How to Decode an HRA Plan

With HRAs' advantages such as employer assistance and extended contributions, everyone should know about them.

Being employed at a good company entails a range of employer benefits. However, they're not always easy to understand: many people are bewildered by the offerings, functions, and importance of benefits packages.

One of these confusing perks comes in the form of HRAs, or health reimbursement arrangements. In this article, we'll clear up the logistics, pros, and cons of HRAs and help you decide whether to enroll.

What is an HRA Plan?

Essentially, HRAs are health care accounts dedicated to qualified spending for medical, pharmaceutical, dental, and vision expenses. All HRAs are IRS-approved portfolios that to reimburse you for eligible out-of-pocket medical expenses and health insurance premiums. Two key things to understand about health reimbursement arrangements are:

1. They are provided, owned, and funded only by your employer

2. They do not tax the money that is taken from these portfolios

Many companies prefer HRAs because they have superior budget control and tax advantages. Some HRAs can be paired with group health insurance plans to benefit deductibles, copays, and other out-of-pocket charges, but, in these circumstances, they cannot reimburse premiums.

HRA, HSA, FSA: What's the Difference?

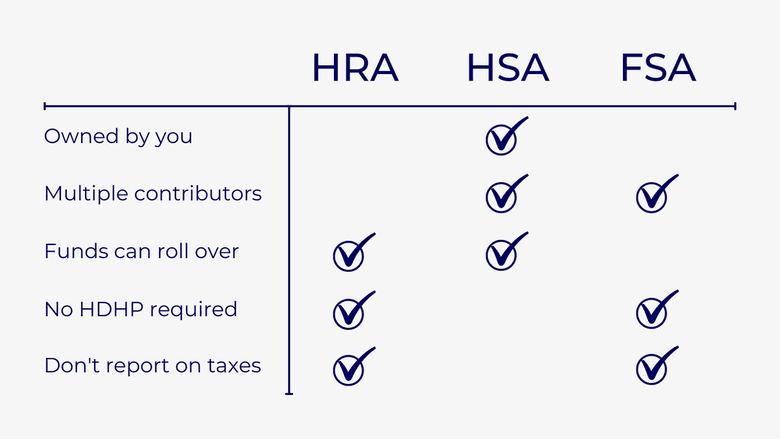

HRAs, HSAs, and FSAs, are all IRS-regulated plans for health insurance coverage. Each of these forms has its own benefits and drawbacks.

Rollover & Ownership: Health savings accounts (HSA) are beneficial because funds in this account to roll over into the next year and you are the one who owns the HSA portfolio. The money in an HRA, on the other hand, is not guaranteed to carry over, so you may lose all of the unused funds. Because a health reimbursement arrangement is owned by your employer, it is up to them whether they allow the money to roll over for next year's health care expenses.

Eligibility: In an HSA, you must be enrolled in a high-deductible health plan. This health plan can put a heavy financial burden on you compared to other types of insurance. Because an HDHP is low in premiums and high in deductibles, it could be difficult to meet the quota to get the health care needed for a certain plan year. HRAs do not have an HDHP requirement, which alleviates some stress for users.

Tax Reporting: Finally, an HSA must be reported when you do your taxes, but with an HRA, you do not have to worry about the extra headache.

A flexible spending account (FSA) follows a similar layout to HRAs. FSAs are owned by your employer, you do not need an HDHP, and you don't need to worry about reporting the account on taxes. A positive note on FSAs is both you and your employer can fund the account. However, while HRA funds have the flexibility to carry into the next year, FSAs are generally known as a "use or lose it account".

How Do I Choose an HRA Plan?

There is a lot to think about when it comes to health reimbursement arrangements. Considerations to take with HRAs include when to enroll, how the funds will be disbursed, and available choices at your specific company. Overall, there are six distinct arrangements that you will see. Although each form is unique, they all follow a standard five-step structure to how the funds in the account move and how you will be reimbursed.

HRA Considerations

You will discover what kinds of health reimbursement accounts are available and how much your employer funds them during specific enrollment timeframes. Your HRA may be disbursed in one of two ways:

- Your HRA will continue to pay for health care expenses until the budget runs out

- If your employer chooses an HRA that only covers your coinsurance, you will pay health care costs out of pocket until you have reached your deductible. After this deductible is met, your coinsurance will begin, and you can utilize the funds in your HRA to cover costs.

