Commodity ETFs as a Hedge Against Inflation

The 4 types of commodity ETFs. How do they work? How do you invest in them? A detailed breakdown of each, explained simply.

Many investors are looking for creative ways to diversify their investment portfolios with alternative investments. In the midst of so much economic uncertainty, commodity ETFs are stepping into the spotlight. Here is everything you need to know about commodity ETFs before you consider investing.

What Is A Commodity?

Simply put, a commodity is something that holds value and can be bought and sold. Typical commodities include gold, oil, lumber. Commodities are often used as inputs for production. Lumber is used to build houses, oil is used to produce energy, etc.

The main qualities of a commodity are that it holds value, it is consistent, and its value fluctuates.

- Holding Value: Commodities like gold have an inherent value. This value comes from its ability to be exchanged for other goods/cash or its ability to be used in production.

- Consistency: A commodity is consistent throughout industries. A barrel of oil is the same product around the world. A block of gold is the same around the world.

- Value Fluctuates: Prices of commodities change over time based on supply and demand.

What Are Commodity ETFs, and What Types Exist?

A commodity ETF is a stock-traded fund that is invested in physical commodities. Examples of physical commodities are metals such as gold, silver, and copper and agricultural products such as cattle, wheat, and soybeans.

At a very simple level, commodity ETFs follow price changes of commodities. If a commodity ETF tracks gold, and the price of gold increases, the ETF increases in value.

Before commodity ETFs, the only way to gain exposure to commodities was to directly invest in them was through complex trading techniques. ETFs simplify this process.

There are four types of commodity ETFs:

- Equity ETFs

- Exchange-traded notes (ETNs)

- Physically-backed funds

- Futures-based funds

There are pros and cons to each of the types, and it is important to research them before choosing to invest in a particular commodity ETF.

How Do Commodity ETFs Work?

Typically, if you were to invest in a commodity ETF, you would not own the physical asset itself. Instead, a commodity ETF tracks the prices of commodities or commodity indexes. Some commodity ETFs track single products, while others present the opportunity to be exposed to a variety of products.

Since commodities are very different from stocks, many funds create their own indexes for simplicity reasons. This can assist you by providing benchmarks for just a single commodity group such as agricultural goods or metals.

Equity ETFs

Equity ETFs invest in companies that produce, transport, and store physical commodities. For example, FTRI invests in companies that produce natural resources in emerging markets.

Equity ETFs allow you to gain exposure to the commodity of interest without having to physically own it. As a result, you may not receive the diversification benefit a true commodity ETF would provide but you do gain equity exposure with a link to commodities.

Equity ETFs are a more inexpensive and accessible way to invest in commodities, and they tend to have lower expense ratios. Expense ratios indicate what the fund’s management operation costs are relative to the fund’s assets.

ETNs

An ETN is a debt security that bases its returns on the performance of a market index, and it can be used to follow the performance of a specific commodity as well.

One advantage of ETNs is that you only pay taxes for capital gains when the asset is sold, and there is no taxation for capital appreciation. There is also no tracking error between the ETN and the underlying asset, which means there is no difference between the ETN invested in and the underlying index.

A disadvantage of investing in commodity ETNs is exposure to credit risk. Credit risk is when a borrower is unable to pay their lenders back, usually because a firm goes bankrupt. ETNs are also prone to being sold short since the debt used to purchase the ETN is unsecured.

Physically-backed funds

Physically-backed funds are funds in which you actually hold the physical commodities in your possession, and this type of commodity ETF is currently limited to precious metals.

The advantage of a physical ETF is that it actually owns the commodity, and you are not prone to:

- Tracking risk: When the ETF does not produce the same returns as the asset it was supposed to track, or

- Counterparty risk: When someone who is involved in the investment defaults on their investment and is not able to follow through.

A disadvantage to physically-backed funds is that precious metals are seen as collectibles under the taxation code, and therefore are taxed at your marginal tax rate. Another disadvantage is the upkeep associated with delivering, holding, storing, and insuring the physical commodities which can overall be expensive.

Futures-based funds

Future-based funds utilize futures contracts, forward contracts, and swaps to gain exposure to the desired commodities. Futures contracts, forward contracts, and swaps are all complex trading techniques with high levels of risk, but also high levels of rewards.

A disadvantage to investing in future-based ETFs is the uncertainty and risk that can be associated with many futures contracts.

Understand Commodity ETFs With Examples

As previously mentioned, commodity ETFs can track a single commodity or a basket of commodities. The basket of commodities can either be centered around one sector, or a variety of sectors.

- VEGI tracks the investment results of companies primarily engaged in the business of agriculture and the United States Commodity Index.

- CORN tracks the corn market

- SOYB tracks the soybean market

- SLV tracks silver

- GLD tracks gold

- PALL tracks palladium

The SPDR S&P Oil & Gas Exploration and Production ETF provides exposure to oil and natural gas. Because commodities like oil and gas cannot be collected, the ETFs centered upon oil and gas invest in futures contracts instead of the commodity itself. Oil and gas markets are prone to extreme volatility, which is why ETFs tend to be a safer and more accessible way to get involved in a profitable market.

