Is Crypto Really Taxed?

Everything you should know about cryptocurrency taxes, including 6 ways you can minimize yours.

Cryptocurrency investors may sometimes forget that cryptocurrency can also be taxed. In general, you need to pay a capital gains tax every time you trade cryptocurrencies.

In general, every penny you earn may be taxable, and cryptocurrency is not an exception.

How Do Cryptocurrency Taxes Work?

Any individual who owns and uses cryptocurrency is subject to taxation. A trade of the asset is a taxable event that must be reported, either as a time-dependent capital gain or loss (discussed more below).

When reporting cryptocurrency taxes, specific forms may be required to disclose your trading history other than standard W-2 and 1099 for cryptocurrency. On form 1040, you will be asked whether you have held, traded, sold, and in general profited from virtual currency. A Form 1099-K may also be necessary if you made over 200 trades, or the trading value exceeded $20,000.

Cryptocurrency Tax Rate

How Is It Assessed?

Although cryptocurrencies are said to be as easy to utilize as cash, the IRS considers their profitability. Like your other investment products and real estate, cryptocurrencies are considered as “property” for income tax purposes.

Anything and everything purchased with cryptocurrency is subject to capital gains tax. Whether it’s a long-term or short-term capital gain depends on how long the asset has been held.

Short vs Long Term Capital Gains and Losses

Tax rates and tax deductions on cryptocurrencies vary based on how long you’ve held the asset. Long-term and short-term cryptocurrency investments lead to quite different numbers on your tax report.

A short-term capital gain or loss is recognized if the asset is held for no longer than one calendar year. Short-term capital gains taxes reflect the same tax rate as your income. To verify that number, you can check the tax rate on your paychecks and other forms of income. As of 2021, there are 7 tax brackets declared by the IRS ranging from 10% to 37%.

Long-term capital gains or losses apply to assets held for longer than 365 days without trading actions. Based on your income bracket, a long-term capital gains tax rate could be 0%, 15%, or 20%. Generally speaking, a long-term capital gain results in a higher net profit because the tax rate is much lower. For those in the 10-15% income tax bracket, the 0% tax rate applies. A rate of 15% applies to taxpayers in the 25-35% bracket. Brackets above 35% pay 20% tax on a long-term capital gain.

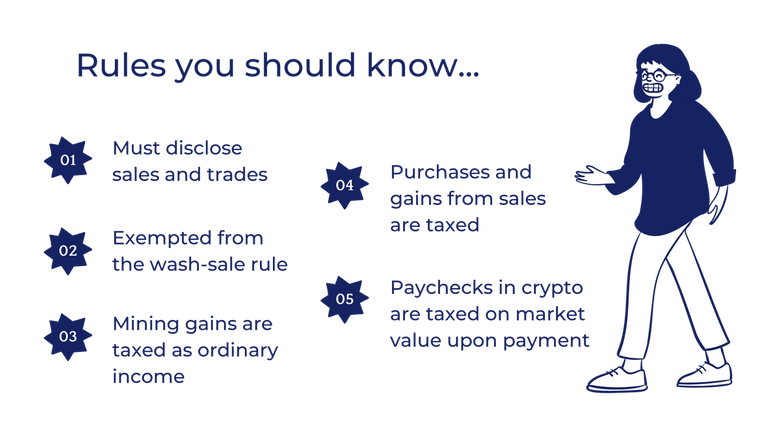

Cryptocurrency Tax Rules

Throughout this article, we have stressed that cryptocurrencies are taxed as property, but this is not the only rule regarding cryptocurrency taxes.

Must disclose trades and exchanges

Selling cryptocurrency results in taxes payable as does simply trading it. When one type of coin is traded for another, you must disclose it on your IRS 8949 form.

Exempted from the wash-sale rule

The wash-sale rule prohibits investors from selling a security at a loss and repurchasing “substantially identical” securities within 30 days for a tax benefit. With every capital loss recognized, taxpayers can file that as tax-deductible.

This rule, luckily, does not apply to the cryptocurrency market. Because cryptocurrencies are not securities, you can sell at a loss and buy them back immediately without losing your right to claim the loss.

Mining gains are taxed as ordinary income

Many people approach coin mining with the hope of making an extra buck rather than viewing it as a hobby. The gain from mining is taxed as ordinary income.

Purchases and gains from sales are taxed

Just being a cryptocurrency user can put tax liability on your shoulders. The obvious scenario is when you buy a good or service with cryptocurrency and its value exceeds the price basis of the coins. In that case, you have received a capital gain.

Put in another scenario, if you bought a car worth $30,000 and later sold it for $31,000, the $1,000 extra you received is the capital gain. It works in the same way with cryptocurrency purchases. When you sell for more than what you purchased, you have a tax liability.

Double-check the current value of the coin before making a purchase with cryptocurrency

Next time you make a purchase with cryptocurrency, it may be wise to double-check the current value of the coin first.

Let’s say I were to pay with cryptocurrency when ordering takeout from a restaurant. The cost basis and price at purchase was $1,200, and the current value of one coin went up to $1,400 at the time I ordered my food. Now I have just purchased a dollar-denominated good with the currency that is worth more in dollars at the time of use.

