The Goldman Sachs Interview Process from A to Z

Real interview questions, insights on the hiring process, and interesting facts.

If you’ve scored an interview at Goldman Sachs, consider yourself exceptional.

The premier investment bank and financial services firm fields over 270,000 applications for its summer analyst internship alone, and hires just 4% of applicants.

With statistics like those, most people assume hiring managers target Ivy Leaguers with a 4.0 GPA and a linear career in finance, but the opposite is true. In fact, getting hired at Goldman Sachs is much like getting into Harvard. Recruiters seek “unusual profiles”: professionals who are ambitious, interesting, and passionate about something outside of finance.

Hence, why the bank has a reputation for hiring people who play competitive sports: Olympic swimmers, semi-professional tennis players, and varsity college athletes alike. If you’ve ever run a startup out of your garage, climbed Mt. Everest, or overcome great adversity, now’s your chance to plug that story and win the most prestigious job in New York city.

Once you get your foot in the door, what can you expect?

How long is the interview process?

The average hiring process at Goldman Sachs takes 54 days, according to research by Glassdoor UK. In a poll by Indeed, 39% of respondents reported the process takes over one month, 27% said about a month, while 16% were hired within two weeks.

Important note...

The majority of candidates indicated they landed a job because a recruiter contacted them (34%), through campus placement (19%), or via an employee referral (15%). Just 8% of candidates surveyed said they were hired through an online job board.

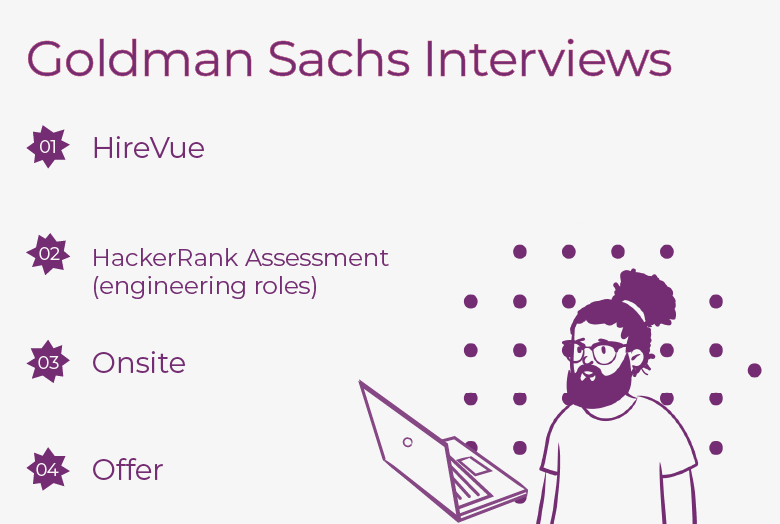

What does the process look like?

Application & Statement of Intent

Cover letters are out of fashion at tech companies like Google and Microsoft, but not at Goldman Sachs, where the ‘statement of intent’ in your application matters more than your resume.

In 300 words, explain why you want the role, why you’re interested in the division you’ve applied to, and what distinguishes you from other applicants.

Show that you’re personable, passionate about the company, and would make for a captivating guest at a dinner party.

Putting effort into this is key: Goldman Sachs recruiters claim that every application is read by a real person.

HireVue Interview

HireVue is a digital interview system used by many banks for job interviews. Candidates film themselves answering a set of predetermined Goldman Sachs interview questions.

Goldman recruiters say you can expect 5-6 questions: competency and behavioral questions (80%), alongside questions specific to the division you’re applying for (20%). Sample behavioral questions include:

You’ll get 30 seconds to prepare each answer and three minutes to speak to the camera, with no second chances to re-record.

The system uses a complicated algorithm (learned from the responses of thousands of prior candidates) to evaluate your answers across 15,000 variables including body language, speech patterns, and blinking.

👉 Want to see GS interview questions from the last 30 days? Click here

HackerRank Assessment (engineering candidates)

HackerRank is a coding-based technical skills and assessment platform commonly used to screen engineering candidates. Recruiters say candidates can choose whether to complete a programming assessment or a math assessment.

The test is timed, so you should familiarize yourself with the platform beforehand by taking a sample test. According to a blog post on the bank’s website

“it is also a good idea to review algorithms and basic data structures from your first few computer science courses as a basic refresher.”

You can take the assessment in a variety of programming languages, including C++, Java 7, Java 8, JavaScript, Python 2&3, or Scala.

Onsite Interviews

Prior to the coronavirus pandemic, Goldman Sachs was notorious for its relentless onsite interviews. It's one of the most quintessential parts of the Goldman Sachs Experience. The company issued an update in March stating that all interviews are being conducted via video conference. Currently, 98% of its workforce is working remotely, according to CEO David Solomon.

Recruiters say you can typically expect three rounds of 30-minute interviews, starting 1:1 and moving up to a panel interview or group interview.

Reviews on Glassdoors indicate that these interviews tend to be highly technical, no matter the job function. Most engineers report fielding questions about hashmap implementations and array/string manipulation and, of course, brain teasers.

