Crypto Hedge Funds: High Risk & High Return?

If you're a wealthy crypto investor, you may have considered crypto hedge funds. Here's everything you need to know and how to get started.

As the cryptocurrency market has grown bigger, new opportunities have emerged. The earlier crypto market was filled with private investors and traders exploring the new world, but in the past few years, more investment professionals have entered the market and crypto hedge funds have become an overlooked trend. 63% of the 150 largest global crypto hedge funds launched between 2018 and 2019. It is not too late to hop on the trend.

One exciting new investment vehicle in crypto is the crypto hedge fund. Let’s look at what it is, how it works, whether it’s right for you, and how you can make gold from it.

What Are Crypto Hedge Funds?

First, we need to understand hedge funds in general. A hedge fund aims to reduce investment risk while trying to generate high returns. Expert managers pool investors' money together and invest in anything from derivatives to real estate. These funds have much more complex portfolios than traditional investments and are only accessible to select investors.

Crypto hedge funds follow the exact same mentality as traditional hedge funds. They also pool investments contributed by a limited number of investors and are operated by expert managers.

There are typically two types of crypto hedge funds:

- Those that exclusively manage cryptocurrency investments

- Those that contain a certain percentage of cryptocurrency mixed with other asset classes

How Do They Work?

Hedges funds are overseen by managers, so the strategy can differ from fund to fund. In general, investors and managers prefer to include both long and short strategies to combat volatile markets when the price fluctuation is high.

Some funds profit through trading activities as they would with other asset classes, while others (more like venture capital funds) buy into newer projects or altcoins that have high growth potential. Once the assets reach the desired target profit or sufficient growth potential, they are sold off for investors to cash out.

There are two approaches when it comes to management:

- Leave the decisions purely to managers: The managers will utilize their expertise to make discretionary investment decisions based on the current market trends and investors’ wishes. This approach is flexible because the manager can easily make changes to the investment portfolio.

- Use a systemic approach where the trades are handled by computer models: This method is considered more reliable and less risky because the final modeling falls on the statistical study and systematic calculation is done automatically.

Who Can Invest in Them?

You should note that there are some limitations on who is qualified to invest. Other than individuals, institutions invest in hedge funds such as universities, government agencies, and nonprofit foundations.

Like traditional hedge funds, crypto hedge funds are often only available to accredited investors, meaning there is a minimum investment requirement:

- In most cases, an investor must have a net worth of $1 million or higher;

- or a salary of $200,000 or higher.

These requirements aren't too surprising because hedge funds typically require a large amount of capital to generate a significant profit — and the profit needs to be significant enough to be worth the job. In addition, many funds require a minimum time commitment, so you can commonly expect to lock up your initial investment for one year before you can retreat.

Why Do People Invest in Them?

From 2018 to the end of 2019, assets under crypto hedge fund management grew from $1 billion to $2 billion. The number may seem small compared to ordinary hedge funds, but the growth rate is skyrocketing.

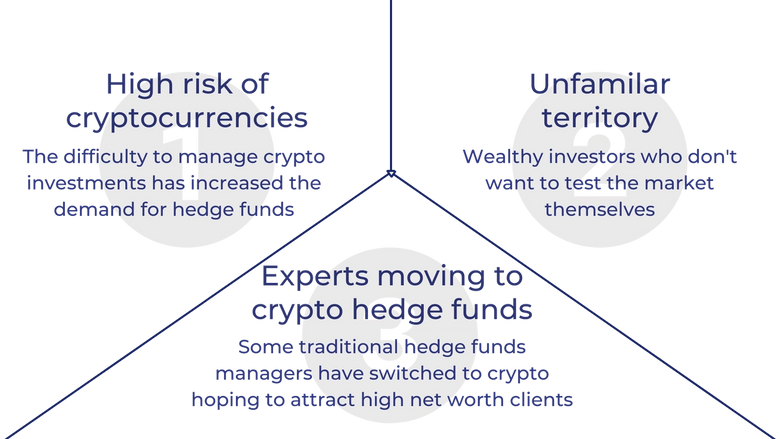

Most regulated crypto hedge funds are transparent about the manager profile, performance history, and assets under management, leading more and more investors to build trust in them. Because cryptocurrencies are high-risk investment products, the difficulty to manage these investments is one reason for the increasing demand for crypto hedge funds.

While many of the earliest cryptocurrency investors became wealthy, their success is harder to duplicate as the coin market has grown infinitely larger. From entering pre-ICO to making sophisticated trades, the complex yet unregulated market can leave newer investors wondering how to strike the right opportunity. Thus, hedge funds have become a potential option for some wealthy investors who don't want to test the market themselves.

Since the birth of Bitcoin a decade ago, cryptocurrency has slowly but steadily made its way into popular investment product lists. Cryptocurrency is still considered new, so the mass population needs more time to navigate the market the way they do in the stock market.

The current outlook of crypto hedge funds has made them a popular choice among some investors. According to a report done by PWC, Elwood, and AIMA, the median return on the $2 billion crypto hedge funds investment in 2019 reached a shocking 30%. People often express that they worry the return on cryptocurrency investment may not be worth the risk; hedge funds have the potential to yield a significant return from crypto.

