5 Most Common Types of Private Equity Funds

Can you name the 5 main types of private equity funds? A breakdown of each, and the pros and cons you must know before investing in private equity.

As you build wealth, you may want to consider alternative forms of investing. While most people have some exposure to public equity trading on the stock market, there is another side of equity investing: private equity.

Unlike trading on public markets, private equity is usually limited to accredited investors: a fairly exclusive category of investors with very high annual incomes. This might limit entry-level employees, but private equity can become a staple in senior, staff, and other wealthy individuals' portfolios. In this article, we will dive into everything you need to know about private equity.

What Is Private Equity and How Does It Work?

Simply put, private equity refers to investing in privately owned and held companies. The most well-known private equity firms include Blackstone Group, Carlyle Group, and KKR. PE firms operate by purchasing portions of ownership in companies. They purchase these companies with the hope that they will become successful in the future, offering investors cash flows that cover the costs of the initial investment.

In most cases, people in the private equity industry have expertise and experience working with and managing corporations. With this background, many PE firms purchase controlling shares in companies and use their employee talent to improve the management and operations of newly acquired businesses. This usually has the result of increasing the value of the company, therefore making the firm's investment more valuable.

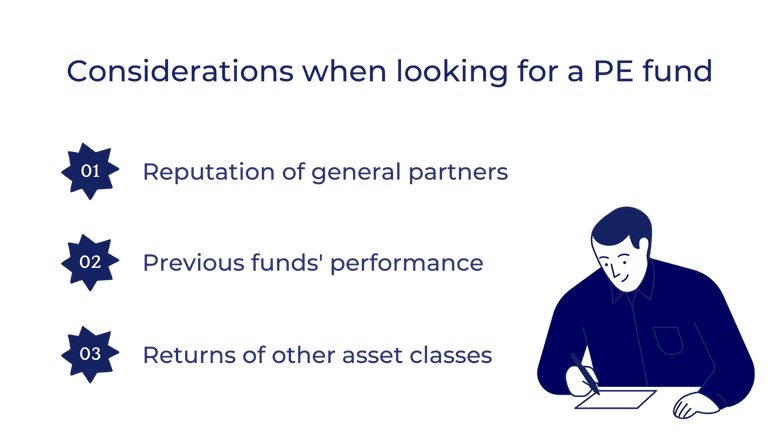

Within private equity, the investors are called the limited partners (LPS), and the fund managers are called the general partners (GPS). The private equity managers run rounds of fundraising to attract investors. Usually, they discuss their previous performance and rate of return to highlight the potential gain that investors will experience if they invest in the fund. Once the management teams of these PE funds secure funds from their investors, they usually close the funding round and begin actively managing an investment portfolio.

According to McKinsey's Private Markets Annual Review, in general, the financing growth of a new private equity fund directly correlates to the performance of the firm's previous fund. Therefore, if a fund performs well and offers a high return to its limited partners, more investors will be interested when it comes time to fundraise a new fund. The high returns of the private equity industry are definitely attractive to potential investors. In 2020, net global returns for the private equity industry were estimated to be around 14%. The industry outperformed other high return asset classes like infrastructure, private debt, and real estate. With a history of outperforming other investment vehicles, it's not hard to see why investors are attracted to the industry.

What Do Private Equity Firms Do and Why?

Private equity firms use investor funds to purchase ownership in privately held companies in hopes of improving the companies' valuations. The general expectation is that these private companies will produce higher returns for their investors compared to the returns of purchasing ownership in publicly traded companies or other asset classes. Additionally, firms actively manage these companies and usually make changes to operations to improve their financials and further boost long-term success. In these cases, a large amount of wealth is needed to purchase a substantial stake in the business and have this controlling interest.

After purchasing a company, PE funds usually hold their shares for 5-10 years, bringing in cash flows and then selling once the company's value increases and growth slows. Because of the long holding periods of portfolio companies, investors in private equity need to be willing to go years without access to their money: a big trade-off they accept in exchange for potentially large returns.

👉 Read Next: Accredited Investor vs. Qualified Purchaser: What’s the Difference?

What Do Private Equity Firms Invest In?

Private equity firms seek high ROI (return on investment) for their stakeholders. With this driving force, they employ multiple investment strategies:

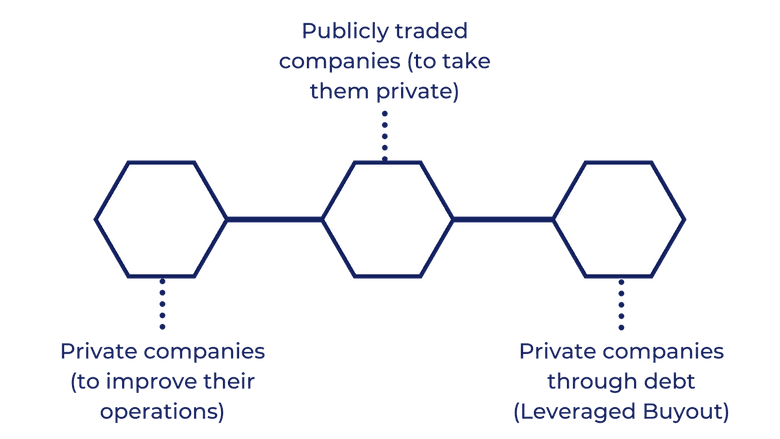

- Purchasing portions of public companies and taking them private in order to remove certain levels of government regulation to enable faster growth and financial performance.

