Opening a Roth IRA: Tax-Free Growth

A Roth IRA is a powerful tool to build wealth for retirement. Learn about its hidden tax benefits, and start saving early!

Roth IRA stands for Roth Individual Retirement Account - an account where you make contributions that grow over time with the help of compounding interest. The growth of your Roth IRA depends on the types of investments you have in your portfolio, but these accounts typically enjoy an annual return of 7-10%. The FDIC insures up to $250,000 in deposits to your Roth IRA and treats multiple accounts at the same financial institution as one, so the insurance applies to all of your accounts combined.

Opening a Roth IRA requires that you have an earned income by working for someone or operating your own business. Note that investment income does not count as earned income. There are no age constraints on setting up a Roth IRA, and having another qualified retirement account does not affect your eligibility or contribution amount.

What are the contribution and income limitations?

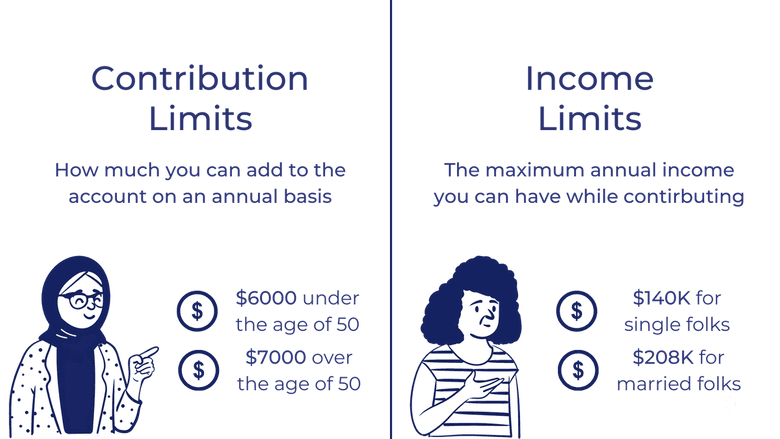

Contribution Limitations

As of 2021, the annual contribution limit is $6,000 per year, or $7,000 per year if you are over the age of 50. You can withdraw Roth IRA contributions tax and penalty-free at your discretion, but the earnings on your contributions may be subject to taxes and penalties. It is also important to note that there is no upper age limit on contributing to your Roth IRA - you can contribute at any point in your adult life as long as you have taxable compensation.

Income Limitations

The IRS lays out income limits for Roth IRAs. The limits are based on your modified adjusted gross income, or MAGI, which is calculated by adding deductions to your adjusted gross income, or AGI.

As of 2021, if your filing status is single, head of household, or married filing separately, these are your income limitations:

- You cannot make contributions to a Roth IRA if your income is $140,000 or higher

- You can make contributions at a reduced amount if your income is between $125,000 and $140,000

- You can make contributions up to the limit if your income is below $125,000

If you file your tax return as married filing jointly or as a qualifying widow(er), you are subject to different income limitations:

- You cannot make contributions to a Roth IRA if your income is $208,000 or higher

- You can make contributions at a reduced amount if your income is between $198,000 and $208,000

- You can make contributions up to the limit if your income is below $198,000

Joint Roth IRAs are not available to married couples, but one spouse can finance both Roth IRAs separately. This is a nice feature if one spouse does not have an earned income because both spouses can open accounts based on the income earner.

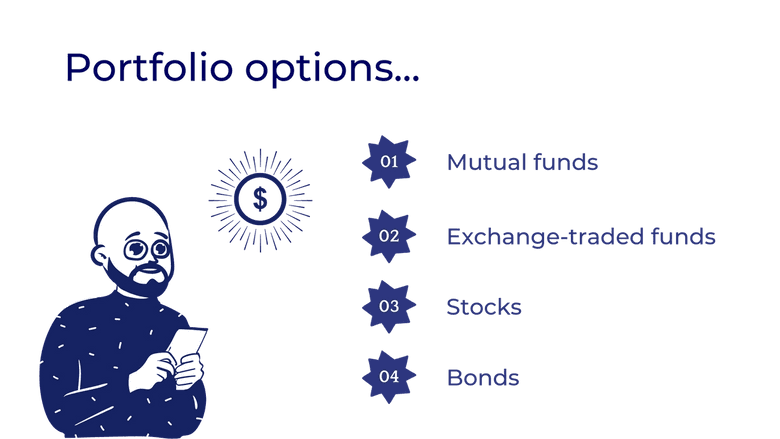

What should your portfolio look like?

When considering a Roth IRA, think about your comfort level with managing your own investments. If you are an experienced investor, your best option may be to manage your own Roth IRA and avoid paying someone to manage the account for you. An easy way to do this is to open an account with an online brokerage. If you don't have experience managing your own investments, you may want to consider a low-fee investment fund that follows a market index, or a professional that can manage your Roth IRA, such as a financial advisor.

The investment options in your portfolio should depend on your risk tolerance. You can choose from a wide mix of investments including mutual funds, exchange-traded funds, stocks, and bonds. If you choose to rely on a professional to manage your account, they will create a portfolio based on your specific situation. If you choose an index fund or decide to manage your portfolio on your own, you'll want to assess your own risk tolerance.

- Mutual funds: a mutual fund is a simple, diversified option for less experienced investors and often comes with low fees. Mutual funds can be actively or passively managed. Actively managed funds come with higher expenses, but they are managed by professionals who can alter your portfolio to be more resilient during downturns and potentially beat the market (which can be difficult to do consistently). Passively managed funds tend to be more tax-efficient because trading occurs less frequently. Mutual funds contain a mix of securities including stocks, bonds, and short-term debt. They can also invest in commodities and real estate.

