The Rise of Digital Assets

The top and emerging classes of digital assets: from cryptocurrencies like Bitcoin and Litecoin to non-fungible tokens launched by famous musicians.

Over the past year, digital assets have been making mainstream headlines as the next big thing in the financial world. Take Bitcoin for example. In 2021, Elon Musk announced that you can purchase a Tesla in Bitcoin (he stopped this practice for different reasons but may resume it again), a $22.5 million penthouse in Miami was purchased with Bitcoin, and El Salvador announced intentions to recognize Bitcoin as a legal tender. Bitcoin is just one example of a digital asset.

What Are Digital Assets?

At a high level, the definition of a digital asset is an item that exists virtually, holds some intrinsic value, and is uniquely identifiable. It could be a virtual stake in the ownership of a real asset such as a company or real estate. It can derive its own intrinsic value like bitcoin.

Because a digital asset has value and is verifiable in its authenticity, it is increasingly becoming a method of exchange. For example, some businesses around the world have begun taking cryptocurrencies as forms of payment. Since these currencies have a system behind them that authenticates them, business owners feel comfortable that they will be protected against fraud when accepting these payments.

How Do Digital Assets Work?

Most digital assets are authenticated through a blockchain process. Blockchain technology is basically a system of computers that creates a network that verifies data. Through this process, certain aspects of a digital asset can be verified such as ownership, authenticity, transaction history, and location. Larger blockchain networks are preferred, since a larger network equates to a digital asset becoming more secure. The blockchain process is continuous and constantly verifies the qualities of an asset, cutting out the need for a trusted broker between exchanges.

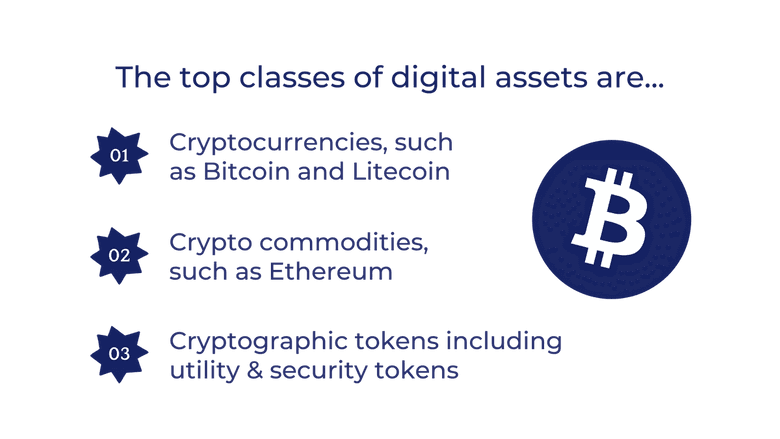

What Are the Top Classes of Digital Assets?

There are many types of digital assets. The top classes are:

1. Cryptocurrencies

Cryptocurrencies are digital currencies that store value and can be used as a unit of exchange. Examples include Bitcoin and Litecoin.

👉 Read Next: What is the Future of Cryptocurrency?

2. Crypto Commodities

Crypto commodities are digital commodities that enable new digital assets to be created. An example is Ethereum which is a standalone cryptocurrency whose blockchain can also be used to create other cryptocurrencies.

3. Cryptographic Tokens

One type of cryptographic token is a utility token which derives value and completes various tasks in a digital ecosystem. An example is the Basic Attention Token (BAT); this token is native to the Brave browser which is running a new advertising model. The model blocks ads, but if a user chooses to view an ad, they are rewarded with a certain amount of BAT. Another example is the Steemit which has the STEEM token; when a user creates high-quality content on their platform, they are rewarded with a portion of a STEEM token.

Another type of cryptographic token is a security token which represents a share of ownership in something (a company, real estate, etc.).

What Are the New Emerging Classes of Digital Assets?

The next big thing in digital assets is likely to be NFTs, or non-fungible tokens. This asset is usually a piece of digital media (a picture, video, or song) that is uniquely owned and authenticated. By definition, non-fungible means that an item is unique and cannot be replicated. For this reason, NFTs have a level of scarcity that helps drive their value up.

Recently many artists have launched NFTs. For example, musical artists like Kings of Leon and Grimes have launched music as NFTs. Holders of the Kings of Leon's NFT have access to exclusive vinyl releases as well as priority when purchasing concert tickets. All of these benefits are in addition to the trading value of the NFT.

The other biggest digital asset class right now is cryptocurrency. An individual unit of cryptocurrency is called a "coin". A coin's price is driven by the supply and demand of the currency. When more retails begin accepting cryptocurrencies as forms of payment, demand increases. The supply of cryptocurrencies changes through a process called mining.

