Crypto Arbitrage: How Your Cryptocurrency Can Make You a Quick Profit

Crypto arbitrage is a relatively simple way to earn a profit, but most don't know how it works. Learn how to find opportunities and the right platform.

Everyday investors are fairly familiar with arbitrage in stock or bond trading. Did you know you can do the same with cryptocurrency investments?

This article will discuss:

- What is crypto arbitrage?

- How does it work?

- The 5 types of crypto arbitrage

- The pros and cons

- How to find opportunities

- How to find the right platform

What Is Crypto Arbitrage?

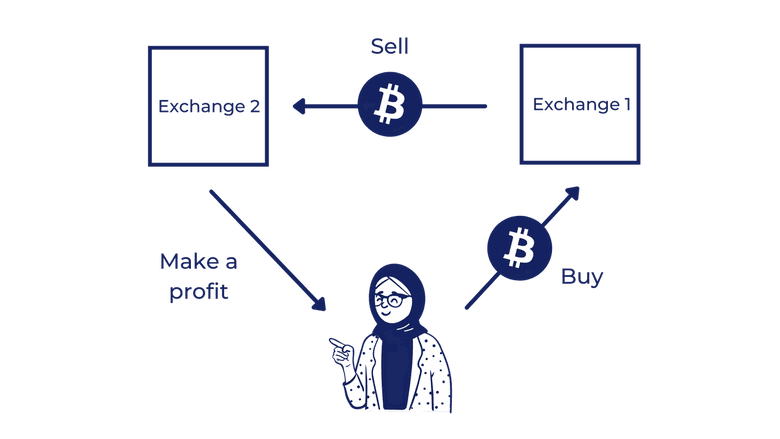

Arbitrage is a long-standing investment method with relatively risk-free profit. Simply put, arbitrage involves buying and selling an asset that is priced differently in two markets to make a profit. Crypto arbitrage is the same idea: investors purchase cryptocurrencies for a lower ask price and sell the same asset for a higher bid price.

Cryptocurrency investment is similar to traditional investment products. If you have previous experience with arbitrage in other investment areas, it’s easy to get the hang of.

How Does It Work?

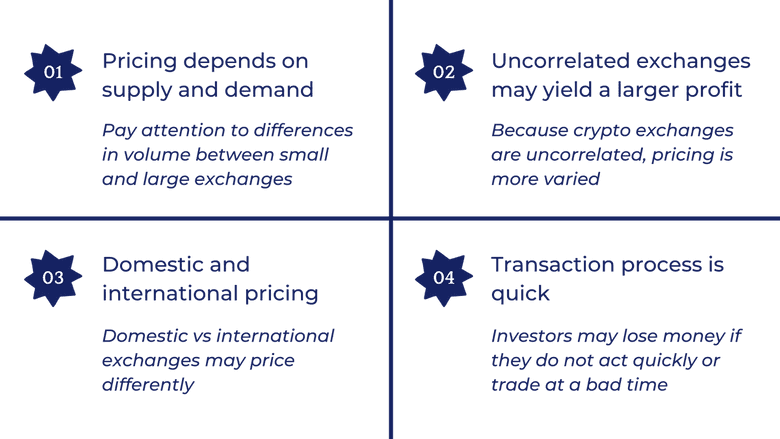

Pricing of crypto is dependent on supply and demand

Usually, the price point of the cryptocurrency market changes rapidly depending on supply and demand. In popular exchanges, the volume of buying and selling is usually large, which leads to lower selling prices. In smaller exchanges, however, trading volume is limited, so sellers have a better chance to sell at a premium.

Uncorrelated exchanges lead to a better chance at a profit

Although it is commonly acknowledged that it’s difficult to profit from arbitrage in the traditional financial market, the cryptocurrency market offers a chance to make a profit. The crypto market has varied pricing because the systems used by different exchanges are uncorrelated. Some small exchanges indeed try to price match the larger ones, but there is a brief buffering time aside from the basic principle of supply and demand. Because of that, some investors take advantage of the market inefficiency for profit.

