Candor’s RSU trading plan: a guide to 10b5-1

The ultimate guide to getting more from your company stock.

If you work for a public company, chances are RSUs make up a large part of your compensation. Others at your company are almost certainly trading their stock year-round, even during blackout periods. If you’re currently confined to trading windows, you might be missing out on consistent income. 10b5-1 staged selling plans might be the solution you are looking for.

- RSU concerns - common pain points for employees.

- Why you should sell - 4 reasons to consider selling.

- Why people are afraid to sell - common biases to be aware of.

- Why 10b5-1 plans are superior - comparison of 4 selling options.

- Why executives use 10b5-1 plans - the benefits they offer.

- How 10b5-1 plans work - in 4 practical steps.

- SEC regulatory changes - how these changes might affect 10b5-1 plans.

I just got paid with stock, now what?

You know that getting paid in stock is anything but transparent. When you get paid in your company's securities, you instantly become an investor. How do investors make money? They hope their investments increase in value. In your case, that means you hope the value of your stock increases. On the flip side, if the issuer's share price falls, you are basically losing money. The profit (or loss) you earn from selling your stocks is considered your returns.

Volatility can stand in the way of making money

Volatility refers to how much a stock's value fluctuates. Investors prefer steady growth over big price fluctuations. The ideal goal of an investor is to choose investments where volatility is small - usually around ~1% per day or less. More volatile stocks are considered riskier, as the stocks could experience big drops that eliminate any returns you have earned.

Investors want these returns to compound, meaning that positive returns from one year become the basis for future returns. Volatility and price drops eat away at compounding, leading to worse long-term returns.

If possible, investors want to avoid drops altogether. Price drops have more of an impact than price increases of the same percentage. For example, to recover from a 5% price drop, you would need a gain the following year of 5.3%.

To highlight how damaging volatility can be, look at this example. A highly volatile investment that produces a 40% return one year and a 20% loss the next year only yields a 10% return. Most investors would prefer an investment that has less volatility like a diversified portfolio. You still get 10% returns but at much lower volatility. This means you can have more peace of mind that your investment won't have a huge drop the next year.

Difficulties of selling company stock

How and when you can sell is managed by your company, not you. Here are some of the most common pain points when it comes to managing RSUs:

- Trading restrictions: Because companies designate everyone as insiders, when and how you can trade is strictly controlled. Often that means that you have to sit idle while everyone else can trade at better prices

- Limited education: Your company may give you RSUs, but they never tell you how to use them. This can leave you feeling clueless and worried that you will manage them incorrectly

- Volatility concerns: You may know firsthand how quickly tech stocks can rise and fall. Other factors like inflation and government action can create even greater price swings. If you don’t know how to properly manage this volatility, you may get stuck selling at a less than favorable price.

- Tax liability: Do you know how RSUs are taxed? RSUs have tax implications that you should be aware of. This consideration can make or break your decision to hold or sell.

4 reasons you should consider selling

Now that you hold RSUs, you are an investor. As you get more and more vests, shares in your company can become the majority of your net worth. This is considered a concentrated position and exposes you to high levels of risks. Most professional money managers would advise against these. If you continue to hold, you can suffer from these risks that could destroy your net worth.

1. Market/macro risk

Market risk is the idea that global events will affect your investments. When the world around you changes, your stock performance will also change. How can you recognize this? Warning signs can look like increases in inflation, changes in unemployment rates, or government actions. While these risks can’t be diversified away, they don’t affect every investment equally.

Tech stocks are considered growth stocks. Inflation hits these stocks the hardest. As a result, your RSUs could take a massive hit. On the other hand, value stocks tend to do well during inflation. Value stocks are established companies that have finished their stages of fast growth. Examples include Berkshire Hathaway and JP Morgan.

2. Company risk

Company risk is the risk that your company will underperform or experience a drop in growth. This can happen for a number of reasons like a key executive leaving, the failure of a new product launch, or misuse of funds. It's very hard to predict if your company will be the next Apple or the next Enron.

