10 Tips to Prepare for a Recession or Depression

Recession vs depression: what's the difference and how to prepare for both.

The National Bureau of Economic Research declared that the United States entered an economic recession in February 2020, ending 11 years of economic expansion. In April 2020, there were 23.1 million unemployed people across the nation, making the unemployment rate 14.7%.

Economists have been largely tracking this recession, coined as the ‘COVID-19 recession,’ due to the sudden economic decline that has resulted from the ongoing public health crisis. Although many predict that the recession should be coming to a close within the next two years, other reports indicate that this recession may turn into an economic depression.

Learn more about the effects of both of these economic downturns, and how to prepare for these crises.

What Is a Recession?

A recession is a significant economic decline that lasts for several months – generally two consecutive quarters of negative growth in gross domestic product (GDP).

While there is no clear definition of a recession, once the duration of a recession goes on for long enough, usually a few years, it is considered an economic depression.

Recessions impact almost every sector of the economy. There are several indicators of a recession, ranging from industrial production, the employment rate, GDP growth, and even personal income. When these indicators decline, and continue to stay low, recessions begin.

Every recession is unique, but there are similarities amongst them that have allowed economists to pick out specific causes and factors that have historically led to such economic declines. The most typical causes of a recession include:

- Loss of confidence in the economy: Loss of confidence leads to weak consumer confidence, the slowing down of wholesale-retail sales, and fewer businesses. This can also lead to declines in international trade, affecting economies everywhere.

- High interest rates: With higher interest rates, there is less liquidity, or less money in circulation that can be invested. This is often caused by the Federal Reserve when they raise interest rates in order to protect the value of the dollar. For instance, the 1980 recession was largely caused by such an event when the Federal Reserve raised interest rates in the 1970s to combat stagflation.

- Stock market crash: The COVID-19 recession and the infamous 1930s Great Recession both coincided with stock market crashes that drained capital out of businesses, and led to economic decline.

- Falling housing prices and sales: The Great Recession of 2008 was largely triggered by homeowners who were forced to cut back on spending when they lost equity and could no longer take out second mortgages.

- Poor Money Management: The 1990 recession was caused by bad business practices, leading to poor money management by the mass public. Poor savings and loans practices led to more than 1,000 bank failures, who totaled in assets of $500 billion, as a result of unethical land flips, questionable loans, and other illegal activities.

- Post-War Slowdowns: Following wars, many economies slow down as a result of returning back to regular levels of business activity. For instance, after the Korean War, the U.S. economy came to such a slow that it caused the 1953 recession. Similarly, following World War II, economies slowed, causing the 1945 recession.

- Deflation: Deflation is the decline of prices of goods and services that occurs when inflation rates dip below 0%. The falling of prices can also lead to people waiting to purchase goods until prices are even lower; this decrease in demand can cause recessions. For example, deflation stemming from trade wars worsened the Great Depression of the 1930s.

- Unexpected Worldwide Events: As seen by the Covid-19 pandemic, unexpected global events that halt economic activity can also lead to recessions.

What Is a Depression?

Essentially the extreme version of a recession, a depression is a significant decline that lasts for years and comes with a severe economic contraction, typically a GDP decline of at least 10%.

The causes of an economic depression can be attributed to the same causes as an economic recession. However, when the effects of such economic downturns become severe, recessions lead to such depressions.

Differences & Similarities

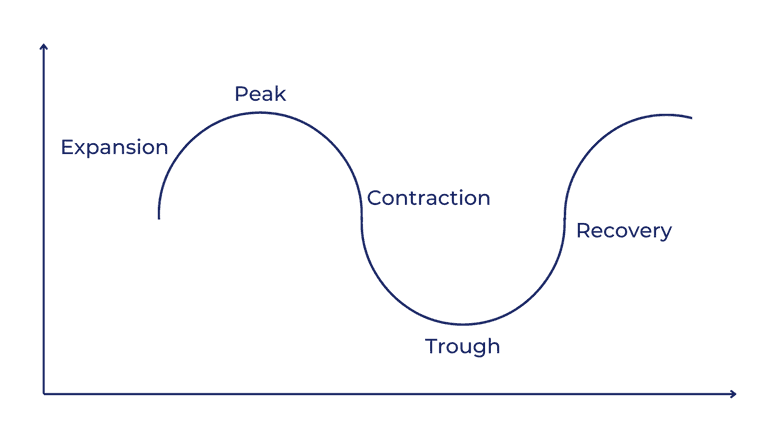

While recessions and depressions are very similar, there are some key differences between the two types of economic declines. In fact, recessions can be a part of a normal business cycle:

1. Expansion

During the expansionary phase, there is clear economic growth over two or more consecutive quarters. In this period, the economy is typically in good shape: interest rates are lower, employment levels are on the rise, and consumer confidence is strong.

2. Peak

Peaks are when the economy has reached its maximum output; productivity is at its highest, signaling the end of the expansionary period.