Domestic vs international exchanges may price differently

In some cases, domestic exchanges price coins differently than the international market. Oftentimes the American market may show the opposite trend of the international market; this leads to greater chances for arbitrage.

The transaction process is quick

It's important to note that to benefit from arbitrage, investors must complete transactions quickly - the process typically takes between 15-20 mins. This period is a risk window. Investors may find themselves losing money if they do not act quickly or trade at a bad time.

Is It Legal?

I’m sure some people are generally worried about the legality of day trading. Sure, back in the day, only people who worked at exchanges and related areas had access to frequent trading. With the advances of digital technology, day trading is becoming more accessible for average investors done in the comfort of their homes.

Crypto arbitrage is entirely legal to do in the U.S., and even encouraged to keep the market at flow. Arbitrage is one of the most common methods of high-frequency trading (HFT), and it is usually free from regulations. In the world of cryptocurrency.

The 5 Types of Crypto Arbitrage

Triangular

Triangular arbitrage involves the conversions of three different currencies in three separate transactions. Because triangular methods can be done within one exchange, it limits the process fees and the risk of opening accounts at multiple exchanges.

In the triangular method, you convert the first cryptocurrency to the second one, and then trade the second one for the third one. In the end, you convert the third cryptocurrency back to the first one. Theoretically, you should end up with more of the first cryptocurrency than you started with. To demonstrate, let’s see an example:

Let’s assume the price of one Bitcoin is $39924.60, that of one Ethereum is $2748.52, and that of one XRP is $0.7125. I will make a triangular trade for arbitrage starting with 100 Bitcoins.

- ETH/BTC=0.0688

- ETH/XRP=3478.6246

- BTC/XRP=56034.5263

- 100*0.0688/3478.6246*56037.5263=110.83 Bitcoins

By converting between three cryptocurrencies, I end up with 10.83 more Bitcoins than I started.

Statistical

The statistical strategy involves arbitrage bots. They use quantitative data models to calculate arbitrage opportunities. Hundreds and thousands of transactions can be made in seconds automatically to maximize possible profits. In this method, the bot gives a score to each currency and an overall ranking based on desirability.

Spatial

Spatial arbitrage is the easiest and most common. When we talk about arbitrage, this is the strategy that comes to mind first. The spatial method is to buy at one exchange with the lower/lowest listing price, then sell at another exchange where the bid price is higher. This way, the investor can make money from the discrepancy in prices.

The good thing about this strategy is how simple it is to understand and operate. However, keep in mind that the price point of each cryptocurrency is constantly changing. The time it takes for your asset to jump from one exchange to another can very well be longer than the time it takes for the price to change. The risk of losing on the deal is significant, and the fees for each transaction can add up.

Typically, traders can also long and short in one exchange, then long to the other exchange to cover the short in order to make a profit. A long position is when an investor buys and holds an asset believing it will go up in value to sell at a higher price in the future. To short is to sell borrowed assets, expecting them to go down later to buy them back.

Spatial Without Transferring

This strategy is growing in popularity because who doesn’t want to reduce their risk and pay lower processing fees in a rapidly changing market?

Spatial without transferring can be done by buying and selling the same asset at two exchanges simultaneously. For example, I decided to purchase 1 BTC at exchange 1 and sell it at exchange 2. When the desired price difference occurs, I would purchase 1 BTC with USD at exchange 1 for $40,000. At the same time, I’d put up a sale for 1 BTC at exchange 2 at the price of $40,100 in fiat currency. Through this transaction, I profited $100 before fees.

Decentralized

Decentralized arbitrage is done on decentralized exchanges (DEX) such as Uniswap, Balancer, or Curve. These exchanges are different from popular centralized ones because they are free from human operations or inspections; rather they function based on coding, making them the perfect playground for arbitrageurs.

In one way, arbitrageurs can buy and sell either over or under-valued assets for arbitrage. Investors can also take advantage of different yields offered for lending protocols. If Uniswap offers 5% from a stable coin, and Balancer offers 7% for a different stable coin, investors can convert the lower rate currency to the higher one to earn the extra 2%.