Organizations normally offer at least one kind of HRA, however, each company comes with various participation. Depending on your situation and employer, there are six main types of health reimbursement accounts that you may come across. Such types include the Integrated HRA, Retiree HRA, Dental/Vision HRA, Qualified Small Employer HRA (QSEHRA), Individual Coverage HRA (ICHRA), and Excepted Benefits HRA.

Breaking Down the HRA Plan Types

Each of these six arrangements has a different function to serve employees their well-deserved health benefits. It can be helpful to see how each compares and contrasts:

- Integrated HRAs generally reimburse you for out-of-pocket eligible expenses. This particular arrangement will require that you are covered by a group health plan.

- Retiree HRAs are a pretty self-explanatory arrangement that provides reimbursements to only retirees.

- Dental/Vision HRAs are another specific arrangement. As the name implies, it is focused on only covering dental and/or vision expenses.

- Qualified Small Employer HRAs (QSEHRA) is a newly established plan. It is restrictive, as employers must qualify as a small business to be eligible. This means having less than 50 full-time employees. If the business qualifies, the reimbursement maximum established by the IRS is $5,150 for single coverage and $10,450 for the whole family. The leading reason for the creation of this HRA was to allow for the reimbursement of both individual health insurance premiums and other out-of-pocket expenses.

- Individual Coverage HRAs (ICHRA) are accessible to all businesses, and like an Integrated HRA, they require employees to be covered by a separate individual health plan or Medicare. The function of this arrangement is steered to reimburse individual health insurance premiums. However, different types of expenses may also be reimbursed. Other rules may apply to an ICHRA, but they will be specified depending on the business.

- Excepted Benefit HRAs compensate for short-term medical plan premiums, COBRA premiums, dental expenses, and vision expenses. The limit to this reimbursement is a maximum of $1,800 on an annual basis.

The Day-To-Day of All HRA Plans

While each of these six types is distinct in nature, all HRAs follow the uniform five-step structure:

- As you enter the company, you will see the budget that your employer has set. They will decide on the amount of tax-free money you will receive each month for applicable medical expenses.

- Here is where the fun part comes in: you start making purchases. You select the health care services and products that you need to satisfy your health requirements, which may include personalized health insurance. Depending on your type of health plan, you could still be dealing with copayments and deductibles.

- After your purchases, you submit proof of these eligible expenses to your place of work. To get your money back from these incurred charges, you need to submit documentation that these costs are HRA qualified medical expenses. Usually, this is given in the form of receipts, however, it could also be acceptable to submit an explanation of benefits. The plan design that your employer decides on may also provide a debit card for you to make qualified purchases.

- From here, your employer does all the rest. They will review the documents you sent to look for three things: the product or service used, the date of the documented expense, and the accumulated amount. Once verifying all of the credentials, your work will approve the expense.

- The last, and most satisfactory step, is when you get your money back. Once the purchases have been approved, your work will reimburse you for your allowance amount. However, be aware that once your allowance amount is maxed-out, your employer will discontinue making further payments until the following month.

Curious to know more about HRAs? The IRS has made a FAQs list about HRAs for both employers and employees.

What Happens to Your HRA Plan Once You Leave Your Job?

In most cases, you will not get back the money from the account. Because your employer established, funded, and controlled the HRA, the account will belong to the business if you retire, resign, or are terminated. While there are some exceptions, this is typically what occurs and should be taken as a rule for HRAs.

However, fret not, because most employers will give a specific timeframe for you to submit claims before you lose your eligibility for these benefits. While it varies from company to company, the grace period is roughly a 90-day timespan. The best way to get the specifics of continued coverage is to read your HRA plan document and consult with your employer or benefits administrator.

The information provided herein is for general informational purposes only and is not intended to provide tax, legal, or investment advice and should not be construed as an offer to sell, a solicitation of an offer to buy, or a recommendation of any security by Candor, its employees and affiliates, or any third-party. Any expressions of opinion or assumptions are for illustrative purposes only and are subject to change without notice. Past performance is not a guarantee of future results and the opinions presented herein should not be viewed as an indicator of future performance. Investing in securities involves risk. Loss of principal is possible.

Third-party data has been obtained from sources we believe to be reliable; however, its accuracy, completeness, or reliability cannot be guaranteed. Candor does not receive compensation to promote or discuss any particular Company; however, Candor, its employees and affiliates, and/or its clients may hold positions in securities of the Companies discussed.