The 6 Levels of Market Cap You Should Know

Market cap is an important way to assess the value of a company. How to use it, what it tells you, and the 6 levels you should know.

What Is Market Cap?

Market cap, or market capitalization, measures the market value of a company. The figure is determined by taking the value of a single share of a public company and multiplying it by that company’s total amount of outstanding shares. So, market cap tells you how much all of a company's shares are worth.

Market valuation is especially used by high-level analysts to study company performance and determine the stock trajectory. Mastering the use of a market cap may help an investor perform high-level transactions and increase investment returns in the future.

What Does It Tell You?

Market capitalization is an important metric for various reasons:

First, it allows an investor to compare the value of two similar companies.

The price of a company’s stock does not tell an investor how valuable the company is as a whole since it most likely has a different number of outstanding shares available to be traded. In addition, market capitalization may provide a better contextual understanding for investors to compare companies to other players in the industry.

At first, companies may not appear as dominant in their industry, but when market cap is considered, the scope and scale of businesses can be clearly understood.

Second, investors may create their own valuations of a company and compare them to their current market cap to determine if the stock itself is undervalued.

Investors can use multiples or comparables models to calculate what they believe to be the true value of the company. From there, they can determine if their calculated value is higher or lower than the market cap:

- If their value is higher than the market cap, the stock is potentially undervalued and worth buying.

- If their value is lower than the market cap, the stock is potentially overvalued and worth selling or shorting.

Watch Out for Inflated Market Caps

Companies may attain very high market capitalizations with nothing but pure speculation.

For instance, if a pharmaceutical company is teasing the release of a new super drug that cures a specific ailment, they may obtain massive sums of investment before the product is even released. If the company fails to deliver the product, its investors will lose massive amounts of money as investors sell off and the stock price drops to its true value.

To truly contextualize a company's value, an investor must determine its market capitalization and understand the factors that drive it.

How Does It Work?

Calculating Market Cap

Market cap is calculated by multiplying the number of outstanding shares available for trade by the price of one share.

If a local grocery store chain, Grocer Co., was trading at $50 per share and had 100,000 outstanding shares in the stock market, their market capitalization could be calculated at $5,000,000 (50x100,000).

What Impacts Market Cap?

Since the market price of a stock is constantly changing, so is its market cap. As different internal/external factors cause fluctuations in the price of a company’s stock, they will affect the overall market capitalization as well.

However, it is important to note that certain artificial changes in the stock price do not always affect a company's market cap. For example, a stock split would not affect a company’s market cap even though the price of the stock is cut in half since the total amount of shares is doubled in the process.

6 Levels of Market Cap

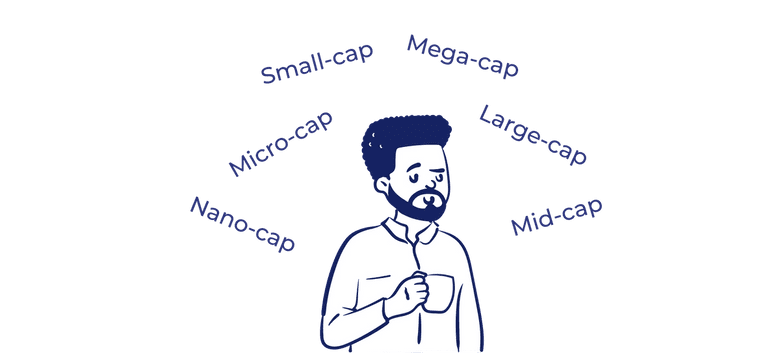

There are several categories of market capitalization of a company. Various factors like a company’s size and market interaction allow for its market cap to be categorized with the following titles:

Large-Cap and Mega-Cap

Companies are considered to be large-cap if their market cap is between $10 billion and $200 billion. Anything over $200 billion is considered to be a mega-cap.

Mega and large-cap companies are categorized as blue chip companies, and they are often associated with being stable and constantly returning investments. These companies are generally considered to be safe investments and tend to prevent investors from being shocked by returns or losses.

