Are Trust Funds Only for the Rich?

Trust funds can be a great tool for passing on assets to a beneficiary. Learn about the different types, the pros and cons, and how you can set one up.

Although trust funds have a bad reputation for being exclusive to the elite, a trust can be a viable option for many looking to financially secure their assets for the future.

What Is a Trust Fund?

A trust fund is an estate planning tool that designates a legal entity to hold assets for a person or organization until the intended recipient is able to receive them – typically after the intended recipient reaches a certain age, or the previous owner of the assets is deceased.

Unlike a will, trust funds offer more control and legality; wills become public records once the original writer has died, and may not always be met.

To better understand trust funds and how they figure into an estate plan, there are a few key terms, provisions, and types to recognize.

How Do They Work?

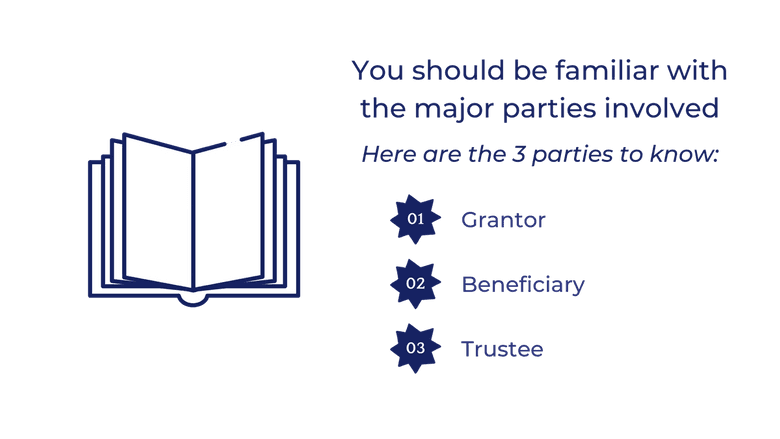

When establishing a trust fund, there are three major parties involved:

- Grantor: The person who starts the trust and transfers their assets; they set the terms for how assets are to be held, distributed, and granted in the future.

- Beneficiary: The recipient of the trust fund -- usually a family member or charity organization.

- Trustee: The entity, either an individual or trust bank, that manages the fund’s assets until the intended recipient can receive them. They also ensure that the stipulations of the trust are followed. Trustees are paid for their management services -- based on the terms of the trust, they either pay themselves from the trust fund they are managing, or are paid based on an hourly or flat rate.

Trust funds generally come up with rules, allowing the grantor to structure how their assets are used by intended beneficiaries. For instance, beneficiaries may not be able to use the trust to pay off debt, may only use the funds towards education, or must be 21-years-old before accessing any assets.

These trust fund earnings are also taxed, with different trusts taxed differently based on the type of fund they are.

Overall, trust funds allow for the easy, controlled transfer of assets met with the help of legal assistance; they can lead to generations of financial gains within families and organizations.

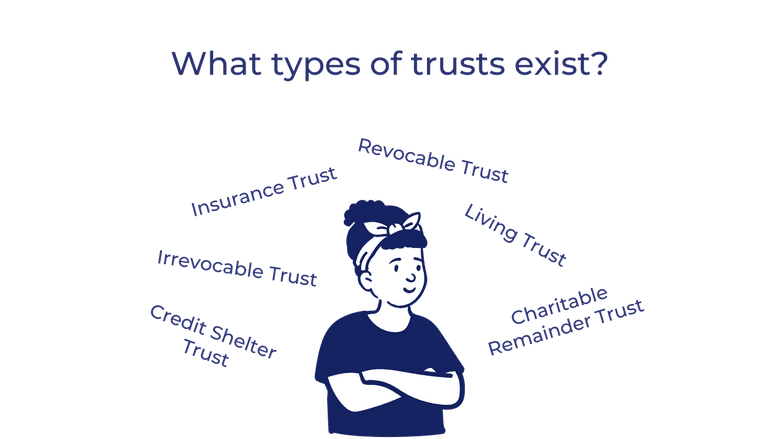

Types of Trusts

While the basic format of trust funds is pretty similar across the board, there are different types of trusts that provide different functions and have their own specific requirements. Finding the right type of trust is important because it allows grantors to tailor their wishes. Here are a few common types of trust funds:

1. Revocable Trust

Revocable trust is the general term for a trust that can be changed or terminated at any time during the grantor’s lifetime by the grantor themself. This type of trust allows the grantor more flexibility and control since they can alter their provisions until they pass.

2. Irrevocable Trust

Irrevocable trust is the general term for a trust in which the grantor cannot make any changes to the trust’s terms or distribution once it is established.

Despite the lack of flexibility, an irrevocable trust offers grantors better tax benefits; since the grantor no longer owns the assets, they don't need to pay any income tax on money made by the assets, helping many grantors enter into a lower tax bracket or avoid paying estate taxes.

