How Can You Utilize an Employee Stock Purchase Plan?

Employee stock purchase plans enable employees to purchase company shares at a discount. Learn how to take advantage of this opportunity to maximize your wealth.

One of the employee benefits that your company offers might be an Employee Stock Purchase Plan, also known as an ESPP. This is a compensation tool that allows you to purchase shares of your company’s stock at a discounted price. You can also receive favorable tax treatment on the profits of your ESPP if the shares you buy meet specific requirements.

It may not be clear how your employee stock purchase plan works, or what types of plans are available. Before you opt in or out, you should have a firm understanding of how you can make the most of an ESPP.

How does an ESPP work?

An ESPP allows employees at some publicly traded companies to buy company shares for a discount, usually somewhere from 10% to 15%.

One you enroll in an ESPP, your employer will automatically deduct a portion of your paycheck into it, in the same way that it deducts money into your 401(k). However, your ESPP contributions are after-tax contributions, meaning you have already paid taxes on this money.

Understanding an ESPP can be difficult, as there are many complexities to the plan. Here are some general terms and need-to-know items about your ESPP.

Limits & Eligibility

ESPPs generally do not allow employees who own more than 5% of company stock to participate in the plan. There also may be restrictions on employees who have been employed at the company for less than a year.

Companies may also restrict ESPP contributions, capping at 10-20% of your pre-tax salary, or a definitive dollar limit.

Even if your company doesn't have a monetary cap, the IRS does. According to IRS rules, you cannot purchase more than $25,000 worth of stock through your ESPP each year.

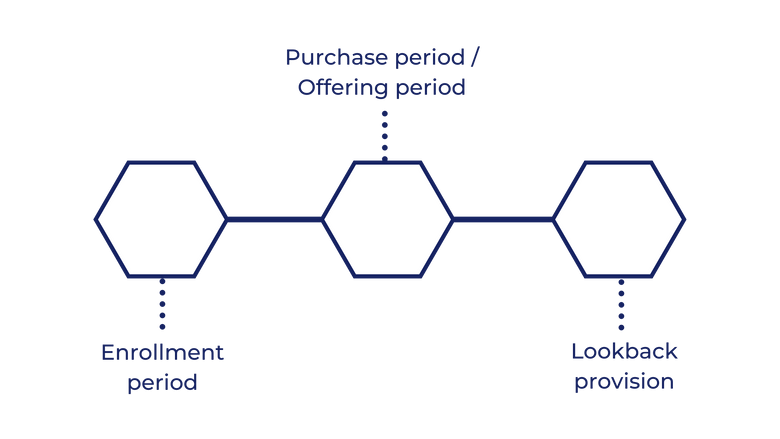

Process Timeline

Enrollment period: The enrollment period for an ESPP usually comes twice per year. Once you enroll in the plan, you decide how much money you want to contribute; you can choose either a fixed dollar amount or a certain percentage of your paycheck.

Purchase period / Offering period: This period is a predetermined length of time where your ESPP contributions are collected. Many companies will allow you to modify your contributions during the purchase period. This period is generally about six months long between purchase dates.

- The first day of the offering period is called the offering date, or grant date

- The last day of the offering period is called the purchase date. On the purchase date specified in your plan, your employer will use the funds collected in the offering period to buy shares of stock on your behalf. The company shares will be available for you at a maximum of 15% of the typical market price.

Lookback provision: If your ESPP includes a lookback provision, that’s good news. It means that you will receive the discount on your purchase price of whichever is lower: the stock value on the first day of the offering period (the offering date) or the final day of the offering period (the purchase date).

- If you have a lookback provision... if the share price goes up during the purchase period, you can make even more money. However, if the price goes down, you can still use the discount at the beginning of the period. Some companies offer lookback periods of 24 months, with six-month purchase periods between them.

- If you do not have a lookback provision... the stock price you pay will be the fair market value on the stock on the purchase date.

Qualified vs Non-qualified Plans

Whether your ESPP is considered qualified or non-qualified is important to know for tax treatment and potential tax consequences. It affects how your stock shares are taxed if you eventually sell them at a profit.

Qualified ESPPs give favorable tax treatment to employees. If you buy stocks through a qualified plan, you won’t owe taxes on the discount at the time of purchase; you only pay when you sell shares, which will be taxed as ordinary income. Qualified plans also require the approval of shareholders, and all plan participants are given equal rights in the plan.

