Diversifying Your Portfolio Through Asset Classes

Diversifying assets is a simple and easy way to increase profits and decrease risk. You can't build a well-rounded portfolio without diversifying!

So you’ve decided to start an investment portfolio, but you’re not sure where to begin. One important thing to keep in mind is constructing a diversified portfolio. Diversification refers to spreading your money between different kinds of investments.

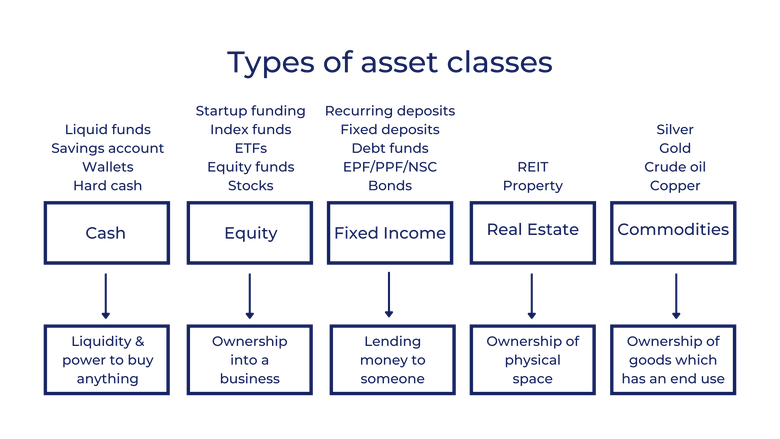

These investments are called asset classes: asset classes are groups of securities or investments with similar characteristics. They're controlled by the same laws and regulations and behave similarly in the marketplace. Diversification among different asset classes allows you to better manage your risk by reducing your portfolio's volatility during market fluctuations.

This article will outline the different types of asset classes, and how you can use each of them to create investment strategies, decide your risk tolerance, and make more money.

What are the types of asset classes?

It’s important to know what your investment options are. We have included the four main asset classes to choose from, plus a few others.

Stocks or Equities

Stocks or equities are shares of ownership issued by publicly traded companies and traded on stock exchanges. This category offers high long-term gains, but there is increased volatility depending on the state of the economy. When you invest in stocks or equities, you can expect to make a profit if the share price rises or the company issues dividends.

Stocks can be divided into further subcategories depending on a few factors...

- Industry or sector: Investing across industries may reduce risk, as the economic cycle will affect each industry differently. Some sectors are cyclical, where a company’s money moves along with the economic cycle, such as consumer discretionary, financial services, or basic materials. Other sectors are defensive and less impacted by the economy, including consumer staples like groceries, utilities, and healthcare.

- Size or market capitalization: Stocks and equities are divided into small-cap stocks, mid-cap stocks, and large-cap stocks. Larger companies are usually more stable, but they also have less growth potential than small-cap companies.

- Style: Companies offer growth stocks, or more expensive stocks, where the prices are justified by future growth potential. They also offer value stocks, or stocks that are on sale, which are seemingly underpriced or undervalued.

Fixed-Income Investments (Bonds)

Fixed-income investments are debt securities, paying a rate of return through interest. Bonds are the most common type of fixed-income investment; they have lower returns and are weaker in an expanding economy. They generally have an inverse relationship with stocks: if stocks are doing poorly, bonds are likely doing better and vice versa.

Bonds are divided based on the following...

- Issuer: Government bonds at the federal level are issued by the U.S. Treasury, and municipal bonds are issued by government institutions at the state and local levels. Other notable bonds are corporate, which are issued by corporations for financing.

- Credit quality: Different bonds offer different levels of credit risk, which correspond with the bond’s level of return. Treasuries are considered closer to risk-free since the federal government will not go bankrupt, but they have a low rate of return.

- Maturity: There are short, intermediate, and long-term bonds. Longer-term bonds receive a higher yield, as they have a higher interest rate risk.

Both stocks and bonds are considered either active or passive. Within active funds, a portfolio manager will pick which stocks to include in the fund. Passive funds cost less as they are dependent on an underlying index. Index funds and ETFs are passive, while mutual funds can be either active or passive. Active funds have better downside protection when the market is down, but passive funds benefit during market upswings and have lower fees.

Money Market and Cash Equivalents

Cash and cash equivalents are a type of asset class easily accessed at any time because of their liquidity. It can refer to the money you have in your savings or checking account, or cash equivalents, which can be converted into cash flow within 90 days or less.

Cash equivalents have the lowest return, but they buffer volatility or unexpected expenses. You can also use them to explore other investment options if opportunities arise. Unlike other asset classes, cash equivalents must have a determined market price that does not fluctuate.

Real Estate or Tangible Assets

Physical assets like real estate offer protection against inflation. They are necessarily tangible in reality, and not just a financial instrument.