This trust also protects the assets from legal claims or debt, so that the beneficiary can still receive assets even if the grantor goes through financial hardship before they die.

3. Charitable Remainder Trust

A charitable remainder trust is a tax-exempt, irrevocable trust that allows grantors the ability to transfer assets towards a specified charity instead of a family member or organization. All assets within this type of charitable trust fund give grantors a fixed-percentage income throughout the duration of the trust.

In addition, grantors are immediately given charitable-contribution tax credits. The income tax deduction from charitable remainder trusts is typically limited to 30% of the grantor’s adjusted gross income, but it can range from 20-60% based on how the IRS defines the charity and the type of asset.

4. Living Trust

Otherwise known as an ‘inter-vivos’ trust, a living trust is a type of revocable trust in which the grantor can use the assets set aside in the trust during their lifetime. Upon the grantor’s death, the remaining assets and property are transferred to the beneficiary.

Typically, a living trust can avoid probate court, or the legal procedure by which a court oversees the distribution of the property of a person who has died, as long as the trust is funded.

5. Insurance Trust

A type of irrevocable trust; An insurance trust allows the grantor to incorporate their life insurance policy within the trust fund, ensuring that it is free from taxation on the beneficiary. Although the beneficiary is unable to change the life policy itself once received, it allows the intended recipient to use the life policy to pay for post-death expenses on behalf of the grantor.

6. Credit Shelter Trust

A credit shelter trust is a type of irrevocable trust designed for affluent couples who seek to either reduce or completely avoid paying estate taxes when transferring assets to family members, typically their children.

This trust also ensures a surviving spouse's access to the trust assets for the remainder of their lifetime. When both grantors of the trust pass, the trust assets are then passed to the remaining beneficiaries without having to pay for any estate taxes.

Credit shelter trusts are also known as ‘AB trusts’ or ‘Bypass trusts.’

Pros and Cons

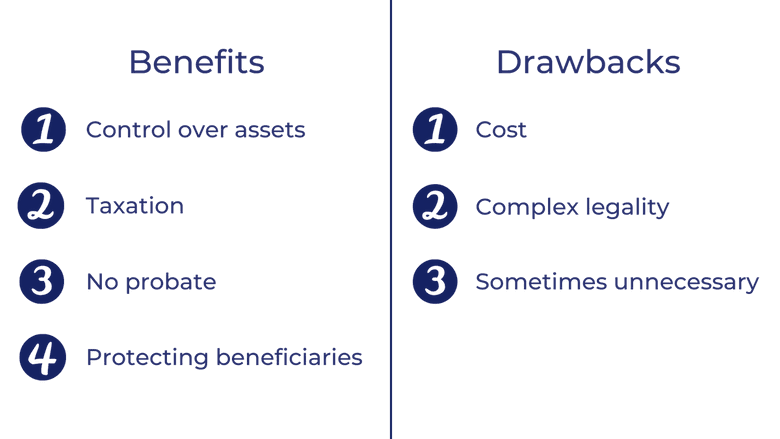

Trust funds can be a critical financial tool with numerous benefits.

- Control over assets: A trust fund gives you rigid control over exactly who will receive your assets with legal steps in place.

- Taxation: Since a trust's assets can be heavily taxed, creating a trust fund allows beneficiaries to gain access to funds in their future without going through massive tax payouts.

- No probate: Through a trust fund, grantors and intended recipients can avoid going through probate court. While most assets in an estate don't always need to go through probate anyway, a trust fund can ensure that.

- Protecting beneficiaries: A trust fund can protect beneficiaries by giving them a source of funds to pull from, whether it be to pay for college or a home. The provisions in a trust can also ensure that beneficiaries only gain access to the funds after they reach adulthood, or are paid in intervals – through a spendthrift trust clause – so that beneficiaries do not spend everything at once. Special needs trusts also ensure that if you have a disabled loved one, they have funds to be taken care of once you pass.

However, there are drawbacks like any financial system.

- Cost: The cost of starting a trust fund can be prohibitive, with attorneys charging anywhere from $1,000 to $5,000 to begin the process.

- Complex legality: With the need for attorneys, trust fund work can require much back and forth, and in-depth consultation from lawyers to ensure that a trust is set up successfully.

- Sometimes unnecessary: People who are looking for general estate planning don't necessarily need to go through the legal process associated with trusts to ensure that their heirs or beneficiaries receive their assets. There are alternatives to trusts that can be more compatible, depending on the grantor’s motivations.

