Tax Loss Harvesting Tricks Everyone Should Know

Tax-loss harvesting can be a powerful strategy to offset some of your taxes. An overview of how it works, and the drawbacks and benefits.

Not every investment can be a winner, so here is how intelligent investors turn their weaknesses into strengths via tax savings. Tax-loss harvesting may help you offset some of your taxes with investment losses, thus reducing what you owe.

This article includes everything you need to know about tax-loss harvesting, and how to utilize this strategy.

The Basics

Tax-loss harvesting (TLH) is the process of selling an investment in your portfolio that has lost value in order to offset a capital gains tax or $3,000 of income on a joint tax return for a single year. Unused losses can be carried forward to apply toward future years.

By offsetting a capital gains tax or deferring income taxes, you can reinvest the money you saved into different securities that align with your asset allocation and investment strategy.

Selling an investment

A capital loss occurs when an asset decreases in value. However, a loss is not considered realized for tax purposes until the investment has been sold for a price lower than the original purchase price.

If you sell any investment, the IRS requires that you report the capital gains or losses along with cost basis information: cost basis is what you paid when buying a security as well as any extra costs and fees.

When you sell a security, your tax liability is determined by the cost basis and the price you sell at. If you sell a security for more than the original purchase price, the net gain is taxable as a capital gain.

Offsetting ordinary income

An additional aspect to this strategy is if an investor’s losses are larger than their gains, they can use the remaining losses to offset up to $3,000 of their ordinary taxable income, or $1,500 if you're married, filing separately. Ordinary income is any type of income that’s taxable at ordinary rates. Examples include wages, tips, bonuses, commissions, pensions, interest, and rents.

The end goal of tax loss harvesting is to have less money going towards taxes and to keep more invested. Many financial advisors and wealth managers offer guidance through this strategy.

Capital gains and Capital Losses: Short and Long Term

Holders of securities have the right to sell the stock and realize capital gains, which is an attractive opportunity for investors because they are not tied down to their initial investments.

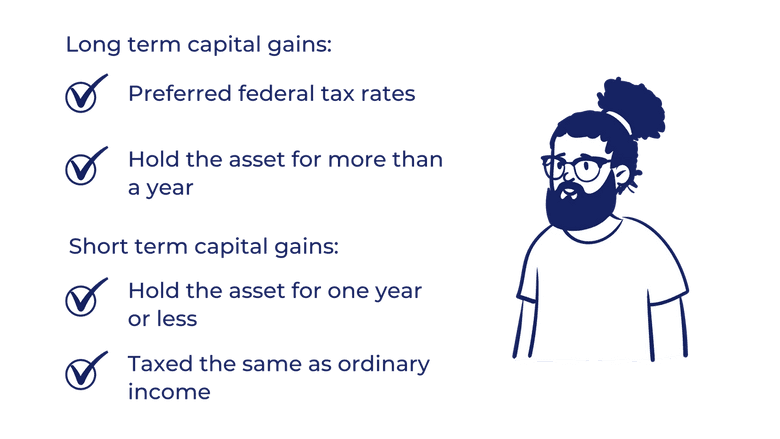

If you hold a financial asset for one year or less, your profit from its sale is treated as a short-term capital gain. If you hold a financial asset for more than a year, the income is treated as a long-term capital gain.

A short-term capital gain is taxed the same as ordinary income. Long-term capital gains qualify for preferred federal tax rates. Below a certain income threshold, preferred federal tax rates can be 0%, and with a higher income, long-term capital gains can be taxed up to 20%. The IRS outlines the capital gains tax rates observed for long-term gains.

In the realm of tax-loss harvesting, long-term losses are applied against long-term gains, and then against short-term gains. Short-term losses are applied first to short-term gains. It takes place in this order because long-term capital gains are taxed at a lower tax rate than short-term capital gains.

Takeaway...

Waiting to hold your assets for the long-term is extremely beneficial to investors who are looking to realize capital gains and capital losses. It is more profitable to realize a long-term capital gain due to the lower tax rate, and realizing long-term losses are more versatile than realizing short-term losses because they can be applied towards long-term and short-term gains.

Examples: How Tax Loss Harvesting Works to Offset Capital Gains and Income Tax

First, let’s look at an example of how investors minimize the impact of taxes by offsetting gains with losses:

- Let’s say you start the year by investing in mutual fund #1 and mutual fund #2.

- Towards the end of the year, you recognize a gain of $10,000 in mutual fund #1, and you recognize a loss of $15,000 in mutual fund #2.

- $10,000 of those $15,000 in capital losses can be used to offset your capital gains so you do not have to pay any short-term capital gains tax rates. $3,000 of the remaining $5,000 can reduce taxes on ordinary income, and the leftover $2,000 can be applied to future capital gains or ordinary income.