Paychecks in crypto are taxed on market value upon payment

There isn’t a specification on how wages are paid. Recently, employees have asked their employers to be paid in Bitcoin, Ethereum, Etc. Although it may seem like a smart move to receive your pay in crypto, be aware of the tax consequences.

When you receive cryptocurrency as payment for your labor, the market value of the coins on the day you received them is the income you are taxed on. The price of coins can change drastically between the time you receive the payment and the day you file your taxes, but it will not affect your taxes by any means.

Contractors, freelancers, or any otherwise self-employed worker who receives virtual payments may be required to pay estimated taxes quarterly.

For more governmental information and common questions, the IRS website is a great resource.

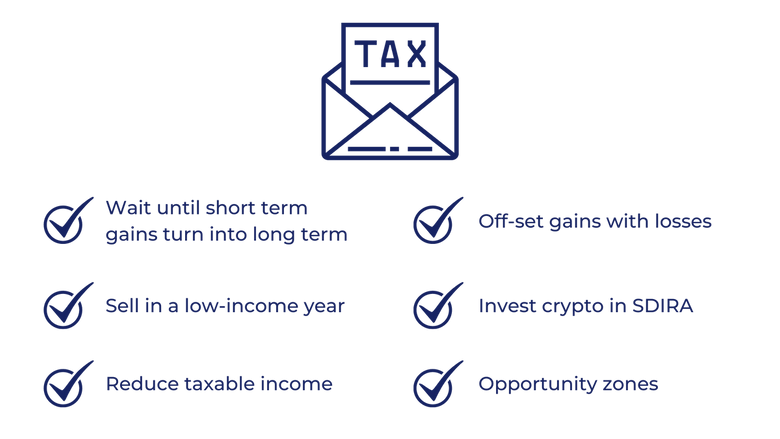

6 Ways to Minimize Cryptocurrency Taxes

1. Wait until short term gains turn into long term

The ideal way to save tax money, in general, is to move to a state without an income tax. Of course, that is not always easy. A good alternative to save taxes on investment gain is to wait 365 days before trading or selling. As we discussed, short-term capital gains are taxed at the same rate as ordinary income which is much higher than long-term gains. Doing so could save lower income bracket investors capital gains taxes entirely.

2. Sell in a low-income year

2020 hit the global economy hard, and many families saw a decrease in total income. When income decreases, you may be eligible to drop down to a lower tax bracket. This can save you money regardless of whether you are benefiting from it in the short term or long term.

3. Reduce taxable income

It’s great to have a big paycheck, but it means income taxes and capital gains taxes are both higher. If it’s a year you plan on actively investing, another trick is to reduce your taxable income. It’s helpful when you are not too far off from the next tax bracket down.

You can take care of a long-waited medical procedure, or put income into traditional IRA and 401(k) plans, etc. You are looking for tax deductions or credits that will lower your taxable income.

4. Off-set gains with losses

Because the wash-sale rule does not apply to cryptocurrency trades, you can keep a record and use it to your advantage. You can subtract total losses on virtual assets you sold from the total cryptocurrency capital gains subjected to taxes.

This strategy is not without its drawbacks:

- The first to note is your losses offset the same type of gain first. Short-term losses offset short-term gains first, and long-term losses first reduce long-term capital gains taxes. If you have more losses still available after offsetting the gains of the same type, you can use them on other kinds of investments or income taxes.

- Second, you are limited to $3,000 of losses to offset your gains. The remaining balance on losses will be rolled forwards to the next year.

5. Invest crypto in SDIRA

SDIRA stands for Self-Directed Individual Retirement Account. Even though trading with SDIRA does not mean you are not liable for the taxes, it does mean you do not have to pay them today.

With SDIRA, you pay taxes upon retirement (when your tax rate may be lower), so the tax money can stay in your account temporarily for you to continuously invest with.

6. Opportunity zones

For high-net-worth investors, a 20% long-term capital gains tax on the unrealized appreciation in cryptocurrency can be a large loss. By rolling over the profit into a Qualified Opportunity Fund (QOF), you can reduce or eliminate the capital gains taxes. The fund will be used to invest in government-identified areas in economic distress.

- Holding your investment in QOF for 5 years, 10% of your initial cryptocurrency capital gains tax will be exempted.

- An additional 5% will be written off if the investment is held for 7 years.

- If the investment is held in the fund for 10 years, the appreciation of QOF stocks would be tax-free in addition to the tax reductions at the 5 and 7-year mark.

The information provided herein is for general informational purposes only and is not intended to provide tax, legal, or investment advice and should not be construed as an offer to sell, a solicitation of an offer to buy, or a recommendation of any security by Candor, its employees and affiliates, or any third-party. Any expressions of opinion or assumptions are for illustrative purposes only and are subject to change without notice. Past performance is not a guarantee of future results and the opinions presented herein should not be viewed as an indicator of future performance. Investing in securities involves risk. Loss of principal is possible.

Third-party data has been obtained from sources we believe to be reliable; however, its accuracy, completeness, or reliability cannot be guaranteed. Candor does not receive compensation to promote or discuss any particular Company; however, Candor, its employees and affiliates, and/or its clients may hold positions in securities of the Companies discussed.