These problems can have a dual impact on employees. If your company underperforms, your RSUs can drop and you may take a pay cut or even lose your job! However, you can take steps to protect yourself. Diversifying your money out of your company. Can safeguard you from a lot of this risk. Now all of your wealth is no longer tied to one company.

3. Overconcentration risk

Overconcentration risk is the risk associated with holding over 10% of your income in one investment. Accumulating new vests can quickly turn this into your reality. This could have benefits for short-term price rallies, but in the long term, it is very hard to reach your financial goals with an over-concentrated position.

JP Morgan performed one of the most comprehensive studies on concentration, looking back at 30 years of investment performance. The study shows that 75% of stockholders with over-concentrated positions would have benefited from diversification. According to Morningstar, the vast majority of individual stocks do worse than the market over 10 years.

4. Investment risk

Like any investment, holding RSUs for long periods of time puts you at risk that they will eventually drop in value. According to JP Morgan, 40% of stocks experience a 70%+ drop from their peak prices.

Investment risk is extremely hard to predict. For example, companies like Blockbuster, Boeing, and Kodak all were major stocks that eventually had major falls from grace. Even the best companies can run out of steam eventually.

Why people are afraid of selling

What is holding you back from selling your RSUs? Research shows that most investors suffer from at least one type of personal bias.

Personal bias risk

Beware of these biases that may be stopping you from making better decisions with your RSUs:

- Trading emotionally: When we don’t have enough information, we often rely on emotion to drive our investment decisions. This is practically gambling! This could look like holding a sinking stock because you hope it will eventually recover. Rather, you should gather info so you can decide if you think the price will rise or fall in the future.

- Historical bias: While your RSUs in the past may have risen in the past, this does not mean they will rise in the future! Heads up, you may be suffering from the Lucretius Problem (thinking the worst event that happened to you is the worst event that has ever happened). You should be making decisions based on the future and not the past.

- Company loyalty: You may think that selling your RSUs is equivalent to betraying your company. In reality, it isn’t! You have every right to put yourself first. If your company execs are selling their shares, why can’t you?

- Overestimating ability: The majority of people believe they have a superior ability to pick investments. We tend to do this, especially with our own company stocks. In reality, the vast majority of stocks perform worse than the market over 10 years.

Ask yourself these questions

Everyone’s ability to take on risk is different. Based on individual circumstances, some people can take on more risk and survive in the worst-case scenario. For others, taking on more risk might put you in a tough spot. Not sure how much risk you are willing to tolerate?

Ask yourself these questions:

- Continue to hold: If you are willing to hold your shares through big drops, you likely have a high risk tolerance. You are willing and able to ride out price fluctuations for long periods of time in hopes that shares rise again. Be careful

- Sell a few shares: If you sell a small portion of your shares, you could still make an impact by putting that money into other investments or covering your expenses. However, be aware that you are still holding a large number of shares in your companies

- Sell them all: Selling all your shares allows you to start fresh. You can put your money into any assets you want like other stocks, retirement accounts, and more. You probably have a lower risk tolerance.

- Yes: You must have a lot of faith in their company specifically. Try to think about making this decision from an outsider’s perspective.

- No: If your answer is no, are you following your own advice? Most financial advisors would not advise a client to hold all their wealth in one company.

- Yes: You likely don’t have any short-term expenses you need to cover. You are also willing to take the risk of holding your company shares long-term. Be aware that prices can drop in the future, eliminating the tax savings you would have gotten.

- No: For many people, the liquidity from selling shares right away is worth more than the potential tax savings from holding for a year. With this liquidity, you can reinvest your money any way you like.

Why a 10b5-1 plan is superior

So, you’ve decided that selling is right for you, but you’re probably wondering how. You have a few different options, and they’re not created equally. Let's look at the different trading arrangements you can choose from.

