Any time you take a job in tech you become an investor in your company’s stock. With 50%+ of your salary paid in equity, there’s hardly anything more important than learning how to manage your investments correctly.

This comes down to 3 stages:

- Pick the right company to work for

- Negotiate to maximize your compensation

- Turn your RSU pay into wealth

Most people get 1) and 2) right and get stuck on the third one. In tech, we’ve been trained to assume the RSUs we get paid will always appreciate - as a result most people sit on them believing that holding RSUs will make you rich “eventually”.

We have a vested belief that our company will take care of us - that is, unfortunately, also incorrect. The company is the issuer of the stock and to them you’re a stockholder first and an employee second. For that reason, companies cannot tell you what to do with your RSUs any more than they can any other holder of the stock. It’s a conflict of interest.

Companies hire brokerages to fill this gap and help employees - but there’s a big problem. Brokerages are not fiduciaries. This means they’re not obligated to act in your best interest. They make money by recommending products where they have the best margin. And, of course, they’re most interested in the employees who hold the most wealth - everyone else gets access to a sub-par robo advisor product.

While all of this is happening, most employees keep racking up RSUs. This can often lead to a concentrated stock position. Why is this important? Concentration = risk. If the market goes down, your stock will tank with it. All your hard work to earn RSUs is for nothing if you can’t hold onto their value and multiply it.

Tech stocks are inherently volatile. In English, this simply means that their price varies a lot. This variation is the key loss leader for most tech employees. The way investments make money is through compounding - steady and consistent returns that multiply your capital over time. Most tech stocks don’t really follow that pattern, leaving many disappointed ( and much poorer in the long run).

What Quants Know That You Don’t

I worked in private banking for nearly a decade. Private banks serve primarily the ultra-rich - people in the highest tax bracket who care about making precise decisions with their money. Your CEO was probably one of our clients. What I noticed consistently is how different wealth management looks like for ordinary people vs for the already wealthy. Many of the strategies I saw can easily be applied to every single tech employee - yet, we don’t even see them offered widely.

Why?

It might surprise you to learn that many of the largest banks and brokerages out there still run on Excel. When an executive comes through the door and gets a bespoke strategy, implementing it becomes a manual process. And brokerages are happy to do it for massive sums of money - but it doesn’t scale to run a VBA model for all their clients.

In summary:

Simple Formula To Manage RSUs

The good news is - it’s quite simple but it’s not something you can do on your own (unless you want a second job as a trader). Many of the strategies that exist for “the wealthy” are actually applicable for everyone who wants to save taxes and make more from their RSUs. That’s because “the wealthy” and the average tech employee face the same problem: concentrated stock positions.

Managing your RSUs comes down to achieving this balance: reduce losses on one end so you can maximize gains on the other.

Reduce losses by:

- Avoiding taxes

- Selling RSUs only when the price is right

- Don’t get blocked from trading windows

Maximizing gains by:

- Find the highest price for your RSUs on your timeline

- Dollar cost average sales

- Reinvest sales proceeds in a way that avoids tax drag

This all sounds obvious, right? But first you have some obstacles to overcome.

Trading Windows Are Bad

Trading windows are bad. Two reasons: 1) The stock is most volatile right after earnings and you’re likely to get a bad price for it and 2) you’re blocked from selling most of the year when the price may be much better for you.

Let’s first look at volatility - the stock price moves the most after earnings because new information is pumped into the market and everyone reacts to it. It’s arguably the worst time to sell RSUs. A stock can go down immediately when a company reports based on data in its earnings release.

This price swing effect has been studied extensively by options traders who speculate on earnings calls. Even amongst them, the most experienced traders, this is considered a gamble and highly speculative. Most don’t trade during this period. The few who do, reduce their risk by buying various kinds of insurance through options - something that you, as a tech employee, can’t do because of your company policy.

Now for our second point: being blocked from selling. This may not seem like a big deal but it is a huge risk for any tech employee. On one side: selling small amounts frequently is much better for you due to dollar cost averaging ( and you can’t do that with trading windows). But even more critically - you want to be able to exit your position if you’re at risk or if you can make a larger profit.

Example: Uber stock started tanking in 2020 but employees were blocked by trading windows and could not sell their RSUs. By the time they were allowed to sell, the stock was down 40%.

Finding the “ right price” to sell at

This is all about having access to data. Similarly to how you negotiate your salary by looking at benchmarks - you should sell your RSUs using benchmarks as well.

How do rich people do this? Their family office buys data feeds from the top analysts. These include projections for the stock 12 months out and allow for much more precise trading.

Analysts dedicate their whole careers to looking at a single stock, getting to know the company executives, the business model and the industry trends. That’s all they do. The reports and date they produce are how hedge funds and large institutional investors more money - but you, as a regular consumer, don’t have access to it because you’re not the intended audience. Also because these reports are super expensive. A single report on Google can run $5K.

If you had this data you could see the statistical probability of different outcomes for your stock over a 12 month period. This helps you in 2 ways: if the price is projected to be higher you can make more money by holding or, inversely, you can save losses by selling sooner.

Avoiding taxes

Taxes as a tech employee are painful. From the time you vest to the time you sell, there are multiple pitfalls to avoid so you don’t give all your hard earned money away to the government. Preserving your capital is also the single most important thing you can do to increase your returns over time.

There are 3 stages of taxes you need to think about:

- At vest

- At sale

- At reinvestment

At vest you’re mostly worried about income taxes. Frequently your company won’t withhold enough and if you’re vesting RSUs for the first you’re in for a rude awakening at the end of the year. Luckily most companies are starting to understand they need to help employees with this and some now offer “sell to cover” options.

