How Risky Are Inverse ETFs?

Inverse ETFs reap the benefits of short selling without the hassle. A breakdown of how they're used, their other benefits, and where to start.

There are many ways to invest one’s money with varying levels of risk, return, and passivity. The most well-known investments are stocks, bonds, and mutual funds.

ETFs, or exchange-traded funds, are much like mutual funds in their makeup: they allow investors to pool their money and invest in an array of underlying stocks, bonds, and other securities under the guidance of a professional money manager. However, ETFs are traded on an exchange like stocks. For example, one can purchase an ETF on the NYSE, the same exchange on which Gamestock stock (Ticker: GME) trades. ETFs are a basket of securities (stocks, bonds, real estate, etc) that track an underlying index, like the S&P 500, and offer greater diversification as a result.

In this article, we'll dive into a particular type of exchange-traded fund: an inverse ETF. Read on to learn what they are and how to use them to your advantage.

Overview of Inverse ETFs

An inverse ETF, also known as a short-ETF or bear-ETF, is an exchange-traded fund that allows an investor to benefit from a decrease in the value of an underlying asset(s).

While owning an ETF would be considered a long position (one thinks the underlying asset will increase in value over time), owning an inverse ETF is a short position (one thinks the underlying asset will decrease in value.)

The price change of an inverse ETF is equal to the opposite percent rise or fall in the price of the underlying asset. For example, if the market falls by two percent, the price of the inverse ETF will increase by two percent (minus broker fees).

Inverse ETFs vs Short Selling

Before further breaking down the features of an inverse ETF, it is important to understand the concept of “shorting” a security, as it is central to an inverse ETF's purpose. A short position, contrary to a long position, is the word given when an investor profits on the decline of an asset.

Short Selling Stocks

With stocks, an investor will borrow a certain number of shares and sell them at the current price under the premise that the price of the shares will be lower in the future, at which point the investor will buy back the shares they sold. This follows the basic form of “buy low, sell high,” but is executed in reverse.

Inverse ETFs

Inverse ETFs, because they have this concept of “shorting” baked-in, allow investors to benefit from this rather advanced trading strategy without the hassle. In the case of an inverse ETF, or any ETF for that matter, no actual buying or selling of an underlying asset (like shares of stock) is accomplished. With an inverse ETF, an investor purchases a basket of derivative securities which represent a short position.

Popular derivatives used in inverse ETFs include futures contracts or options contracts. Derivatives are securities whose value is “derived from” underlying assets. For example, a gold futures contract is based upon the market price of gold. Further, a futures contract forces an investor to purchase or sell some quantity of an underlying asset (gold) at a previously agreed-upon price and date.

ETFs also give inverse exposure to small-cap stocks because they are baskets. Each derivative may have built-in leverage or time period criteria that allow an investor to take a more specific position on an underlying security.

How Inverse ETFs are Used

To Hedge or Speculate in a Portfolio

Investors who own an abundance of stock, commodities, or currencies and are looking to hedge their investments can use inverse ETFs to reduce their portfolio's exposure to risk. Hedging is simply the act of attempting to reduce risk in a portfolio by taking an opposite position in a related security in order to offset losses.

Inverse ETFs are also used for taking speculative positions on a security or market as a whole. An investor can open up uncovered positions with inverse ETFs which usually carry shorter time periods, in hopes to make significant returns.

In Leveraged Form

Adding to their speculative opportunities, inverse ETFs also exist in a leveraged form, which allows investors to double-down on their positions. Like standard leveraged ETFs, leveraged inverse ETFs are made up of derivatives that multiply the returns of an underlying asset.

Instead of an ETF moving on a one-to-one basis according to the rise and fall of the underlying market, leveraged inverse ETFs can boost returns on a 2:1 or even 3:1 basis. For instance, if the S&P 500 falls by 1%, the leveraged inverse ETF will increase by 2 or 3%, depending on one’s preferences. A popular leveraged inverse fund is the ProShares UltraPro Short QQQ (Ticker: SQQQ), which is a bear 3x fund, offering 3:1 return compounding.

In Existing Portfolios

Inverse ETFs can also be used in the context of existing portfolios--and particularly those whose goals are not to “beat the market.”

Portfolios with the purpose of funding retirement plans or charitable organizations may stand to benefit the most from incorporating inverse ETFs. In these cases, inverse ETFs, due to their short nature provide hedging and enhancement of returns, especially in markets with high volatility.

Key Benefits of Inverse ETFs

One characteristic of inverse ETFs that is worth highlighting further is the potential for investors to profit from the decrease in a market without engaging in short selling. There are several drawbacks to short selling:

- Short selling requires investors to open margin accounts with their brokers, in which the brokers lend money to investors.

- Short selling also requires stock loan fees which come as a result of borrowing the shares.

- Fees on short selling are usually higher than what one would expect from buying a stock. If one’s broker cannot find shares to be shorted, do not be surprised if borrowing fees reach four percent.

Inverse ETFs are not only easier to use than short selling, but also less costly.

