Angel Investing With as Little as $10

Angel investing is no longer only accessible to the ultra-wealthy. Here's how the everyday investor can get started.

In 2011, Silicon Valley business magnate Elon Musk contributed $2M in angel investing towards Stripe, the San Francisco-based financial technology company that pioneered the economic infrastructures of the Internet. At the time, Stripe was only one year into its launch, looking for early-stage funding in order to expand their business, along with millions of other aspiring small businesses. Fast-forward a decade, Stripe has become one of the foremost leaders in the fintech startup world, and Musk’s initial angel investment soared; it is worth $1.75 billion as of 2021, an 80-fold return on a comparatively minuscule venture. So, what exactly is an angel investor, and how does it work?

What Is an Angel Investor?

The term angel investor comes from Broadway: ‘Angels’ were nicknames for backers of Broadway shows who wanted to help struggling artists achieve their dreams.

In the financial realm, angel investors refer to high-net-worth individuals who provide funding to startups, usually in exchange for company shares. As opposed to venture capitalists, angel investors spend their own money to invest in smaller, growing companies – typically startups trying to get off the ground.

While experienced entrepreneurs like Musk or Jeff Bezos, or business professionals, like lawyers, doctors, accountants and financial advisors, are known for angel investing, angel investors aren’t always wealthy individuals with vast investment networks.

This shift was enabled by regulatory adjustments by the U.S. Securities and Exchange Commission. In 2016, the SEC made two critical changes that relaxed funding requirements:

- Startups could raise capital through equity crowdfunding – the ability for startups and private companies to raise money from a crowd, not private investors – which allowed more people to participate with smaller stakes.

- The definition of an “accredited investor” was loosened – anyone with an “understanding of private markets'' could become an angel investor.

These changes have given rise to “Gen-Z angel investors,” or younger people with an interest in finance and startup culture. The majority of investments from this group are around $2,500 a check, but with the right company, have led to significant returns.

With a growing understanding of angel investing, more and more people can participate, opening up new financial opportunities and contributing to startups alike.

So How Does Angel Investing Work?

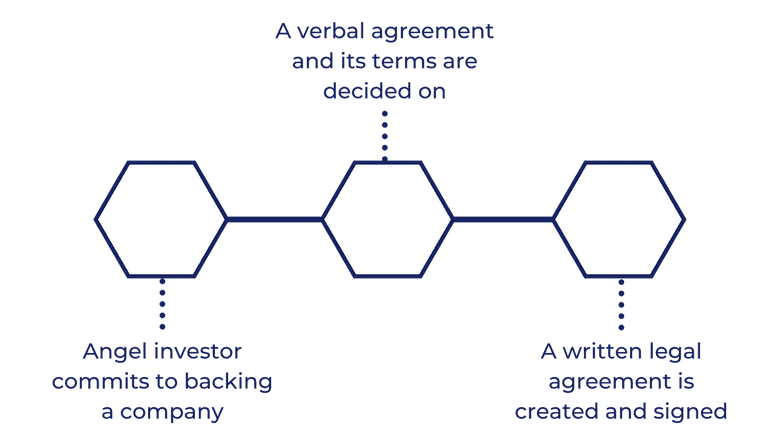

Angel investors usually start investing at the early stages of a company, which is known as the “seed” or “angel” funding phase. These investments are critical to such companies as they are just beginning to bring their initial ideas to profitability, making angel investors key to their success.

Once an angel investor commits to backing a company, a verbal agreement between an angel and the company is in place.

Following this verbal agreement, a written legal agreement is created and signed, finalizing the details of their investment.

Investment amounts vary depending on the investors themselves, and their belief in the company’s mission; funding can be as low as $2,500 and as high as $150,000. Some angel investors will band together to pay up to $1M for companies they see fit. As returns on investment, angel investors are given stakes for their funds; these stakes will generally never go above 25% because veteran investors know that the company’s founders should hold a majority stake of a company in order for the business to be successful in the long run.