Risks of Investing in Commodity ETFs

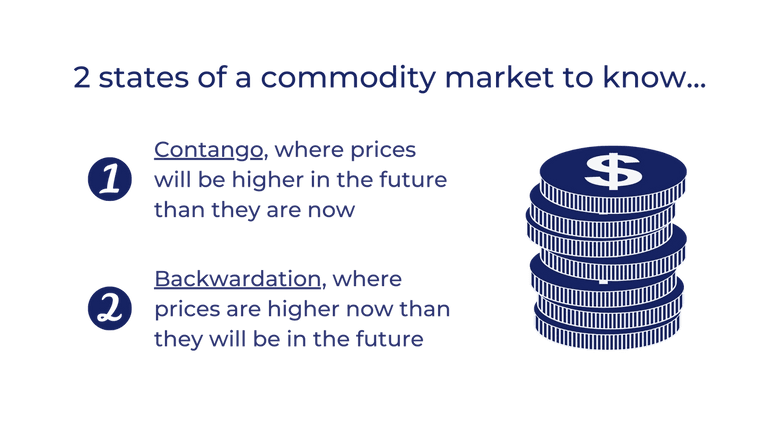

There are two different states of a commodity market that are important to understand, especially when investing in future-based funds. They are called contango and backwardation. When futures are in contango, prices for a particular commodity will be higher in the future than they are now. When futures are in backwardation, prices for a commodity are higher now than they will be in the future.

When a futures market is in contango, the structure of the forward price curve is upward-sloping. Also in contango, the rolling risk is "negative." This means that a commodity ETF will be selling lower-priced futures that are expiring and buying higher-priced futures. This is known as “negative roll yield.”

The opposite goes when a futures market is in backwardation. Since the prices are higher now than they will be in the future, the rolling risk is “positive” and a commodity ETF will end up buying lower-priced futures which causes “positive roll yield.” These two states of the futures market explain why future-based commodity funds tend to be more expensive, and have higher expense ratios.

Benefits of Investing in Commodity ETFs

It is commonly known that commodities are used as a hedge against inflation, which can be especially pertinent in times of economic uncertainty. Inflation refers to rising prices on goods and services across an economy over a period of time, which is also known as a decline in purchasing power.

Commodities are known as real assets, whereas popular investments such as stocks and bonds are known as financial assets. Real assets are tangible and have fundamental value. So their worth increases with increased inflation. It can be beneficial to have commodities during times of high inflation because they have intrinsic value, unlike financial assets which have no intrinsic value.

Overall, investing in commodities can be a sustainable investment strategy because commodities are a direct input for many goods and services such as transportation, food and beverages, technology, and so on.

Commodities typically also have an inverse relationship with stocks and bonds, so as stocks and bonds decrease in value, commodities increase in value, and the same goes for the other way around. This inverse relationship provides investors with a possible opportunity to diversify their portfolios and to deter reliance upon a single asset class.

How to Invest in Commodity ETFs

Investing in ETFs can be done through most online brokerage accounts.

👉 Read next: Everything You Should Know About ETFs, which outlines this in more detail.

Once you are set up with an online brokerage account, here are some basic guidelines for investing in commodity ETFs.

1. Decide what commodity you want to invest in.

Figuring out if you want to focus on a single commodity or a basket of commodities is a good first step when it comes to investing in commodity ETFs. As mentioned before, there are a variety of ETFs that provide exposure to just a single commodity or a variety of them. Once you figure this out, it will allow you to narrow down your search.

A good place to start your research would be Bloomberg. Their website has a variety of market data, and a very useful page with the latest commodity index activity. Bloomberg commodity data has sections on energy, metals, and agriculture. Energy commodities include crude oil and refined products. Metals include precious metals and base metals, which are nonferrous industrial metals (copper, aluminum, zinc, etc.). Agricultural products include grains, soft commodities (coffee, orange juice, etc.), and livestock.

2. Understand which of the four types it falls under.

When choosing a commodity or basket of commodities, it is important to understand which type of commodity ETF it falls under. For example, if you are looking to invest in precious metals, physically-backed funds are a viable option. On the other hand, if you are interested in investing in oil or gas, you will most likely invest in a future-based fund.

Understanding whether you will be investing in a commodity ETF that relies on futures contracts or one that buys and sells at a spot price is integral to understanding associated risks.

In the next section, the concepts of contango and backwardation will be discussed as they relate to future-based funds.

3. Research the profitability and activity of the funds of interest.

Once you have some potential candidates for investing, you will want to take a look at the expense ratios and the volume of trade for each individual ETF. The expense ratios are important because they illustrate the profitability of each ETF. Even a small difference in expense ratio can cost a lot of money in the long run.

The volume of trade is another important metric to observe because it is a measure of the market's activity and liquidity over time. If an ETF is inactive or stagnant, that could be a red flag because it would show that the commodities in question may not be a desirable investment.

Having background knowledge of the commodity of interest is important when trying to understand how your investment will do in both the short and long run.

👉 Read next: Alternative Investments: A How-To Guide, to learn about other types of alternative investments.

The information provided herein is for general informational purposes only and is not intended to provide tax, legal, or investment advice and should not be construed as an offer to sell, a solicitation of an offer to buy, or a recommendation of any security by Candor, its employees and affiliates, or any third-party. Any expressions of opinion or assumptions are for illustrative purposes only and are subject to change without notice. Past performance is not a guarantee of future results and the opinions presented herein should not be viewed as an indicator of future performance. Investing in securities involves risk. Loss of principal is possible.

Third-party data has been obtained from sources we believe to be reliable; however, its accuracy, completeness, or reliability cannot be guaranteed. Candor does not receive compensation to promote or discuss any particular Company; however, Candor, its employees and affiliates, and/or its clients may hold positions in securities of the Companies discussed.