What's a Stock Refresh and Why Should You Care?

Stock refreshers can have a huge impact on your total compensation.

Silicon Valley workers often receive a significant portion of their compensation in company stocks. One engineer at Square collected and anonymously posted thousands of tech employees’ salaries to promote pay transparency, and she found that “the real wealth in Silicon Valley is generated through equity,” particularly at public companies.

In fact, Amazon caps base pay for all employees, including executives, at 160k per year. This means that stock option and RSU (restricted stock unit) packages are a critical factor in an employee’s decision of joining a company, or even staying at one they’ve worked at for years. That includes more than just the initial package offered at sign-on, as many companies will continue to grant equity in the form of refreshers over the years.

👉 Tech compensation can be confusing. Learn more about how to navigate it here.

What Are Refreshers?

The concise definition of a refresher, according to one Quora post, is

“an incremental grant by a company of additional ownership of the company to an employee or other team member who has already received an initial equity grant.”

Most stock option and RSU packages take four years to vest, which means that employees are given their allotment piecemeal over the course of four years. Options and RSUs end up being a very valuable benefit for employees, but total compensation drops after the first four years once employees are fully vested.

In order to avoid this drop-off, many companies will award additional grants over time, usually during an employee’s annual performance review. These refreshers often have a four-year vesting period as well, and they can overlap with grants awarded in previous years.

Why Do Only Some Companies Grant Refreshers?

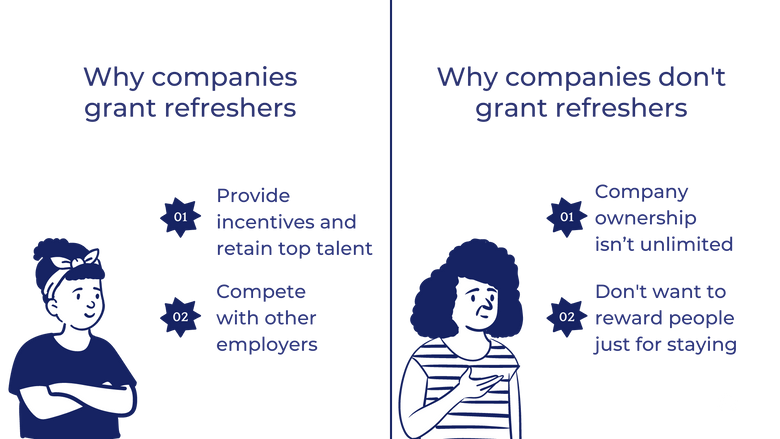

Why companies grant refreshers...

According to an article in Forbes, companies in the 1990s and 2000s only awarded RSU and option grants when employees were first hired. However, because of the steep drop-off in compensation after an initial grant is fully vested, this practice gives many employees little incentive to stay at their company past the four-year mark.

Therefore, in order to retain top talent and compete with other employers, many companies decided to start refreshing these packages later on down the line.

Why companies don’t grant refreshers...

Though widely accepted by some companies, granting refreshers to employees on a regular basis is considered a controversial practice by many others. Many sources advocate instead for granting options or RSUs based on performance, warning against “refreshing equity for the sake of refreshing equity.”

Although the vesting period prevents outstanding shares from being diluted all at once, company ownership isn’t unlimited, and some companies don’t want to give it out just to reward employees for staying at the company.

How Do Different Companies Handle Refreshers?

How it works at startups

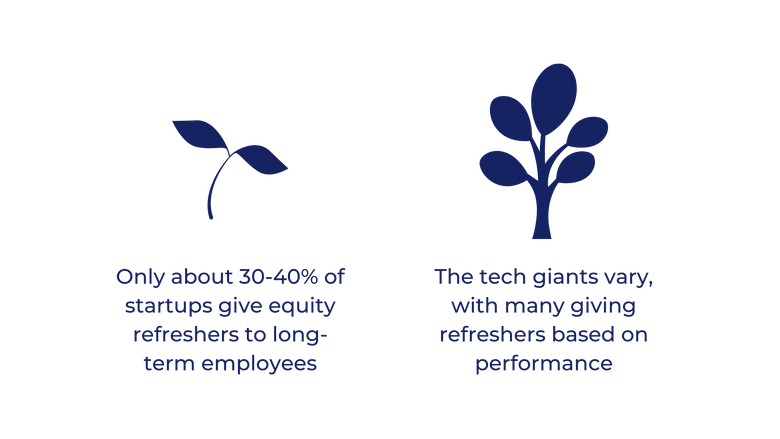

Startups can be especially hesitant to give refreshers, although many do have their own systems in place. One startup adviser estimates that only about 30-40% of startups give equity refreshers to long-term employees. He says that refreshers are especially uncommon in the first few years of operation, when all employees are still in their initial vesting period, and the company may not have a clear compensation plan and equity management system.

Additionally, because employees typically can’t sell shares of a private company (with exceptions), equity doesn’t factor into compensation the same way it would for a public company. Instead, the option or RSU package can be treated as more of a one-time bonus that employees can cash in once the company goes public.

How it works at tech giants

The process of granting refreshers varies widely from company to company.

Meta refreshes RSUs formulaically based on level and performance. Meta is widely known for having the best refreshers in the industry. Engineers at E7 can earn up to $400k in refreshers.

Apple refreshes RSUs based on level, performance, and org. Low performers get no refreshers. Apple refreshers aren't as good as Meta's, but they're better than Google's.

Google bases refreshers on an algorithm that takes into account your last two performance reviews.

Amazon has a more complicated system. They incorporate their refreshers into their total compensation target model. Employees complain that this can leave them with the short end of the stick, as this system takes into account current grants when determining how many grants you’ll receive in the future in order to make sure it doesn’t exceed the promised amount. The calculation also projects 15% stock growth each year, which makes future RSU grants potentially overvalued.

Do your research

Companies aren’t typically very forthcoming about their refresher packages. Even employers with generous refreshers don’t usually mention bonuses or refresh grants in their offer letters. Many tech workers say that refreshers aren’t a given and therefore shouldn’t be expected. At the same time, many believe that a company that doesn’t grant refreshers doesn’t care about retaining its employees for longer than four years (or however long it takes for the initial grant to vest). A Facebook employee on Blind said that if you’re looking for a company that will give you the best refreshers, you should go to the place where you’ll perform the best.

“Equity grants are usually based on performance and the top folks get the top retention,” they said.

However, it still doesn’t hurt to do some research on a company before accepting an offer to make sure you’re not setting yourself up to be short-changed.

👉 Don't think you're being paid what you're worth? Check out our salary negotiation guide.

The information provided herein is for general informational purposes only and is not intended to provide tax, legal, or investment advice and should not be construed as an offer to sell, a solicitation of an offer to buy, or a recommendation of any security by Candor, its employees and affiliates, or any third-party. Any expressions of opinion or assumptions are for illustrative purposes only and are subject to change without notice. Past performance is not a guarantee of future results and the opinions presented herein should not be viewed as an indicator of future performance. Investing in securities involves risk. Loss of principal is possible.

Third-party data has been obtained from sources we believe to be reliable; however, its accuracy, completeness, or reliability cannot be guaranteed. Candor does not receive compensation to promote or discuss any particular Company; however, Candor, its employees and affiliates, and/or its clients may hold positions in securities of the Companies discussed.