How to Set Up a Trust Fund

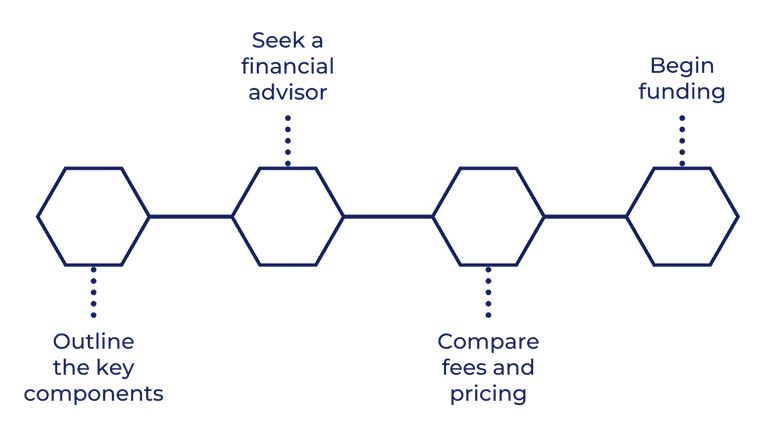

Outline the key components within your trust

In order to set up a trust, grantors should think about what type of trust they want to pursue, and outline these four key components of their trust:

- Who is the grantor

- What property and assets will be included in the trust

- Who will be the beneficiaries

- Who will be the trustee(s)

Once those details have been decided on, you can begin looking for the trust that best meets your needs.

Seek a financial advisor

Grantors should seek financial advisors to officialize their trust, and go through the legal motions. When looking for a financial advisor, there are many options -- State and local bar associations also list attorneys that will be familiar with state trust laws, many go through referrals or word-of-mouth, banks offer trust fund services, and there are several websites out there as well (albeit credibility must be confirmed).

Compare fees and pricing

Fees for trust fund services range, so individuals should compare prices as well as personal testimonials to ensure they are getting the right person for their plan. Many employers also offer discounted estate planning services that may also connect individuals to trust fund administrators, and also reduce the cost.

Begin funding

After opening the trust fund, a grantor can begin funding the trust with their assets, and formally designate trustees. Once the trust is funded and established, the grantor must register the fund with the IRS. Then, the trust fund is ready and activated for use!

Looking at the Alternatives

If trust funds aren’t the right fit for you, there are other estate planning options available.

Transfer on Death (TOD) or Payable on Death (POD)

A POD or TOD is an arrangement between a bank or credit union that immediately transfers assets to a grantor’s beneficiary upon the grantor’s death. This system allows beneficiaries to skip probate court completely; however, if the grantor passes with unpaid debts or taxes, the POD account may be subject to claims by creditors or even the government.

Since there is no cost to designating a beneficiary through a POD/TOD, it allows people to overcome many of the costly barriers to starting a trust fund.

The major drawback is that a POD account does not allow individuals to have alternative beneficiaries. This means that if the intended beneficiary dies before the grantor, the assets are then transferred to an estate or will.

Family Investment Companies (FICs)

Family Investment Companies are a tax-efficient process for grantors to manage control over their assets and pass them on to their family members.

Parents will fund an FIC via a loan and become shareholders of the company; in return, the FIC acquires all assets, and the underlying capital value of those assets grow, and is given to the shareholder’s children.

FICs are tax-efficient because profit on an investment held within a company is taxed at corporation tax rates, which can be up to 25% less.

Will with a Trusted Executor

A trusted executor is the person (or people) in charge of organizing an individual’s affairs after their death. While an individual’s will may not be completely met, a trusted executor offers more control in being able to ensure that it does. Executors are similar to trustees; the difference is a trustee is appointed in a trust document, while an executor is named in a will.

Utilizing a will with a trusted executor may also lower costs, and allow individuals to avoid the complicated process of trust funds. However, wills may only be completed upon an individual’s death, while trusts can be set up to allow beneficiaries access even while the grantor is alive. In addition, all wills must go through a probate process. Individuals can also have both a will and a trust.

Key Takeaways

Ultimately, trust funds allow individuals to have more control over how their assets are passed onto future generations. While a trust fund may seem like a daunting endeavor, there are ways to avoid the large costs associated with the legalities, and produce a detailed financial plan for your family members, favorite charities, or more.

The information provided herein is for general informational purposes only and is not intended to provide tax, legal, or investment advice and should not be construed as an offer to sell, a solicitation of an offer to buy, or a recommendation of any security by Candor, its employees and affiliates, or any third-party. Any expressions of opinion or assumptions are for illustrative purposes only and are subject to change without notice. Past performance is not a guarantee of future results and the opinions presented herein should not be viewed as an indicator of future performance. Investing in securities involves risk. Loss of principal is possible.

Third-party data has been obtained from sources we believe to be reliable; however, its accuracy, completeness, or reliability cannot be guaranteed. Candor does not receive compensation to promote or discuss any particular Company; however, Candor, its employees and affiliates, and/or its clients may hold positions in securities of the Companies discussed.