How to Spot a Short Squeeze — What Every Short Seller Should Know

Everything you must know about short squeezes as an investor. How they happen, how to spot them, and how to evaluate your risk.

There are many moving factors in the stock market that influence whether a stock’s price goes up, down, or stays steady. One reason a stock price rises far beyond what’s anticipated is a short squeeze.

This article will explain what a short squeeze is, examples of short squeezes in today’s market, why they occur, and their advantages and disadvantages.

The Basics

Defining a Short Squeeze

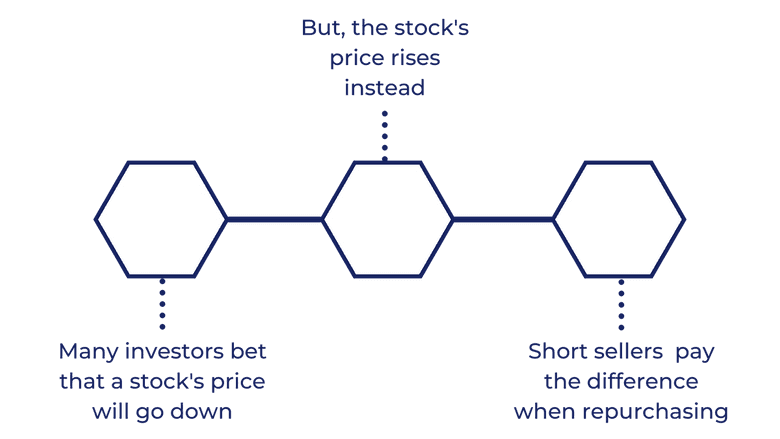

A short squeeze happens when many investors bet that a stock price will go down, but the stock price rises instead.

These investors, also called short sellers, employ the trading strategy of shorting stocks that they believe are overvalued in the market. Short sellers borrow shares from other investors and sell them, but then must return the shares to the original lender. So, the short sellers buy back the shares at a discounted price if the company’s share price has indeed gone down over time.

However, short squeezes happen when a company’s share price goes up instead, and short sellers are forced to cut their losses and buy back stocks at a loss to themselves. Short sales have an expiration date, so if the stock price goes up, short sellers have to pay the difference when repurchasing the stock.

Because many short sellers frequently need to buy back stocks at the same time, a short squeeze drives up the price of the stock even more. The price movement rises rapidly, which attracts even more buyers to the stock who are not short sellers. Therefore, if too many investors overvalue a company, then they drive up the stock prices in a short squeeze.

Why Do Short Squeezes Happen?

Short selling happens when many investors believe a stock is overvalued, and therefore will eventually decline in price. When they are correct, they can pocket the difference between the price they originally borrowed the stock at and the resale price.

However, many factors can lead to a stock’s value going up instead, whether in a temporary or permanent way. A positive news story, buzz on social media, or a new product announcement might gain positive traction for a company's stock prices.

When this unexpected rise in price happens, short sellers tend to sell immediately, regardless of their loss. The more short sellers that sell, the more the short squeeze is exacerbated.

Examples of Short Squeezes

GameStop

GameStop (NYSE: GME), a video game retailer, took over the news cycle in January 2021 after it became the target of short selling by hedge funds. GameStop’s short interest grew to over 100% in shares outstanding due to short sales.

The Reddit community of day traders called WallStreetBets, however, thought that GameStop stock could become profitable again, and organized online stock purchases. WallStreetBets (WSB) has organized stock buying for companies like AMC Entertainment (NYSE: AMC) and BlackBerry (NYSE: BB) as well, but GameStop took off in an unprecedented way.

The GME stock originally began as a meme stock, or a stock that gained cult status on social media, but it quickly blew up far beyond what anyone predicted. Retail investors bought stock and call options, and as the price increased, more short sellers from hedge funds were driven out.

The story also attracted bigger names who invested in GME. Chewy cofounder Ryan Cohen and Scion Asset Management’s Michael Burry both took long positions on GME, and Cohen became the chairman of GME’s committee to shift to e-commerce.

GME’s stock price increased in value, going from less than $5 a share to $325 a share in January of 2021, and also increased in volatility. NASDAQ reported that it only became more stable in June of 2021, trading in the range of $200-$230.