- Purchasing large portions of private companies to have a say in the operations. Firms may hold these purchases for years and then sell the shares for profit (Note: private equity funds sometimes use IPOs, or Initial Public Offerings, as an exit strategy).

- Purchasing entire companies mostly through debt and holding them for 5 to 10 years while attempting to improve operations to raise the value of these companies; this is called a leveraged buyout, or LBO. Additionally, these purchases typically produce yearly cash flows. Because these deals are mostly funded with debt, the private equity industry closely monitors interest rates when making these deals

How Do Private Equity Funds Make Money?

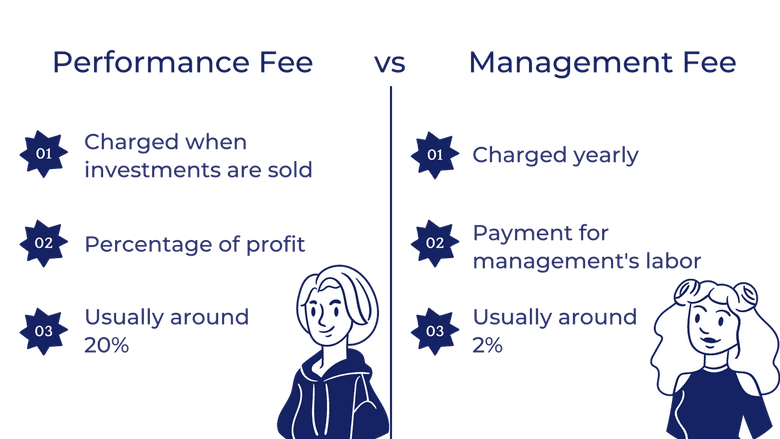

Private equity funds make money in two ways. First, management usually charges their clients a yearly management fee of around 2%. Second, the firm takes a percentage of profit called a performance fee once investments are sold, usually around 20%. This is called carried interest and serves to motivate the management team to seek higher returns.

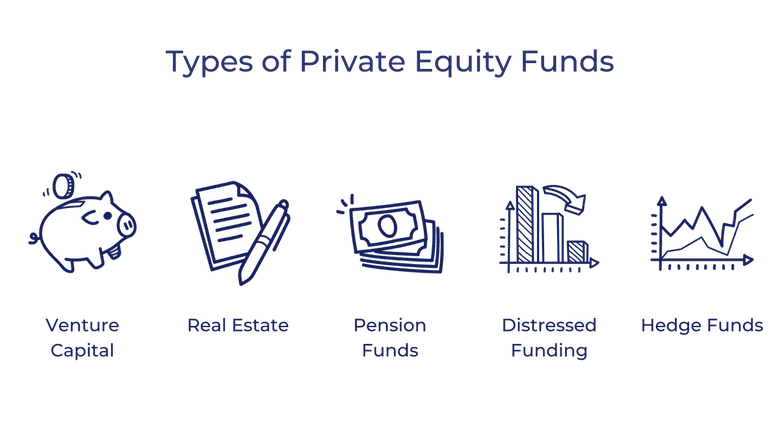

What Are the Different Types of Private Equity Funds?

Different types of private equity firms take different approaches to investing. While all seek to earn high returns for their limited partners, their strategies and capital sources may be different. The following are the most common types of private equity funds.

- Venture Capital

- Real Estate Private Equity

- Pension Funds

- Distressed Funding

- Hedge Funds

Venture Capital

Venture capital firms earn returns by purchasing ownership in early-stage businesses (or startups) in hopes that they become hugely successful in the future. Mainly, VCs do their due diligence by assessing the growth potential of the company. They aim to purchase investments in companies that are relatively small; in doing so, they hope to take on a high level of ownership, and therefore earn higher future returns.

The biggest trade-off with venture capital firms is the high risk associated with the businesses they invest in. In general, these businesses are so early stage that many of them fail after a few years. As a result, venture capital portfolios are very volatile and require investors to have high risk tolerances.

Some of the most popular venture capital firms include Khosla Ventures, Sequoia Capital, and Kleiner Perkins.

Real Estate Private Equity

Some private equity funds exclusively invest in real estate. These funds appeal to investors due to the constant cash flows associated with real estate. Regular payments from tenants or vendors offer a more structured return compared to other types of private equity.

Companies with high-performing real estate private equity funds include Blackstone, Brookfield Asset Management, and Starwood Capital Group.

Pension Funds

Pension funds use money from individual pension plans to invest. These funds invest in a variety of asset classes in order to provide future returns to retiree contributors. The pension fund managers earn income by taking a portion of the profits earned. They also usually charge a management fee of a portion of a percent.

