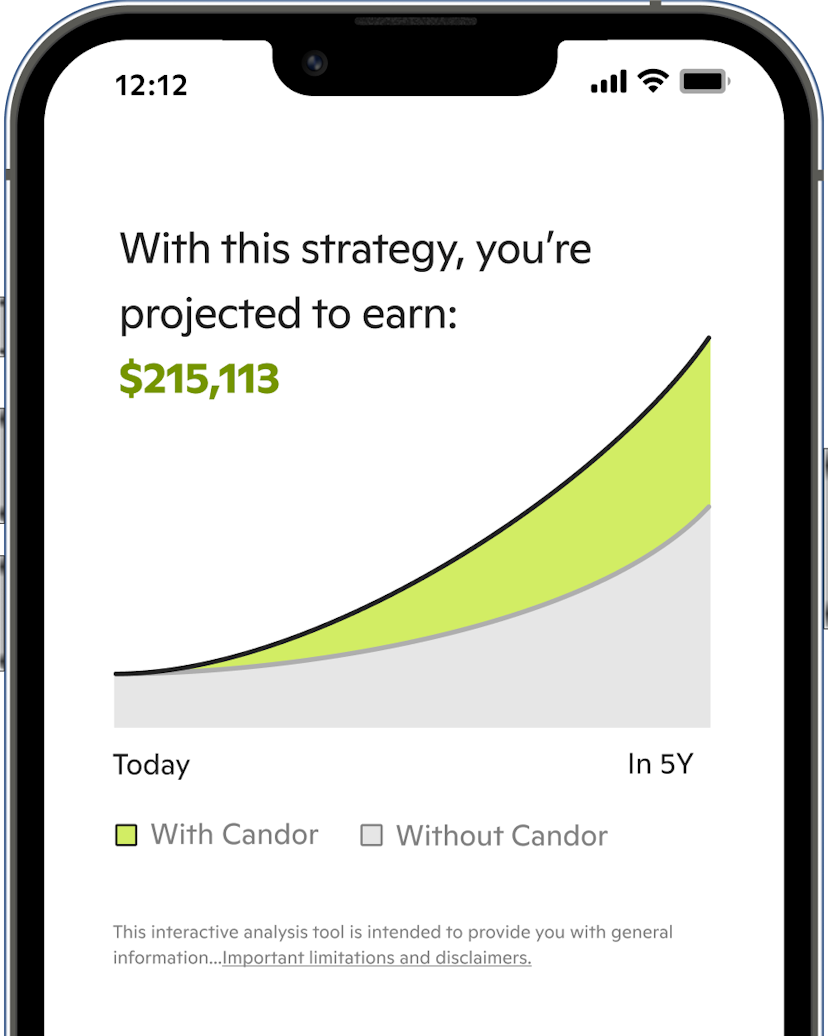

Capture the most value

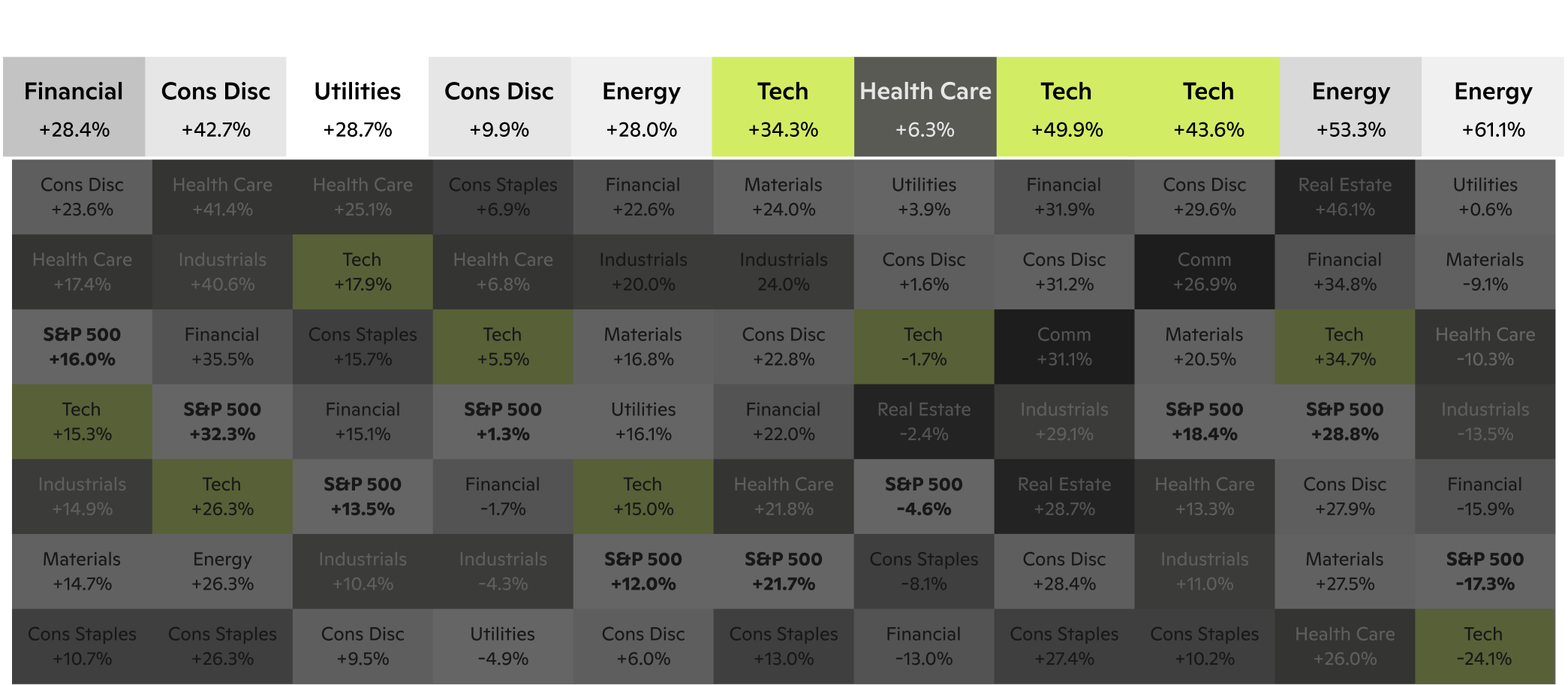

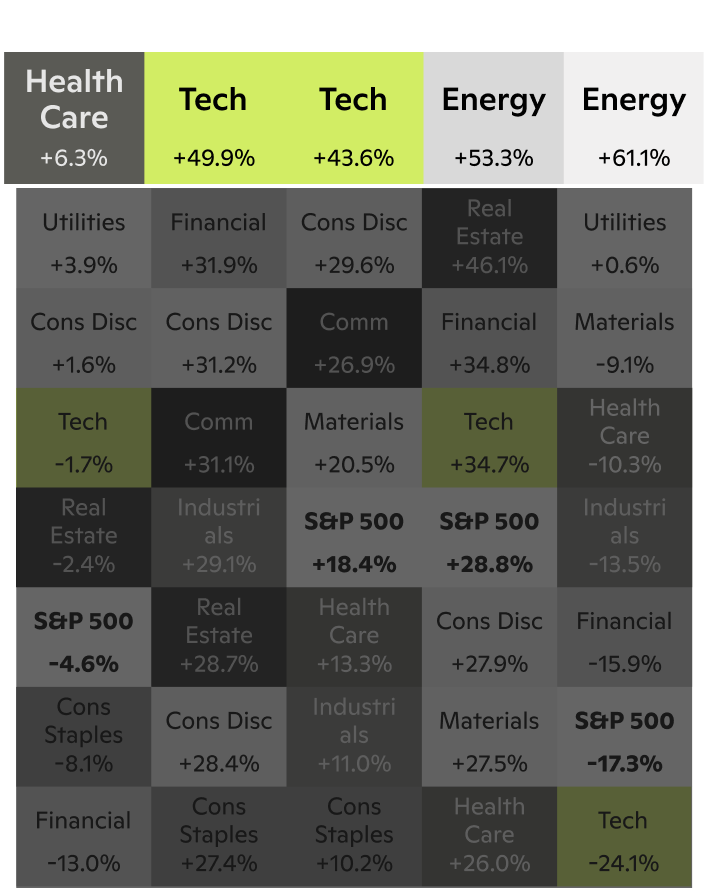

Every year the market winner is different.

Invest in a broad basket of winners.

Invest in a broad basket of winners.

Based on S&P 500 sector returns from 2012 to 2022, see "S&P 500 Sector Quilt" by Ben Carlson. All investing involves risk and diviersification does not guarantee positive results. Results will depend on your individual factors and circumstances, including your personal investment decision-making.

Intentions in the right place

Unlike brokerages, we’re a fiduciary

Brokerages can get kickbacks for recommending less-than-optimal strategies.

Our revenue comes from serving you and only you.

Save on taxes

Over the 94-year period ending in 2019, investors gave up from 1 to 2 percentage points of their annual returns to taxes.

Unlike traditional advisors, Candor's Tax-free rebalancing doesn't cause a tax liability during ongoing portfolio management. Based on a study by Morningstar, investors gave up from 1 to 2 percentage points of their annual returns to taxes over the 94-year period ending in 2019.

Impact of taxes on investment returns, 1926-2019

Average annual return %

2%

net returns per year

Unlike traditional advisors, Candor's Tax-free rebalancing doesn't cause a tax liability during ongoing portfolio management. Based on a study by Morningstar, investors gave up from 1 to 2 percentage points of their annual returns to taxes over the 94-year period ending in 2019.

No performance fees, ever.

Candor charges a portfolio management fee based on assets under management (AUM). Additional miscellaneous fees may apply for certain transactions. See Form CRS (conversation starters) and the Wrap Fee Program Brochure for more information. Form CRS (conversation starters) and Wrap Fee Program Brochure.

protect your salary

Get the most from your RSUs

Try it out

Get clarity today

See your RSU recommendations

Experiment with settings

Sign up only when you’re ready.

now

Holding until your shares reach $415.

Frequent questions

Can I use Candor if I already have an advisor?

Yes. You can choose to withdraw your money as cash and re-invest it outside Candor. Note that you won't be able to advantage of some tax optimizations (like tax-free rebalancing) if you do so.