Alternative Investments: A How-To Guide

The top 10 alternative investments you absolutely need to know and their pros and cons.

If you’re looking for an investment to diversify your portfolio without the stock market's volatility, one option is alternative investments.

Also called alternatives or alts, alternative investments are any investments made in asset classes outside of the traditional investments of stocks, bonds, and cash. They might include tangible assets for individual investors like art or precious metals, or they might include financial assets from a larger institution with a tolerance for illiquidity, like real estate and venture capital.

Alternative investments can be a meaningful way to provide diversification to your investment portfolio, with their own risks and rewards. Because alternatives have a low correlation to traditional investments, they provide diversification and return profiles that often differ from traditional asset classes.

This article will cover the following topics:

- Traditional Asset Classes vs. Alternative Investments

- Top 10 Alternative Investments

- Pros and Cons of Alternative Investments

- Top Alternative Investment Strategies

- Where Are Alternative Investments Bought, and by Whom?

Traditional Asset Classes vs. Alternative Investments

Alternative investments are not traded on public markets like Dow Jones or NASDAQ. They are traded through exclusive channels including hedge funds, wealth management firms, and accredited investors with high net worths.

Because they are not traded publicly, there is less transparency around pricing for alternative investments, as well as less liquidity. It can be more difficult to observe how alternative investments are performing as opposed to stocks and bonds that you can look up on the stock market, and they can often be harder to sell than investments in traditional asset classes as well.

However, alternative investments are not tied to the stock market’s volatility, and will be far less affected by a decline in the traditional market. Alts have a low correlation to stocks, bonds, and other traditional asset classes.

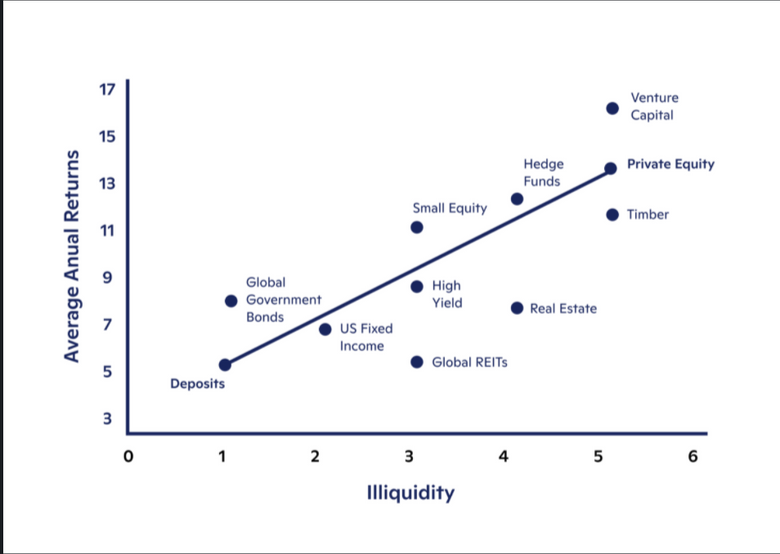

Alternatives tend to have higher returns than traditional investments as well. They are often illiquid, and have more complex investment structures and risk-return profiles. Alts also have longer lock-up periods; their shares and interests cannot be redeemed or sold on a regular basis, which allows for exposure to assets with less liquidity.

There also tends to be higher minimum investments for alternatives than traditional assets.

Top 10 Types of Alternative Investments

There are numerous possible alternatives to invest in, and individual investors should do their own research into what alternative assets might work best with their finances, knowledge, and experience. However, here are ten of the most popular types of alternative investments to consider:

1. Real Estate

Real estate is one of the most popular investments because it appreciates over time, and provides a bigger return on investment when you decide to sell it. Real estate is inflation-protected, so it helps you diversify your investment portfolio, and can come with tax benefits as well. Real estate can include publicly listed or private real estate, including private real estate investment trusts (REITs), along with private commercial real estate debt. Different types of real estate have different sources of appreciation, so make sure to do further research before you make a real estate investment.

2. Private Mortgages

A private mortgage is a loan provided to a real estate owner over a length of time specified in a contract, usually 1-5 years. Private mortgages are considered low-risk because loans are typically made at 60-70% of the property’s market value.

