Pricing benefits- the hidden hack to salary negotiation

Candidates who disregard benefits in negotiation can lose $30k or more on Total Comp. Don't leave money on the table.

Want to get the most out of your offer? Then be serious about looking at benefits, not just negotiating salary, equity and bonus. Benefits matter a lot and have massive impact on your take:

If you choose a company with poor lifestyle coverage for you, you will lose part of your income every year paying the gap out of pocket.

You can also make a sub-optimal employer choice that can have a significant cost on your future earnings (think no 401k match offered, for example).

By mapping your lifestyle needs and using that to negotiate your salary offer, you can easily maximize your earning potential beyond basic TC.

How do you find out what benefits companies offer?

If you're already interviewing - just ask the recruiter, they will be happy to share. Make sure you compare benefits between companies apples to apples. Does company X offer student loan repayment help? That's an extra $20k/ year out of your pocket.

Valuing benefits relative to your lifestyle is also important. Some offerings, although generous, may not apply to you at all and just introduce noise. In fact, HR folks are experts at purchasing loads of small benefits that offer little value but signal abundance.

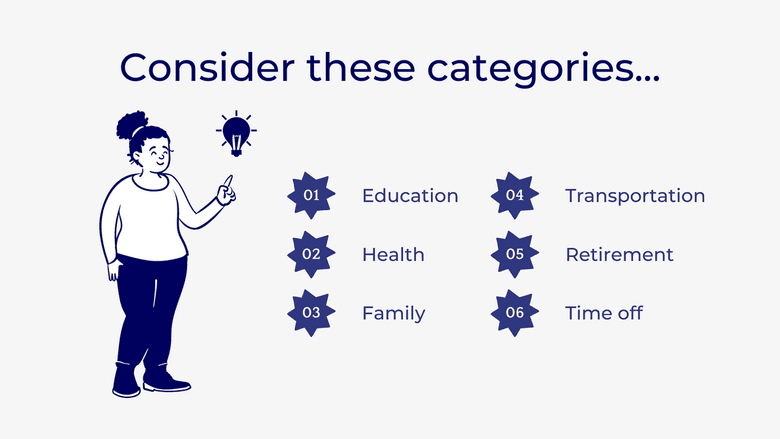

So, what matters to you?

A good place to start is reviewing what benefits really matter to you. Particularly, think about the categories below.

Which benefits should you look at?

Education...

- Do you have student debt? Potential annual savings: $3K Companies like Salesforce offer help paying down your loans my matching your payments or using providers like SoFi to help you consolidate and refi your loans.

- Are you planning on a higher degree or cert? Potential annual savings: $5-12k Google offers up to 12K in reimbursable educational costs, both for job-related and personal enrichment training. Want to learn how to play the ukulele? Google will pay for it. Adobe is next in line with about $11k (Most companies reimburse up tp $5k.).

- Do you have dependents with educational needs? Potential annual savings: $4k Salesforce and Adobe offer college admissions tutoring for your adult children and Adobe offers competitive 529 savings plans through Vanguard as well.

Health...

- How many people do you need to insure under you? Potential annual savings: $6- 12k Market value for reasonable HMO coverage is $6k/ year. Companies like Cisco provide coverage for your whole family for $800/ year. That's $11k in annual savings if you have a spouse and child (or parents) that depend on you for coverage.

- Do you have a chronic medical condition? Potential annual savings: $3k If you have a condition like diabetes, you go through a lot of medical supplies annually + likely pay for some uncovered treatments/ health apps, etc. Health savings accounts offer a triple tax break -- contributions aren’t taxed, the money grows tax-deferred, and it can be used tax-free for eligible medical expenses at any time. Employers like AirBnB seed your HSA with $3k annually - that can be used after you leave the company as well.

- How important is mental health coverage for you? Potential annual savings: $5k This is a benefit to look out for - biweekly therapy sessions can add up to a serious expense quickly. Many employers say they provide coverage through an EAP ( which is generally completely useless and heavily restricted on who you can see) or through their HMO (ultra restricted and usually more clinically focused therapy). But companies like Paypal offer counseling through a dedicated provider and that's a real competitive benefit that few companies provision.

