Understanding Job Relocation Assistance Packages: Taxes, Costs and Options

Understanding taxes, associated costs, and when to negotiate will assure you have an easy move.

You got a job offer in a new city. Congratulations!

You're probably excited, but also a bit stressed-- the new job is great, but it also means you have to pack up your entire life. In addition to the difficulties of moving, you have to worry about finding a new home and jumping into your position relatively quickly.

Luckily for you, many companies in the United States offer relocation services to new employees and it is especially commonplace in tech. These services are designed to help with the stressors that come with moving to a new city, state, or country.

Every company's relocation policy is different. We're here to give you some tips to navigate any employer's policy and give some more detailed insight into the Big 5 Tech Giants.

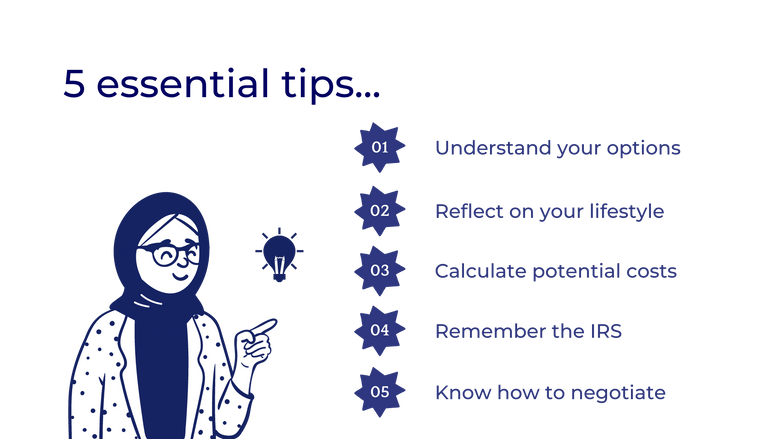

Tips to Easily Navigate Relocation Assistance

#1: Understand your options

Relocation package (best for out-of state movers):

Relocation packages are a bundle of moving-related expenses that your employer opts to cover.

These packages are typically customized based on your level in the company and your overall lifestyle. A basic package will likely include most of these components: hiring a moving company, providing airfare to the new city (and temporary housing when you get there), shipping your car to the new location, and providing storage for the duration of your transition.

Some packages have additional perks such as help selling your current home (or breaking your lease), utility hook-up in your new place, or an allowance to cover unexpected moving expenses.

Lump sum payment:

A lump sum is a one time, predetermined amount of money, provided to help you cover moving costs as you see fit.

If you do not anticipate having many moving costs, this can be the option for you. However, it usually requires that you make all of the above arrangements, from hiring a moving company to finding housing, on your own.

Reimbursement:

Less common in medium to large companies. In this case, you would cover all of the costs up front and your employer would reimburse you.

Beware of two potential obstacles: (1) having to keep track of all your receipts, and (2) the likelihood that an employer will impose a cap on the amount they're willing to reimburse.

#2: Reflect on your lifestyle

Here are a few factors to consider...

How many people are moving with you?

Are you single, married, or do you have a large family? Think about pets too -- some employers cover pet relocation costs in the relocation package.

How many belongings you have?

Are you moving with a couple of suitcases or 20 years worth of furniture and household goods? Keep in mind that the cost of moving belongings will vary based on amount and size, and some employers cap the amount they're willing to transport.

Do you own a home or rent?

Different benefits are provided to owners and renters. Home owners may receive access to a real estate agent, help with closing costs, or a house hunting trip to the new city. Renters often receive more limited benefits, or may be offered a smaller stipend/lump sum.

Account for abnormal costs...

Maybe you have unusual costs involved in your move, like transporting an expensive car collection or a saltwater fish tank (random examples, but you see my point). Consider which option will best cover these costs -- some relocation packages are customizable enough to allow for this, but a cash payment may be best in other cases.

#3: Calculate potential costs

Once you've spent some time reflecting on your lifestyle, you'll have a better idea of how much moving might cost. With this information in mind, look at your options again:

- Examine the benefits a your relocation package provides: how much would each cost you to do on your own? If there's an additional allowance or stipend for unexpected expenses, factor that in too.

- Then, examine your lump sum: is it worth more or less than the value of the relocation package? If you don't spend the entire lump sum, will the company let you keep the cash (hint: many companies do)?

Consider both the raw, cash value and the personal value of each option before making your choice. For example, a taking a lump sum often means that you'll have to orchestrate the move on your own-- is that worth the hassle?

