5 Ways to Get Into Venture Capital

Learn about the five different ways a tech employee can become a venture capitalist, their benefits and pitfalls, and VC success stories.

Have you ever wondered how to break into venture capitalism? New companies, especially tech startups, are always on the lookout to jumpstart their business with capital provided by venture capitalists, or VCs. A venture capitalist is a private equity investor that provides capital to companies with high growth potential in exchange for an equity stake.

Venture capitalists look for startups in early stages, or pre-IPO. IPO stands for initial public offering, which means that venture capitalists are investing before the company begins to raise capital from public investors. VCs buy a stake before the company goes public, hoping for a strong return on investment (ROI).

If you’re a tech employee, how do you begin a full-time career path as a venture capitalist and find success? This article will detail the five most common paths to become a VC, along with the top VCs that saw high rates of return and success.

What Is a Venture Capitalist?

You don’t necessarily need a massive bank account to begin a career as a venture capitalist. Beginning VCs come from many backgrounds, and most commonly they are former investment bankers, financial advisors, technical business processors, research analysts, academics, or entrepreneurs.

The difference between venture capitalists and other investors is that VCs deploy third-party assets to improve the efficacy of a young, early stage company with a high upside. Private equity firms are interested in cash flow, profit, and other metrics of improving a company’s bottom line.

Venture capitalists can work as employees of larger venture capital firms or for smaller, more independent VC firms. However, younger firms have to prove themselves before they can get access to most third-party funds, and often lack the necessary expertise and experience.

The Necessary Skill Set

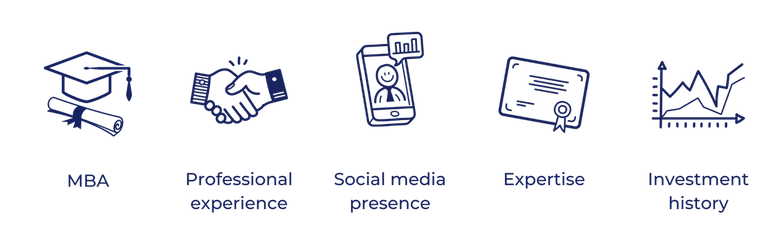

Venture capitalism is a highly competitive industry where professional experience is key. Without a strong track record, you won’t get very far as a VC. Here are some helpful traits to have as a future venture capitalist:

- MBA: Attending business school can be incredibly important in this industry. Over half of venture capitalists have an MBA, and many of those MBAs come from Harvard or Stanford.

- Professional experience: It’s helpful to have experience working for a reputable firm in technology, consulting, investment banking, media, or a startup.

- Social media presence: A strong presence on platforms like LinkedIn and Twitter can help you make connections in the industry. Make sure you keep up with VC blogs and technology news sites as well.

- Expertise: If you have expertise in a certain area of technology, that can give you an edge. You could also bring industry expertise for a specific field like healthcare.

- Investment history: Show success in your own investment portfolio before you make it a full-time job.

If you think you have what it takes to make it in the venture capitalist industry, then keep reading for the five different ways to start your path toward becoming a top VC.

#1: Become an Angel Investor

An angel investor is someone who invests in small startups or entrepreneurs, either as seed money or for growing an existing business. Angel investors put their own money into entrepreneurs’ new companies for a return on investment (ROI).

Angels have ownership within the business, and the right to make company decisions. They frequently have some financial or technical expertise that helps qualify them to make smart business choices that help grow the startup.

Most experts recommend that up to 10% of your investment portfolio can go to angel investments. If you are not independently wealthy, you can also invest on a smaller scale. However, it’s important to remember that the smaller your investment is, the smaller your share and your profits will be. You’re also going to be investing in the early stages of a startup before it’s clear if the business will succeed or not.

Angel investors often need to be accredited investors, which means they have an annual income that exceeds $200,000, or a joint income of $300,000, for the past two years, or someone with a net worth that exceeds $1 million dollars.

Angel investments can be very risky; at least 50 percent of angel investments lose some, or even all, of their money.

Pros of angel investing:

- High return: Angel investing can be the most lucrative investment option.