You’ll be expected to be aware of current events and industry trends, especially for summer analyst roles. You may be asked questions like:

👉 Want to see GS interview questions from the last 30 days? Click here

Superday (summer analysts)

"Superday" is a day of in-person interviews onsite. For summer analyst roles, it represents the final interview round. Due to the COVID-19 pandemic, upcoming sessions may be conducted virtually.

Sessions are hosted from August to December, typically every other week. Recruiters conduct 2-5 interviews for campus hires depending on the division, and 25%-35% of candidates who attend a superday receive an offer.

Candidates must know their resume, skills, and why they’ve chosen their specific division and location. They must also demonstrate knowledge of current events. Each interview is typically conducted by two investment banking executives -- primarily VPs and managing directors.

Offer

After Superday, candidates typically hear back within 24-48 hours. For professional roles, the timeline varies, but always make sure to follow up with your interviewer and send thank you notes to everyone who interviewed you.

Extra Tips

Be prepared to show your knowledge of current events and industry trends.

Regularly read finance trade journals, the Wall Street Journal, Bloomberg and other business-focused publications well ahead of your interview. Your interviewers are trained to ask follow-up questions, so making a surface-level observation or referencing a news article you didn’t thoroughly read could backfire.

Expect tough technical and behavioral questions.

You should be incredibly prepared for questions about investment banking and finance. Know your technical stuff inside and out. Even candidates for client-facing analyst roles field tough technical questions about DCFs, EBITDA, LBO analysis and more.

Additionally, Goldman is known for asking unique behavioral questions, many of which catch interviewees off guard. Be sure to do your research and practice recent interview questions beforehand.

You may have to interview multiple times, so hang in there.

Senior positions typically involve a longer interview process. In fact, John Rogers, a current partner, recalls in the documentary ‘Goldman Sachs at 150’ that he went through 27 rounds of interviews before he was hired. Part of this is by design; Goldman tests candidates’ perseverance to ensure that only those who really want the job receive an offer.

Frequently Asked Interview Questions

Sample behavioral questions...

- Can you talk about a mistake you made in the past, and how you overcame it?

- Who is the most famous and influential person you would like to meet and why?

- Can you talk about a challenge you faced in the past? How did you overcome it?

- Can you talk through a time you worked with a coworker? How did you build that relationship?

- What's more important: deadlines, or the quality of work?

- Describe a conflict you had with a colleague in the past. How did you resolve it?

- Can you give an example of a time you streamlined a process?

- Can you tell me a time when you failed to meet a deadline?

- Which part of your previous jobs did you like the least?

- What motivates you the most in your career?

👉 Want to see GS interview questions from the last 30 days? Click here

Sample technical questions (engineering roles)...

- How many golf balls can fit inside Boeing’s manufacturing warehouse?

- Given an array [A] consisting of zeros, ones and twos, write a function that sorts [A].

- Given two sorted integer arrays, find the median element.

- What is a static class in Java? What is a singleton class?

- You toss a fair coin 400 times. What’s the probability that you get 220 heads?

- How do you implement your own hashmap?

- Tell me about the Java collections framework. What are its main interfaces?

- Let’s say I gave you a long string and I wanted you to tell me that most common word in that string. How would you do that?

- How would you design a multi-format converter that supports reading data from multiple data sources?

- If you have a 10GB file and only 2GB of memory, how would you store the file? Describe the solution and write the code.

👉 Want to see GS interview questions from the last 30 days? Click here

Sample technical questions (investment banking analyst)...

- Walk me through the three different ways of valuing a company.

- What does a DCF do?

- Briefly walk me through a discounted cash flow analysis. (including WACC).

- How do you get to free cash flow (FCF) from EBITDA?

- Walk me through an LBO analysis.

- What factors can lead to the dilution of EPS in an acquisition?

- You're using multiples to value a company but those multiples are skewed. What do you do?

- What is Minority Interest and why do we add it in the Enterprise Value formula?

- Why is cash subtracted from Enterprise Value (EV)?

- If you are in a business that wants to preserve cash, what type of inventory accounting method would you use (LIFO or FIFO) in a time of rising prices, and why?

👉 Want to see GS interview questions from the last 30 days? Click here

Read Next: What it's like to work at Goldman Sachs

The information provided herein is for general informational purposes only and is not intended to provide tax, legal, or investment advice and should not be construed as an offer to sell, a solicitation of an offer to buy, or a recommendation of any security by Candor, its employees and affiliates, or any third-party. Any expressions of opinion or assumptions are for illustrative purposes only and are subject to change without notice. Past performance is not a guarantee of future results and the opinions presented herein should not be viewed as an indicator of future performance. Investing in securities involves risk. Loss of principal is possible.

Third-party data has been obtained from sources we believe to be reliable; however, its accuracy, completeness, or reliability cannot be guaranteed. Candor does not receive compensation to promote or discuss any particular Company; however, Candor, its employees and affiliates, and/or its clients may hold positions in securities of the Companies discussed.