Your tax treatment will also depend on how long you have owned the shares. The sale of your ESPP shares is identified as either a qualifying disposition or disqualifying disposition.

- Qualifying disposition: the final sale of your ESPP shares occurs at least two years after the offer date, and the one year after the purchase date. More of the gain will be taxable as long-term capital gains, and less as ordinary income. This offers taxpayer benefits, as the capital gains tax rates may be lower than the rate of ordinary income tax.

- Disqualifying disposition: anything that doesn’t meet the qualifying criteria. Ordinary income tax will equal the difference between the stock price of the shares on your purchase date and the purchase price. Any additional gain you have will be taxable as short-term or long-term capital gain.

Non-qualified ESPPs, while they can be structured like qualified plans, do not provide you with the same tax benefits, though they are less restricted than a qualified plan. With either type of plan, you can usually sell company shares at any given time; however, the amount of taxes you pay will depend on your plan.

The taxation rules around ESPPs are complicated and specific to your plan documents. Be sure to reach out to financial advisors or tax advisors about any questions regarding your company’s plan.

What are the benefits of an ESPP?

If uses correctly, an ESPP can bring you closer to your financial goals. You will want to strategize the best way to fit an ESPP into your financial planning, and potentially consult financial advisors to see what will work best for you.

One of the obvious benefits of utilizing your ESPP is the discount you get on company shares. If you want to build an investment portfolio but do not have much of your own money to put into the market, an ESPP can be a great way to start.

You can use an ESPP to either save for short-term goals or invest in long-term goals. Selling stock as soon as you receive it can increase your cash flow in the short-term, or you can hold onto it and diversify periodically to make the money compound. Used alongside your 401(k), it can help you accumulate more wealth in the long run.

Should you participate in an ESPP?

As with all stock investments, there is a level of risk involved. The shares you buy might end up going down in value, which has a greater impact when investing in your own company. If you plan to hold stock rather than sell it, there is a concentration risk; if your company’s stock loses value, that’s also where your paycheck comes from. Both your investments and salary could take a hit at the same time.

To minimize risk, there are a few things you can do. Before you dive in, obtain a copy of your plan document for informational purposes before you make any decisions. That way, you know exactly what you can get out of your company’s ESPP. If the plan has generous benefits, like a lookback provision and a high discount, that can help you decide whether or not to go for it.

Additionally, keep your own financial situation in mind. Remember that the money for the ESPP is coming out of your payroll deductions, and ask yourself if you’re willing to sacrifice that part of your paycheck, even if it means that you can make more money later.

If you choose to enroll in an ESPP, make an investment plan and stick with it. You will eventually want to sell some of your ESPP shares and reinvest them elsewhere, making your ESPP only a small part of your portfolio. Therefore, be prepared to start engaging with the stock market to build a diversified portfolio. If you need help, be sure to talk with a financial advisor about your best course of action.

When used correctly, an employee stock purchase plan is a major benefit to participating employees. It can be complex, but as long as you know what your company’s ESPP entails, and are willing to manage it to the best of your ability, you can make a bigger profit with less risk than you normally would investing in stock options.

Which tech companies have ESPP plans?

You get 10% discount on the lowest price of last two years. You can buy with up to 10% of your salary

- Microsoft

Up to 15% of your salary with 10% discount on stock and a $25,000 cap.

- Adobe

15% discount. You can invest a maximum 25% of your paycheck.

The information provided herein is for general informational purposes only and is not intended to provide tax, legal, or investment advice and should not be construed as an offer to sell, a solicitation of an offer to buy, or a recommendation of any security by Candor, its employees and affiliates, or any third-party. Any expressions of opinion or assumptions are for illustrative purposes only and are subject to change without notice. Past performance is not a guarantee of future results and the opinions presented herein should not be viewed as an indicator of future performance. Investing in securities involves risk. Loss of principal is possible.

Third-party data has been obtained from sources we believe to be reliable; however, its accuracy, completeness, or reliability cannot be guaranteed. Candor does not receive compensation to promote or discuss any particular Company; however, Candor, its employees and affiliates, and/or its clients may hold positions in securities of the Companies discussed.