Investors can discover such opportunities through a myriad of ways:

- Many angel investors are already well-reputable in the tech space, and receive personal pitches or decks asking for financial backing.

- Networking events and spaces allow founders of startups to pitch their ideas and potentially meet with investors.

- Angel investing platforms allow companies to apply to join their network; individual investors can look through these vetted-for startups, and send their money to opportunities they believe in.

Ultimately, angel investors can utilize their connections and technology to uncover innovative talent in the tech space, and give young entrepreneurs the funds they need to embark on their business ventures.

Angel Investing Platforms

With the rise of interest in angel investing, various online angel investing platforms have been formed to make such investment opportunities more accessible and less risky. These platforms also give founders more direct lines of communication when searching for the right investor.

Here are a few of the top angel investing platforms to streamline the process:

SeedInvest

Founded in 2012, SeedInvest is an equity crowdfunding platform that connects startups with investors through its online platform; it is well known for being one of the most-used angel investing platforms for startups and new investors. The site has been a reputed investment source for healthcare tech companies looking for funds.

Investors can make investments that are a minimum of $500, which is 50 times lower than typical startup investments. By doing so, SeedInvest allows investors to diversify their portfolios, and opens startups up to a larger investor pool.

Companies can be featured on the platform after going through an arduous application process. Due to the high-risk nature of angel investing, SeedInvest meticulously vets each of the businesses that appear on their platform, with less than 2% of applicants even making it onto their site.

Republic

Seeded by AngelList in 2016, Republic was launched as an online crowd-invest platform that would easily connect promising startups to retail investors, across all income brackets. That’s why investors on Republic can begin investing with as little as $10.

Like SeedInvest, the application process for the Republic is demanding, with less than 3% of startups passing through their due diligence and investment committee. However, the site includes highly-vetted investment opportunities in startups, real estate, video games, and crypto. For investors, the platform is free, with no hidden fees. The site has also been used by famed angel investors and venture capitalists, adding to the site’s credibility.

Since its launch, the platform has achieved over 1M+ members, has closed 250+ deals, and has had 150M+ in investments.

Wefunder

Since its founding in 2011, Wefunder is the largest regulation crowdfunding portal that connects startups with investors online. The site was created under the JOBS Act in order to allow unaccredited investors to be able to purchase equity in early-stage companies.

The initial investment for Wefunder requires a minimum of $100. Wefunder works more similarly to crowdfunding platforms like IndieGoGo and Kickstarter, with all funders treated as a single shareholder for simplicity.

The innovative platform has 75 startups, 40,000 investors (including 4 startups worth over $1 billion and 12 worth over $100 million), and is continuing to expand its site to include more companies outside the realm of angel investing.

By utilizing any of these platforms, investors and small businesses can symbiotically reach new deals that benefit both their profit margins.

What Are Rolling Funds?

The popularity of angel investing has also led to new forms of investment, such as rolling funds.

A rolling fund is a new type of investment vehicle that allows its managers to share deal flow with fund investors on a quarterly subscription basis while netting carried interest over a multi-year period (usually two to four years). To put it more simply, fund managers can invest at their own discretion in opportunities on behalf of their investors – the investor in this case is often referred to as a limited partner.

Rolling funds differ from traditional venture funds in three main ways:

1. No Need for ‘Big-Bang’ Fundraising

Prior to the development of rolling funds, fund managers needed to raise their entire fund’s capital in a short period of time, which is known as ‘big-bang’ fundraising. Fund managers also cannot raise additional capital during portfolio markups, or when an opposing venture capitalist invests in a portfolio for a higher price, making fundraising even more difficult. Without reaching the necessary funds, many managers were unable to invest, losing out on opportunities.

2. Flexibility

Rolling funds give limited partners, or the investors, more opportunities to increase, decrease, or halt their investment commitments based on the quarterly subscription basis.

3. More Control, Less Legal

While the traditional venture fund requires a 1% administrative fee, rolling funds only require 0.15% of committed capital over a 10-year period. In addition, AngelList, which headed this new rolling fund system, takes care of all the legal paperwork, making the process smoother for both parties.