- Do you have any gym, fitness, etc memberships? Potential annual savings: $1k We love he gym, we just hate paying for it. But worry not - Asana has free yoga on site, Facebook offers $720/ year wellness stipend. LinkedIn lets you use $2000/ year PerkUp credits towards wellness, Google, Genentech and LinkedIn have sports facilities on site.

Family...

- Do you plan to start a family/ have children? Potential overall savings: $20-100K OK, this is a major thing to look into if you're even remotely thinking about fertility - whether you're freezing your eggs, plan to adopt or plan on having your own children. Facebook and LinkedIn provide up to $100k through Progyny, other companies average $20k. Guess there the difference will come from? Your pocket. Pick employers wisely if this is on the horizon for you.

- Do you have parents who depend on you? Potential overall savings: $10- 20k Most of us in our 20s don't think about this, but if you're older or your parents are older, this is a large out of pocket expense. Being able to insure them as your dependents can save you up to $12k/ year and you can also shoot for a company that offers elder care benefits like Netflix or Google - they will offer 10 days of backup care/year. Lastly, having a company that will be flexible with you working from home and not having to use sick days or a leave to care for your parents is a major relief and can stave off you needing a nurse, assistant or other in-home care.

- How do you handle family leave and childcare? Potential overall savings: $20k It's 2019 but that doesn't mean all companies offer progressive parental leave. If you're trans or non-binary especially, please get the DL ahead of time. The variance in this area is massive - Salesforce offers 26 fully paid weeks and a gradual return to work schedule, other companies offer as little as 6 weeks (for a secondary parent) or don't fully pay time off. There are also restrictions on when you have the child to qualify. At Amazon for instance, some benefits are not available unless you've worked a year there. Childcare is also a major expense- some employers offer Bright Horizons backup or subsidized childcare, some have it onsite and others, like Facebook, offer stipends ($3k baby cash bonus and $4k/ year daycare subsidy).

Transportation...

- How far do you live from work? Potential annual savings: $2k This is about time/ convenience as well as cost. Netflix will pay for Lyft/Uber to and from work and in some cases even for your relocation closer to work, if it significantly affects your commute. Other companies provide shuttles, clipper cash and, on the lower end - just a pre-tax discount. If your commute is long, this is something to think about.

Retirement & Investing...

- How much investing do you do? Potential savings: Varies Remember that not all companies offer ESPP (Amazon famously does not) and not all companies match 401k (we're looking @ you, Lyft, Uber and Pinterest). In some cases, even when it is offered, it's restrictive - Amazon will do a clawback if you leave before 3 years. Read the fine print and don't be afraid to discuss this in detail with your recruiter. This is a major part of compensation that we often ignore and can result in significant loss of future earnings.

Time Off...

- How much does WLB matter? Potential savings: Sanity There is a major difference between a company where you will do your best work and a place where you will be resting and vesting. Negotiate your salary accordingly. Highly competitive jobs where you will be constantly on call can afford to pay you what you're worth.

- Do you have/ need unlimited time off? Potential savings: Instagram popularity Do you travel a lot? Expedia, Capital One and AirBnB have travel perks and cash you can use towards your best trip.

In a nutshell, don't discount the value of benefits. Many of us do early in our careers but if you take some time to map out your lifestyle needs, you'll be in a position to negotiate a much better TC offer. Remember that if an employer does not offer the benefit, you can ask for a cash equivalent in your negotiation.

Don't leave money on the table.

The information provided herein is for general informational purposes only and is not intended to provide tax, legal, or investment advice and should not be construed as an offer to sell, a solicitation of an offer to buy, or a recommendation of any security by Candor, its employees and affiliates, or any third-party. Any expressions of opinion or assumptions are for illustrative purposes only and are subject to change without notice. Past performance is not a guarantee of future results and the opinions presented herein should not be viewed as an indicator of future performance. Investing in securities involves risk. Loss of principal is possible.

Third-party data has been obtained from sources we believe to be reliable; however, its accuracy, completeness, or reliability cannot be guaranteed. Candor does not receive compensation to promote or discuss any particular Company; however, Candor, its employees and affiliates, and/or its clients may hold positions in securities of the Companies discussed.