Cryptocurrency mining is the process that introduces new coins into the market. During mining, people use high-powered computers to solve complex puzzles. As a result, a blockchain grows and the person who is mining is rewarded with that blockchain's cryptocurrency. Cryptocurrency mining has been a growing practice with miners filling warehouses with high-tech computers to mine crypto.

What Are the Pieces Around Digital Asset Infrastructure?

With the increasing number of transactions around digital assets, trading platforms have adapted to allow investors to purchase digital assets. For example, in 2021, Venmo and Robinhood started allowing their users to purchase cryptocurrency in their apps. Additionally, Coinbase, a prominent cryptocurrency exchange platform, launched its IPO in April of 2021.

Also, ETFs have begun to track the performance of digital assets. For example, the VanEck Vectors Digital Transformation ETF tracks the performance of the MVIS Global Digital Assets Index, enabling investors to follow digital assets without directly purchasing one.

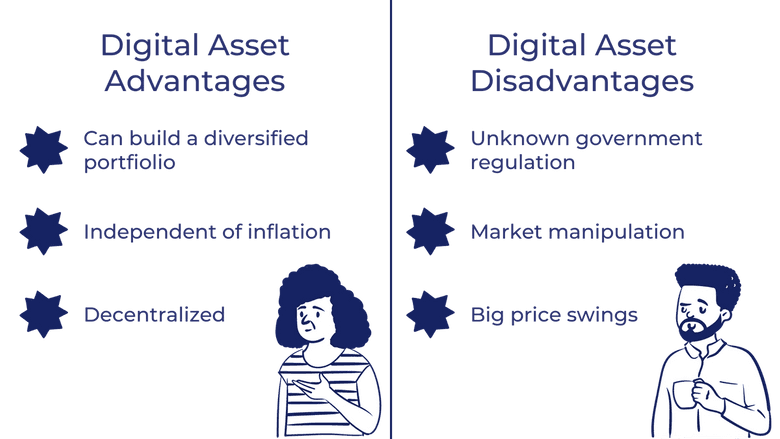

What Are the Advantages and Disadvantages of Digital Assets?

Disadvantages

There are a couple of disadvantages associated with digital assets. First, due to the relatively small size of the markets, there tend to be big swings in the values of these assets. For example, in April 2021, Bitcoin hit an all-time high price per coin of over $63,000. Two months later in June 2021, the price per coin dropped over 50% to around $31,000.

Another disadvantage is market manipulation. The communities around digital assets follow a select number of market leaders.

Another concern about digital assets is unknown government regulatory behavior. Some countries like El Salvador are embracing it, while some countries like China are cracking down on mining practices or banning these assets altogether.

Advantages

One of the greatest advantages of digital assets is that they are decentralized and therefore much less constrained by the financial influences of federal governments. While most assets and currencies are tied to the actions of governments and financial institutions, these assets exist internationally due to their digital nature. Therefore, they mostly depend on market forces.

Another positive benefit of digital assets is that they usually exist independent of inflation. With many countries in Latin America and the Middle East suffering from rapid inflation, digital assets are seen as safe investments that hold value well in comparison to other currencies. Also, they have high levels of liquidity and accessibility.

Third, digital assets are “non-correlated assets”, meaning their performance has little to no correlation to the performance of other investments. As a result, many investors see digital assets as a strong way to diversify their investment portfolios.

Takeaways

- The future of digital assets is uncertain.

- With digital assets gaining traction, governments are now expected to step in and provide some structure/regulation. Some governments, such as El Salvador, are embracing it, while some governments, such as China, are cracking down on it.

- The long-term trajectory will be reliant on how governments and businesses either accept or reject digital assets in the near future.

The information provided herein is for general informational purposes only and is not intended to provide tax, legal, or investment advice and should not be construed as an offer to sell, a solicitation of an offer to buy, or a recommendation of any security by Candor, its employees and affiliates, or any third-party. Any expressions of opinion or assumptions are for illustrative purposes only and are subject to change without notice. Past performance is not a guarantee of future results and the opinions presented herein should not be viewed as an indicator of future performance. Investing in securities involves risk. Loss of principal is possible.

Third-party data has been obtained from sources we believe to be reliable; however, its accuracy, completeness, or reliability cannot be guaranteed. Candor does not receive compensation to promote or discuss any particular Company; however, Candor, its employees and affiliates, and/or its clients may hold positions in securities of the Companies discussed.