As angel investing gains momentum, more developments in the forms of investments may arise, leading to better entrepreneurship, and better opportunities.

Prominent Angel Investors

To get you started in angel investing, here are a few prominent angel investors to read about and learn from:

1. Fabrice Grinda

Nicknamed a “super angel,” Grinda is a New York-based French entrepreneur who has 200+ startups in his portfolio; Grinda is reputed for garnering $300M in over 150 exits. Grinda is so committed to angel investing, he employs a team of experts who help him analyze about 100 companies a week, and commits to a new investment almost every 15 days. His investments range from U.S.-based to international companies, including Alibaba Group, Airbnb, Palantir and Windeln.

2. Paul Buchheit

Responsible for creating Gmail, American computer engineer and entrepreneur Buchheit has a portfolio of 150+ investments, with about 80 of these investments reaching an exit. His previous investments include DoorDash, Clever, Caviar, Delight, DocTalk, Cisco Meraki, and more. Since founding numerous startups throughout his career, Buchheit turned towards angel investing, and spends millions helping small companies garner the funds they need to secure their place in the competitive startup space.

3. Daniel Curran

Curran is such a popular, well-networked angel investor, he receives about 300 decks a week from companies looking to receive his check. During his 35-year long career, Curran has been responsible for founding 14 startups and has invested in over 176 startups with 50+ of his investments reaching an exit (of which 11 were unicorns). His latest investment was $6.6M at Series B to CARD.com, a service that allows you to get a prepaid Visa or MasterCard without opening a bank account, in December of 2020.

4. Max Levchin

Best known for his role in founding PayPal, Levchin is a key angel investor; In 2010, Businessweek.com ranked him 12th in their list of Top Angels in Tech. Since his start, Levchin has made 34 investments, and his biggest exit includes earning $1.5B when PayPal sold to eBay in 2003. His most recent investments include Homejoy, an online platform that connects customers with home service providers like cleaners and handymen, and Misfit Wearables, a consumer electronics company that specializes in wearable technology that uses sensors and home automation products.

5. Kim Perell

As the only female angel investor on this list, award-winning entrepreneur, investor, and best-selling author Kim Perrell is one to watch, with 54.5% of her portfolio angel investments reaching an exit. Perrell is best known for being the former Chief Executive Officer of Amobee, a subsidiary of the telecommunications company Singtel. Now, she resides in the San Diego area mentoring women entrepreneurs. She is known as the top female investor in the U.S., investing in leading brands such as Apple, Intuit, and TheTradeDesk.

6. Scott Banister

Prominent angel investor Scott Banister has more than 180 angel investments and 64 exits. He was an early board member at PayPal and cofounded IronPort, a computer security company. Banister won the Angel of the Year Crunchie award in 2016 with his wife, Cyan Banister. The couple has investments in Uber, Zappos.com, SpaceX, as well as many other notable startups.

Takeaways

For those looking to jumpstart their startups, or others looking to become angel investors, these key individuals – ranging from entrepreneurs to accredited investors – are great sources to understand the decision-making strategies when investing, gain sound advice for high-risk opportunities, and learn how to build a financial portfolio.

The information provided herein is for general informational purposes only and is not intended to provide tax, legal, or investment advice and should not be construed as an offer to sell, a solicitation of an offer to buy, or a recommendation of any security by Candor, its employees and affiliates, or any third-party. Any expressions of opinion or assumptions are for illustrative purposes only and are subject to change without notice. Past performance is not a guarantee of future results and the opinions presented herein should not be viewed as an indicator of future performance. Investing in securities involves risk. Loss of principal is possible.

Third-party data has been obtained from sources we believe to be reliable; however, its accuracy, completeness, or reliability cannot be guaranteed. Candor does not receive compensation to promote or discuss any particular Company; however, Candor, its employees and affiliates, and/or its clients may hold positions in securities of the Companies discussed.