- Exchange-traded funds (ETFs): this type of fund is also diversified and offers lower expenses than a mutual fund. ETFs are usually passively managed, meaning that they follow a market index, such as the S&P500. ETFs contain a mix of investments similar to mutual funds.

- Stocks: if you are far away from retirement, you may want to choose a higher-risk portfolio of stocks, depending on your comfort level. A stock-heavy portfolio will help your money grow faster, and if there is a drop in the market, you'll have more time to recover.

- Bonds: if you have a lower tolerance for risk, you may want a portfolio that is bond-heavy. If you are closer to retirement, you may want to opt for a lower-risk portfolio because you won't suffer as great of a loss during a significant drop in the market as someone with a stock-heavy portfolio.

How is a Roth IRA different from other retirement savings accounts?

Roth IRA vs Traditional IRA: Taxes

The most significant difference between traditional and Roth IRAs is when each is taxed. Roth IRAs tax your earnings when you contribute them to your account, and thus you benefit from tax-free withdrawals. The opposite is true for a traditional IRA, which is tax-deferred, meaning your money goes in tax-free and you pay taxes when you withdraw it.

Here's how these two methods of taxation impact the amount of money you get when you are ready to use it: If you expect to be in a higher tax bracket once you start making withdrawals, then a Roth IRA may be advantageous because you will have already paid taxes while in a lower bracket. If, on the other hand, you expect to be in the same or lower tax bracket once you start making withdrawals, then a traditional IRA may be better because your tax rate will be lower when you start making withdrawals. However, if you predict your income will be over the Roth IRA income limit, a traditional IRA may be best because it comes with no income limitations. It all comes down to what you think your income will be over the course of your life.

Another consideration is the tax benefits associated with both accounts. Roth IRAs do not offer any current year tax deductions because you contribute after-tax income. Contrarily, with traditional IRAs, your contributions are tax-deductible, as they reduce your taxable income by the amount you contribute.

Although Roth IRAs do not typically offer tax breaks, low and moderate-income folks may be eligible for a saver's credit. This tax credit is anywhere from 10% to 50% of contributions capping at $1,000.

Roth IRA vs Traditional IRA: Early Withdrawals

Roth IRA contributions are not subject to early withdrawal penalties because contributions are made with post-tax income, but if you withdraw earnings before turning 59 1/2, you may be subject to a 10% penalty. Traditional IRAs, on the other hand, impose penalties on both contributions and earnings because these accounts are made up of tax-free income, and the IRS wants to collect. Withdrawals from traditional IRAs prior to the age of 59 1/2 are considered early withdrawals and may impose income taxes and up to 10% in penalties.

There are instances in which you can take qualified distributions on earnings from your Roth IRA before the age of 59 1/2. Roth IRAs are subject to a five-year rule, specifying that a distribution is qualified if five years have passed since your first contribution to your retirement plan and one of the following conditions pertains to you:

- You made the withdrawal because of a permanent disability

- Your beneficiary or estate made the withdrawal after you passed away

- You made the withdrawal to buy or build a home that qualifies under the first-time homebuyer exception.

Roth IRA vs Traditional IRA: Required Minimum Distributions

Roth IRAs do not impose required minimum distributions, or RMDs. These are minimum amounts you must withdraw yearly during retirement, and many retirement accounts have them. Traditional IRAs set RMDs starting at age 72 1/2, and the IRS sets a 50% penalty on missed RMDs. With a Roth IRA, you never have to make withdrawals and can allow the money to grow. Your Roth IRA can then be transferred to your beneficiaries, but they will face RMDs and a 50% penalty for not taking them.

Roth IRA vs Roth 401(k)

Roth 401(k) accounts are similar to Roth IRAs in that contributions to both are taxed going in and thus experience tax-free growth. However, a Roth 401(k) allows earners of any income to contribute, and the limits on contributions are higher at $19,500 annually plus an additional $6,500 for savers over 50 years old. Roth 401(k)s, like traditional 401(k)s, exist through your employer and benefit from employer matching.

Is a Roth IRA right for you?

One of the biggest considerations for Roth IRAs is your eligibility based on the income limit. If your income is over this level, then you cannot make contributions to your account. If you have a high income or predict your income will be too high in a future tax year, then a traditional IRA may be better for you. If your income is under the limit, Roth IRAs provide more flexibility than traditional IRAs and allow your money to grow tax-free.

Taking all of these considerations into mind, you should be able to make an informed decision regarding which type of retirement account best meets your needs!

The information provided herein is for general informational purposes only and is not intended to provide tax, legal, or investment advice and should not be construed as an offer to sell, a solicitation of an offer to buy, or a recommendation of any security by Candor, its employees and affiliates, or any third-party. Any expressions of opinion or assumptions are for illustrative purposes only and are subject to change without notice. Past performance is not a guarantee of future results and the opinions presented herein should not be viewed as an indicator of future performance. Investing in securities involves risk. Loss of principal is possible.

Third-party data has been obtained from sources we believe to be reliable; however, its accuracy, completeness, or reliability cannot be guaranteed. Candor does not receive compensation to promote or discuss any particular Company; however, Candor, its employees and affiliates, and/or its clients may hold positions in securities of the Companies discussed.