To observe the case where you primarily use your capital losses to offset your ordinary income rather than offsetting capital gains:

- Let’s say that you invested $30,000 in a security.

- A year later, the security is only worth $24,000. If you sell all $24,000 of the security, you would realize capital losses of $6,000.

- Now, you would have a $6,000 capital loss on your tax return. You can use $3,000 per year to offset your ordinary income taxes. The exact savings depends on your income tax rate. Let’s say that your federal income tax rate is 24%. To apply the $3,000 to reduce ordinary income, we simply multiply $3,000 by 24%, which yields potential tax savings of up to $720.

- The $3,000 of that loss that was not used gets carried over to the next year. And this continues into perpetuity until your death.

To sum, you can harvest losses to offset gains as well as up to $3,000 in non-investment income.

Both of these examples look at when your losses outweigh your gains, and that is why no capital gains taxes were paid. However, when your net gains are positive, you can still use your capital losses to offset the gains.

Drawbacks and Benefits of Tax-Loss Harvesting

Overall, tax-loss harvesting allows you to take advantage of losses in your portfolio. This section takes a look at the shortcomings as well as the overall benefits of tax-loss harvesting.

Drawbacks

Tax-loss harvesting can be complicated

Tax-loss harvesting can be complicated in practice which is one disadvantage. As an investor, it is crucial to keep track of what securities you have held for over a year to see if they qualify for long-term tax rates.

Your tax-loss harvesting strategy is very dependent on being fully aware of your finances. All of the details associated with tax-loss harvesting can be seen as a disadvantage because not everyone has the time to do the work.

In the next section, I will discuss who can help investors implement a tax-harvesting strategy.

Fewer benefits for those in lower-income tax brackets

Another drawback is that investors in lower-income tax brackets do not benefit as much as those in higher-income tax brackets, due to the sheer nature of the numbers.

The higher your income tax bracket, the bigger your savings. For instance, if you are married filing jointly and you make $622,051 or more in income, your tax rate is 37%. When you offset your income taxes with that tax rate, it yields a higher amount of tax savings.

Benefits

Reducing or eliminating capital gains tax

The primary goal and benefit of tax-loss harvesting is reducing or even eliminating a capital gains tax.

Taking advantage of investments that have declined in value, which is a common temporary occurrence in diversified investment portfolios, increased after-tax investment returns by more than 1.55% according to a study conducted by Wealthfront.

Rebalancing your portfolio

Common thought deems tax-loss harvesting a viable and profitable practice, and many see how tax-loss harvesting and rebalancing one’s portfolio go hand in hand. Rebalancing is the process of adjusting portfolio asset weights to restore target allocations or desired risk levels over time.

Periodic rebalancing allows you to see which of your underperforming investments could be candidates for tax-loss harvesting.

However, before you consider harvesting your losses, the next section outlines some different people and resources that can be helpful.

Who It Is Good For

Overall, tax-loss harvesting may be beneficial for any investor looking to take advantage of a capital loss. However, as mentioned above, investors with higher taxes reap more savings.

When looking for advice before harvesting your losses, there is a slew of advisory services such as financial advisors, tax advisors, and robo-advisors. Financial advisors may do your tax-loss harvesting if it aligns with your investment strategy, so it is not a bad idea to have a conversation asking them what they have done.

If you want to do it yourself, it’s a good idea to consult a tax professional. Wealthfront and Betterment are popular robo-advisors who monitor taxable accounts daily to look for opportunities to harvest losses. The daily monitoring feature within robo-advisors yields value to an investor who is trying to utilize tax-loss harvesting, but does not want to infringe on the wash-sale rule.

Takeaway

Implementing tax-loss harvesting into your investment strategy is a good option to consider. As said before, not every investment can perform well regardless of how “good” of an investor you are.

However, it is important to understand the nuances of tax-loss harvesting before pursuing the strategy. If the process of tax-loss harvesting interferes with your investment goals and asset allocation strategy, then you do not need to force it. Similarly, if the time and energy you need to put into tax-loss harvesting interfere with your personal life, it may not be worth it.

The information provided herein is for general informational purposes only and is not intended to provide tax, legal, or investment advice and should not be construed as an offer to sell, a solicitation of an offer to buy, or a recommendation of any security by Candor, its employees and affiliates, or any third-party. Any expressions of opinion or assumptions are for illustrative purposes only and are subject to change without notice. Past performance is not a guarantee of future results and the opinions presented herein should not be viewed as an indicator of future performance. Investing in securities involves risk. Loss of principal is possible.

Third-party data has been obtained from sources we believe to be reliable; however, its accuracy, completeness, or reliability cannot be guaranteed. Candor does not receive compensation to promote or discuss any particular Company; however, Candor, its employees and affiliates, and/or its clients may hold positions in securities of the Companies discussed.