Peeling Away the Essentials of an HSA

HSAs, or Health Savings Accounts, offer financial flexibility for future medical spending. Learn about how to take full advantage of these accounts.

Most people like being in control of their own money. After all, it is such a satisfying power to decide how much, when, and where your money goes. If you want to take control of your financial portfolio, setting up a health savings account, or an HSA, might be the place to start. Millions of Americans agree: In 2020, Devenir estimated that $82.2 billion was held over 30 million HSAs.

With rapidly increasing popularity, these flexible spending accounts are worth looking into. Here's what you need to know before investing.

What is a Health Savings Account?

An HSA is a beneficial, tax-advantageous health care account for U.S. taxpayers who are currently enrolled in a high-deductible health plan (HDHP). You may use an HSA for services and items that are covered under your health plan but subject to cost-sharing (minimum deductible, co-payments, etc) and other types of expenses that are not covered by the medical plan.

A health savings account may be used to pay for a variety of medical expenses. Some IRS qualified purchases include:

- Prescription drugs

- Health insurance plan deductibles, coinsurance, and copays.

- Dental expenses such as braces, bridges, crowns, and more.

- Long-term care services

- Vision expenses such as glasses or Lasik eye surgery.

- Transportation and lodging that is medically related.

- Specific health premiums such as COBRA.

Advocates of HSAs believe they are an pivotal in reducing health care costs and increase productivity for the whole health care system. Proponents also say that HSAs encourage saving for future health care expenses, allow the patient to get the preventive care they need without a gatekeeper, and nurtures users to take responsibility for their healthcare choices.

What makes an HSA unique?

Top 6 Perks of an HSA

There's a lot of buzz around HSAs, so you may wonder if the hype is justified. Rest assured, owning a health savings account can be beneficial in many financial aspects:

- Financial contributions are tax-free. The contributions you make to your HSA are made on a pre-tax basis, making all of your savings immediate. These contributions can also be utilized for tax deductibles.

- Your HSA funds can be retrieved tax-free. Qualified healthcare purchases can be made free of tax when using an HSA. Charges can be settled directly from the account either by a healthcare debit card, online bill-pay, or ACH. You can also pay out-of-pocket and get reimbursed by your HSA).

- Get tax-free interest. Unlike standard savings accounts, the interest earned on your health savings account is not considered taxable income.

- Carry the balance over. HSA balances can be transferred over from year to year. A memorable motto is they are not a "use-it-or-lose-it" account; the balance from your HSA will continue to grow in value each year without any limits.

- Invest HSA funds. You could be eligible to invest your HSA in a mutual fund, interest-bearing account, stock, or bond similar to an IRA or 401K. The options for this feature depend on the HSA custodian. Many custodians instruct a minimum amount of the portfolio to be in liquid form before investing. This is to make sure you have enough funds to pay for qualified medical expenses.

- Save for the future. HSAs can be used to help cushion your retirement funds. Once you turn 65, you may take funds from the account as you please without any penalty.

How HSAs Differ From HRAs & FSAs

It may be difficult to decipher the difference between an HSA, HRA (health reimbursement arrangement), and an FSA (flexible spending account). After all, each one is a three-letter acronym related to healthcare savings: all of them are used to save on taxes and pay for qualified medical expenses.

However, in both HRAs and FSAs, you do not own the account, you cannot invest in the account, you do not need to have a high-deductible health plan, and you do not need to report the account when filing your taxes. In flexible spending accounts, you and your employer may fund the account, while with a health reimbursement arrangement, only your employer may contribute.

Am I Eligible for an HSA?