While GameStop is certainly the most famous short squeeze story in the news today, it’s far from the only case.

Tesla

In early 2020, Tesla was shorted by investors betting on its failure, with 18% of its outstanding stock in short positions. However, short-sellers eventually lost $8 billion collectively, after Tesla stock went up by 400%.

Volkswagen

An earlier example of a short squeeze is Volkswagen (NYSE: VWAGY). In 2008, Volkswagen’s stock price jumped more than 300%, which made the company seem as though it was worth $400 billion.

Most of this price movement came from the holding company Porsche SE, as well as the German government, who both owned a great deal of the shares, meaning very few shares were actually being traded publicly.

Even when the stock market crashed in 2008, Volkswagen’s stock price remained high. Short sellers assumed the price would fall eventually, but then Porsche announced publicly that it had been building its stake in Volkswagen via options, so only 6% of shares remained in the public market. With very little supply left, the stock prices skyrocketed into a short squeeze as short sellers scrambled to sell their shares.

Short squeeze vs. Naked Short-Selling: What’s the Difference?

Naked short-selling occurs when an investor short sells a stock without borrowing the asset from another investor: the short shares in naked short-selling haven’t been proven to exist.

As of 2008, abusive naked short-selling has been prohibited by the Securities and Exchange Commission (SEC). Abusive naked short-selling is defined by the SEC as selling a short stock that the seller has not actually bought and failing to deliver it to the buyer.

Naked shorting still occurs in the market, however, and it contributes to short squeezes by allowing additional shorting that may not actually exist. However, naked shorting in a short squeeze can also help balance the stock market when it forces a price drop.

How to Spot Short Squeezes

Short squeezes obviously come with a high degree of risk. There are two measures that short sellers use when deciding whether or not to short a stock: short interest and the short interest ratio.

Short Interest

Short interest is the total number of shares sold short as a percentage of total shares outstanding. If a seller watches a stock’s short interest closely, they can often predict whether or not a short squeeze is imminent.

When the short interest indicates fewer short sales, it could mean that the price of the stock has risen too high, or that it has become too stable for short sellers to make a profit off of. A rise in the short stock interest, on the other hand, could indicate that a short squeeze is coming.

Short Interest Ratio

A stock’s short interest ratio is the total number of shares sold short divided by the stock’s average daily trading volume. Also called "days to cover," the short interest ratio can tell an investor the number of days of normal trading needed for the trading volume to reach the point to buy back all the shares sold.

Another key element to watch is the short percentage of the float, or the percent of shares available for trading currently being held short. Watch for anything above 10% to indicate a short squeeze; at one point, GameStop’s short percentage of the float was at 100%.

Considerations

Taking a short position on a stock can bring you a profit if you predict the market correctly, but there is a huge potential downside, with losses much greater than potential rewards.

Heavily shorted stocks tend to be heavily shorted for a reason; make sure to seek investment advice and evaluate a given company, and understand why it’s being valued the way it is by the stock market as a whole.

If you decide to short an investment, start small so you can cut your losses if the trade goes wrong, and avoid stocks with a high short interest in order to avoid being caught on the wrong side of a short squeeze.

In general, think of short squeezes as a short-term event, not a long-term trading strategy. Even when a stock price unexpectedly skyrockets, what goes up must come back down eventually, and short squeezes are usually short-lived.

While you can utilize short squeezes when they pop up, you can minimize your risk and make more money by holding your stocks and taking long positions instead.

The information provided herein is for general informational purposes only and is not intended to provide tax, legal, or investment advice and should not be construed as an offer to sell, a solicitation of an offer to buy, or a recommendation of any security by Candor, its employees and affiliates, or any third-party. Any expressions of opinion or assumptions are for illustrative purposes only and are subject to change without notice. Past performance is not a guarantee of future results and the opinions presented herein should not be viewed as an indicator of future performance. Investing in securities involves risk. Loss of principal is possible.

Third-party data has been obtained from sources we believe to be reliable; however, its accuracy, completeness, or reliability cannot be guaranteed. Candor does not receive compensation to promote or discuss any particular Company; however, Candor, its employees and affiliates, and/or its clients may hold positions in securities of the Companies discussed.