There is also a less common asset class of futures and other financial derivatives, which includes futures contracts, the forex market, and options.

Additional Asset Classes

Other asset classes can include collectibles, hedge funds, private equity investments, cryptocurrency, or commodities such as natural resources or precious metals. These are often referred to as alternative investments, since they are less common and far riskier than the primary classes. They also have a lower correlation to the stock market.

Categorization can be difficult, and not every financial instrument easily fits into only one category. For instance, exchange-traded funds (ETFs), trade on exchanges like stocks. However, ETFs can include investments from one or more of the asset classes. A real estate investment trust (REIT) could equally be considered a tangible asset or an equity investment, since REITs are exchange-traded securities.

Another categorization for asset classes is location. Investments in domestic security, foreign investments, and investments in emerging markets might be considered a completely different category of assets.

What should I know about managing my risk?

Every time you invest money, you’re engaging in some level of risk, and everyone has a different risk tolerance. Capital risk, or the extent to which the value of your investments will wing up and down, depends on the type of asset class you invest in.

Cash or cash equivalents carry the lowest risk, followed by fixed-income investments, and then real estate. Stocks and equities carry the highest investment risk among the primary classes. Depending on your level of risk tolerance, you may opt for a low-risk portfolio with more cash or a high-risk portfolio with more stocks.

Investments have two broad types of risk...

- Market risk (systematic risk): The risk that comes with owning any asset. The market could become less valuable for all assets, interest rates could change, or unexpected factors may arise like, say, a global pandemic.

- Asset-specific risks (unsystematic risks): These risks are specific to investments or to companies themselves. They include the success of a company’s products, the management’s performance, and the stock’s price.

Remember, no matter how much you diversify your portfolio, there is no way to avoid all risk. With smart investing strategies, however, you can put yourself in the best position possible.

How can you use asset classes to create a diverse investment portfolio?

The most important lesson about investing is diversification: your investment portfolio should have different asset classes represented. That way, not all of your money is in the same place if the market has larger fluctuations than you were expecting.

Asset classes have very little correlation, and sometimes they have a negative correlation. When one category, such as equities, performs well in the market, the other asset classes might be suffering. However, if the stock market is performing badly, real estate might be doing well.

If you hedge your investments in one asset class by also holding investments in other asset classes, you can reduce your risk exposure. Even if you’re trying to make more money with higher-risk investments, it’s still a good idea to utilize lower-risk assets to help mitigate your level of risk.

Find a Diversified Investment Type

Choosing your asset allocation can be tricky, so even though you can buy investments directly, you can also research already created portfolios designed to spread out the level of risk in your investments.

Mixed investment funds hold a specified proportion in shares, the highest risk of the four main asset classes. If you have a mixed investment fund with 0-35% shares, it would be a lower-risk investment option. However, you can also have a mixed investment fund with 40-85% shares. These investments are called automatic asset allocation.

Diversification can be difficult, especially if you don’t have the time to research individual stocks or companies. Most securities can be purchased individually or in a collection, such as through mutual funds, index funds, or exchange-traded funds (ETFs). These can help you invest and diversify quickly but safely, with relatively low risk.

Diversify Within & Beyond Asset Classes

It’s important not only to diversify across the different types of asset classes but within them as well. Investing across different industries or sizes of companies in stocks can help manage your risk, as can investing across passive and active funds or any other distinction.

Diversifying beyond asset class is an option, too. Other products like pensions, annuities, and insurance products provide guaranteed income streams and returns. Your portfolio can include these as well.

Contact an Advisor

If you are unsure what asset allocation will work best for your investment objectives, reach out to a financial advisor for investment advice. Advisors can help you decide what asset classes will most benefit you and your financial situation; advisors can also help you determine how much you should diversify and what risks you can take. If you're on a tight budget, you can utilize robo-advisories.

The market changes every day, so even though one asset class might perform particularly well for you this year, everything could change in 2022; asset classes that haven’t performed well might become the big winners in the next economic cycle. No one stock is going to make all of your money for you; a well-diversified stock portfolio is what will bring you long-term high yields. Variability and diversification are necessary due to the fickle nature of the market.

The information provided herein is for general informational purposes only and is not intended to provide tax, legal, or investment advice and should not be construed as an offer to sell, a solicitation of an offer to buy, or a recommendation of any security by Candor, its employees and affiliates, or any third-party. Any expressions of opinion or assumptions are for illustrative purposes only and are subject to change without notice. Past performance is not a guarantee of future results and the opinions presented herein should not be viewed as an indicator of future performance. Investing in securities involves risk. Loss of principal is possible.

Third-party data has been obtained from sources we believe to be reliable; however, its accuracy, completeness, or reliability cannot be guaranteed. Candor does not receive compensation to promote or discuss any particular Company; however, Candor, its employees and affiliates, and/or its clients may hold positions in securities of the Companies discussed.