So we now know several key features of inverse ETFs and how ETFs work: the way profit is determined, how ETFs fit into the context of a financial plan, and some key benefits. But how can you incorporate them into your portfolio?

Where to Start

Some Popular Choices

The most popular and largest inverse ETF by value is the ProShares Short S&P 500 (Ticker: SH) which boasts almost $4 billion in asset value. As one might expect, this fund reflects the inverse of the most widely watched index, the S&P 500. As a result, the ProShares S&P 500 can be a tool for investors who predict a fall of the stock market as a whole, as it tracks the 500 largest US corporations.

Another popular inverse ETF is the MicroSectors FANG+ Index Inverse ETN (GNAF). This fund by MicroSectors moves in the opposite direction of the four largest technology stocks: Facebook (FB), Amazon.com (AMZN), Netflix (NFLX), and Google (GOOG, GOOGL). This fund can be a tool for investors who are looking to play the most volatile sector, and in particular, take a short position on the technology sector. MicroSectors also offers inverse ETFs on the Russell 2000, Nasdaq 100, Dow Jones, and other popular indexes.

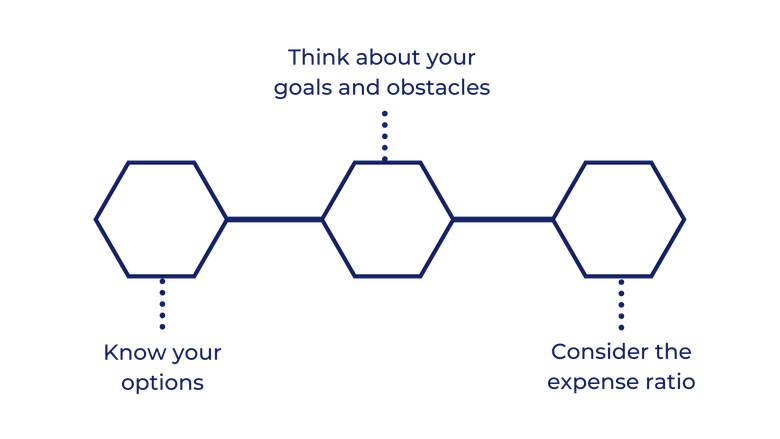

How to Choose the Right Fund

With so many funds offered, it can be intimidating to pick the right one. The two aforementioned funds are some of the largest in the inverse-ETF world, which makes them popular choices. Larger managers such as ProShares, Vanguard, and MicroSectors are also popular starting places as they make all performance data publicly available and understandable for the lay investor.

When it comes to choosing a fund, one should consider their purpose. For example, if an investor has a long-term holding of multiple S&P 500 companies and foresees a temporary dip in price, they could take advantage of the daily ProShares S&P 500; this allows them to maintain their position while hedging themselves against the temporary fall.

The Significance of the Expense Ratio (ER)

In addition to understanding one’s investing goals, an investor should know the expense ratio of their fund, as it is one of the most prominent distinguishing features. An expense ratio is a fee charged to clients that covers the fund’s operating expenses. Operating expenses range from compliance fees, marketing, shareholder services, research, and manager fees.

The expense ratio is expressed as a percentage of the fund’s total net assets. Because of this structure, funds with larger net assets under management will be able to charge a lower expense ratio, while the inverse is true for smaller funds. For instance, ProShares ETFs have an average expense ratio of .87%.

Expense ratios are critical because inverse ETFs usually incur higher fees (due to their short-term nature) which means that the additional cost of a high expense ratio will further eat into one’s profits.

In Conclusion

The tendency toward higher trading fees may give investors pause before investing. In addition, inverse ETFs present a high loss potential if the underlying asset increases in price. Considering that there is no ceiling to a security’s price (as opposed to a floor), this is particularly dangerous as it can lead to infinite losses. To combat this, inverse ETF funds will alert investors when losses get out of hand, in addition to offering stop-loss measures. Inverse ETFs are usually only held for one day, so they are not a popular tool for the passive investor.

Inverse ETFs, whether in their leveraged or unleveraged form, offer investors an opportunity to express their short positions, generate returns in a bear market, or beat index benchmarks. Inverse ETFs are short-term instruments, and investors should expect to purchase new inverse ETFs from their brokerage accounts on a daily basis.

The information provided herein is for general informational purposes only and is not intended to provide tax, legal, or investment advice and should not be construed as an offer to sell, a solicitation of an offer to buy, or a recommendation of any security by Candor, its employees and affiliates, or any third-party. Any expressions of opinion or assumptions are for illustrative purposes only and are subject to change without notice. Past performance is not a guarantee of future results and the opinions presented herein should not be viewed as an indicator of future performance. Investing in securities involves risk. Loss of principal is possible.

Third-party data has been obtained from sources we believe to be reliable; however, its accuracy, completeness, or reliability cannot be guaranteed. Candor does not receive compensation to promote or discuss any particular Company; however, Candor, its employees and affiliates, and/or its clients may hold positions in securities of the Companies discussed.