- Shaping a company: If you commit a large angel investment, you can hold a significant portion of ownership, and you can make decisions about the company’s future.

- Diversification in your portfolio: An angel investment can shake up your usual combination of stocks, bonds, and ETFs.

Cons of angel investing:

- High chance of failure: Although you can make a lot of money as an angel investor, it’s equally likely that you will lose everything if the company underperforms, or goes under like many new startups.

- It’s an investment, not a loan: Angel investments are great for new companies because it’s not money they’re required to pay back. You bought part of the business, which means that if it fails, there’s no legal recourse to get your money back.

Success story: Peter Thiel

Peter Thiel invested $500,000 in Facebook in 2004, prior to when Facebook went public. Although he has now sold 80% of his shares, that initial $500,000 would be worth $10 billion today.

It’s important to remember that angels have to use their own net worth to invest in companies, not a third party’s. Although you don’t have to be incredibly wealthy to be an angel investor, it might not be accessible early in your career.

If angel investing still sounds like a viable option for you, look at websites like Angel List and Angel Investment Network to get a sense of what businesses are looking for angels to swoop in and invest. You can also search LinkedIn to find interested startups and other companies.

#2: Invest in a Rolling Fund

A rolling fund is a type of investment vehicle that allows its managers to share deal flow with fund investors on a quarterly subscription basis while netting carried interest over a period of multiple years.

At the end of each quarterly investment period, a new fund is offered on the same terms, for as long as the rolling fund continues to operate. This structure allows rolling funds to remain open to new investors and be publicly marketable.

Angel List now has an early-access program for rolling venture funds available for investors to use with many financial services offered.

Limited partnerships, or LPs, require that you make a capital contribution to the next quarterly fund, or the beginning of the next quarterly investment periods. Fund managers set the specific terms and investment details, which can be as low as $1,000 per quarter for some funds.

They may include a minimum subscription period, or a requirement for four quarters of capital contributions. Once LPs meet the minimum, they can modify or cancel their subscription.

Benefits of rolling funds:

- Simplicity: Rolling funds can be an easy way to invest in startups without a major monetary commitment, and provide access to deal flow.

- Diversification: Rolling funds are an asset class that the typical investment portfolio typically includes.

- Single investment: A rolling fund offers the accessibility to “roll up” to capture all of a general partner’s deal flow in a single investment.

- More agile: Traditional venture capitalism secures funding in the early stages of a startup. Once an early-stage fundraising goal is met, the startup doesn’t raise funds again for many years. However, with a rolling fund, funds can be raised and distributed much faster.

- Less commitment: Other than meeting the minimum subscription period, investors can leave and come back, or just invest for a single quarter.

Success story: Immad Akhund

Immad Akhund launched his own rolling fund, a $10,000+ quarterly subscription fund. He’s one of many company owners who are running funds alongside their companies. Many founders and CEOs have their own rolling funds on Angel List.

#3: Become a VC

Venture capital firms, whether large or small, have a limited number of positions for junior-level VCs, or associates, available. The role that these full-time employees play in the company will differ depending on the firm’s investment stage, industry focus, and strategy.

Look out for the following in your job search:

- Investing stage: The firm may be interested only in early-stage or late-stage investments, or be looking for growth equity.

- Industry focus: The firm may be oriented toward tech startups, fintechs, life sciences, or something more industry-specific like healthcare.

- Strategy: The firm may focus on portfolio companies, finding new investments, or doing industry research. They also could find new investments in many ways, including outbound marketing, referrals, or something data-driven.

Your job search will be relegated to specific cities, particularly on the east or west coast of the United States. VC jobs are not plentiful, as they are flat partnerships with fixed budgets based on assets under management, so new hires reduce the earnings of the higher-level partners. It’s also an incredibly popular industry with stiff competition.

The venture capital recruiting process is unstructured, and you have to be proactive in making contacts and getting referrals. LinkedIn and other professional tools can help you make connections.

VC interviews have questions similar to interviews in sectors like corporate development or investment banking, but the focus and distribution of the questions are very different. VCs are more interested in your market views and investment ideas than technical questions, along with getting a sense of if you’ll be a good fit with the team.

