How to Avoid the Penalties of Insider Trading

Insider trading can come with steep consequences like fines or even prison time. Here's how to legally trade your stock as a company insider.

If you have traded the stock of the company you work for, you have engaged in insider trading. Though insider trading has a reputation for being illegal, there are both legal and illegal ways to engage in the practice.

A corporate insider is considered anyone who has access to material nonpublic information about a company’s stock, and owns more than 10 percent of a firm’s equity. However, corporate officers are not the only investors privy to inside information; ordinary employees and outsiders can also possess inside information that they might act illegally on.

Whether insider trading is legal or illegal depends on the timing of when an insider buys and sells stocks. This article will outline when insider trading is illegal, examples of insider trading, and the consequences of illegal insider trading.

How Does Insider Trading Work?

Legal insider trading happens frequently within public companies, as insiders are legally permitted to buy and sell shares of the firm that employees them. When a CEO buys back shares of their company or when an employee purchases stock in the company where they work, they are engaging in insider trading. NASDAQ's Insider Activity can provide investors with insights into the legal insider trading of corporate officers.

However, according to insider trading law, these transactions must be registered with the U.S. Securities and Exchange Commission (SEC). You can find more information on what SEC forms must be filled out here. When they are not, and when insiders are acting on information that has not yet been made publicly available to make a securities transaction, they are engaging in illegal insider trading.

The SEC defines illegal insider trading as “buying or selling a security, in breach of a fiduciary duty or other relationship of trust and confidence, while in possession of material, nonpublic information about the security.”

Although the most famous insider trading cases have CEOs and CFOs at their head, illegal insider trading can be committed by family members, friends, relatives, or anyone with access to confidential information.

SEC regulators monitor illegal insider trading by looking at a stock’s trading volume. When the volume of a stock rises without any public news issued, it can be a warning sign that something unusual and possibly illegal is happening with regard to insider trading.

Examples of Insider Trading

There are several examples of high-profile insider trading cases. One of the more famous is Jeffrey Skilling, CFO of Enron. When Enron was in serious financial trouble, Skilling began dumping his stock. He was convicted of 19 different charges, including insider trading.

Skilling is an example of a corporate insider who was convicted of insider trading, but R. Foster Winans is an example of how someone without an employee relationship to a company can still get embroiled in a scandal. Winans was a columnist for The Wall Street Journal who had connections within the financial media of New York, and eventually was involved in a scheme where he shared tips with a stockbroker about what his upcoming Wall Street Journal columns would include; as a result, he was given a cut of the stockbroker’s profits. The case eventually went to the Supreme Court.

Who Can Engage in Insider Trading?

An insider is anyone that has a relationship with a business that provides them with information that is not yet public; therefore, even though chief executive officers, corporate officers, and corporate insiders are in danger of illegal insider trading, their employees and family members are also considered insiders. Insiders have a fiduciary relationship with their companies and shareholders, and when they try to profit from insider information, they put their own interests above the entities to whom they owe a fiduciary duty.

Acting on insider information for profit gives insiders an unfair advantage over other investors: this is when the practice becomes illegal. However, it is not just those with a fiduciary duty to a company that can act on these laws; even if an insider does not directly profit from such information, they can still be a “tipper” to a “tippee” outside of the company.

Although being a corporate insider puts you at more risk of engaging in illegal insider trading, ordinary employees and those with personal relationships to a CEO or CFO or being in a vendor/supplier/client relationship with a company should also make sure that they are not acting on any nonpublic information that could influence the stock market.

The SEC is currently developing legal theories to help prosecute nonemployees who have taken part in illegal insider trading, including misappropriation theory and temporary insider theory. The SEC is also turning its eye toward hedge funds to discover insider trading practices, as the growth of the hedge fund industry has provided a unique challenge to regulators.