3. Private Company Equity

Investing in private equity funds from smaller companies allows investors to get involved in the business of a company much more so than investing in a public company, and without the competition. Investors in private equity also tend to be significant early-stage investors, and can help influence decisions to pay off their investment in the long run. However, private companies are not held to the same standards for transparency as public companies, and should be thoroughly researched.

4. Farmland

Like real estate, farmland appreciates in value over time. You can also lease or sharecrop farmland in order to generate higher returns. Farmland takes about five years to start seeing a profit, and is therefore a longer-term investment. Because it is a niche market, find an investment manager who specializes in farmland or ranching.

5. Artwork and Collectibles

Collectibles can include a wide range of real assets, including stamps, coins, wine, or antiques. This type of investment requires a high level of knowledge, as it is difficult to predict how the market price of art and collectibles will change or grow with time. They are also an illiquid investment, and likelier than most asset classes to lose value.

6. Timberland

Investing in forest growth or timberland allows you to contribute to better site conditions and tree management, and generates a profit when the trees are harvested. Timberland is considered to be a solid investment, as the demand for timber is expected to continue, and has a low correlation with the stock market.

7. Private Equity

Private equity requires acquiring a company, and therefore makes the most sense for investors with a high net worth and income. These investors have an active role in the growth and change of a company; they invest growth capital into startups and other new businesses to accelerate their growth. Typically, once acquired, the business is restructured to increase profit and then sold on the market.

👉 Read Next: Investing in Private Equity

8. Venture Capital

Venture capitalists pledge an investment to a small company or startup that has long-term potential, in exchange for equity. The difference between private equity and venture capital is that with private equity, investors tend to buy and sell quickly, while venture capital is a longer-term investment. Venture capitalists also tend to be high-net-worth individuals or even institutional investors that carefully monitor the progress of their companies.

9. Hedge Funds

A hedge fund uses money pooled together from accredited investors in order to generate higher returns for their investors, as well as absorb their losses. Hedge funds can invest in any of the other investments on this list, and many others, but the actual investment is made by a professional whose job it is to understand the market and what is likely to succeed. While they can be very successful, many hedge funds are blind pools, so individual investors will not be aware of how their money is being used. Some strategies that hedge funds utilize might include:

- Alternative risk premia: These investment strategies deliver higher returns by earning a premium through exposure to exploitable risk factors. They leverage long and short positions within traditional asset classes.

- Managed futures: These investment strategies use quantitative signals to define when securities are trending. The signals compare the current price of an asset to its trailing moving average, and make investments based on how each asset is trending.

- Global macro: Global macro invests across asset classes and global markets, taking into consideration both relative value and directional positions. This is based on economic and political analysis, with the employment of computer models to predict and evaluate market movement.

👉 Read next: Top Hedge Funds in the US by 2020 Profits

10. Commodities

Commodities include tangible assets such as precious metals, crops, or livestock. “Soft” commodities, or commodities that cannot be stored for long periods of time, include food items like sugarcane and coffee, along with cotton.

You can buy and sell commodities on the stock market or through derivatives like futures and options.

Other Options

Other types of alternative investments to look into include tax liens, structured settlements, equipment leasing, oil and gas LPs, fund of funds, trade finance, marine finance, litigation funding, film, aviation, franchise, distressed debt, intellectual property, mezzanine debt, liquid alternatives, and structured notes.

Pros and Cons of Alternative Investments

Drawbacks and Risks

Potential drawbacks of alternative investments stem from how complex they are, along with the higher fees that are associated with them. Private equity funds are also generally illiquid and can be difficult to value, so it is challenging to offer them in defined contribution plans, which provide liquidity and daily prices to plan participants.

While private equity firms are looking to offset this by offering private equity exposure via target-date funds and collective investment trusts, alternatives are still more volatile than traditional asset classes. There is also a general lack of transparency around alternatives because they are offered almost exclusively through private channels.

The liquidity risk of alternatives is that individual investors are less able to sell your financial assets when they wish to, especially at a fair market price. Liquidity risk can be affected by many factors, especially in real estate where new mortgages might be harder to access or there are more foreclosures than usual.