3. Contraction - recessions and depressions (if it leads to one)

Following the peak, leads to the contraction phase, or a decline in economic activity: employment numbers slow, housing starts to decline, availability of credit lowers, and prices begin to fall. If the contractionary period is severe, this oftentimes leads to recessions, which can become depressions.

4. Trough

The trough is characterized as the lowest point on the business cycle. However, this also marks the end of a period of declining business activity.

5. Recovery

Ultimately, all roads lead back to recovery, or the slow transition back to the expansionary period.

Overview of the business cycle

The business cycle demonstrates how recessions can be a regular part of economic activity, but depressions are far rarer; since 1854, there have been 33 recessions. In contrast, there have only been two major depressions in the United States: The Long Depression in the 1870s, and the Great Depression of the 1930s.

Ultimately, a recession and depression differ based on three main factors: severity, duration, and impact.

How to Prepare for a Recession and Depression

Since recessions are unfortunately more common than not, there are a few ways to prepare for such an event before the impact hits home. When preparing for a depression, you can take a similar approach.

Here are ten tips on how to start building up your savings and prepare your finances before the next economic decline affects your personal life.

1. Start with your debts.

Catch up on any ongoing debts you may have, whether it may be late rent checks or overdue car troubles. Allowing yourself to catch up gives you a clean slate as you start your journey towards financial stability.

2. Create a budget.

Reevaluate how you spend your money by setting up a clear budget that allows you to save for the future. Cutting out unnecessary expenses can help you be more financially stable in the long run.

Utilizing budgeting apps or creating a spreadsheet of expenses can help you cut out these unnecessary expenses, and set more money aside towards an emergency fund.

3. Save up emergency funds.

Emergency funds allow you to have a safety net in the event of losing your job or enduring a recession. Cutting out just a few unnecessary expenses a month can give you a solid start in building up your emergency funds. You can also take a look at high-interest savings accounts to store your money in a place with better returns.

4. Pay off high-interest debt accounts.

Make sure to track all of your debt accounts, and focus on ones with high interest. Also, look into the types of debt accounts you own; you might consider paying off tax-deductible loans, like college loans, to get cash back during the tax season.

For college students who have just graduated, consider focusing on paying off your student loans before your grace period ends so you can get a head start on them before interest rates are applied again.

5. Evaluate any investment decisions.

Whether it be investing in stocks or putting your money towards a small business, make sure that you are confident in your choices. Seek out financial advisors if you’re having any second thoughts, or need help deciding what to do with your current investments.

Investments can also be great for the long term; contributing to your 401(k) plan, for example, is one way to invest in yourself for your future.

6. Build up your resume.

By utilizing free online learning resources such as Coursera, LinkedIn Learning, Youtube, or Khan Academy, add business skills to your resume that increase your value and earnings potential.

Showing employers that you are willing to learn to improve yourself can be key to landing a job that will help you survive any economic downturn in the future. Many of these online classes are also offered for free, giving you accessible means to pad up your resume.

👉 Read Next: How far back should your resume go? Strategies for every career stage

7. Pick up a side hustle.

There are all types of innovative ways to make extra cash on top of your primary job. Whether it be selling stock photos for Shutterstock, posting old clothes on platforms like Depop, or watching advertisements for quick cash on InboxDollars, there are hundreds of ways to use your free time to make some money on the side.

8. Work with your creditors.

Instead of fearing payments, get help. Reach out to financial advisors to understand how you can pay off your debts and reach your financial goals. You can also learn about your unemployment benefits, making your time looking for your next job a little less stressful.

By working with your creditors and expanding your financial knowledge, you may be able to get a better grasp on catching up on, and growing your personal finances.

9. Keep an eye on your credit score.

Head to your bank and check on your credit score so you know where you stand with the banks if in need of loans or cash during a recession. There are many online platforms and apps out there that help you improve your credit, and allow you to easily check on it periodically.

10. Focus on the long haul.

Especially for an economic depression, your strategy should take a long-term approach that allows you to feel secure. Furthermore, economic downturns, even if it is not a full-blown recession or depression, occur often, and can be unexpected. Instead of reacting to every change in the economy, focus on any long-term financial securities you have.

Key Takeaways

The economy is constantly fluctuating, which can lead to some personal hardships and holes in your personal finances. However, understanding what happens in a financial crisis and learning how you can build up securities means that you can be best prepared to survive these turbulent times.

The information provided herein is for general informational purposes only and is not intended to provide tax, legal, or investment advice and should not be construed as an offer to sell, a solicitation of an offer to buy, or a recommendation of any security by Candor, its employees and affiliates, or any third-party. Any expressions of opinion or assumptions are for illustrative purposes only and are subject to change without notice. Past performance is not a guarantee of future results and the opinions presented herein should not be viewed as an indicator of future performance. Investing in securities involves risk. Loss of principal is possible.

Third-party data has been obtained from sources we believe to be reliable; however, its accuracy, completeness, or reliability cannot be guaranteed. Candor does not receive compensation to promote or discuss any particular Company; however, Candor, its employees and affiliates, and/or its clients may hold positions in securities of the Companies discussed.