Laws About Illegal Insider Trading

Insider trading law has expanded over time, but is spelled out by the SEC in Rule 10b-5 of the Securities Exchange Act, the primary vehicle for investigations of securities fraud, which says:

“It shall be unlawful for any person, directly or indirectly, by the use of any means or instrumentality of interstate commerce, or of the mails or of any facility of any national securities exchange,

(a) To employ any device, scheme, or artifice to defraud,

(b) To make any untrue statement of a material fact or to omit to state a material fact necessary in order to make the statements made, in the light of the circumstances under which they were made, not misleading, or

(c) To engage in any act, practice, or course of business which operates or would operate as a fraud or deceit upon any person”

Material information is any information that could have a substantial impact on whether an investor decides to buy or sell a security. SEC regulators have expanded material information beyond just simple good news or bad news from a company, where the stock price is influenced in less obvious ways.

There are steep consequences for breaking federal securities laws, and particularly for taking part in insider trading. A conviction for insider trading holds a maximum fine of $5 billion and up to 20 years in prison.

When Is Trading Stock Legal for Employees?

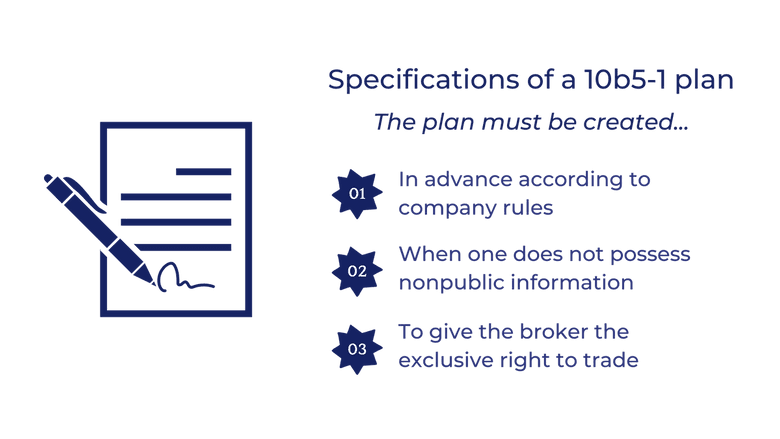

Many companies will set up a Rule 10b5-1 Plan for their executives and employees: employees can set up a predetermined plan to sell stocks according to securities laws and avoid allegations of insider trading.

Financial markets also have blackout periods, which is a period of time that certain people, either executives or employees or both, cannot buy or sell shares in their company or make changes to their pension plan investments. Generally, for a company’s stock, a blackout period will happen before earnings announcements.

Trading windows refer to the period of time each quarter when insiders are allowed to trade. They start a couple of days after a company's quarterly earnings statement is released and typically last up to six weeks. Because there are four quarters in a year, there are also four trading windows each year.

Insider Trading Takeaways

Illegal insider trading is a risk whenever you are privy to inside information about a company that other investors do not have access to.

If you are an employee of a public company with access to inside information, make sure to follow all of your company’s strategies in place for protecting you from allegations of illegal insider trading. Set up a 10b5-1 plan and follow it, and clear your purchases or sales of company stock on securities markets with your company’s chief legal officer. That way, you know that you are following all laws and regulations, and avoiding conflicts of interests or breaking insider trading law.

👉 Visit Candor's homepage and sign up for our free info session to learn how you can earn more from your company equity while being in compliance with insider trading law.

The information provided herein is for general informational purposes only and is not intended to provide tax, legal, or investment advice and should not be construed as an offer to sell, a solicitation of an offer to buy, or a recommendation of any security by Candor, its employees and affiliates, or any third-party. Any expressions of opinion or assumptions are for illustrative purposes only and are subject to change without notice. Past performance is not a guarantee of future results and the opinions presented herein should not be viewed as an indicator of future performance. Investing in securities involves risk. Loss of principal is possible.

Third-party data has been obtained from sources we believe to be reliable; however, its accuracy, completeness, or reliability cannot be guaranteed. Candor does not receive compensation to promote or discuss any particular Company; however, Candor, its employees and affiliates, and/or its clients may hold positions in securities of the Companies discussed.