Another meaningful risk with alternatives is their loan-to-value ratio, or LTV. This is the ratio of a loan to the value of the financed asset; when a loan is at or near an asset’s appraised value, its LTV is considered high. High LTVs, which are common with alternatives, have a higher chance that their sale amount will not be enough to cover the outstanding principal loan balance.

Alts also have a higher default risk than traditional investments, or the risk that the borrower will not be able to pay back the interest and principal of a loan. Principal loss is more likely with alternative investments; this is when a lender doesn’t get back some or all of the principal balance that they originally invested.

There is also a concentration risk if an individual investor puts too much of their investment portfolio into one particular industry, which can be offset with diversification.

Due to their complex structure, there will also be more uncertainty in timing when investing alternatives. With event-based payments like litigation finance, a case may settle before or after your expected payout date. While this is more inconvenient than a meaningful loss, it is less predictable than other investments. Many investors may leverage this risk to increase their investment yield, rather than take a principal loss.

Payment frequency may also affect alternative investments most closely tied to assets, with unexpected increases or early payments being more likely.

Advantages

On the benefits side of things, alternative investments can be a good way to diversify your investment portfolio, and they reduce your exposure to the stock market. You can also utilize your retirement accounts like your IRA, which is tax-efficient. Most alternative investments are allowed for retirement account investments, with the notable exception of collectibles and some others.

Alternatives allow you to invest in niche projects, including startups, or within industries like film or aviation, which means you can contribute to a business you care about and get involved in companies with missions you want to support.

Alternatives are so diverse in their scope that your returns overall will have a low correlation with the stock market or bond market. The broadest possible definition of alternatives also includes some exchange-traded funds (ETFs) and mutual funds that use hedge fund strategies to minimize risk.

In conclusion...

Keeping in mind both the positives and negatives of alternatives, it would be helpful, especially for early-stage investors and those just dipping their toes in alternatives, to use them in order to diversify their portfolio rather than making alternatives their central investment strategy.

As with most investments, whether traditional or alternative, the higher the risk, the higher the reward. Good investment management is key to making certain that you utilize alts correctly and to your benefit, so make sure to do your due diligence and seek advice from reputable investment managers and advisors before you add alternatives to your investment portfolio.

Do You Know About the Top Alternative Investment Strategies?

When considering your investment strategies before putting your money into alternative investments, there are three categories that the investment could fall into:

- Income: An income investment provides a cash-on-cash return, such as a franchise.

- Growth: A growth investment involves investing in goods or commodities that could have a large price appreciation, but do not generate their own income. This includes collectibles such as art or wine.

- Balance: A balance investment provides both income and growth, such as real estate.

Diversification is key to your investment portfolio, and that is also true within the realm of alternative investments. Balancing between these three possible types of alts can help you make the most money with the least amount of risk.

Where Are Alternative Investments Bought, and by Whom?

Alternative investments tend to be purchased through private, exclusive channels such as hedge funds or venture capital.

Traditionally, alternative investments were only available to high net worth individuals, as they are the only people who can qualify as accredited investors.

👉 Read about accredited investors here: Accredited Investor vs. Qualified Purchaser: What’s the Difference?

You can read more about the Fair Investment Opportunities for Professional Experts Act here.

However, alternatives definitely are not well-suited to all investors; they have a unique risk-return profile and can have far more complex investment characteristics than traditional investments, along with a lack of transparency once you start investing outside of the public market. Alternatives are best-suited for sophisticated investors, especially those with a high net worth who can risk losing more money.

The information provided herein is for general informational purposes only and is not intended to provide tax, legal, or investment advice and should not be construed as an offer to sell, a solicitation of an offer to buy, or a recommendation of any security by Candor, its employees and affiliates, or any third-party. Any expressions of opinion or assumptions are for illustrative purposes only and are subject to change without notice. Past performance is not a guarantee of future results and the opinions presented herein should not be viewed as an indicator of future performance. Investing in securities involves risk. Loss of principal is possible.

Third-party data has been obtained from sources we believe to be reliable; however, its accuracy, completeness, or reliability cannot be guaranteed. Candor does not receive compensation to promote or discuss any particular Company; however, Candor, its employees and affiliates, and/or its clients may hold positions in securities of the Companies discussed.