Selling on your own

This is probably the most common way of dealing with your RSUs. Once your shares vest, you can sell them during the trading windows set by your company. To get the most out of your RSUs using this method, you have to time the market properly (which is very difficult to do).

What’s wrong with it? You’re confined to trading windows set by your company. But, trading windows are the most volatile time to sell because they follow the release of your company’s quarterly financial results when the rest of the market reacts to the stock. Essentially, you’re confined to selling at what’s often considered the worst time to sell.

Autosale

Some companies give you the option to choose autosale, where the company will automatically sell your RSUs as they vest, cover the income taxes, and give you the cash.

What’s wrong with it? This method doesn’t give you much flexibility. All of the stock will be sold, meaning you can’t keep any portion of it. Also, it’s possible that the state of the market won’t be ideal at the time of selling. If you want to utilize dollar-cost averaging or wait for a better tax environment, you can’t do that with this method.

Hedging with derivatives

Hedging is the idea of using options and other financial instruments to bet against your investments. This could mean owning a stock and buying an option that bets on the price going down. This way, you would have a gain either from the stock if its price rises, or from your option if the price drops. By hedging, you would get some sort of gain no matter which direction the stock price moved.

What’s wrong with it? Firstly, hedging is a very sophisticated strategy, so you should have a lot of experience in the market before even considering this method. Hedging also requires constant monitoring. Options and other complex financial tools tend to experience quick price changes that can take you from a profit to a loss in an instant. Hedging with derivatives is an edge case scenario – it’s risky and only appropriate for the short-term.

Using a 10b5-1 plan

Rule 10b5-1 plans allow you to sell company stock throughout the entire year (even outside of trading windows). You essentially determine a predetermined schedule for selling your stock in good faith: when you’re not aware of material nonpublic information (MNPI). Because you pick your settings in advance and let the plan run its course, you can sell your stock during blackout periods while staying compliant with insider trading laws.

By selling at regular intervals, 10b5-1 plans use dollar-cost averaging – a strategy that smooths out volatility and gets you the best average price over time.

So, who is this for? For decades, these plans have been used by company executives to manage their RSUs. Mark Zuckerberg, Jack Dorsey, and Tony Xu all use 10b5-1 trading plans. In 2021, Zuckerberg used his plan to sell shares almost every day of the year.

A lot of employees don’t realize this, but anyone can set up a 10b5-1 plan. These plans are most widely used by company executives, but they’re open to employees of all levels.

You'll set up a written plan where you can specify the number of shares to sell, frequency of trades, and duration of the plan. For example, you could set your plan to sell 10 shares every week for a year. Once initiated, the plan will be executed following your schedule, and your shares will be converted into cash.

Why do executives use 10b5-1 plans?

A lot of the time, executives and other company insiders are required to set up 10b5-1 plans to preemptively shield the company from insider trading liability.

Executives also use these plans because of all the benefits that come with selling company stock on a regular basis.

Benefits of 10b5-1 plans

These plans can be a great tool to help you reach your financial goals faster. Let’s take a look at the benefits they offer:

- Sell year-round: Sell your stock on a pre-set schedule outside of volatile trading windows when everyone else is selling

- Get more predictable income: Get predictable streams of income by selling your stock at consistent intervals that smooth out your trades

- Hedge stock price volatility: Dollar-cost averaging aims to get the best average price since it smooths out volatility

- Avoid concentration risk: Holding a large amount of one stock is risky because you’re essentially tying a big portion of your net worth to the performance of that company

- Liquidity: Sell your shares and convert them into cash that you can use to cover expenses or invest in other assets

- Peace of mind: You pick your settings and then let the plan do all the work, allowing you to sell regularly without even thinking about it

How a 10b5-1 plan works in 4 steps

Step 1. Self-assessment

When making any investment decision, the very first thing you should do is assess your financial situation. Here are some factors to consider:

- What are your financial goals?

- What is your timeline to meet these goals?

- How much money do you have?

- What is your risk tolerance?

A self-assessment can help you figure out if a staged selling plan is the right move for you.