Benefits and Risks

PROS

Potential for high returns

Crypto hedge funds have the potential to provide higher returns than other investments because their strategies are meant to generate profit regardless of price fluctuation in the cryptocurrency market.

The coins in the portfolio include both popular and less popular coins, older and newer coins, store of value coins, and utility tokens. To combat unpredictable cryptocurrency pricing, managers never put too many eggs in the same basket to ensure the portfolio allows a positive return when one or a few coins hit the downhill.

Diversification

Cryptocurrencies are their own market free from the systematic risks that your other investment vehicles face. Crypto hedge funds can help balance out the risk of other traditional investments.

Crypto hedge funds allow you to put your money into a large pool of coins leading to a better chance to earn returns when trusted coins meet a downfall. Because each coin’s pricing can be impacted by the supply and demand, it’s unlikely all your coins in the hedge fund would meet a significant decline in value at once. Along with a carefully chosen strategy, it is considered a safer way to invest in crypto in comparison to pouring capital into a few big names in the market.

Managers have expertise and tools

One of the biggest concerns for people when putting money into crypto products is unfamiliarity. You may be inclined to follow the golden rule of “only invest in what you know.” An average investor may not have the analysis skills, software, and experience to get familiar with highly volatile products quickly, let alone when the product is still just in a kickstart stage.

There is a good reason why hedge fund managers are paid a boatload of money for what they do. Managers are extremely knowledgeable about investment treatment and have likely faced other high-risk products in their careers — this is their most valuable asset. They are experienced enough to foresee potentials and come up with plans when one coin hits a roadblock. Moreover, aside from experience, they have the system to analyze market data.

CONS

High fees

As much as crypto hedge funds might sound like a dream, the fees may make you think twice. In crypto hedge fund operations, the “2 and 20” compensation rule applies. Under this scheme, the manager charges a 2% management fee on your initial investment and a 20% performance fee on the return.

Risky strategies

Because managers’ activities aren’t regulated, they utilize some fairly risky strategies to meet their projections. A highly concentrated strategy could cause you to lose it all, and even conservative managers tend to include rather risky methods in their roadmap.

Inaccessible for most

The minimum investment requirement makes crypto hedge funds inaccessible to most. You can expect to put down at least $100,000 to enter a fund. Additionally, hedge funds are illiquid investments — there is a contract requiring you to leave your money in the fund for an extended period of time. Sometimes you can get out in one year, but it can very well be longer too.

Long story short, before it’s time for you to cash out, you may have to keep filling the hole. Even if you earn a great return, the money isn’t in your pocket until the time constraint is met. So, if you are considering a crypto hedge fund, ask yourself how long you are willing to stay in the market.

How to Invest in Them

Let's talk about 2 ways to invest in crypto hedge funds: the traditional way and through online platforms.

The Traditional Way

The first and traditional way to invest is through a financial service firm, or to seek a hedge fund that’s right for you with the help of an investment professional.

For the most part, your advisor should have a wide range of resources on the open funds. They can conduct a background check on the manager and analyze the performance as well as the strategy for you systematically. Sometimes, you may be able to invest straight from the financial service firm you work with. You can add the hedge fund to your general portfolio for your advisor to monitor it for you.

The problem is many firms do not offer any cryptocurrency investment opportunity or hedge funds made up exclusively by crypto products. Large firms such as Fidelity and Merrill Lynch have done research on cryptocurrencies, but strictly exclude them from their portfolios even restricting advisors from promoting them.

Online Platforms

If you do not have an advisor or the firm you work with does not include cryptocurrency investment, you can also find and invest in funds online through various platforms. Platforms like the eToro Cryptofund or Strix Leviathan allow you to choose from any mixed selections of cryptocurrencies to form a fund. These funds are easy to navigate and the platform makes the searching process much more accessible.

Doing your homework before an investment never hurts. Generally speaking, avoid evaluating a fund solely based on the return and performance history. Make a comprehensive evaluation based on what your investment goals are, how the specific hedge fund would meet your goal, and whether it's compatible with your risk tolerance.

Bottom Line

The risks and advantages of crypto hedge funds can balance each other out, lure you in, or push you out based on your personal risk tolerance, so there's no right answer as to whether or not you should invest your capital. Before investing, carefully evaluate the risks and any unexpected surprises that may occur, and invest in whatever suits your financial situation. Any investment will always come with its own set of advantages and disadvantages.

The information provided herein is for general informational purposes only and is not intended to provide tax, legal, or investment advice and should not be construed as an offer to sell, a solicitation of an offer to buy, or a recommendation of any security by Candor, its employees and affiliates, or any third-party. Any expressions of opinion or assumptions are for illustrative purposes only and are subject to change without notice. Past performance is not a guarantee of future results and the opinions presented herein should not be viewed as an indicator of future performance. Investing in securities involves risk. Loss of principal is possible.

Third-party data has been obtained from sources we believe to be reliable; however, its accuracy, completeness, or reliability cannot be guaranteed. Candor does not receive compensation to promote or discuss any particular Company; however, Candor, its employees and affiliates, and/or its clients may hold positions in securities of the Companies discussed.