👉 Read Next: Diversifying Your Portfolio Through Asset Classes

Distressed Funding

Distressed funding involves purchasing failing businesses with the goal of improving management to improve financial performance. This type of investment is extremely illiquid, as the funds need every dollar in order to improve operations. Additionally, this type of fund hinges largely on the timing of investments and exits. Investors choose to either hold their investment until the company's debt turns into equity, or will hold the equity in hopes that it increases in value. Either way, the goal of the exit is to get out when the business' value peaks and before it can drop.

Hedge Funds

Similar to private equity funds, hedge funds use pooled money to perform complex trades and portfolio-building. Rather than purchasing shares in companies like many private equity funds, hedge funds tend to purchase more liquid assets and perform many quick, complex transactions. Hedge funds are risky, but they tend to offer extremely large rewards to investors when they are successful.

Companies that run some of the most successful hedge funds include Bridgewater Associates, Renaissance Technology, and Pershing Square.

👉 Read Next: Top Hedge Funds in the US by 2020 Profits

Pros and Cons of Private Equity for Business Owners

Pros

First, private equity offers another potential source of a large amount of capital for business owners. While banks usually offer businesses debt financing with various interest rates depending on their credit rating, private equity allows businesses to raise capital in exchange for giving up equity. This form of capital fundraising may be better for business owners who do not have the cash flows to cover interest payments.

Businesses who seek private equity investment or delist from stock exchanges through private equity investment benefit from less government scrutiny than if they were public. Public companies are expected to release consistent quarterly reports as well as follow specific government regulations on how they run their businesses and report them. Operating under less scrutiny can enable a company to run with lower costs and grow faster.

Cons

Business owners are likely to lose some level of autonomy when accepting investments from PE funds. Many times, these funds want to hold onto a large percentage of a company's equity to make the investment worthwhile. Additionally, business owners may not want to give up such a large portion of their ownership if they expect their business to grow. By doing so, they would lose out of a larger portion of profits down the line.

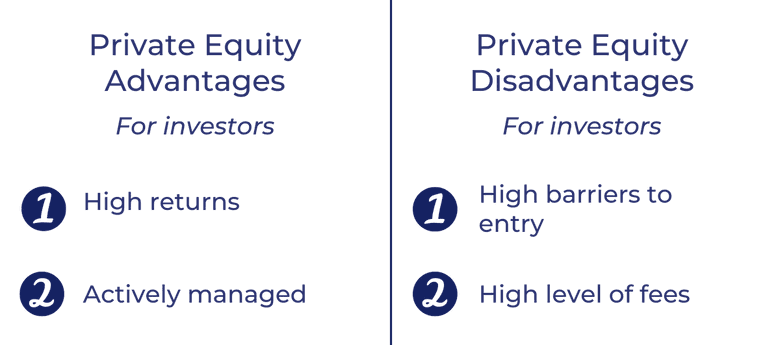

Pros and Cons of Private Equity for Investors

Pros

Investors in private equity usually benefit from higher returns than public equity markets. Generally, this is because publicly listed companies are phased out of their hyper-growth stages, while smaller private businesses have more growth potential. However, this potential for higher rates of return is associated with higher risk.

Another benefit of private equity for investors is that the funds are actively managed for you. Rather than focusing on balancing your portfolio, limited partners are able to focus on their other investments, jobs, and commitments.

Cons

Entering into private equity investing requires a large financial commitment. Most funds will not accept you if you are not willing to commit more than $250,000. Additionally, these sums are locked into businesses and are very illiquid. As a result, most investors need to be willing to hold their money in the fund for years and years on end.

The other main drawback of private equity investing is the high level of fees. The management fee and performance fee need to be high enough for the management team to justify working for you. If the rate of return is not drastically higher than the rate of return of your other investments, these fees will cut your return to a level that might not be worth the investment in the first place.

Takeaways

- Private equity has traditionally been a growing industry that has attracted more investors based on previous success.

- For most people, private equity is not a realistic approach to investing unless you have large sums of wealth that you can invest for years.

- Different types of private equity funds practice different investing styles and have various levels of risk and reward.

- If you do have a high net worth, private equity enables you to invest in an actively managed fund while you can focus on managing other income streams.

- When engaging in private equity investing, make sure the rate of return after fees will be worth the initial investment.

The information provided herein is for general informational purposes only and is not intended to provide tax, legal, or investment advice and should not be construed as an offer to sell, a solicitation of an offer to buy, or a recommendation of any security by Candor, its employees and affiliates, or any third-party. Any expressions of opinion or assumptions are for illustrative purposes only and are subject to change without notice. Past performance is not a guarantee of future results and the opinions presented herein should not be viewed as an indicator of future performance. Investing in securities involves risk. Loss of principal is possible.

Third-party data has been obtained from sources we believe to be reliable; however, its accuracy, completeness, or reliability cannot be guaranteed. Candor does not receive compensation to promote or discuss any particular Company; however, Candor, its employees and affiliates, and/or its clients may hold positions in securities of the Companies discussed.