To make a good impression on VC firms, make sure you stay up to date with the industry by sourcing. Subscribe to newsletters or podcasts that provide helpful information about venture capitalism; try to spot emerging trends across business and tech news with websites like TechCrunch.

You should also create an investment thesis, which is a reasoned argument for a particular investment strategy backed up by research and analysis. Be prepared to discuss your investment thesis with the companies you reach out to, or if you manage to secure an interview with them.

Success story: Bill Gurley

Bill Gurley began working at Benchmark in 1999 after working as a technology analyst. In 2017, the New York Times listed him as the top venture capitalist worldwide. He invested in companies including GrubHub, OpenTable, and Zillow.

#4: Become an Entrepreneur in Residence (EIR)

An entrepreneur in residence is a short-term position where an experienced entrepreneur is hosted by a VC fund as a consultant in a business setting. Typically a subject matter expert, an EIR is hired to work in a company, community, or country where their expertise can be used to help an organization achieve its goals.

Benefits of being an EIR:

- Exposure: As an EIR, you get exposed to many early-stage companies, founders, and other employees. This can be a great opportunity for sourcing and networking.

- VC fund insight: If you’re sponsored by a VC fund, you can get a first-hand look at what they decide to invest in and what the due diligence process looks like.

- Reputation: You can build your reputation as an EIR and hope that a VC firm takes notice when they’re looking to fill leadership positions at portfolio companies.

EIRs are useful for VC firms and startups because they’re very low risk and benefit everyone involved. The insight and support that EIRs provide help businesses make better choices that lead to high growth and a higher ROI.

Success story

The best option for possible EIRs is to find an already successful and established EIR program. Some of the most highly regarded programs include Cisco, BCG DV Torque, Google for Entrepreneurs CODE2040, HHS Idea Lab, San Francisco Startup in Residence, and Target.

#5: Start Your Own Venture Capital Fund

Once you have a strong track record and industry experience, you might decide to start your own VC fund. Beginners don't start with their own fund, but it can be an eventual goal; you typically need to find success in smaller scale investments first, whether it’s angel investments or rolling funds.

It’s difficult, but not impossible, to start your own VC fund without being independently wealthy. Often, the people and institutions that invest in VC funds want fund managers to contribute 2-3% of the fund’s total assets, which doesn’t sound like much but will likely be millions of dollars.

If you’re attempting to start a VC fund of your own, you may want to try to find limited partners (LPs) that will accept less than 2-3%, or even less than 1% of your own funds. It will limit your options, but investors are more likely to be flexible now than ten years ago. You can also look to offset your management fees.

Raising money for a VC fund, regardless of how you do it, will take a lot of time, and is much more difficult than raising money for a startup. It’s important to remember that you will almost certainly not be making much money right away; venture capitalism is a long game, not a short one.

Success story: Jason Lemkin

Jason Lemkin closed his debut venture fund, SaaStr Fund, with $70 million. Lemkin got his start blogging on Quora, and eventually created a website with SaaS tips and news.

The Bottom Line

Venture capital is a tough business to get into, and it’s even tougher to succeed. Venture capitalism is a very small industry with few job opportunities, and it's also incredibly competitive.

However, if you have a real passion for the industry and have had some success so far with your investments, these 5 options provide different career paths to get you there.

The information provided herein is for general informational purposes only and is not intended to provide tax, legal, or investment advice and should not be construed as an offer to sell, a solicitation of an offer to buy, or a recommendation of any security by Candor, its employees and affiliates, or any third-party. Any expressions of opinion or assumptions are for illustrative purposes only and are subject to change without notice. Past performance is not a guarantee of future results and the opinions presented herein should not be viewed as an indicator of future performance. Investing in securities involves risk. Loss of principal is possible.

Third-party data has been obtained from sources we believe to be reliable; however, its accuracy, completeness, or reliability cannot be guaranteed. Candor does not receive compensation to promote or discuss any particular Company; however, Candor, its employees and affiliates, and/or its clients may hold positions in securities of the Companies discussed.