Mid Cap

Mid-cap companies are located in the range of $2 billion to $10 billion in total market capitalization. These companies are considered more volatile than blue-chip companies and will present an investor with more risk on their investment.

Companies that currently occupy the title of mid-cap are considered to be growth stocks and can rise into the blue-chip range if they continue to grow and increase their market capitalization.

Small-Cap

Small-cap companies are valued anywhere from $300 million to $2 billion. This group of companies is typically composed of young companies on the rise. However, some older and more well-established brands can fall back into this category as business begins to falter.

Small-cap companies continue the trend and present an even more volatile experience for their investors than mid-cap companies.

When analyzing small-cap companies, it may be important to note whether the company is considered small-cap because it has yet to take off, sunken down into the category with a downward trajectory, or is content with remaining in this category for the foreseeable future.

Micro-Cap

Micro-cap companies are organizations with market capitalizations between $50 million and $300 million. These companies may be listed under micro-cap because of limited trading opportunities. For example, small pharma and tech companies will limit their total amount of outstanding shares until they feel their current share price is valuable enough to allow more stock trading to take place.

Public companies assume the risk of dealing with volatile investment downturns, and therefore, many micro-cap companies await rapid growth from the release of a certain product before surging into higher market cap categorizations.

Nano-Cap

Nano-cap companies are typically composed of organizations with smaller equity value. When dealing with nano-cap businesses, the company's market cap will be less than $50 million.

The enterprise value of nano-cap companies is inherently lower than those of higher cap categorizations. Having such a low total value of equity results in the highest level of volatility in share price.

Why Is Market Cap Important?

There are several reasons why market cap is important:

- Market cap provides investors with information about how much a company is truly worth. If an investor is comparing two similar companies, they may use the market cap to determine which has more potential down the road.

- Investors can use absolute or variable valuations of a company to determine if it is currently over or undervalued by the market.

An investor may use reliable sales metrics to determine an accurate estimate as to how much a company should be worth, or will be worth in the future. They can then compare it to the current market cap of the company and determine a fair valuation.

If BMW is going to begin distributing electric vehicles and an investor believes they have the data necessary to determine how that would affect company performance, they can predict how the stock price will fluctuate once the cars begin to be sold.

If the value of the company will go up significantly, then the investor will be keen on purchasing the asset, since an increase in market capitalization often accompanies an increase in share price as well.

Takeaways

- Market capitalization is the total dollar value of a stock’s current market price multiplied by the company's outstanding shares available.

- Market cap is used to determine how much companies are worth and determine how they will fluctuate with future performance benchmarks. Analysts use the market cap to determine growth potential and explore possible increases in market valuation.

- Companies like Amazon and Apple, which dominate their industries and return massive streams of revenue, began as companies with small market capitalizations. Therefore, it is not inherently good or inherently bad to invest in a company just because of its market cap. However, the market cap can be a useful tool in making effective and informed investment decisions.

- Companies may be categorized as large-, mid-, or small-cap depending on their market cap value. Different size market caps accompany varying levels of volatility.

- Absolute or variable valuations can be done on a company to determine whether it is currently under or overvalued by the market.

The information provided herein is for general informational purposes only and is not intended to provide tax, legal, or investment advice and should not be construed as an offer to sell, a solicitation of an offer to buy, or a recommendation of any security by Candor, its employees and affiliates, or any third-party. Any expressions of opinion or assumptions are for illustrative purposes only and are subject to change without notice. Past performance is not a guarantee of future results and the opinions presented herein should not be viewed as an indicator of future performance. Investing in securities involves risk. Loss of principal is possible.

Third-party data has been obtained from sources we believe to be reliable; however, its accuracy, completeness, or reliability cannot be guaranteed. Candor does not receive compensation to promote or discuss any particular Company; however, Candor, its employees and affiliates, and/or its clients may hold positions in securities of the Companies discussed.