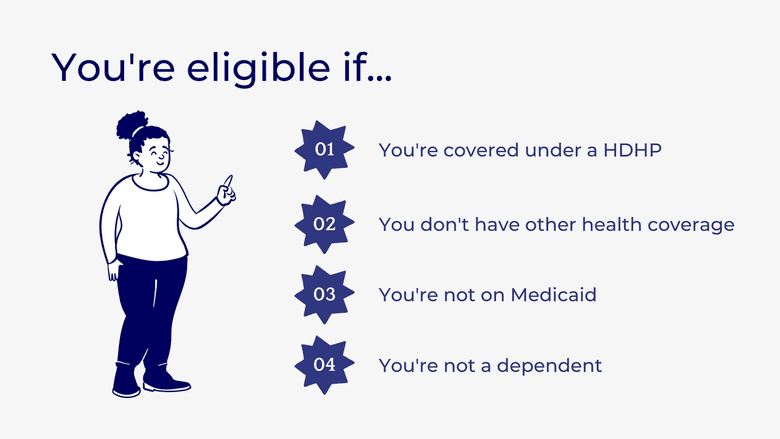

To own a health savings account, there are qualifications of eligibility. To see if you are HSA-eligible, you need to meet the following requirements:

- You must be covered under an HDHP by the first day of the month.

- Usually, you may not have other health coverage except under special circumstances.

- You are not enrolled in Medicare or Medicaid.

- You are not claimed as a dependent on another person's tax return.

Now that you're qualified and feeling inspired, it's time to get started! To set up your HSA, you will need to contact your employer's HR department. They can tell you about the enrollments they offer or suggest a financial institution that offers HSAs. Many major financial institutions offer HSAs, so you could potentially open your health savings through your bank account. Be aware of the fees that may be attached for the maintenance of the account.

Once you've enrolled in a qualified HDHP and decided where you want to set up the portfolio, you simply complete the application process and set up your method for funding for it. After your account has been activated, the custodian administering your HSA will usually provide a debit card, but you may be able to order checks too, to pay for all qualified medical expenses.

Who Can Contribute to an HSA?

An HSA account is owned by the individual, however, several parties may fund this portfolio. As you already know, an HSA is often funded by pretax dollars through the payroll deductions of your employer. Through this method, you are not subjected to all federal income tax and most state income taxes. Funds may also be added to your HSA balance via payroll deduction, or, by after-tax contributions.

Your HSA can be funded by you, your employer, a family member, or any other individual who desires to add to your portfolio. If another party makes an HSA contribution to the portfolio, all of the tax advantages apply to you. However, irs.gov does specify a contribution limit each tax year, so the tax breaks aren't limitless.

These HSA contributions can be added at any time. You can either fund the maximum contribution limit of your account on the first day of the year, or you can spread deposits throughout the year. Generally, for calendar year taxpayers the deadline for contributions is April 15th of the following year.

What Happens to Your HSA When You Leave the Company?

For the most part, nothing! The biggest potential downside: nominal bank fees after ending enrollment of your HSA through your employer.

The best part of an HSA is it belongs to you throughout your whole life. In essence, an HSA is a bank account that's in your name, so you may treat it just like an individual retirement account or an IRA for health care. Whether you change insurance plans, resign, are terminated, or retire, the capital in your health savings account will remain available for you to decide when and how to use the money. Unlike FSAs which are often a "use it or lose it" account, HSAs do not need to be used by a specific timeframe. Instead, you could continue to add to your account for the tax advantages until the sweet day of retirement.

In 2018, research from the Employee Benefits Research Institute found that the average person who saves in their HSA began 2019 with an extra $2,764. You may use your HSA to finance COBRA premiums, long-term care insurance, or other forms of health insurance premiums if you are acquiring unemployment benefits. However you decide to use this money, the HSA will be there through thick-and-thin to provide you financial backing in your future.

The information provided herein is for general informational purposes only and is not intended to provide tax, legal, or investment advice and should not be construed as an offer to sell, a solicitation of an offer to buy, or a recommendation of any security by Candor, its employees and affiliates, or any third-party. Any expressions of opinion or assumptions are for illustrative purposes only and are subject to change without notice. Past performance is not a guarantee of future results and the opinions presented herein should not be viewed as an indicator of future performance. Investing in securities involves risk. Loss of principal is possible.

Third-party data has been obtained from sources we believe to be reliable; however, its accuracy, completeness, or reliability cannot be guaranteed. Candor does not receive compensation to promote or discuss any particular Company; however, Candor, its employees and affiliates, and/or its clients may hold positions in securities of the Companies discussed.