#4: Remember the IRS

The degree to which the company covers relocation benefit taxes is dependent upon policy, your level, and the benefits you choose.

Some companies only cover taxes on packages but not lump sums, some only cover taxes for senior employees, and some don't cover any at all. Every situation is unique, so ask your recruiter or human resources department how taxes will be handled.

In larger tech companies, it's common that some (or most) taxes are covered for you. They often do this by "grossing up", where the company provides additional money to cover the taxes. For example, if you received a $15K lump sum and the taxes were $7K, the company would give you $22K so that you had access to the full $15K (after taxes) for your move.

#5: Know how to negotiate

Yes, these packages are negotiable. Relocation packages are carefully curated to suit your needs. Companies are not trying to screw you over or make moving difficult.

If you believe your job relocation package will not cover your moving expenses, it's perfectly acceptable to reach out to your employer. They may not be fully aware of your situation, or you may have forgotten to mention a key expense you'll encounter during the relocation process. In that case, many employers will hear you out and even provide additional assistance.

Here's an example on how to ask for relocation assistance:

Relocation costs

Hello [Their Name],

I am so excited to join Amazon and move to Seattle! I was looking at the expenses associated with the move and, unfortunately, I don't think $20k will cover it.

Can we go over this again and reassess? Let me know when you're available for a call.

Best,

[Your Name]

However, negotiating just for the sake of it is strongly advised against. For example, if you only want a larger lump sum because you want to keep some extra cash after your move, but the sum adequately covers moving expenses, do not try to negotiate. This will start you out in a dishonest place with your new employer, which could easily lead to difficulties down the line.

Think you might be getting less assistance than you need? Check out our salary negotiation guide (many of the principles can apply) or schedule a consultation with us to see if we can help.

Which Companies Offer Relocation Assistance?

5 Principles for Tech Giants...

- Options: All of the tech giants offer either a lump sum or relocation package option (except for Apple, which offers a sort of hybrid).

- Coverage: All basic packages appear to cover, at the very least, airfare to the new city, a moving service, corporate housing in the new city, shipment of your car, and a rental car until it gets there.

- Variance: All packages vary by level and individual need. Some even vary by positions within the same level. The degree to which they vary is difficult to determine.

- Taxes: All cover some (or most) of the taxes associated with relocation expenses. Check with your relocation consultant or recruiter to determine how taxes will be handled.

- Clawback: Depending in the company and seniority level, there may be a clause in your contract that requires you to pay back relocation assistance if you leave the company quickly (i.e. in 6 months, 1 year, etc). Keep an eye out for this at the big 5, especially since they're giving you such large sums of money.

Company-Specific Policies...

Facebook:

Facebook's standard package provides all of the core moving services (on which they cover taxes) and a "plus budget" for any additional expenses or benefits (on which you pay taxes).

Amazon:

It seems that their taxation is level-dependent: for some, they gross up, while others have to pay taxes out of their lump sum. Overall, they have a reputation for being fairly generous.

Apple:

Apple is quite generous with their relocation assistance. In addition to their standard package (which covers all the basic expenses), they give you one month's salary as a lump sum payment-- rumor has it that it's even grossed up for taxes!

Microsoft:

They have plans for both renters and homeowners and have a basic relocation package, with utility hookup and a relocation allowance added on. Their lump sums are a bit lower than the other tech giants, but their relocation package is solid. Most benefits are grossed up for taxes.

Google:

Google is very generous with their relocation benefits, regardless of the option you choose. Their relocation package works a bit differently. Based on your level and the information you give to their relocation consultants (regarding your lifestyle, family situation, etc), you are allotted a certain number of points. These points are redeemed to pay for relocation expenses of your choice. You will not know how many points you get until after you sign an offer. Most benefits are grossed up for taxes.

The information provided herein is for general informational purposes only and is not intended to provide tax, legal, or investment advice and should not be construed as an offer to sell, a solicitation of an offer to buy, or a recommendation of any security by Candor, its employees and affiliates, or any third-party. Any expressions of opinion or assumptions are for illustrative purposes only and are subject to change without notice. Past performance is not a guarantee of future results and the opinions presented herein should not be viewed as an indicator of future performance. Investing in securities involves risk. Loss of principal is possible.

Third-party data has been obtained from sources we believe to be reliable; however, its accuracy, completeness, or reliability cannot be guaranteed. Candor does not receive compensation to promote or discuss any particular Company; however, Candor, its employees and affiliates, and/or its clients may hold positions in securities of the Companies discussed.