The Good and The Bad

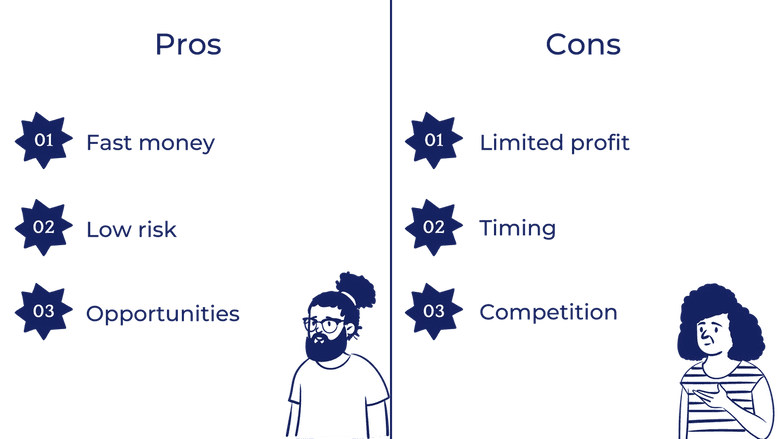

Pros

Cons

How to Find a Crypto Arbitrage Opportunity

Choose the Right Technology

More and more software development companies are targeting arbitrageurs with new products, such as software that tracks the pricing at different exchanges to alert investors when opportunities arise. Some companies also offer services such as live charts, arbitrage finders with filters, and one-click trading. Mobile apps can also provide you the convenience to monitor the market without a computer.

Aside from operational software, arbitrage bots are also available for those who are interested in statistical strategy. You can find bots online or build your own for your specific preferences.

Choose Less Popular Coins

While big names in the market such as Bitcoin can make you a profit, less popular coins can have an even bigger price difference giving you a better chance of making more from each transaction. These less popular coins are usually valued lower, allowing investors to trade in large volumes with limited capital.

How to Find the Right Platform

There is not an across-the-board best platform for arbitrage trading. Each investor may find different platforms more attractive based on their needs and preferred strategies. The key is to understand what you are looking for and your style.

The top platforms often support automatic arbitrage trading. These platforms offer connections with APIs to support external bots or even have internal tools such as tracking and auto trading bots. This could be a good choice if you are looking for a simple path to perform arbitrage trades.

It is generally better to choose a platform that is in connection with a wide range of other platforms, thus allowing you to track them all at once. It is still doable to browse through each platform and analyze profit with 30 tabs open on your screen, but since arbitrage is time-sensitive, it is easier to observe as much information as possible at once. This will allow you to have a clear run-down of numbers and more time for trading.

Exchanges make most of their profit through transaction fees and processing fees. When looking for a platform for arbitrage, you want to find the one that charges lower fees for all types of transactions you will make. It is also smart to look for one that has a variety of deposit and withdrawal options: that way, you can easily withdrawal raw profit without having to exchange again for fiat currency.

Takeaways

Cryptocurrency is an exciting but scary investment product. Its price fluctuations make it concerning as a long-term investment for many people.

Cryptocurrencies run automatically on the back end, are not backed up by any organization, are free from predictable real-time events, and price purely based on supply and demand. On the other hand, their characteristics open a crack for arbitrageurs to wedge themselves in, making it a popular option for a quick profit.

If holding onto cryptocurrencies is a bolder move for you, crypto arbitrage may be something to consider.

The information provided herein is for general informational purposes only and is not intended to provide tax, legal, or investment advice and should not be construed as an offer to sell, a solicitation of an offer to buy, or a recommendation of any security by Candor, its employees and affiliates, or any third-party. Any expressions of opinion or assumptions are for illustrative purposes only and are subject to change without notice. Past performance is not a guarantee of future results and the opinions presented herein should not be viewed as an indicator of future performance. Investing in securities involves risk. Loss of principal is possible.

Third-party data has been obtained from sources we believe to be reliable; however, its accuracy, completeness, or reliability cannot be guaranteed. Candor does not receive compensation to promote or discuss any particular Company; however, Candor, its employees and affiliates, and/or its clients may hold positions in securities of the Companies discussed.