Step 2. See if you qualify

Anyone can set up a 10b5-1 plan – executives and regular employees alike.

Some companies will even require executives and certain insiders to set up 10b5-1 plans (these people tend to be bigger targets for insider trading allegations).

Additionally, you should read all company policies on 10b5-1 plans to ensure the one you choose is compliant. And, of course, there is the good faith requirement – you cannot be aware of any material nonpublic information while setting up the plan.

Step 3. Pick your settings

If you’ve decided a 10b5-1 plan is right for you, this is the fun part. You can customize your plan based on your financial situation (hence why the self-assessment is so important). The settings you choose will aggregate to form your plan:

- Amount of securities to sell: You can elect to only sell a portion of your stock and hold onto the rest

- Cooling off period: You can add a time delay between the setup date and the date that trades begin in accordance with your company policy

- Frequency of trades: You can specify how often you want to sell your shares

- Duration: You can set your plan for any length of time, but you may limit your flexibility if you set yours for too long

Candor's plans offer additional benefits, listed here.

Step 4. Keep as cash or reinvest

Once you’ve sold your RSUs, you can decide if you want to keep your earnings as cash or reinvest them into a diversified portfolio. If you have immediate needs, keeping some of your earnings as cash can be beneficial. However, if you don’t need immediate liquidity, you can reinvest into a diversified portfolio to protect your money against inflation.

SEC’s proposed regulatory changes

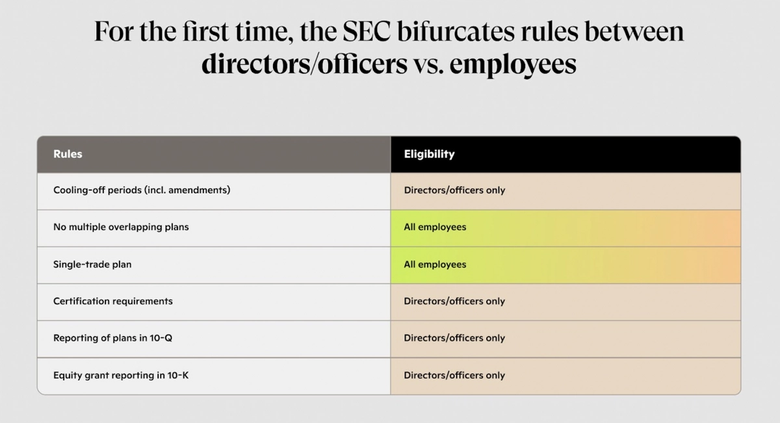

The SEC has proposed amendments to make 10b5-1 plans stricter for executives but not for employees. To ensure 10b5-1 plans are not abused, the SEC's proposed rules would mandate additional constraints on how plans can operate:

- Cooling-off period: Company directors and officers must wait 120 days from the date of adoption before the first trade can be executed; the same is true for amendments

- Certification of good faith: Officers and directors must certify that they are not aware of material nonpublic information when setting up 10b5-1 plans

- Multiple overlapping plans: Employees are not allowed to have multiple plans at the same time

- Singe-trade plans: Single trade plans only make one trade within a year. Employees can only use this type of plan once in a 12 month period

The information provided herein is for general informational purposes only and is not intended to provide tax, legal, or investment advice and should not be construed as an offer to sell, a solicitation of an offer to buy, or a recommendation of any security by Candor, its employees and affiliates, or any third-party. Any expressions of opinion or assumptions are for illustrative purposes only and are subject to change without notice. Past performance is not a guarantee of future results and the opinions presented herein should not be viewed as an indicator of future performance. Investing in securities involves risk. Loss of principal is possible.

Third-party data has been obtained from sources we believe to be reliable; however, its accuracy, completeness, or reliability cannot be guaranteed. Candor does not receive compensation to promote or discuss any particular Company; however, Candor, its employees and affiliates, and/or its clients may hold positions in securities of the Companies discussed.