At sale, the taxes you’re worried about depend on the value of your stock. If it’s increased in value - then you really care about capital gains and timing your sales can save you up to 20% on your tax bill. If your RSU value has decreased, then you should care about the wash sale rule instead- if you’re not precise with your sales you won’t be able to write off your losses on your tax statement.

Arguably the most important part of taxes though often ends up being forgotten - and that’s reinvestment tax drag. If you’ve sold your RSUs then you’ve already paid income tax on them (ouch) and some form of capital gains ( 2x ouch) so you should be extra careful not to put your proceeds into something that will eat even more taxes. Unfortunately this is what most people do - go to some roboadvisor to buy ETFs, buy a mutual fund and not look at the insane fees that stack on top of taxes or even worse pick a bad portfolio.

Few people outside finance know this but you can actually get buried under taxes by buying a portfolio. I’ll explain how in the next section.

Re- Investing smartly

Wealthy people use a “ family office” - which is just saying they hire their own team to source strategies for them. They buy access to portfolios that the general public can’t get. They also pay for tools like Parametric to offset their taxes. So between not paying taxes and picking a good strategy it’s easy to see how riches multiply.

But let’s be realistic - not everyone has $5M + sitting around to open a family office or wants to pay 0.5% to Parametric.

Still, you can get both of these benefits.

We just talked about how taxes can be a killer so let’s start there. The way a portfolio works is by setting a strategy of what assets to buy and what ratio to hold between them to build wealth over time. Because assets perform differently in each economic cycle you’re protecting yourself from loss if you pick a solid mix. That’s the whole magic behind wealth management that you didn’t learn in school.

But, it all starts falling apart when you add taxes. And you better believe that 99.9% of wealth managers will never mention this to you when they sell you a product.

Here’s the reality:

Taxes on reinvestment eat returns.

Say you choose 30% equities, 20% bonds etc… But over time, as some of these assets grow faster than others and now you have more bonds than you wanted. Since your returns are based on the original ratio of stocks: bonds, you need to maintain that over time to not lose money. So you will need to sell the bonds until they’re back to being 20% of your holdings, just like when you started out. This is called rebalancing.

Rebalancing involves a sale and every sale involves taxes. Most wealth managers rebalance monthly - so that’s 12x taxes for you to pay. By the time the end of the year rolls around - did you even make any money on your returns? Spoiler alert: most strategies are not profitable.

And that’s ON TOP of all the taxes you already paid to cash out your RSUs.

So how do rich people do it?

The short answer is - their family office pays for a tool like Prometric. It’s costly, with some family offices reporting they pay 0.5% to them. This should tell you 2 things: 1) Avoiding taxes is that valuable and 2) Some advisors have higher fees than others because they bring in different value in their management style.

Some portfolios are better than others

In this day and age where you can buy things on Robinhood or pay 0.25% to Betterment - why bother with a portfolio? It’s simple: you get what you pay for.

While the face value of some of these services is lower, the long term costs associated with putting all your money into these strategies doesn’t account for taxes, market conditions or investment mix. Many of these “portfolios” are jam packed with funds that give the brokerage kickbacks while you end up paying the price.

That’s why rich people hire their own advisor.

Family offices get access to a different grade of portfolios called “institutional strategies”. These are portfolios based on robust models that are tested against different economic regimes and actively maintained - for example, when tech started going down, many managers moved to energy and made a large profit.

Institutional strategies come at a premium - they’re not offered to the public and they’re meant for private money managers who can maintain them for their clients via a data feed.

You could be in one of these portfolios, if you found a manager who carries them.

The huge benefit is that some of these are tax-drag optimized. This means they rebalance in a way that generates 0 additional taxes for you as long as you hold the portfolio. According to Fidelity, this can save up to 2% yearly on capital than can be reinvested into the portfolio to get even more returns - it’s simple to see how over time this creates a huge benefit.

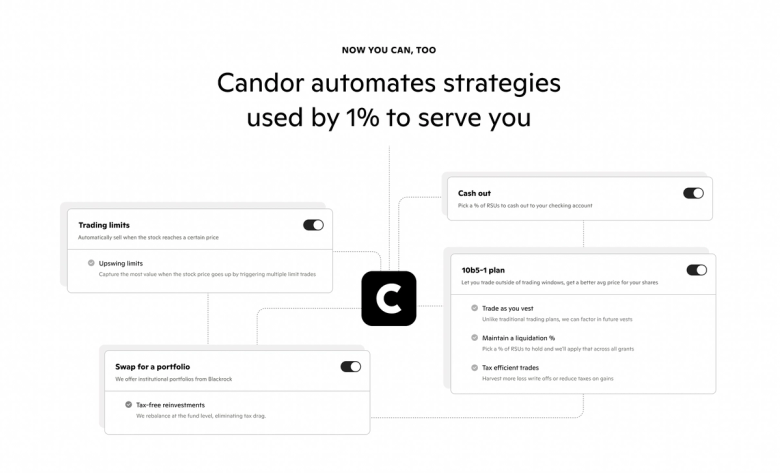

Get all these strategies with Candor... and more!

The information provided herein is for general informational purposes only and is not intended to provide tax, legal, or investment advice and should not be construed as an offer to sell, a solicitation of an offer to buy, or a recommendation of any security by Candor, its employees and affiliates, or any third-party. Any expressions of opinion or assumptions are for illustrative purposes only and are subject to change without notice. Past performance is not a guarantee of future results and the opinions presented herein should not be viewed as an indicator of future performance. Investing in securities involves risk. Loss of principal is possible.

Third-party data has been obtained from sources we believe to be reliable; however, its accuracy, completeness, or reliability cannot be guaranteed. Candor does not receive compensation to promote or discuss any particular Company; however, Candor, its employees and affiliates, and/or its clients may hold positions in securities of the Companies discussed.